Hummingbird Resources Plc (LSE:HUM) #Gold #SP500

The TV show Gold Rush never fails to fascinate, the champion of 2022 being a miner (Parker) who stumbled across over 8,000 ounces of the shiny stuff. Knocking it all into perspective, Hummingbird Plc appear to be anticipating over 140,000 oz annually for the next couple of years and they’ve plenty of future areas still to mine. While Gold Rush’s Parker has been searching in Alaska and currently Peru to indentify new prospects.

Regular readers will know, we’re addicted to this particular TV show, though often less than enthralled with some of the miners Discovery TV decide to focus on. Some of them couldn’t be relied upon to pull a can of beans out of a cupboard, let alone run a gold mine. A mainstay failure for the last few years decided the route to success was surrounding himself with disabled ex-military, presumably ‘cos they were working for beans and if they could drive a tank, an excavator wouldn’t be different. Needless to say, things didn’t work out, this years season effectively ending with the guys employees taking a collection for him as they wanted to return for another year. It was clearly great fun, big machines, lots of mud, no officers, and no-one shooting at them! And if they found gold, they’d all be millionaires faster than you can say Ponzi Scheme…

From reading their website, it’s quite enlightening how the big boys go about the search for gold, both explaining why Parker from Gold Rush is so successful and also, delineating the massive jump required from his current level to the big league. Hummingbird share price is on the edge of some serious movements, requiring only to close a session above 13.25p to hopefully trigger some proper recovery, doubtless mimicking the price of Gold which presently looks like it wants to explore life above $2,100. Surely it’s the case such a potential should impact major gold explorer share prices?

Day trade prices now above 13.75p should promote a near term visit to 17.5p next with secondary, if exceeded, at 21.5p and a price level where the visuals almost guarantee some hesitation due to prior history. Our underlying argument demand the share price close above 13.25p (the price level when the share last broke the Red uptrend since 2016) as this makes such a rise about as close to “safe” as it gets.

If trouble is planned, the share needs below 7.8p to signal an investment in running shoes may be wise, risking a visit to our ultimate bottom of 0.5p.

For now, we’re fairly optimistic about this lots potentials. We’ve displayed a longer term ambition at 33p but there are a few criteria needing confirmed before this can become an official target.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:30:39PM | BRENT | 82.64 | ‘cess | ||||||||

| 10:34:59PM | GOLD | 1995 | 1975 | 1964 | 1948 | 1995 | 1997 | 2008 | 2021 | 1988 | Success |

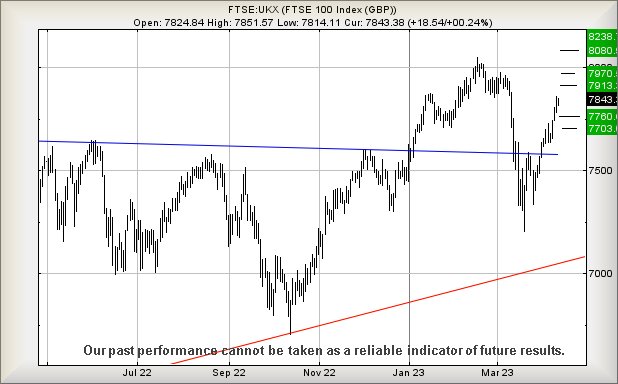

| 10:36:46PM | FTSE | 7898 | |||||||||

| 10:39:16PM | STOX50 | 4400.1 | Shambles | ||||||||

| 10:41:24PM | GERMANY | 15901.33 | |||||||||

| 11:05:49PM | US500 | 4151.57 | 4129 | 4125 | 4108 | 4148 | 4166 | 4174 | 4189 | 4144 | |

| 11:08:02PM | DOW | 33861.6 | |||||||||

| 11:10:06PM | NASDAQ | 13078.05 | ‘cess | ||||||||

| 11:12:01PM | JAPAN | 28537 | Success |

19/04/2023 FTSE Closed at 7898 points. Change of -0.14%. Total value traded through LSE was: £ 4,106,183,420 a change of -11.15%

18/04/2023 FTSE Closed at 7909 points. Change of 0.38%. Total value traded through LSE was: £ 4,621,350,278 a change of -3.08%

17/04/2023 FTSE Closed at 7879 points. Change of 0.1%. Total value traded through LSE was: £ 4,768,055,555 a change of -13.28%

14/04/2023 FTSE Closed at 7871 points. Change of 0.36%. Total value traded through LSE was: £ 5,498,351,712 a change of 11.26%

13/04/2023 FTSE Closed at 7843 points. Change of 0.24%. Total value traded through LSE was: £ 4,941,877,578 a change of -0.83%

12/04/2023 FTSE Closed at 7824 points. Change of -100%. Total value traded through LSE was: £ 4,983,460,119 a change of 0%

11/04/2023 FTSE Closed at 7785 points. Change of 0%. Total value traded through LSE was: £ 6,576,655,503 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BT.A British Telecom** **LSE:EMG MAN** **LSE:JET Just Eat** **LSE:SBRY Sainsbury** **LSE:TERN Tern Plc** **LSE:TSCO Tesco** **

********

Updated charts published on : British Telecom, MAN, Just Eat, Sainsbury, Tern Plc, Tesco,

LSE:BT.A British Telecom Close Mid-Price: 157.65 Percentage Change: -1.68% Day High: 161.35 Day Low: 158.15

Further movement against British Telecom ABOVE 161.35 should improve acce ……..

</p

View Previous British Telecom & Big Picture ***

LSE:EMG MAN Close Mid-Price: 208 Percentage Change: -0.10% Day High: 208.3 Day Low: 205.2

Weakness on MAN below 205.2 will invariably lead to 175 with secondary, i ……..

</p

View Previous MAN & Big Picture ***

LSE:JET Just Eat. Close Mid-Price: 1438 Percentage Change: + 0.14% Day High: 1506 Day Low: 1346

Continued weakness against JET taking the price below 1346 calculates as l ……..

</p

View Previous Just Eat & Big Picture ***

LSE:SBRY Sainsbury. Close Mid-Price: 282.2 Percentage Change: + 0.68% Day High: 283 Day Low: 279.5

In the event of Sainsbury enjoying further trades beyond 283, the share s ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:TERN Tern Plc Close Mid-Price: 5 Percentage Change: -13.04% Day High: 5.75 Day Low: 4.75

Target met. If Tern Plc experiences continued weakness below 4.75, it wil ……..

</p

View Previous Tern Plc & Big Picture ***

LSE:TSCO Tesco. Close Mid-Price: 275.9 Percentage Change: + 0.91% Day High: 277.6 Day Low: 272.6

Further movement against Tesco ABOVE 277.6 should improve acceleration to ……..

</p

View Previous Tesco & Big Picture ***