#FTSE #GOLD We always have a very poor view of the half day session just before Christmas. It gets a little old after a few years, turning on monitors for 8am and watching the market move by a few points until maybe 1 minute past eight. Then nothing happens until just after 12 noon, sometimes even later, as all the work which should have taken place in the previous four hours actually happens. One year, everything kicked off with just 3 minutes to go until the Xmas break.

It’s easy to be cynical, especially if watching the market via a chart in minute by minute mode. After a while of viewing 5 point oscillations, a 7 point movement can suddenly look like things have gotten exciting until you zoom out and realise everything just dropped back into “do nothing” place. From our perspective, it results in a situation where attempting to produce analysis for the final session before Xmas is usually a situation of trying to sound enthusiastic about the potential of picking up pathetically low numbers of points.

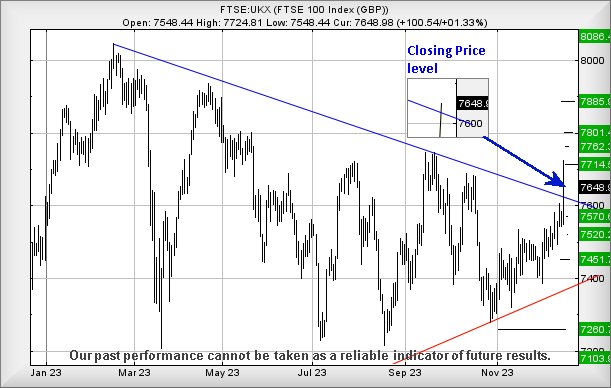

Maybe this year it shall be different, if only thanks to the 30 point upward spike at the open on Wednesday implying a potential for imminent weakness. This is a bit of a pity, thanks to the FTSE ticking the first box in a logic trail which calculates with an eventual visit to 8066 points. Unfortunately, we worry the market has also noticed this and decided the UK doesn’t deserve a visit to a new all time high, unlike Wall Street.

To dwell on the side of positive, ‘cos it’s Christmas soon, above 7750 points looks capable of triggering near term movement to an initial 7778 points. Our longer term secondary, if bettered, calculates at 7802 points and some probable hesitation. If triggered, the tightest stop loss level looks like 7700 points, suggesting a pretty well balanced Risk/Reward scenario.

Our alternate viewpoint, thanks to the upward spike at the open on Wednesday, by necessity makes us suspect reversals shall prove imminent. This being the case, below 7678 appears to have the potential of triggering reversal to an initial 7620 points with our secondary, if broken, a less likely (because it breaks below Blue) 7518 points.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:14:02PM | BRENT | 7928.2 | 7917 | 7843 | 7766 | 7976 | 8074 | 8122 | 8211 | 7979 | ‘cess |

| 10:16:49PM | GOLD | 2030.96 | 2020 | 2011 | 1999 | 2034 | 2048 | 2055 | 2068 | 2032 | |

| 10:21:08PM | FTSE | 7673.8 | 7652 | 7610 | 7557 | 7693 | 7731 | 7761 | 7792 | 7674 | ‘cess |

| 10:23:24PM | STOX50 | 4497.4 | 4491 | 4483 | 4447 | 4539 | 4557 | 4570 | 4596 | 4525 | Success |

| 10:25:22PM | GERMANY | 16624 | 16600 | 16573 | 16492 | 16698 | 16816 | 16845 | 16927 | 16718 | ‘cess |

| 10:27:43PM | US500 | 4700.6 | 4691 | 4669 | 4633 | 4730 | 4777 | 4806 | 4844 | 4769 | |

| 10:35:34PM | DOW | 37106 | 37029 | 36968 | 36742 | 37223 | 37307 | 37359 | 37469 | 37200 | ‘cess |

| 10:38:21PM | NASDAQ | 16585.5 | 16554 | 16482 | 16354 | 16659 | 16665 | 16695 | 16742 | 16581 | Success |

| 10:43:05PM | JAPAN | 33210 | 33073 | 32980 | 32878 | 33185 | 33428 | 33562 | 33724 | 33298 | Shambles |

20/12/2023 FTSE Closed at 7715 points. Change of 1.01%. Total value traded through LSE was: £ 5,802,090,818 a change of -19.89%

19/12/2023 FTSE Closed at 7638 points. Change of 0.32%. Total value traded through LSE was: £ 7,242,394,350 a change of 68.88%

18/12/2023 FTSE Closed at 7614 points. Change of 0.5%. Total value traded through LSE was: £ 4,288,360,200 a change of -64.11%

15/12/2023 FTSE Closed at 7576 points. Change of -0.94%. Total value traded through LSE was: £ 11,949,408,359 a change of 47.73%

14/12/2023 FTSE Closed at 7648 points. Change of 1.32%. Total value traded through LSE was: £ 8,088,595,771 a change of 41.45%

13/12/2023 FTSE Closed at 7548 points. Change of 0.08%. Total value traded through LSE was: £ 5,718,449,628 a change of 4.86%

12/12/2023 FTSE Closed at 7542 points. Change of -0.03%. Total value traded through LSE was: £ 5,453,180,069 a change of 16.03%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BARC Barclays** **LSE:BDEV Barrett Devs** **LSE:CASP Caspian** **LSE:CPI Capita** **LSE:EZJ EasyJet** **LSE:GLEN Glencore Xstra** **LSE:IHG Intercontinental Hotels Group** **LSE:MKS Marks and Spencer** **LSE:OCDO Ocado Plc** **LSE:OXIG Oxford Instruments** **LSE:PHP Primary Health** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:SPX Spirax** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : Barclays, Barrett Devs, Caspian, Capita, EasyJet, Glencore Xstra, Intercontinental Hotels Group, Marks and Spencer, Ocado Plc, Oxford Instruments, Primary Health, Scottish Mortgage Investment Trust, Spirax, Taylor Wimpey,

LSE:BARC Barclays. Close Mid-Price: 151.64 Percentage Change: + 2.70% Day High: 152.36 Day Low: 148.9

Target met. All Barclays needs are mid-price trades ABOVE 152.36 to impro ……..

</p

View Previous Barclays & Big Picture ***

LSE:BDEV Barrett Devs. Close Mid-Price: 563.4 Percentage Change: + 1.29% Day High: 582.2 Day Low: 557.6

Target met. Further movement against Barrett Devs ABOVE 582.2 should impr ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:CASP Caspian. Close Mid-Price: 2.75 Percentage Change: + 3.77% Day High: 2.75 Day Low: 2.6

Weakness on Caspian below 2.6 will invariably lead to 2.2p with secondary ……..

</p

View Previous Caspian & Big Picture ***

LSE:CPI Capita Close Mid-Price: 21.92 Percentage Change: -0.09% Day High: 22.98 Day Low: 21.62

All Capita needs are mid-price trades ABOVE 22.98 to improve acceleration ……..

</p

View Previous Capita & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 508.2 Percentage Change: + 1.19% Day High: 513.2 Day Low: 506

Target met. Continued trades against EZJ with a mid-price ABOVE 513.2 sho ……..

</p

View Previous EasyJet & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 469.15 Percentage Change: + 0.29% Day High: 478 Day Low: 468.45

All Glencore Xstra needs are mid-price trades ABOVE 478 to improve accele ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 7118 Percentage Change: + 0.31% Day High: 7182 Day Low: 7098

Further movement against Intercontinental Hotels Group ABOVE 7182 should ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:MKS Marks and Spencer. Close Mid-Price: 271.4 Percentage Change: + 2.61% Day High: 272.6 Day Low: 266.2

Further movement against Marks and Spencer ABOVE 272.6 should improve acc ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:OCDO Ocado Plc. Close Mid-Price: 789 Percentage Change: + 2.90% Day High: 798.6 Day Low: 771.4

Target met. Further movement against Ocado Plc ABOVE 798.6 should improve ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:OXIG Oxford Instruments. Close Mid-Price: 2370 Percentage Change: + 3.04% Day High: 2375 Day Low: 2300

All Oxford Instruments needs are mid-price trades ABOVE 2375 to improve a ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:PHP Primary Health. Close Mid-Price: 106.3 Percentage Change: + 4.22% Day High: 109 Day Low: 103

Further movement against Primary Health ABOVE 109 should improve accelera ……..

</p

View Previous Primary Health & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 794.6 Percentage Change: + 0.40% Day High: 805.4 Day Low: 793.6

Target met. In the event of Scottish Mortgage Investment Trust enjoying f ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:SPX Spirax. Close Mid-Price: 10475 Percentage Change: + 1.31% Day High: 10515 Day Low: 10365

Further movement against Spirax ABOVE 10515 should improve acceleration t ……..

</p

View Previous Spirax & Big Picture ***

LSE:TW. Taylor Wimpey. Close Mid-Price: 144.8 Percentage Change: + 0.49% Day High: 149.75 Day Low: 144.35

Target met. In the event of Taylor Wimpey enjoying further trades beyond ……..

</p

View Previous Taylor Wimpey & Big Picture ***