#Gold #SP500

It’s funny how a brush with UFO’s can provoke thoughts on UPS’ share price. It all started with two lights in the night sky, one which made an impossible 90 degree turn with no loss of speed, the other continuing onward in utter silence. In the years since the event, clear nights justified wandering outside but for the last two years, the primary moving lights high overhead have been from UPS & DHL airfreight craft.

The shear volume of airfreight proved astounding, especially during Lockdowns as passenger aircraft became a rarity. Instead, a hurried glance at the popular FlightRadar24 website would reveal incredible numbers of air cargo jets, moving parcels back and forth across the Atlantic. Recently however, while there’s a noticeable uptick in passenger jets, there also appears to be a reduction in the number of cargo aircraft, making us wonder if the charge back to “normal” is now effecting peoples shopping habits, fewer parcels needing sent around the world. Quite why people prefer shopping ‘in person’ remains a complete mystery.

A glance at UPS’s share price starts to confirm this suspicion as something certainly appears to be going on, due to their share price constantly descending to lower altitudes.

UPS needs exceed $203 to nullify this scenario, so as it’s trading around $190, this permits a reasonable stop loss level.

Now below $186 allows weakness down to an initial $168 with secondary, if broken, at $154 and visually, a very possible bounce level. There is the potential for extreme danger, should the price discover an excuse to close a session below $154 as we can calculate $120 as a “bottom”.

Infosys Limited (NYSE:INFY) A share, clearly beloved by the current UK chancellor and his wife, trades on the New York stock exchange and for obvious reasons, must be worthy of a glance. From Wikipedia, the company is described as “Infosys Limited is an Indian multinational information technology company that provides business consulting, information technology and outsourcing services. The company was founded in Pune and is headquartered in Bangalore“.

Doubtless the company are cursing the political ambitions of one of the family as it appears their share price has suffered, thanks to the rumbling scandal from the UK. The immediate situation looks fraught with danger as weakness below $22.5 looks capable of promoting reversal to a pretty safe sounding $21.94. While visually there’s a degree of hope for a rebound from such a level, things become nasty as the price will be viewed as breaking the Covid-19 uptrend since 2020. This creates a situation where weakness below $21.94 allows further traffic down to the $17 level.

We can hope the company have avoided contracts with the UK Government. The current climate shall doubtless expose them to scrutiny, conjecture and rumour. Should the $17 level make an appearance, there’s a severe risk of ongoing weakness to an eventual ultimate bottom at $9.22.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:29:05PM | BRENT | 99.18 | |||||||||

| 10:30:56PM | GOLD | 1954.36 | 1940 | 1933 | 1921 | 1950 | 1969 | 1973 | 1982 | 1945 | ‘cess |

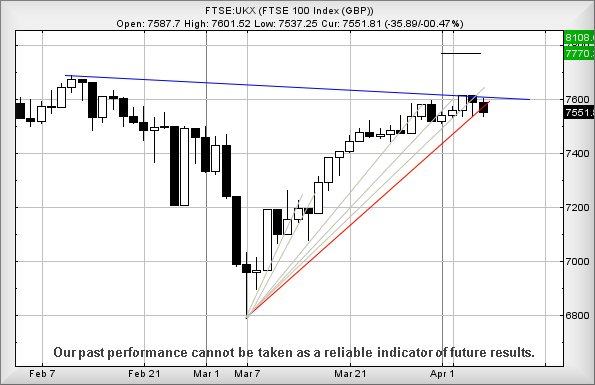

| 10:33:36PM | FTSE | 7590.43 | ‘cess | ||||||||

| 10:35:44PM | FRANCE | 6506.3 | ‘cess | ||||||||

| 10:37:28PM | GERMANY | 14078.36 | ‘cess | ||||||||

| 10:54:29PM | US500 | 4415 | 4407 | 4397 | 4374 | 4422 | 4460 | 4471 | 4482 | 4425 | Success |

| 10:58:06PM | DOW | 34331 | ‘cess | ||||||||

| 11:01:39PM | NASDAQ | 14000 | ‘cess | ||||||||

| 11:03:33PM | JAPAN | 26731 |

11/04/2022 FTSE Closed at 7618 points. Change of -0.67%. Total value traded through LSE was: £ 5,589,702,864 a change of 0.53%

8/04/2022 FTSE Closed at 7669 points. Change of 1.56%. Total value traded through LSE was: £ 5,560,387,967 a change of -14.51%

7/04/2022 FTSE Closed at 7551 points. Change of -0.47%. Total value traded through LSE was: £ 6,503,801,029 a change of -11.79%

6/04/2022 FTSE Closed at 7587 points. Change of -0.34%. Total value traded through LSE was: £ 7,373,306,998 a change of -8.37%

5/04/2022 FTSE Closed at 7613 points. Change of 0.73%. Total value traded through LSE was: £ 8,046,795,473 a change of 61.76%

4/04/2022 FTSE Closed at 7558 points. Change of 0.28%. Total value traded through LSE was: £ 4,974,492,195 a change of -8.16%

1/04/2022 FTSE Closed at 7537 points. Change of 0.29%. Total value traded through LSE was: £ 5,416,602,044 a change of -16.69%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:AVCT Avacta** **LSE:EME Empyrean** **LSE:GLEN Glencore Xstra** **LSE:IAG British Airways** **LSE:SCLP Scancell** **

********

Updated charts published on : Aston Martin, Avacta, Empyrean, Glencore Xstra, British Airways, Scancell,

LSE:AML Aston Martin Close Mid-Price: 811.6 Percentage Change: -6.69% Day High: 875.4 Day Low: 797.4

Target met. Weakness on Aston Martin below 797 will invariably lead to 78 ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:AVCT Avacta. Close Mid-Price: 112 Percentage Change: + 12.45% Day High: 126.5 Day Low: 100

Target met. All Avacta needs are mid-price trades ABOVE 126.5 to improve ……..

</p

View Previous Avacta & Big Picture ***

LSE:EME Empyrean Close Mid-Price: 11.5 Percentage Change: -2.54% Day High: 13 Day Low: 11.5

All Empyrean needs are mid-price trades ABOVE 13 to improve acceleration ……..

</p

View Previous Empyrean & Big Picture ***

LSE:GLEN Glencore Xstra Close Mid-Price: 520.4 Percentage Change: -1.44% Day High: 536.4 Day Low: 520.4

Continued trades against GLEN with a mid-price ABOVE 536.4 should improve ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 136.48 Percentage Change: + 2.49% Day High: 139.1 Day Low: 130.6

Weakness on British Airways below 130.6 will invariably lead to 119 with ……..

</p

View Previous British Airways & Big Picture ***

LSE:SCLP Scancell. Close Mid-Price: 16.9 Percentage Change: + 57.21% Day High: 18.25 Day Low: 10.75

Target met. All Scancell needs are mid-price trades ABOVE 18.25 to improv ……..

</p

View Previous Scancell & Big Picture ***