#Gold #Germany We’ve had a fondness for Versarien dating back to the time their share price nearly hit 2 quid! The reason is quite ridiculous, due to the vague similarity of their name to “Valerian”, a movie with one of the best opening sequences since “2001, A Space Odyssey”. While neither movie makes it into the unforgettable category, there’s something about the transit from Earth to Space which clearly caught the attention. While we generally avoid shares trading under a penny, we’ve had a few email enquiries asking us to take a glance at this.

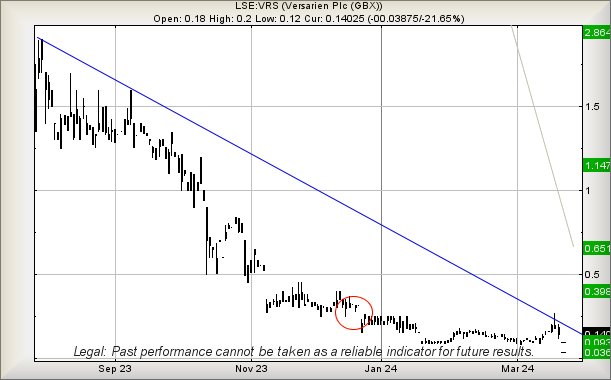

Of course, with Versarien Plc, something else is worthy of attention. When we reviewed the price around a year ago, we’d given 0.23p as a potential ultimate bottom. For reasons best known to the markets, the share price was literally gapped below this level in December last year (circled). We suspect the implication was an attempt to both keep the share trading and trap the price in an effective straight line, rather than allowing the reversal to continue directly into a zone where targets must be prefaced with minus signs.

Visually the share price recently made an attempt to escape upward, a movement immediately reversed by the marketplace, dumping the share into a zone where an ultimate bottom calculates at a silly 0.09p, perhaps even 0.06p.

But on the basis the market has opted to restrict Versarien in a parking orbit while awaiting positive news, above 0.21 should now prove useful, hopefully capable of propelling the share price upward to an initial 0.39p with secondary, if bettered, a rather surprising 0.65p. While such a target would represent a four fold increase from current, it effectively dumps the share into a region where some proper recovery becomes possible.

Importantly, until such time the share price closes above Blue on the chart, it’s worth remembering the company are now trading in an area, where it’s effectively impossible for us to calculate any sort of Big Picture ultimate bottom.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:20:35PM | BRENT | 8548.4 | Success | ||||||||

| 9:22:53PM | GOLD | 2185.86 | 2178 | 2175 | 2172 | 2188 | 2190 | 2192 | 2198 | 2182 | Success |

| 9:25:20PM | FTSE | 7772 | Success | ||||||||

| 9:28:45PM | STOX50 | 5042.1 | |||||||||

| 9:32:18PM | GERMANY | 18142.5 | 18043 | 18024 | 17980 | 18098 | 18156 | 18199 | 18221 | 18119 | Success |

| 9:35:48PM | US500 | 5233.3 | Success | ||||||||

| 9:59:08PM | DOW | 39530.5 | Success | ||||||||

| 10:04:19PM | NASDAQ | 18290.7 | |||||||||

| 10:06:59PM | JAPAN | 40559 | ‘cess |

20/03/2024 FTSE Closed at 7737 points. Change of -0.01%. Total value traded through LSE was: £ 5,293,450,897 a change of -24.59%

19/03/2024 FTSE Closed at 7738 points. Change of 0.21%. Total value traded through LSE was: £ 7,019,485,626 a change of 32.39%

18/03/2024 FTSE Closed at 7722 points. Change of -0.06%. Total value traded through LSE was: £ 5,302,291,747 a change of -63.39%

15/03/2024 FTSE Closed at 7727 points. Change of -0.21%. Total value traded through LSE was: £ 14,485,048,081 a change of 162.41%

14/03/2024 FTSE Closed at 7743 points. Change of -0.37%. Total value traded through LSE was: £ 5,520,093,152 a change of -24.07%

13/03/2024 FTSE Closed at 7772 points. Change of 0.32%. Total value traded through LSE was: £ 7,270,420,862 a change of 0.35%

12/03/2024 FTSE Closed at 7747 points. Change of 1.02%. Total value traded through LSE was: £ 7,245,332,425 a change of 15.81%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BP. BP PLC** **LSE:FRES Fresnillo** **LSE:LLOY Lloyds Grp.** **LSE:RR. Rolls Royce** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:TRN The Trainline** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : BP PLC, Fresnillo, Lloyds Grp., Rolls Royce, Scottish Mortgage Investment Trust, The Trainline, Zoo Digital,

LSE:BP. BP PLC Close Mid-Price: 493.65 Percentage Change: -0.93% Day High: 497.4 Day Low: 491.6

All BP PLC needs are mid-price trades ABOVE 497.4 to improve acceleration ……..

</p

View Previous BP PLC & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 440.3 Percentage Change: -0.25% Day High: 442.8 Day Low: 435.2

Target met. In the event Fresnillo experiences weakness below 435.2 it ca ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 50.04 Percentage Change: + 1.00% Day High: 50.23 Day Low: 49.48

In the event of Lloyds Grp. enjoying further trades beyond 50.23, the sha ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 406.7 Percentage Change: + 1.50% Day High: 407.7 Day Low: 397

Target met. In the event of Rolls Royce enjoying further trades beyond 40 ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 843.2 Percentage Change: + 1.59% Day High: 842.8 Day Low: 829

In the event of Scottish Mortgage Investment Trust enjoying further trade ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:TRN The Trainline. Close Mid-Price: 386.4 Percentage Change: + 1.42% Day High: 393.8 Day Low: 381

In the event of The Trainline enjoying further trades beyond 393.8, the s ……..

</p

View Previous The Trainline & Big Picture ***

LSE:ZOO Zoo Digital Close Mid-Price: 21.75 Percentage Change: -3.33% Day High: 22.5 Day Low: 21.75

In the event Zoo Digital experiences weakness below 21.75 it calculates w ……..

</p

View Previous Zoo Digital & Big Picture ***