#Brent #SP500 The Singapore Grand Prix was boring. Perhaps cruel to admit this so blatantly but as a race usually editing itself to be quite lively, it proved more exciting watching a couple of leaves falling off a Beech Tree in the garden, slowly spiralling to the ground and trying to guess which would be first. Even the jaded sounding commentators on Sky Sports were starting to sound like they’d prefer to be cataloguing the behaviour of left leaf vs. right leaf. As can be assumed, cold and windy September Sundays here in Argyll can be somewhat lacking in entertainment value.

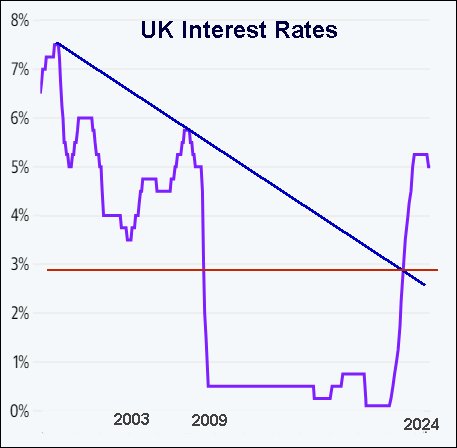

Since the start of August, it has been more interesting watching leafs falling than reviewing Barclays share price movements. We’d been hopeful the coming of September, along with the prospect of interest rate reductions by Central Banks, could’ve improved the prospect for retail banks but thanks to the behaviour of the UK’s BoE, it looks like the Britain shall be late to the party. Perhaps the oncoming budget in the coming week shall dangle some reason for optimism but, given the folks unveiling their plans for the country, we’re not going to be surprised if they make Liz Truss look competent.

Maybe it shall prove to be the case Barclays shall continue to march on the spot while we await October but now, below 214p risks triggering reversals to an initial 196p and perhaps a rebound. Should such a level break, our secondary works out at 181p. The visuals don’t hold out any great hope for a bounce at such a level.

Of course, we could be surprised and feel the 232p level should perhaps be expected to prove capable of giving a trigger for recovery. Closure above such a level calculates with the potential of a lift to an initial 261p with our secondary, if bettered, at a more impressive 305p. Who knows, maybe a UK Government shall abandon tradition and try and do something useful for the country…

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 11:11:55PM | BRENT | 7369.3 | 7355 | 7329 | 7278 | 7415 | 7456 | 7476 | 7567 | 7390 |

| 11:18:23PM | GOLD | 2620.09 | 2612 | |||||||

| 11:21:02PM | FTSE | 8213 | 8316 | |||||||

| 11:25:00PM | STOX50 | 4874.2 | 4915 | |||||||

| 11:27:14PM | GERMANY | 18795.2 | 18797 | |||||||

| 11:30:20PM | US500 | 5719 | 5674 | 5665 | 5643 | 5698 | 5714 | 5730 | 5748 | 5694 |

| 11:32:56PM | DOW | 42118.5 | 42047 | |||||||

| 11:35:50PM | NASDAQ | 19900.8 | 19756 | |||||||

| 11:38:34PM | JAPAN | 38635 | 38234 |

20/09/2024 FTSE Closed at 8230 points. Change of -1.18%. Total value traded through LSE was: £ 12,930,077,535 a change of 99.09%

19/09/2024 FTSE Closed at 8328 points. Change of 0.91%. Total value traded through LSE was: £ 6,494,685,893 a change of -5.91%

18/09/2024 FTSE Closed at 8253 points. Change of -0.67%. Total value traded through LSE was: £ 6,902,679,441 a change of 22.65%

17/09/2024 FTSE Closed at 8309 points. Change of 0.37%. Total value traded through LSE was: £ 5,628,109,018 a change of 50.11%

16/09/2024 FTSE Closed at 8278 points. Change of 0.06%. Total value traded through LSE was: £ 3,749,335,232 a change of -16.44%

13/09/2024 FTSE Closed at 8273 points. Change of 0.4%. Total value traded through LSE was: £ 4,486,905,265 a change of -19.07%

12/09/2024 FTSE Closed at 8240 points. Change of 0.57%. Total value traded through LSE was: £ 5,544,211,682 a change of 9.81%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BLVN Bowleven** **LSE:DGE Diageo** **LSE:FGP Firstgroup** **LSE:GRG Greggs** **LSE:HIK Hikma** **LSE:IQE IQE** **LSE:PMG Parkmead** **LSE:RR. Rolls Royce** **LSE:SPX Spirax** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : Bowleven, Diageo, Firstgroup, Greggs, Hikma, IQE, Parkmead, Rolls Royce, Spirax, Taylor Wimpey,

LSE:BLVN Bowleven. Close Mid-Price: 0.28 Percentage Change: + 57.14% Day High: 0.28 Day Low: 0.18

It’s hard to be optimistic with this shambles. It needs above 0.28 to now ……..

</p

View Previous Bowleven & Big Picture ***

LSE:DGE Diageo Close Mid-Price: 2494.5 Percentage Change: -2.25% Day High: 2533 Day Low: 2492.5

Above 2535 has the potential to trigger recovery to an initial 2573 with o ……..

</p

View Previous Diageo & Big Picture ***

LSE:FGP Firstgroup Close Mid-Price: 145.7 Percentage Change: -5.27% Day High: 152.6 Day Low: 144.5

Target met. Continued weakness against FGP taking the price below 144.5 c ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:GRG Greggs Close Mid-Price: 3140 Percentage Change: -1.57% Day High: 3250 Day Low: 3124

In the event of Greggs enjoying further trades beyond 3250, the share sho ……..

</p

View Previous Greggs & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1902 Percentage Change: -3.16% Day High: 1953 Day Low: 1891

This feels like it is going wrong. Below 1890 now calculates with the pote ……..

</p

View Previous Hikma & Big Picture ***

LSE:IQE IQE Close Mid-Price: 17.12 Percentage Change: -3.17% Day High: 17.94 Day Low: 17.22

If IQE experiences continued weakness below 17.22, it will invariably lea ……..

</p

View Previous IQE & Big Picture ***

LSE:PMG Parkmead Close Mid-Price: 7.75 Percentage Change: -6.06% Day High: 8.25 Day Low: 7.75

In the event Parkmead experiences weakness below 7.75 it calculates with ……..

</p

View Previous Parkmead & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 526.2 Percentage Change: + 0.23% Day High: 527 Day Low: 518

All Rolls Royce needs are mid-price trades ABOVE 527 to improve accelerat ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SPX Spirax Close Mid-Price: 7160 Percentage Change: -4.79% Day High: 7510 Day Low: 7160

If Spirax experiences continued weakness below 7160, it will invariably l ……..

</p

View Previous Spirax & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 165.55 Percentage Change: -1.95% Day High: 169.15 Day Low: 165.95

All Taylor Wimpey needs are mid-price trades ABOVE 169.15 to improve acce ……..

</p

View Previous Taylor Wimpey & Big Picture ***