#FTSE #Nasdaq Tuesday was interesting, thanks to the fallout from banging my head! We left the hospital, my wife clutching a list of symptoms to watch for and frantically made up an endless stream of daft questions to check my memory and cognisance abilities. The 22nd of October will be difficult to forget, due to being asked todays date repeatedly, along with additional questions like “How many days until your birthday?”, “How old is Amber? (grand-daughter)” and what’s the name of that YouTube political show you watch every single night? (It’s The Megyn Kelly Show) The moral of the story was fairly simple. Don’t knock yourself out by tripping on a kitchen rug!

Thankfully, once the rain stopped, the offending rug was placed at the top of the burn pile in our wood cutting area. This particular location, for the last ten years, has been the host of multiple bonfires as we attempt to immolate the trunk and root base of an old Ash Tree. We’re getting close to success and a constant worry concerns what will happen when we finally burn through the thing. The problem is, when we burn though the core and it breaks, it might roll downhill into the stream, potentially creating a dam and diverting the water flow. We’ve a couple of ideas to derail this danger as we’d prefer to avoid creating a swimming pool on the upper part of the lawn. However, it transpired the kitchen rug burnt extremely well, joining a growing list of items sourced via Temu which failed real life use. For some reason, they all burn well.

As for Hunting Plc, the company enjoy a fascinating history, one which was personally relatable as being part of a family business produces an amazing “private society” where the only thing which matters is the company and everything in the family rotates around it. For over 20 years, it was easy to rejoice in such an environment, aware I was being groomed to take over the financial side of the company once the university thing was over and the requisite number of years were spent learning everything in the background. Fortunately, discovering computers, motorcycles, music, and girls intruded, finding myself opting to learn everything from the ground level. This meant I finished university on a Friday and started as an apprentice mechanic on Monday. Other family members preferred schmoozing around wearing suits in the various franchise outlets but within three years, my qualifications came through, so of course I was tossed into the parts department (a room with piles of pallets) and told to sort things out. Everything changed within a year as no-one had realised whoever controls the spares department can easily control the company.

From new car deliveries, service department load, even the coffee vending machines, workshop overalls, or whatever, all relied on the parts department operating efficiently but finding myself at management meetings to be “roasted” for failing in an area provoked some pushback, entirely due to a sales manager demanding his new company car be fitted with a top of the range Blaupunkt stereo system. From a personal perspective, this was an obvious “nope” as it was obvious spending 25% of the vehicles value on a sound system would never be recouped. Few things can short circuit a company faster than a junior family member laying down some rules, company politics immediately becoming quite messy. From a personal perspective, avoiding seeking logical support from a main office grown up was perhaps a mistake, but things got so bad, the section MD returned from holiday due to the accountant taking the sales managers side.

The compromise decision was genius, the sales manager being told he could have the fancy stereo system but unless the cost was recouped when the vehicle was sold in six months, any loss would be taken from his wages. He settled for a standard Motorola sound system, the accountant also getting “talked too” over the whole event. Blissfully unaware the grown ups in my family had been standing back, letting me dig whatever shape of hole I wanted, when everything settled down, I was to find myself an involved party to virtually every decision being made at management level. Thinking back, the situation was appalling, a multi franchise dealership effectively being run by a jumped up motor mechanic, one blessed with being designated as unfireable This sort of thing is the delicious poison which infects a family business and a few years later, now controlling the service and parts department, a parental order to move into the sales department caused a ruckus. I left, assigned to internal Siberia to run our loss-making petrol stations. A few years later, an oil company made an offer to take over a few of their sites which seemed a great idea. The rest is history but I’ve never forgotten a key thing about working for family. Since the day I’d started as an apprentice mechanic, my wage had been 75p/hour and it never changed. For some reason, I thought every girlfriend would always earn substantially more. Believing the only thing which matters is the business certainly proved humbling.

Five years after I left, the company imploded due to a spectacular series of terrible decisions, the two family half’s splitting and neither surviving. Now, years later, it’s easy to review everything and assign blame, especially as the culprit who caused the mess which lost 900 jobs wasn’t even part of the family, just a son-in-law with an ingratiating smile. Nowadays, when any of us gather, there’s only regret from some cousins who thought they’d be measured by the cars they drove or the suits they wore.

Then again, you can come across a family business like Hunting Plc, a company dating back 150 years with a few messy periods to their name, something they don’t bother trying to cover up. As an aviation fan, it was quite a surprise to discover they were behind the Jet Provost, a dinky little jet which was capable of over 400 mph and became the stepping stone for generations of RAF pilots through a 40 year training history. In addition, Hunting Plc knocked together the 1-11, initially designated as a 30 seat aircraft but one which became quite a biggie. Essentially, before the Boeing 737 or MD DC9, there was the Hunting 1-11 and it was a lovely jet, especially when it decided to serve breakfast from the roof. As a child, my father would take me to London every few months when he’d meetings arranged. Nowadays, I think it was due to my mother hating the idea of being left with me for the day, but these frequent trips let to fascination about the jets in use. Plus, whatever secretary was designated with babysitting usually hard a carte blanche budget, the poor girl being able to order a car to drive us anywhere around London for the day. Years later, my very hung-over wife and I did a similar day out and both remained disappointed at Buck Palace as being a little drab and small…

Obviously, as fans of Hunting for surviving the last 150 years while my own family struggled to beat 15 years, suggests they should be worth paying some close attention to.

From our perspective, there is a key trigger level at 464p and the company are currently a country mile away from such a target. In fact, even above just 454p should next trigger surprise recovery to an initial 589p with our secondary, if bettered, a longer term 747p.

Alternately, if things intend go horribly wrong, below 238 looks troubling as it allows for reversal to an initial 205 with our secondary, if broken, at 118p.

We think, despite the price being forced down, this shall prove worth watching.

FUTURES

| Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

| 11:06:25PM |

BRENT |

7522.7 |

|

|

|

|

|

|

|

|

Success |

| 11:08:57PM |

GOLD |

2747.07 |

|

|

|

|

|

|

|

|

‘cess |

| 11:11:32PM |

FTSE |

8312.5 |

8252 |

8245 |

8194 |

8282 |

8330 |

8345 |

8376 |

8302 |

Success |

| 11:17:33PM |

STOX50 |

4935.4 |

|

|

|

|

|

|

|

|

‘cess |

| 11:23:29PM |

GERMANY |

19421.5 |

|

|

|

|

|

|

|

|

|

| 11:27:55PM |

US500 |

5845.3 |

|

|

|

|

|

|

|

|

Shambles |

| 11:34:31PM |

DOW |

42791 |

|

|

|

|

|

|

|

|

‘cess |

| 11:36:31PM |

NASDAQ |

20360 |

20205 |

20132 |

20028 |

20292 |

20446 |

20465 |

20552 |

20349 |

|

| 11:40:04PM |

JAPAN |

38254 |

38182 |

38085 |

37918 |

38410 |

38586 |

38725 |

38904 |

38342 |

|

22/10/2024 FTSE Closed at 8306 points. Change of -0.14%. Total value traded through LSE was: £ 4,277,437,819 a change of 11.53%

21/10/2024 FTSE Closed at 8318 points. Change of -0.48%. Total value traded through LSE was: £ 3,835,225,981 a change of -24.37%

18/10/2024 FTSE Closed at 8358 points. Change of -0.32%. Total value traded through LSE was: £ 5,071,129,740 a change of -4.53%

17/10/2024 FTSE Closed at 8385 points. Change of 0.67%. Total value traded through LSE was: £ 5,311,482,750 a change of -18.88%

16/10/2024 FTSE Closed at 8329 points. Change of 0.97%. Total value traded through LSE was: £ 6,547,715,770 a change of 9.87%

15/10/2024 FTSE Closed at 8249 points. Change of -0.52%. Total value traded through LSE was: £ 5,959,303,789 a change of 44.82%

14/10/2024 FTSE Closed at 8292 points. Change of 0.47%. Total value traded through LSE was: £ 4,114,889,557 a change of -0.88%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BLOE Block Energy PLC** **LSE:BME B & M** **LSE:CEY Centamin** **LSE:EME Empyrean** **LSE:FRES Fresnillo** **LSE:IAG British Airways** **LSE:IHG Intercontinental Hotels Group** **LSE:IQE IQE** **LSE:ITM ITM Power** **LSE:LLOY Lloyds Grp.** **

********

Updated charts published on : Block Energy PLC, B & M, Centamin, Empyrean, Fresnillo, British Airways, Intercontinental Hotels Group, IQE, ITM Power, Lloyds Grp.,

LSE:BLOE Block Energy PLC Close Mid-Price: 0.8 Percentage Change: -3.03% Day High: 0.82 Day Low: 0.8

Target met. Weakness on Block Energy PLC below 0.8 will invariably lead t ……..

Subscribe for more

</p

View Previous Block Energy PLC & Big Picture ***

LSE:BME B & M. Close Mid-Price: 408 Percentage Change: + 0.57% Day High: 406.6 Day Low: 400.7

In the event B & M experiences weakness below 400.7 it calculates with a ……..

Subscribe for more

</p

View Previous B & M & Big Picture ***

LSE:CEY Centamin. Close Mid-Price: 173.2 Percentage Change: + 0.99% Day High: 175.3 Day Low: 170.4

Target met. In the event of Centamin enjoying further trades beyond 175.3 ……..

Subscribe for more

</p

View Previous Centamin & Big Picture ***

LSE:EME Empyrean. Close Mid-Price: 0.27 Percentage Change: + 34.75% Day High: 0.3 Day Low: 0.2

Weakness on Empyrean below 0.2 will invariably lead to 0 as this now repr ……..

Subscribe for more

</p

View Previous Empyrean & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 769 Percentage Change: + 2.88% Day High: 775.5 Day Low: 750

All Fresnillo needs are mid-price trades ABOVE 775.5 to improve accelerat ……..

Subscribe for more

</p

View Previous Fresnillo & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 215.4 Percentage Change: + 0.61% Day High: 217 Day Low: 213.4

In the event of British Airways enjoying further trades beyond 217, the ……..

Subscribe for more

</p

View Previous British Airways & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 8714 Percentage Change: + 1.73% Day High: 8714 Day Low: 8342

Target met. Further movement against Intercontinental Hotels Group ABOVE ……..

Subscribe for more

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:IQE IQE Close Mid-Price: 15.56 Percentage Change: -4.54% Day High: 16.5 Day Low: 15.7

Weakness on IQE below 15.7 will invariably lead to 15p with secondary (if ……..

Subscribe for more

</p

View Previous IQE & Big Picture ***

LSE:ITM ITM Power Close Mid-Price: 40.28 Percentage Change: -2.71% Day High: 42 Day Low: 40.12

Weakness on ITM Power below 40.12 will invariably lead to 39.5p with seco ……..

Subscribe for more

</p

View Previous ITM Power & Big Picture ***

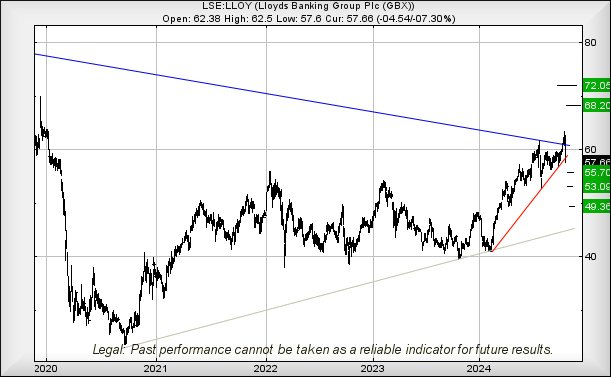

LSE:LLOY Lloyds Grp.. Close Mid-Price: 62 Percentage Change: + 0.32% Day High: 62.42 Day Low: 61.4

All Lloyds Grp. needs are mid-price trades ABOVE 62.42 to improve acceler ……..

Subscribe for more

</p

View Previous Lloyds Grp. & Big Picture ***

*** End of “Updated Today” comments on shares.