#FTSE #Nasdaq It cannot be easy, trying to trade successfully while based (and your share price traded) in a country where the Government actively works against your industry, all in the name of a political narrative which has now been abandoned by the USA and an ideal which other oil producing nations ridicule and ignore. But in the UK, not only has Scotlands ONLY oil refinery been allowed to close but the government opted to assist the company in relocating to Europe, ensuring some sort of box is ticked in the NetZero checklist!

It was certainly a shock to discover the level of C02 in the worlds atmosphere is around 0.04%, the level regularly boosted by volcanic events rather than this writer starting the engine of his little old tractor to cut the grass or lighting the wood burning stove. It’s a bit like finding out the UK Government has decided to wage a battle against the moon and its effect on the tide, a ridiculous concept…

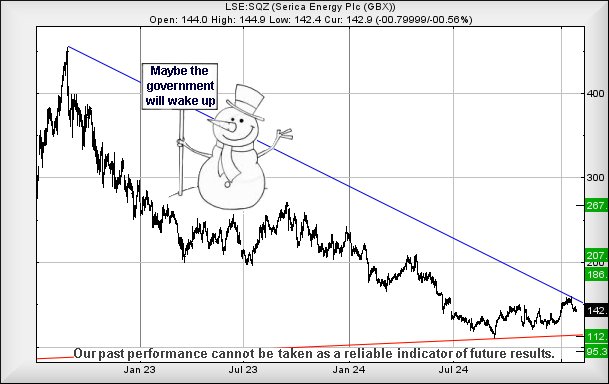

With all this negativity, it may be a surprise to hear we’re slightly optimistic about SQZ’s future, thanks to a movement down at 112p in September of 2024. This death lunge was interesting, insofar as it almost exactly hit a bottom target we’d calculated, a point where our in-house rules dictate a rise should be expected. Aside from the salient detail the share price really has not recovered with any enthusiasm as, while the 20% rise since is useful, we would have hoped for more. A bit like expecting your child’s exam results to be just a little bit better but instead, you are left with a slightly empty feeling and suspecting she’d spent all her time chatting on Facebook, rather than actually studying! This familiar scenario will doubtless become more familiar in the years ahead as while our own daughter had a computer far in advance of anything in her school, she’s about to have a hard time with her own daughters, both of whom have smartphones and aside from proper coding, are capable of knocking our daughters original PC into the gutter.

Currently, the share price needs exceed just 151p to suggest it’s moving into a new reality, giving an initial target of price recovery to an initial 186p with our secondary, if beaten, at a visually pleasing and probable 207p. Our software happily tosses out a third level ambition at 267p, one which also makes an awful lot of sense as historically this represents a price area where the market found things quite interesting.

This one is difficult as it appears dependent on UK government competence, something which is notably lacking while we’re governed by folk who’ve declared war on the strongest industry in the UK, a sacrifice at the alter of a fiction folk no longer believe. Any U-turn by the government is liable to provoke a sharp change in the fortunes of mid-level energy companies such as Serica.

Our alternate scenario requires the share price to drip below 126p to spell trouble, allowing for reversal to 112p again and hopefully a bounce. Should such a level break, we can currently calculate a longer term secondary at 95p and a hope for a solid bounce. At this point in time, we have some difficulty in calculating any target levels below 95p.

This is perhaps worth watching, a real company doing real production rather than being based on rumours and unfounded hope.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:19:27PM | BRENT | 7557 | |||||||||

| 11:23:11PM | GOLD | 2759.68 | |||||||||

| 11:27:13PM | FTSE | 8554.1 | 8514 | 8502 | 8475 | 8545 | 8554 | 8562 | 8578 | 8529 | |

| 11:31:13PM | STOX50 | 5240.3 | Success | ||||||||

| 11:34:30PM | GERMANY | 21657 | Success | ||||||||

| 11:37:45PM | US500 | 6059 | |||||||||

| 11:41:32PM | DOW | 44839.5 | |||||||||

| 11:47:46PM | NASDAQ | 21538 | 21036 | 20842 | 20624 | 21192 | 21574 | 21816 | 22208 | 21436 | |

| 11:49:55PM | JAPAN | 39441 |

29/01/2025 FTSE Closed at 8557 points. Change of 0.28%. Total value traded through LSE was: £ 5,492,931,897 a change of 11.31%

28/01/2025 FTSE Closed at 8533 points. Change of 0.35%. Total value traded through LSE was: £ 4,934,936,161 a change of 3.9%

27/01/2025 FTSE Closed at 8503 points. Change of 0.01%. Total value traded through LSE was: £ 4,749,731,761 a change of -19.91%

24/01/2025 FTSE Closed at 8502 points. Change of -0.74%. Total value traded through LSE was: £ 5,930,778,515 a change of -10.73%

23/01/2025 FTSE Closed at 8565 points. Change of 0.23%. Total value traded through LSE was: £ 6,643,702,165 a change of 25.9%

22/01/2025 FTSE Closed at 8545 points. Change of -0.04%. Total value traded through LSE was: £ 5,277,040,750 a change of 4.97%

21/01/2025 FTSE Closed at 8548 points. Change of 0.33%. Total value traded through LSE was: £ 5,027,009,717 a change of 16.44%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports.

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

If you want to ask a question about something Market Related intraday, don’t hesitate to email private.client@trendsandtargets.com. If something has gone volatile and a quick answer is needed, we’ve probably already run the numbers on it. As you’ll appreciate, we try and avoid spamming people needlessly.

Section One – Outlook Updated Today. Click here for Section Two – Outlook remains valid stocks

Click Epic to jump to share: LSE:CCL Carnival** **LSE:EXPN Experian** **LSE:GLEN Glencore Xstra** **LSE:HIK Hikma** **LSE:HSBA HSBC** **LSE:IHG Intercontinental Hotels Group** **LSE:NWG Natwest** **

********

Updated charts published on : Carnival, Experian, Glencore Xstra, Hikma, Intercontinental Hotels Group, Natwest,

LSE:CCL Carnival Close Mid-Price: 2010 Percentage Change: + 0.25% Day High: 2047 Day Low: 1983.5

Further movement against Carnival ABOVE 2047 should improve acceleration toward an initial 2081p with secondary (if initial bested) at 2313p. The share would require to weaken BELOW 966p calculates as leading to an initial 964p with secondary (if broken) at a longer term 805p.

Previous Report:

28/01/2025 Target met. Continued trades against CCL with a mid-price ABOVE 2014 should improve the share value to firstly 2081p with secondary (if initial bested) at 2313p. The share would require to weaken BELOW 966p calculates as leading to an initial 964p with secondary (if broken) at a longer term 805p.

</p

View Previous Carnival & Big Picture ***

LSE:EXPN Experian. Close Mid-Price: 3962 Percentage Change: -0.10% Day High: 3985 Day Low: 3937

All Experian needs are mid-price trades ABOVE 3985 to improve acceleration toward an initial 4004p with secondary (if initial bested) at 4187p. The price would require to slip BELOW 2366 will invariably lead to 2355p with secondary (if broken) at a longer term 2259p.

Previous Report:

01/10/2024 In the event of Experian enjoying further trades beyond 3978, the share should experience improved acceleration toward an initial 4004p with secondary (if initial bested) at 4187p. The price would require to slip BELOW 2366 will invariably lead to 2355p with secondary (if broken) at a longer term 2259p.

</p

View Previous Experian & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 345.5 Percentage Change: -2.66% Day High: 354.6 Day Low: 345.55

Continued weakness against GLEN taking the price below 345.55 calculates as leading to an initial 342p with secondary (if broken) at a longer term 308p. Glencore Xstra share price requires to recover ABOVE 414 is now needed to ideally trigger recovery to an almost certain 465p and possible hesitation. Our secondary, if bettered, is at an eventual 506p.

Previous Report:

20/12/2024 Target met. If Glencore Xstra experiences continued weakness below 348.35, it will invariably lead to 342p with secondary (if broken) at a longer term 308p. Glencore Xstra share price requires to recover ABOVE 414 is now needed to ideally trigger recovery to an almost certain 465p and possible hesitation. Our secondary, if bettered, is at an eventual 506p.

</p

View Previous Glencore Xstra & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 2248 Percentage Change: + 1.63% Day High: 2254 Day Low: 2204

Target met. Further movement against Hikma ABOVE 2254 should improve acceleration toward an initial 2283p with secondary (if initial bettered) at 2421p. The price would require to slip BELOW 1757, it will invariably lead to 1732p with secondary (if broken) at a longer term 1551p.

Previous Report:

28/01/2025 In the event of Hikma enjoying further trades beyond 2226, the share should experience improved acceleration toward an initial 2232 with secondary (if initial bettered) at 2283p. The mid-price would require to trade BELOW 1757, it will invariably lead to 1732p with secondary (if broken) at a longer term 1551p.

</p

View Previous Hikma & Big Picture ***

LSE:HSBA HSBC Close Mid-Price: 835.8 Percentage Change: + 1.41% Day High: 834.6 Day Low: 823.7

Target met. All HSBC needs are mid-price trades ABOVE 834.6 to improve acceleration toward an initial 843p with secondary (if initial exceeded) at 896p. The mid-price would require to trade BELOW 613p and heading to an initial 585p with secondary, if broken, at 540p and hopefully a rebound.

Previous Report:

21/01/2025 Continued trades against HSBA with a mid-price ABOVE 829.2 should improve the share value to firstly 834p with secondary (if initial bettered) at 896p. The mid-price would require to trade BELOW 613p and heading to an initial 585p with secondary, if broken, at 540p and hopefully a rebound.

</p

View Previous HSBC & Big Picture ***

LSE:IHG Intercontinental Hotels Group Close Mid-Price: 10680 Percentage Change: + 0.90% Day High: 10735 Day Low: 10635

Target met. All Intercontinental Hotels Group needs are mid-price trades ABOVE 10735 to improve acceleration toward an initial 10837p with secondary (if initial exceeded) at 11030p. The mid-price would require to trade BELOW 9988 will invariably lead to 9388p with secondary (if broken) at a longer term 8978p.

Previous Report:

24/01/2025 Further movement against Intercontinental Hotels Group ABOVE 10655 should improve acceleration toward an initial 10725 with secondary (if initial bested) at 10837. The mid-price would require to trade BELOW 9988 will invariably lead to 9388p with secondary (if broken) at a longer term 8978p.

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:NWG Natwest Close Mid-Price: 435.1 Percentage Change: + 2.33% Day High: 436.5 Day Low: 427.3

In the event of Natwest enjoying further trades beyond 436.5, the share should experience improved acceleration toward an initial 439p with secondary (if initial bested) at 468p. The mid-price would require to trade BELOW 230, calculating as leading to an initial 201p with secondary (if broken) at a longer term 153p.

Previous Report:

24/01/2025 Further movement against Natwest ABOVE 430.9 should improve acceleration toward an initial 439p with secondary (if initial bested) at 468p. The mid-price would require to trade BELOW 230, calculating as leading to an initial 201p with secondary (if broken) at a longer term 153p.

</p

View Previous Natwest & Big Picture ***

*** End of “Updated Today” comments on shares. Listed below are those where commentary remains valid.

SECTION TWO

Click Epic to jump to share:LSE:AAL Anglo American** **LSE:AFC AFC Energy** **LSE:AML Aston Martin** **LSE:ASC Asos** **LSE:AV. Aviva** **LSE:AVCT Avacta** **LSE:AZN Astrazeneca** **LSE:BARC Barclays** **LSE:BBY BALFOUR BEATTY** **LSE:BLOE Block Energy PLC** **LSE:BME B & M** **LSE:BP. BP PLC** **LSE:BT.A British Telecom** **LSE:CAR Carclo** **LSE:CASP Caspian** **LSE:CEY Centamin** **LSE:CLAI Cellular Goods** **LSE:CNA Centrica** **LSE:CPI Capita** **LSE:DARK Darktrace Plc** **LSE:DGE Diageo** **LSE:ECO ECO (Atlantic) O & G** **LSE:EME Empyrean** **LSE:EMG MAN** **LSE:EZJ EasyJet** **LSE:FGP Firstgroup** **LSE:FOXT Foxtons** **LSE:FRES Fresnillo** **LSE:GENL Genel** **LSE:GKP Gulf Keystone** **LSE:GRG Greggs** **LSE:HL. Hargreaves Lansdown** **LSE:IAG British Airways** **LSE:IDS International Distribution** **LSE:IGG IG Group** **LSE:IPF International Personal Finance** **LSE:IQE IQE** **LSE:ITM ITM Power** **LSE:ITRK Intertek** **LSE:ITV ITV** **LSE:JET Just Eat** **LSE:LLOY Lloyds Grp.** **LSE:MKS Marks and Spencer** **LSE:MMAG Music Magpie** **LSE:NG. National Glib** **LSE:OCDO Ocado Plc** **LSE:OPG OPG Power Ventures** **LSE:OXIG Oxford Instruments** **LSE:PHP Primary Health** **LSE:PMG Parkmead** **LSE:QED Quadrise** **LSE:RKH Rockhopper** **LSE:RR. Rolls Royce** **LSE:SBRY Sainsbury** **LSE:SCLP Scancell** **LSE:SDY Speedyhire** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:SPT Spirent Comms** **LSE:SPX Spirax** **LSE:SRP Serco** **LSE:STAN Standard Chartered** **LSE:STAR Star Energy** **LSE:TERN Tern Plc** **LSE:TLW Tullow** **LSE:TRN The Trainline** **LSE:TSCO Tesco** **LSE:TW. Taylor Wimpey** **LSE:VOD Vodafone** **LSE:ZOO Zoo Digital** **

********

LSE:AAL Anglo American. Close Mid-Price: 2,362.50 Day High: 2375.5 Day Low: 2345

From: 20/01/2025 ; Target met. Further movement against Anglo American ABOVE 2642 should improve acceleration toward an initial 2662p with secondary (if initial bettered) at 2782p. It would require trading BELOW 1989 it calculates with a drop potential of 1952p possible with secondary, a bottom of 1760p.

View Previous Anglo American & Big Picture ***

LSE:AFC AFC Energy. Close Mid-Price: 9.08 Day High: 9.4 Day Low: 9.01

2018=70

From: 18/10/2024 ; Continued weakness against AFC taking the price below 6.9 calculates as leading to an initial 6.2p with secondary (if broken) at a longer term 3.2p. AFC Energy share price requires to recover ABOVE 20p should promote the idea of movement to an initial 26 with secondary, if beaten, an eventual 30.5p.

View Previous AFC Energy & Big Picture ***

LSE:AML Aston Martin. Close Mid-Price: 106.40 Day High: 106.7 Day Low: 105

From: 15/01/2025 ; Continued weakness against AML taking the price below 97 calculates as leading to an initial 94.5p with secondary (if broken) at a longer term 10p. It’s still my suspicion this shall experience a panic price recovery when the market realises it’s on the edge of a cliff… The share requires to sneak ABOVE 171, the share should experience improved acceleration toward an initial 174p with secondary (if initial bettered) at 181p

View Previous Aston Martin & Big Picture ***

LSE:ASC Asos. Close Mid-Price: 404.40 Day High: 414 Day Low: 402.6

2018=10

From: 29/12/2024 ; Further movement against Asos ABOVE 454.2 should improve acceleration toward an initial 472p with secondary (if initial exceeded) at 536p. The price would require to slip BELOW 329 will invariably lead to 325p with secondary (if broken) at a longer term 308.

View Previous Asos & Big Picture ***

LSE:AV. Aviva. Close Mid-Price: 511.40 Day High: 514 Day Low: 508.8

2018=70

From: 22/01/2025 ; Target met. All Aviva needs are mid-price trades ABOVE 514.2 to improve acceleration toward an initial 526p with secondary (if initial exceeded) at 620p. The mid-price would require to trade BELOW 452p calculates as leading to an initial 450p with secondary (if broken) at a longer term 417p.

View Previous Aviva & Big Picture ***

LSE:AVCT Avacta. Close Mid-Price: 47.50 Day High: 49.5 Day Low: 47.5

From: 2/10/2024 ; Target met. Continued weakness against AVCT taking the price below 42 calculates as leading to an initial 38.5p with secondary (if broken) at a longer term 28p. Avacta share price requires to recover ABOVE 86 should improve acceleration toward an initial 94p with secondary (if initial bested) at 111p.

View Previous Avacta & Big Picture ***

LSE:AZN Astrazeneca. Close Mid-Price: 11232.00 Day High: 11326 Day Low: 11120

From: 3/09/2024 ; All Astrazeneca needs are mid-price trades ABOVE 13338 to improve acceleration toward an initial 13362p with secondary (if initial bettered) at 14226p. It would require trading BELOW 9461 it calculates with a drop potential of 9404p with secondary (if broken) at a longer term 8832p.

View Previous Astrazeneca & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 296.30 Day High: 298.4 Day Low: 289.65

2018=12

From: 22/01/2025 ; Continued trades against BARC with a mid-price ABOVE 299.3 should improve the share value to firstly 308p with secondary (if initial exceeded) at 316p. The mid-price would require to trade BELOW 136p calculates as leading to an initial 130p and hopefully a bounce. Our secondary, if broken, calculates at 119p.

View Previous Barclays & Big Picture ***

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 452.20 Day High: 455 Day Low: 440.4

2018=9

From: 5/12/2024 ; Target met. In the event of BALFOUR BEATTY enjoying further trades beyond 472.8, the share should experience improved acceleration toward an initial 479p with secondary (if initial bettered) at 494p. The share would require to weaken BELOW 292p it calculates with a drop potential of 290p with secondary (if broken) at a longer term 265p.

View Previous BALFOUR BEATTY & Big Picture ***

LSE:BLOE Block Energy PLC. Close Mid-Price: 0.75 Day High: 0.8 Day Low: 0.75

From: 27/01/2025 ; In the event Block Energy PLC experiences weakness below 0.62 it calculates with a drop potential of 0.6p with secondary (if broken) at a longer term 0.55p. The share requires to sneak ABOVE 1.98, the share should experience improved acceleration toward an initial 2.17p with secondary (if initial bettered) at 2.3p.

View Previous Block Energy PLC & Big Picture ***

LSE:BME B & M. Close Mid-Price: 320.20 Day High: 323.6 Day Low: 319.5

From: 9/01/2025 ; Target met. Continued weakness against BME taking the price below 299.8 calculates as leading to an initial 279p with secondary (if broken) at a longer term 242p. B & M share price requires to recover ABOVE 540 to trigger recovery to an initial 575p with secondary, if bettered, at 598p.

View Previous B & M & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 416.40 Day High: 419.1 Day Low: 412.15

2018=18

From: 13/11/2024 ; If BP PLC experiences continued weakness below 365.2, it will invariably lead to 358p with secondary (if broken) at a longer term 346p. The share requires to sneak ABOVE 541 should improve the share value to firstly 544p with secondary (if initial bested) at 621p.

View Previous BP PLC & Big Picture ***

LSE:BT.A British Telecom. Close Mid-Price: 146.00 Day High: 146 Day Low: 142.9

2018=18

From: 2/12/2024 ; Target met. All British Telecom needs are mid-price trades ABOVE 161.9 to improve acceleration toward an initial 165p with secondary (if initial exceeded) at 170p. It would require trading BELOW 101p, it will invariably lead to 99p with secondary (if broken) at a longer term 80p.

View Previous British Telecom & Big Picture ***

LSE:CAR Carclo. Close Mid-Price: 23.20 Day High: 23.6 Day Low: 22.8

2018=70

From: 9/01/2025 ; Weakness on Carclo below 22.8 will invariably lead to 20.3 with secondary (if broken) at a longer term 19p. This is not looking like a happy share!

The share price now needs above 36.5 to be taken seriously, giving the potential of recovery to an initial 45p with our secondary, if bettered, at an eventual 49p.

View Previous Carclo & Big Picture ***

LSE:CASP Caspian. Close Mid-Price: 2.90 Day High: 2.9 Day Low: 2.9

2018=35

From: 8/11/2024 ; If Caspian experiences continued weakness below 2.7, it will invariably lead to 2.25 next with our secondary, if broken, at a threatened bottom of 1.25p. Alternately, if any miracle is to occur, above 4.5 hints at 5.8 with secondary, if beaten, at 6.9p

View Previous Caspian & Big Picture ***

LSE:CEY Centamin. Close Mid-Price: 146.00 Day High: 0 Day Low: 0

2018=35

From: 22/10/2024 ; Target met. In the event of Centamin enjoying further trades beyond 175.3, the share should experience improved acceleration toward an initial 196p with secondary (if initial bettered) at 250p. The mid-price would require to trade BELOW 77p will invariably lead to 75p with secondary (if broken) at a longer term 63p.

View Previous Centamin & Big Picture ***

LSE:CLAI Cellular Goods. Close Mid-Price: 0.30 Day High: 0.3 Day Low: 0.27

From: 21/02/2024 ; Unless this makes it above 0.48p, it is not going to be worth reviewing.

View Previous Cellular Goods & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 139.35 Day High: 139.25 Day Low: 135.55

From: 6/11/2024 ; If Centrica experiences continued weakness below 113, it will invariably lead to 100p with secondary, if broken, down at 80p. The share requires to sneak ABOVE 174, the share should experience improved acceleration toward an initial 196p with secondary (if initial exceeded) at 251p.

View Previous Centrica & Big Picture ***

LSE:CPI Capita. Close Mid-Price: 14.06 Day High: 14.74 Day Low: 14

From: 20/01/2025 ; In the event Capita experiences weakness below 13.14 it calculates with a drop potential of 11p with secondary 3.5p and an ultimate bottom. The share requires to sneak ABOVE 22p, the share should experience improved acceleration toward an initial 24p with secondary, if exceeded, working out at 28p.

View Previous Capita & Big Picture ***

LSE:DARK Darktrace Plc. Close Mid-Price: 576.80 Day High: 0 Day Low: 0

From: 26/04/2024 ; Target met. In the event of Darktrace Plc enjoying further trades beyond 624, the share should experience improved acceleration toward an initial 744p with secondary (if initial bettered) at 829p. It would require trading BELOW 345 to invariably lead to 290p with secondary, if broken, at 232p.

View Previous Darktrace Plc & Big Picture ***

LSE:DGE Diageo. Close Mid-Price: 2,426.50 Day High: 2474.5 Day Low: 2425

2018=35

From: 6/11/2024 ; Target met. In the event Diageo experiences weakness below 2288 it calculates with a drop potential of 2222p with secondary (if broken) at a longer term 1501p. The share requires to trade ABOVE 2677p to improve acceleration toward an initial 2706p with secondary (if initial exceeded) at 2868p.

View Previous Diageo & Big Picture ***

LSE:ECO ECO (Atlantic) O & G. Close Mid-Price: 11.25 Day High: 11.25 Day Low: 11.25

From: 16/10/2024 ; Target met. In the event ECO (Atlantic) O & G experiences weakness below 9.2 it calculates with a drop potential of 8.75p with secondary (if broken) at a longer term 7p. The share requires to sneak ABOVE 14p to improve acceleration toward an initial 16p with secondary (if initial exceeded) at 19p.

View Previous ECO (Atlantic) O & G & Big Picture ***

LSE:EME Empyrean. Close Mid-Price: 0.11 Day High: 0.11 Day Low: 0.1

2017=17

From: 22/10/2024 ; Weakness on Empyrean below 0.2 will invariably lead to 0 as this now represents an ultimate bottom. The share requires to move ABOVE 0.36 to cancel the immediate drop potentials and allow improvement to 0.42 with our secondary, if bettered, a game changing 0.56. Closure above 0.56 shall prove critical for the long term, finally placing the share in a zone where some recovery can be dreamt of.

View Previous Empyrean & Big Picture ***

LSE:EMG MAN. Close Mid-Price: 209.80 Day High: 212.6 Day Low: 208.2

2018=35

From: 31/10/2024 ; If MAN experiences continued weakness below 197, it will invariably lead to 195p with secondary (if broken) at a longer term 185p. The share requires to move ABOVE 279 should improve the share value to firstly 295p with secondary (if initial bested) at 310p.

View Previous MAN & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 490.70 Day High: 501.4 Day Low: 491.1

2018=35

From: 12/12/2024 ; Target met. Further movement against EasyJet ABOVE 590.8 should improve acceleration toward an initial 598p with secondary (if initial bettered) at 685p. The share would require to weaken BELOW 474p to ring the changes, allowing wealness to an eventual 430p.

View Previous EasyJet & Big Picture ***

LSE:FGP Firstgroup. Close Mid-Price: 163.90 Day High: 167.6 Day Low: 158

2018=23

From: 4/11/2024 ; Target met. In the event Firstgroup experiences weakness below 128.6 it calculates with a drop potential of 125p with secondary (if broken) at a longer term 73p. The share requires to move ABOVE 177 should be useful, allowing for movement to an initial 187 with secondary, if beaten, at 201p.

View Previous Firstgroup & Big Picture ***

LSE:FOXT Foxtons. Close Mid-Price: 66.20 Day High: 67.8 Day Low: 66.2

2018=35

From: 11/11/2024 ; If Foxtons experiences continued weakness below 52, it will invariably lead to 51p with secondary (if broken) at a longer term 44.5p. Foxtons share price requires to recover ABOVE 71.4 should improve the share value to firstly 73p with secondary (if initial bested) at 89p.

View Previous Foxtons & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 675.00 Day High: 679 Day Low: 660.5

2018=35

From: 23/10/2024 ; Target met. Continued trades against FRES with a mid-price ABOVE 781 should improve the share value to firstly 806p with secondary (if initial bested) at 981p. It would require trading BELOW 435p it calculates with a drop potential of 425p with secondary (if broken) at a longer term 405p.

View Previous Fresnillo & Big Picture ***

LSE:GENL Genel. Close Mid-Price: 58.60 Day High: 59.9 Day Low: 57.4

2018=10

From: 28/01/2025 ; If Genel experiences continued weakness below 57.6, it will invariably lead to 55p with secondary (if broken) at a longer term 29p. Genel share price requires to recover ABOVE 103 to improve acceleration toward an initial 104p initially with secondary, if beaten, at 120p.

View Previous Genel & Big Picture ***

LSE:GKP Gulf Keystone. Close Mid-Price: 154.00 Day High: 155.8 Day Low: 152.5

2018=10

From: 17/01/2025 ; Target met. All Gulf Keystone needs are mid-price trades ABOVE 172.1 to improve acceleration toward an initial 180p with secondary (if initial exceeded) at 196p. The price would require to slip BELOW 111 will invariably lead to 105p with secondary (if broken) at a longer term 75p.

View Previous Gulf Keystone & Big Picture ***

LSE:GRG Greggs. Close Mid-Price: 2,092.00 Day High: 2168 Day Low: 2094

From: 13/01/2025 ; Continued weakness against GRG taking the price below 2028 calculates as leading to an initial 1977p with secondary (if broken) at a longer term 1685p. The share requires to move ABOVE 3250, the share should experience improved acceleration toward an initial 3255p with secondary (if initial bettered) at 3510p.

View Previous Greggs & Big Picture ***

LSE:HL. Hargreaves Lansdown. Close Mid-Price: 1,102.00 Day High: 1102 Day Low: 1101

2018=18

From: 20/06/2024 ; In the event of Hargreaves Lansdown enjoying further trades beyond 1169, the share should experience improved acceleration toward an initial 1185p with secondary (if initial exceeded) at 1244p. The mid-price would require to trade BELOW 688, it will invariably lead to 674p with secondary (if broken) at a longer term 601p.

View Previous Hargreaves Lansdown & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 330.70 Day High: 332.5 Day Low: 323.3

2018=70

From: 24/01/2025 ; All British Airways needs are mid-price trades ABOVE 334.2 to improve acceleration toward an initial 345p with secondary (if initial bettered) at 471p. The share would require to weaken BELOW 159 calculates as leading to an initial 150p with secondary, if broken, at 127p.

View Previous British Airways & Big Picture ***

LSE:IDS International Distribution. Close Mid-Price: 364.60 Day High: 364.8 Day Low: 364.4

2018=23

From: 14/01/2025 ; All International Distribution needs are mid-price trades ABOVE 365 to improve acceleration toward an initial 375p with secondary (if initial bettered) at 495p. Otherwise, now below 289 risks a visit to 278 with secondary, when broken, at 270 and a probable rebound.

View Previous International Distribution & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 1,020.00 Day High: 1024 Day Low: 1014

2018=23

From: 23/01/2025 ; Target met. All IG Group needs are mid-price trades ABOVE 1106 to improve acceleration toward an initial 1140p with secondary (if initial exceeded) at 1287p. The mid-price would require to trade BELOW 608p it calculates with a drop potential of 606p with secondary (if broken) at a longer term 573p.

View Previous IG Group & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 127.00 Day High: 127.5 Day Low: 126

2018=18

From: 20/12/2024 ; Continued weakness against IPF taking the price below 124.5 calculates as leading to an initial 120p with secondary (if broken) at a longer term 112p. The share requires to sneak ABOVE 139 to suggest coming recovery to an initial 145 with our secondary, if bettered, at 155p.

View Previous International Personal Finance & Big Picture ***

LSE:IQE IQE. Close Mid-Price: 13.66 Day High: 14.52 Day Low: 13.56

2018=10

From: 18/11/2024 ; Target met. If IQE experiences continued weakness below 8.61, it will invariably lead to 6.14p with secondary (if broken) at a longer term 5p. The share requires to trade ABOVE 32p as this should provoke recovery to an initial 35.5 with secondary, if bettered, at 43.5p

View Previous IQE & Big Picture ***

LSE:ITM ITM Power. Close Mid-Price: 35.04 Day High: 36.68 Day Low: 34.34

From: 2/12/2024 ; In the event ITM Power experiences weakness below 32.46 it calculates with a drop potential of 31p with secondary (if broken) at a longer term 25p. ITM Power share price requires to recover ABOVE 68p to improve acceleration toward an initial 73p with secondary (if initial exceeded) at 79p.

View Previous ITM Power & Big Picture ***

LSE:ITRK Intertek. Close Mid-Price: 5,070.00 Day High: 5110 Day Low: 5045

From: 27/09/2024 ; Target met. Continued trades against ITRK with a mid-price ABOVE 5235 should improve the share value to firstly 5346p with secondary (if initial bested) at 5549p. It would require trading BELOW 3820 risks promoting reversal down to an initial 3540p with secondary, if broken, at 3211p.

View Previous Intertek & Big Picture ***

LSE:ITV ITV. Close Mid-Price: 71.25 Day High: 72.75 Day Low: 71.15

2018=18

From: 8/11/2024 ; Target met. Weakness on ITV below 61.3 will invariably lead to 56p with secondary (if broken) at a longer term 48p. The share requires to sneak ABOVE 89 to promote recovery to an initial 94p with secondary, if beaten, at a longer term 111p.

View Previous ITV & Big Picture ***

LSE:JET Just Eat. Close Mid-Price: 1,134.00 Day High: 0 Day Low: 0

From: 9/12/2024 ; In the event of Just Eat enjoying further trades beyond 1384, the share should experience improved acceleration toward an initial 1396p with secondary (if initial bested) at 1462p. It would require trading BELOW 861, it will invariably lead to 838p with secondary (if broken) at a longer term 821p and a probable bottom.

View Previous Just Eat & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 62.52 Day High: 62.64 Day Low: 61.64

2018=23

From: 10/01/2025 ; Weakness on Lloyds Grp. below 52.44 will invariably lead to 51.3p with secondary (if broken) at a longer term 48.2p. Lloyds Grp. share price requires to recover ABOVE 63.46, the share should experience improved acceleration toward an initial 64p with secondary (if initial bettered) at 65.8p but we’re a bit reticent about it

View Previous Lloyds Grp. & Big Picture ***

LSE:MKS Marks and Spencer. Close Mid-Price: 330.10 Day High: 332.3 Day Low: 326.9

2018=18

From: 6/11/2024 ; Target met. Further movement against Marks and Spencer ABOVE 415.2 should improve acceleration toward an initial 430p with secondary (if initial bettered) at 501p. The price would require to slip BELOW 210p to allow reversal to 172p with secondary, if broken, at 153p.

View Previous Marks and Spencer & Big Picture ***

LSE:MMAG Music Magpie. Close Mid-Price: 8.95 Day High: 0 Day Low: 0

From: 6/12/2024 ; Continued trades against MMAG with a mid-price ABOVE 9.41 should improve the share value to firstly 9.75p with secondary (if initial bettered) at 11.75p. The mid-price would require to trade BELOW 5 calculates as leading to an initial 4.6p with secondary (if broken) at a longer term 2.7p.

View Previous Music Magpie & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 968.60 Day High: 972.8 Day Low: 958.8

2018=14

From: 14/01/2025 ; Target met. Weakness on National Glib below 909.8 will invariably lead to 898p with secondary (if broken) at a longer term 863p. It needs above the 10 quid mark to hopefully trigger an initial 1052p with our secondary, if bettered, at 1117p.

Visually, it’s going down.

View Previous National Glib & Big Picture ***

LSE:OCDO Ocado Plc. Close Mid-Price: 300.40 Day High: 311.6 Day Low: 300.5

From: 13/01/2025 ; Continued weakness against OCDO taking the price below 270.1 calculates as leading to an initial 248p with secondary (if broken) at a longer term 214p.The share requires to move ABOVE 411, the share should experience improved acceleration toward an initial 480p with our secondary, if bettered, working out at 551p.

View Previous Ocado Plc & Big Picture ***

LSE:OPG OPG Power Ventures. Close Mid-Price: 5.15 Day High: 5.15 Day Low: 4.46

2017=28

From: 20/11/2024 ; Weakness on OPG Power Ventures below 4.15 will invariably lead to 3.7p with secondary (if broken) at a longer term 2.24p. The share requires to trade ABOVE 12p (Blue trend) now calculates with the potential of a lift to 12.76p with secondary, if bettered, at 14p.

View Previous OPG Power Ventures & Big Picture ***

LSE:OXIG Oxford Instruments. Close Mid-Price: 2,055.00 Day High: 2100 Day Low: 2060

2018=10

From: 11/10/2024 ; Weakness on Oxford Instruments below 1932 will invariably lead to 1853p with secondary (if broken) at a longer term 1760p. The share requires to sneak ABOVE 2765, the share should experience improved acceleration toward an initial 2771p with secondary (if initial bettered) at 2996p.

View Previous Oxford Instruments & Big Picture ***

LSE:PHP Primary Health. Close Mid-Price: 91.30 Day High: 93 Day Low: 91.3

From: 9/01/2025 ; Target met. Continued weakness against PHP taking the price below 85.4 calculates as leading to an initial 84p with secondary (if broken) at a longer term 75p. Primary Health share price requires to recover ABOVE 105, the share should experience improved acceleration toward an initial 108p with secondary (if initial bettered) at 114p.

View Previous Primary Health & Big Picture ***

LSE:PMG Parkmead. Close Mid-Price: 17.00 Day High: 17 Day Low: 17

2018=70

From: 12/12/2024 ; Target met. Further movement against Parkmead ABOVE 24.5 should improve acceleration toward an initial 28p with secondary (if initial bettered) at 30p. The price would require to slip BELOW 7.75 it calculates with a drop potential of 7.25p with secondary (if broken) at a longer term 0.5p.

View Previous Parkmead & Big Picture ***

LSE:QED Quadrise. Close Mid-Price: 3.95 Day High: 4.49 Day Low: 3.9

2018=10

From: 3/01/2025 ; Target met. All Quadrise needs are mid-price trades ABOVE 7.98 to improve acceleration toward an initial 8.3p with secondary (if initial exceeded) at 12p. The mid-price would require to trade BELOW 2 for panic, giving the threat of reversal to an initial .95p with secondary, if broken, at 0.61p.

View Previous Quadrise & Big Picture ***

LSE:RKH Rockhopper. Close Mid-Price: 35.20 Day High: 36.4 Day Low: 33.5

2017=42

From: 20/01/2025 ; Further movement against Rockhopper ABOVE 42 should improve acceleration toward an initial 44p with secondary (if initial exceeded) at 52p. The mid-price would require to trade BELOW 10p calculates as leading to an initial 9.5p with secondary (if broken) at a longer term 5p.

View Previous Rockhopper & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 584.20 Day High: 593 Day Low: 582

2018=23

From: 24/01/2025 ; Target met. Continued trades against RR. with a mid-price ABOVE 624.6 should improve the share value to firstly 646p with secondary (if initial bested) at 722p. The share would require to weaken BELOW 466p to bring 348p with secondary, if broken, at 286p.

View Previous Rolls Royce & Big Picture ***

LSE:SBRY Sainsbury. Close Mid-Price: 256.20 Day High: 259.6 Day Low: 255.8

2018=23

From: 14/11/2024 ; Target met. Continued weakness against SBRY taking the price below 237.8 calculates as leading to an initial 231.5p with secondary (if broken) at a longer term 226p. The share requires to sneak ABOVE 302p should improve acceleration toward an initial 314p with secondary (if initial exceeded) at 323p.

View Previous Sainsbury & Big Picture ***

LSE:SCLP Scancell. Close Mid-Price: 9.66 Day High: 9.75 Day Low: 9.66

2018=18

From: 14/01/2025 ; Continued weakness against SCLP taking the price below 9.25 calculates as leading to an initial 8p with secondary, if broken, at a bottom of just 5p. Scancell share price requires to recover ABOVE 19.5 should improve the share value to firstly 20.5p with secondary (if initial exceeded) at 33p.

View Previous Scancell & Big Picture ***

LSE:SDY Speedyhire. Close Mid-Price: 27.05 Day High: 27.05 Day Low: 26.75

2018=35

From: 28/01/2025 ; If Speedyhire experiences continued weakness below 26.5, it will invariably lead to 24 with our secondary, if broken, an eventual 16p. It needs above 35 to give hope, calculating with the hope of a visit to an initial 39 with our secondary, if bettered, at 43p.

View Previous Speedyhire & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 1,056.00 Day High: 1072 Day Low: 1048.5

From: 22/01/2025 ; Further movement against Scottish Mortgage Investment Trust ABOVE 1078 should improve acceleration toward an initial 1079p with secondary (if initial bested) at 1095p. The mid-price would require to trade BELOW 604p calculates as leading to an initial 601p with secondary (if broken) at a longer term 596p.

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:SPT Spirent Comms. Close Mid-Price: 181.00 Day High: 182.3 Day Low: 180.1

From: 31/10/2024 ; In the event Spirent Comms experiences weakness below 166.2 it calculates with a drop potential of 160p possible. If broken, our secondary is at 145p. The share requires to move ABOVE 201 should improve acceleration toward an initial 206.5p with secondary (if initial bettered) at 237p.

View Previous Spirent Comms & Big Picture ***

LSE:SPX Spirax. Close Mid-Price: 8,025.00 Day High: 8100 Day Low: 7940

From: 13/11/2024 ; Continued weakness against SPX taking the price below 6355 calculates as leading to an initial 6213p with secondary (if broken) at a longer term 5792p. The share requires to move ABOVE 11280 should improve acceleration toward an initial 11673p with secondary (if initial bettered) at 12233p.

View Previous Spirax & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 150.60 Day High: 152.9 Day Low: 150.9

From: 29/07/2024 ; Target met. In the event of Serco enjoying further trades beyond 195.4, the share should experience improved acceleration toward an initial 203p with secondary (if initial bettered) at 213p. The share would require to weaken BELOW 135p, it will invariably lead to 134p with secondary (if broken) at a longer term 122p and a vague hope of a bounce.

View Previous Serco & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 1,082.00 Day High: 1083.5 Day Low: 1056

2018=12

From: 23/01/2025 ; Further movement against Standard Chartered ABOVE 1084 should improve acceleration toward an initial 1103p with secondary (if initial bettered) at 1202p. The share would require to weaken BELOW 629p to potentially trigger reversal to an initial 578p with secondary, if broken, at a bottom of 545p.

View Previous Standard Chartered & Big Picture ***

LSE:STAR Star Energy. Close Mid-Price: 8.24 Day High: 0 Day Low: 0

2018=70

From: 12/11/2024 ; Target met. Further movement against Star Energy ABOVE 9.74 should improve acceleration toward an initial 10p with secondary (if initial bettered) at 13p. The price would require to slip BELOW 6p it calculates with a drop potential of 5.6p with secondary (if broken) at a longer term 4.9p.

View Previous Star Energy & Big Picture ***

LSE:TERN Tern Plc. Close Mid-Price: 1.70 Day High: 1.73 Day Low: 1.62

From: 27/01/2025 ; Above just 1.85 now looks capable of triggering an initial 2.15 with our secondary, if bettered, at 3.17 – perhaps even 4p if a rise is powered by good news. Alternately, below 1.3 looks troubling, allowing for an initial 1p with secondary a bottom now at 0.71p

View Previous Tern Plc & Big Picture ***

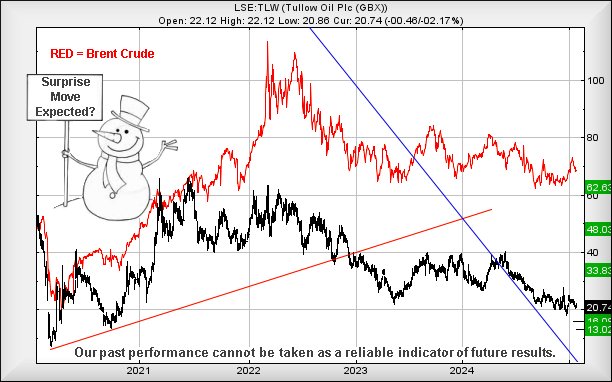

LSE:TLW Tullow. Close Mid-Price: 19.39 Day High: 21 Day Low: 19.4

2018=10

From: 29/12/2024 ; Target met. Weakness on Tullow below 18.92 will invariably lead to 15p with secondary (if broken) at a longer term 13p. The share requires to sneak ABOVE 28p to improve acceleration toward an initial 29p, returning the share above the level of the trend break and making a longer term 33.6 a logical ambition.

View Previous Tullow & Big Picture ***

LSE:TRN The Trainline. Close Mid-Price: 366.40 Day High: 374 Day Low: 362.4

From: 12/12/2024 ; All The Trainline needs are mid-price trades ABOVE 442.2 to improve acceleration toward an initial 452p with secondary (if initial bettered) at 470p. The share would require to weaken BELOW 293p calculates as leading to an initial 290p with secondary (if broken) at a longer term 278p and perhaps a bounce.

View Previous The Trainline & Big Picture ***

LSE:TSCO Tesco. Close Mid-Price: 368.80 Day High: 372.2 Day Low: 368.6

2018=23

From: 16/12/2024 ; In the event of Tesco enjoying further trades beyond 375.1, the share should experience improved acceleration toward an initial 380p with secondary (if initial bested) at 486p. The share would require to weaken BELOW 272p calculates as leading to an initial 263p initially and a very probable bounce. However, should 263p break, our secondary is down at 255p.

View Previous Tesco & Big Picture ***

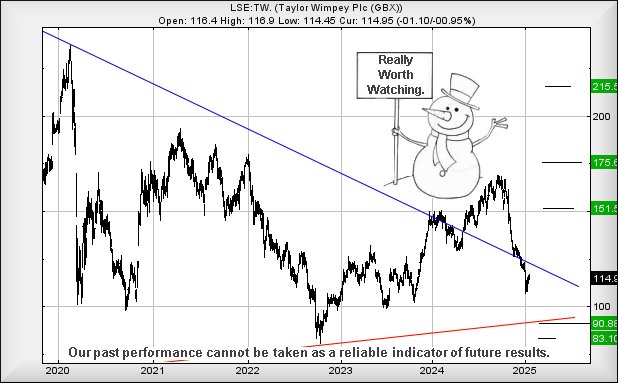

LSE:TW. Taylor Wimpey. Close Mid-Price: 118.70 Day High: 121.45 Day Low: 118.9

2018=23

From: 9/01/2025 ; In the event Taylor Wimpey experiences weakness below 106.8 it calculates with a drop potential of 98p with secondary (if broken) at a longer term 90p. The share requires to sneak ABOVE 169p to improve acceleration toward an initial 175p with secondary (if initial bettered) at 209p.

View Previous Taylor Wimpey & Big Picture ***

LSE:VOD Vodafone. Close Mid-Price: 68.82 Day High: 69.06 Day Low: 67.4

2018=18

From: 17/09/2024 ; Continued trades against VOD with a mid-price ABOVE 79.5 should improve the share value to firstly 81p with secondary (if initial exceeded) at 85p. The price would require to slip BELOW 64p for panic, giving the potential of weakness to an initial 56p with secondary, if broken, at 52p and hopefully a bottom.

View Previous Vodafone & Big Picture ***

LSE:ZOO Zoo Digital. Close Mid-Price: 29.60 Day High: 28.5 Day Low: 27.5

From: 27/01/2025 ; Continued weakness against ZOO taking the price below 27.5 calculates as leading to an initial 25 with our secondary, if broken, a bottom of 20p. The share requires to move ABOVE 40 should hit an initial 45 with secondary, if beaten, at 48.75p.

View Previous Zoo Digital & Big Picture ***

Many thanks for taking the time to read this and good luck for today.

\s

\s \s

\s \s

\s