Astrazeneca (LSE:AZN) The market recently kicked out a little threat against Astrazeneca, a couple of breaks of the uptrend since 2020 effectively proving this trend line may not matter. It’s surprising how many times these symptoms prove important – generally with 20:20 hindsight – but we do think they are worth commenting on, just in case. It’s often the case “the market” knows or suspects something is coming, so perhaps extreme caution should be invoked.

In the case of AZN.L or LSE:AZN, we’d advocate 10080p as a sensible level to press the Red button and panic, achieving such a level exceeding the previous lows achieved by the share, triggering a logic which permits reversals down to 9629p with our very probable secondary, if broken, at 8382p. Importantly, overall this suggests an imminent cycle down to an eventual bottom at 6989p, again a price level which makes a lot of sense as it matches the low of 2021, effectively undoing all the Covid-19 inspired gains.

As the recipient of SEVEN Covid booster shots and a certified fanboy of the treatment, suffering no side effects to the jab and indeed, only a very positive side effect with a clear boost to my personal immune system, I shall not decline the next time I’m invited to bare my arm and be stabbed. After all, the one time I “caught” Covid, the symptoms remained for around 3 days, proving less irritating than a few days of Hay Fever. But without a doubt, it appears the vaccine manufacturers are losing favour with the market place, despite many other successful products in the company’s paddock. Perhaps they need a new Pandemic, something like Politician Flu, leading the nation to require emergency insulation against the effects of our classless rulers.

Perhaps the immediate efforts to inhibit Astrazeneca falling off a cliff, it appears above 11438p should trigger gains to an initial 11916p with our secondary, if beaten, at 12,746p. Achieving our first target wouldn’t cancel out our drop potentials but a visit to our secondary would suggest our work on reversals was a waste of time.

FUTURES

FUTURES

| Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

| 11:26:15PM |

BRENT |

7530.1 |

7619 |

7313 |

7007 |

7727 |

7882 |

7944 |

8086 |

7657 |

|

| 11:29:26PM |

GOLD |

2817.95 |

2793 |

2789 |

2781 |

2806 |

2827 |

2835 |

2856 |

2813 |

|

| 1:17:13AM |

FTSE |

8577 |

8546 |

8461 |

8383 |

8596 |

8607 |

8624 |

8662 |

8568 |

Success |

| 1:20:25AM |

STOX50 |

5218 |

5173 |

5115 |

5048 |

5222 |

5250 |

5264 |

5318 |

5198 |

|

| 1:23:23AM |

GERMANY |

21447.6 |

21259 |

21100 |

20866 |

21427 |

21562 |

21604 |

21779 |

21388 |

|

| 1:31:31AM |

US500 |

6007.4 |

5909 |

5852 |

5762 |

5966 |

6042 |

6057 |

6106 |

5992 |

‘cess |

| 3:21:39AM |

DOW |

44470 |

44220 |

44207 |

44047 |

44387 |

44689 |

44915 |

45281 |

44552 |

‘cess |

| 3:24:47AM |

NASDAQ |

21250.4 |

21234 |

21165 |

21056 |

21375 |

21492 |

21552 |

21792 |

20293 |

|

3/02/2025 FTSE Closed at 8583 points. Change of -1.04%. Total value traded through LSE was: £ 4,827,982,037 a change of -38.35%

31/01/2025 FTSE Closed at 8673 points. Change of 0.31%. Total value traded through LSE was: £ 7,830,859,911 a change of 58.83%

30/01/2025 FTSE Closed at 8646 points. Change of 1.04%. Total value traded through LSE was: £ 4,930,240,161 a change of -10.24%

29/01/2025 FTSE Closed at 8557 points. Change of 0.28%. Total value traded through LSE was: £ 5,492,931,897 a change of 11.31%

28/01/2025 FTSE Closed at 8533 points. Change of 0.35%. Total value traded through LSE was: £ 4,934,936,161 a change of 3.9%

27/01/2025 FTSE Closed at 8503 points. Change of 0.01%. Total value traded through LSE was: £ 4,749,731,761 a change of -19.91%

24/01/2025 FTSE Closed at 8502 points. Change of -0.74%. Total value traded through LSE was: £ 5,930,778,515 a change of -10.73%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports.

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

If you want to ask a question about something Market Related intraday, don’t hesitate to email private.client@trendsandtargets.com. If something has gone volatile and a quick answer is needed, we’ve probably already run the numbers on it. As you’ll appreciate, we try and avoid spamming people needlessly.

Click Epic to jump to share: LSE:GKP Gulf Keystone** **LSE:GLEN Glencore Xstra** **LSE:IAG British Airways** **LSE:SDY Speedyhire** **LSE:TLW Tullow** **

********

Updated charts published on : Gulf Keystone, Glencore Xstra, British Airways, Speedyhire, Tullow,

Target met. In the event of Gulf Keystone enjoying further trades beyond 193.5, the share should experience improved acceleration toward an initial 196 with secondary (if initial bettered) at 215p. It would require trading BELOW 111 will invariably lead to 105p with secondary (if broken) at a longer term 75p.

Previous Report:

31/01/2025 Continued trades against GKP with a mid-price ABOVE 172.3 should improve the share value to firstly 180p with secondary (if initial exceeded) at 196p. The price would require to slip BELOW 111 will invariably lead to 105p with secondary (if broken) at a longer term 75p.

</p

View Previous Gulf Keystone & Big Picture ***

In the event Glencore Xstra experiences weakness below 337.75 it calculates with a drop potential of 326p with secondary (if broken) at a longer term 308p. Glencore Xstra share price requires to recover ABOVE 414 is now needed to ideally trigger recovery to an almost certain 465p and possible hesitation. Our secondary, if bettered, is at an eventual 506p.

Previous Report:

30/01/2025 Target met. Weakness on Glencore Xstra below 339.85 will invariably lead to 326p with secondary (if broken) at a longer term 308p. Glencore Xstra share price requires to recover ABOVE 414 is now needed to ideally trigger recovery to an almost certain 465p and possible hesitation. Our secondary, if bettered, is at an eventual 506p.

</p

View Previous Glencore Xstra & Big Picture ***

In the event of British Airways enjoying further trades beyond 341.7, the share should experience improved acceleration toward an initial 345p with secondary (if initial bettered) at 471p. The share would require to weaken BELOW 159 calculates as leading to an initial 150p with secondary, if broken, at 127p.

Previous Report:

31/01/2025 Further movement against British Airways ABOVE 340.5 should improve acceleration toward an initial 345p with secondary (if initial bettered) at 471p. The share would require to weaken BELOW 159 calculates as leading to an initial 150p with secondary, if broken, at 127p.

</p

View Previous British Airways & Big Picture ***

Target met. Weakness on Speedyhire below 18.6 will invariably lead to 16p with secondary (if broken) at a longer term 6p. The share requires to move ABOVE 35 to give hope, calculating with the hope of a visit to an initial 39 with our secondary, if bettered, at 43p.

Previous Report:

28/01/2025 If Speedyhire experiences continued weakness below 26.5, it will invariably lead to 24 with our secondary, if broken, an eventual 16p. It needs above 35 to give hope, calculating with the hope of a visit to an initial 39 with our secondary, if bettered, at 43p.

</p

View Previous Speedyhire & Big Picture ***

If Tullow experiences continued weakness below 17.46, it will invariably lead to 15p with secondary (if broken) at a longer term 13p. The share requires to sneak ABOVE 28p to improve acceleration toward an initial 29p, returning the share above the level of the trend break and making a longer term 33.6 a logical ambition.

Previous Report:

31/01/2025 Continued weakness against TLW taking the price below 18.22 calculates as leading to an initial 15p with secondary (if broken) at a longer term 13p. The share requires to sneak ABOVE 28p to improve acceleration toward an initial 29p, returning the share above the level of the trend break and making a longer term 33.6 a logical ambition.

</p

View Previous Tullow & Big Picture ***

*** End of “Updated Today” comments on shares. Listed below are those where commentary remains valid.

Click Epic to jump to share:LSE:AAL Anglo American** **LSE:AFC AFC Energy** **LSE:AML Aston Martin** **LSE:ASC Asos** **LSE:AV. Aviva** **LSE:AVCT Avacta** **LSE:AZN Astrazeneca** **LSE:BARC Barclays** **LSE:BBY BALFOUR BEATTY** **LSE:BLOE Block Energy PLC** **LSE:BME B & M** **LSE:BP. BP PLC** **LSE:BT.A British Telecom** **LSE:CAR Carclo** **LSE:CASP Caspian** **LSE:CCL Carnival** **LSE:CEY Centamin** **LSE:CLAI Cellular Goods** **LSE:CNA Centrica** **LSE:CPI Capita** **LSE:DARK Darktrace Plc** **LSE:DGE Diageo** **LSE:ECO ECO (Atlantic) O & G** **LSE:EME Empyrean** **LSE:EMG MAN** **LSE:EXPN Experian** **LSE:EZJ EasyJet** **LSE:FGP Firstgroup** **LSE:FOXT Foxtons** **LSE:FRES Fresnillo** **LSE:GENL Genel** **LSE:GRG Greggs** **LSE:HIK Hikma** **LSE:HL. Hargreaves Lansdown** **LSE:HSBA HSBC** **LSE:IDS International Distribution** **LSE:IGG IG Group** **LSE:IHG Intercontinental Hotels Group** **LSE:IPF International Personal Finance** **LSE:IQE IQE** **LSE:ITM ITM Power** **LSE:ITRK Intertek** **LSE:ITV ITV** **LSE:JET Just Eat** **LSE:LLOY Lloyds Grp.** **LSE:MKS Marks and Spencer** **LSE:MMAG Music Magpie** **LSE:NG. National Glib** **LSE:NWG Natwest** **LSE:OCDO Ocado Plc** **LSE:OPG OPG Power Ventures** **LSE:OXIG Oxford Instruments** **LSE:PHP Primary Health** **LSE:PMG Parkmead** **LSE:QED Quadrise** **LSE:RKH Rockhopper** **LSE:RR. Rolls Royce** **LSE:SBRY Sainsbury** **LSE:SCLP Scancell** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:SPT Spirent Comms** **LSE:SPX Spirax** **LSE:SRP Serco** **LSE:STAN Standard Chartered** **LSE:STAR Star Energy** **LSE:TERN Tern Plc** **LSE:TRN The Trainline** **LSE:TSCO Tesco** **LSE:TW. Taylor Wimpey** **LSE:VOD Vodafone** **LSE:ZOO Zoo Digital** **

********

From: 20/01/2025 ; Target met. Further movement against Anglo American ABOVE 2642 should improve acceleration toward an initial 2662p with secondary (if initial bettered) at 2782p. It would require trading BELOW 1989 it calculates with a drop potential of 1952p possible with secondary, a bottom of 1760p.

View Previous Anglo American & Big Picture ***

2018=70

From: 18/10/2024 ; Continued weakness against AFC taking the price below 6.9 calculates as leading to an initial 6.2p with secondary (if broken) at a longer term 3.2p. AFC Energy share price requires to recover ABOVE 20p should promote the idea of movement to an initial 26 with secondary, if beaten, an eventual 30.5p.

View Previous AFC Energy & Big Picture ***

From: 15/01/2025 ; Continued weakness against AML taking the price below 97 calculates as leading to an initial 94.5p with secondary (if broken) at a longer term 10p. It’s still my suspicion this shall experience a panic price recovery when the market realises it’s on the edge of a cliff… The share requires to sneak ABOVE 171, the share should experience improved acceleration toward an initial 174p with secondary (if initial bettered) at 181p

View Previous Aston Martin & Big Picture ***

2018=10

From: 29/12/2024 ; Further movement against Asos ABOVE 454.2 should improve acceleration toward an initial 472p with secondary (if initial exceeded) at 536p. The price would require to slip BELOW 329 will invariably lead to 325p with secondary (if broken) at a longer term 308.

View Previous Asos & Big Picture ***

2018=70

From: 22/01/2025 ; Target met. All Aviva needs are mid-price trades ABOVE 514.2 to improve acceleration toward an initial 526p with secondary (if initial exceeded) at 620p. The mid-price would require to trade BELOW 452p calculates as leading to an initial 450p with secondary (if broken) at a longer term 417p.

View Previous Aviva & Big Picture ***

From: 2/10/2024 ; Target met. Continued weakness against AVCT taking the price below 42 calculates as leading to an initial 38.5p with secondary (if broken) at a longer term 28p. Avacta share price requires to recover ABOVE 86 should improve acceleration toward an initial 94p with secondary (if initial bested) at 111p.

View Previous Avacta & Big Picture ***

From: 3/09/2024 ; All Astrazeneca needs are mid-price trades ABOVE 13338 to improve acceleration toward an initial 13362p with secondary (if initial bettered) at 14226p. It would require trading BELOW 9461 it calculates with a drop potential of 9404p with secondary (if broken) at a longer term 8832p.

View Previous Astrazeneca & Big Picture ***

2018=12

From: 22/01/2025 ; Continued trades against BARC with a mid-price ABOVE 299.3 should improve the share value to firstly 308p with secondary (if initial exceeded) at 316p. The mid-price would require to trade BELOW 136p calculates as leading to an initial 130p and hopefully a bounce. Our secondary, if broken, calculates at 119p.

View Previous Barclays & Big Picture ***

2018=9

From: 5/12/2024 ; Target met. In the event of BALFOUR BEATTY enjoying further trades beyond 472.8, the share should experience improved acceleration toward an initial 479p with secondary (if initial bettered) at 494p. The share would require to weaken BELOW 292p it calculates with a drop potential of 290p with secondary (if broken) at a longer term 265p.

View Previous BALFOUR BEATTY & Big Picture ***

From: 27/01/2025 ; In the event Block Energy PLC experiences weakness below 0.62 it calculates with a drop potential of 0.6p with secondary (if broken) at a longer term 0.55p. The share requires to sneak ABOVE 1.98, the share should experience improved acceleration toward an initial 2.17p with secondary (if initial bettered) at 2.3p.

View Previous Block Energy PLC & Big Picture ***

From: 9/01/2025 ; Target met. Continued weakness against BME taking the price below 299.8 calculates as leading to an initial 279p with secondary (if broken) at a longer term 242p. B & M share price requires to recover ABOVE 540 to trigger recovery to an initial 575p with secondary, if bettered, at 598p.

View Previous B & M & Big Picture ***

2018=18

From: 13/11/2024 ; If BP PLC experiences continued weakness below 365.2, it will invariably lead to 358p with secondary (if broken) at a longer term 346p. The share requires to sneak ABOVE 541 should improve the share value to firstly 544p with secondary (if initial bested) at 621p.

View Previous BP PLC & Big Picture ***

2018=18

From: 2/12/2024 ; Target met. All British Telecom needs are mid-price trades ABOVE 161.9 to improve acceleration toward an initial 165p with secondary (if initial exceeded) at 170p. It would require trading BELOW 101p, it will invariably lead to 99p with secondary (if broken) at a longer term 80p.

View Previous British Telecom & Big Picture ***

2018=70

From: 30/01/2025 ; Continued weakness against CAR taking the price below 22.4 calculates as leading to an initial 20.3 with secondary (if broken) at a longer term 19p. This is not looking like a happy share!

The share price now needs above 36.5 to be taken seriously, giving the potential of recovery to an initial 45p with our secondary, if bettered, at an eventual 49p

View Previous Carclo & Big Picture ***

2018=35

From: 8/11/2024 ; If Caspian experiences continued weakness below 2.7, it will invariably lead to 2.25 next with our secondary, if broken, at a threatened bottom of 1.25p. Alternately, if any miracle is to occur, above 4.5 hints at 5.8 with secondary, if beaten, at 6.9p

View Previous Caspian & Big Picture ***

From: 31/01/2025 ; Target met. All Carnival needs are mid-price trades ABOVE 2095 to improve acceleration toward an initial 2112p with secondary (if initial exceeded) at 2313p. The share would require to weaken BELOW 966p calculates as leading to an initial 964p with secondary (if broken) at a longer term 805p.

View Previous Carnival & Big Picture ***

2018=35

From: 22/10/2024 ; Target met. In the event of Centamin enjoying further trades beyond 175.3, the share should experience improved acceleration toward an initial 196p with secondary (if initial bettered) at 250p. The mid-price would require to trade BELOW 77p will invariably lead to 75p with secondary (if broken) at a longer term 63p.

View Previous Centamin & Big Picture ***

From: 21/02/2024 ; Unless this makes it above 0.48p, it is not going to be worth reviewing.

View Previous Cellular Goods & Big Picture ***

From: 6/11/2024 ; If Centrica experiences continued weakness below 113, it will invariably lead to 100p with secondary, if broken, down at 80p. The share requires to sneak ABOVE 174, the share should experience improved acceleration toward an initial 196p with secondary (if initial exceeded) at 251p.

View Previous Centrica & Big Picture ***

From: 20/01/2025 ; In the event Capita experiences weakness below 13.14 it calculates with a drop potential of 11p with secondary 3.5p and an ultimate bottom. The share requires to sneak ABOVE 22p, the share should experience improved acceleration toward an initial 24p with secondary, if exceeded, working out at 28p.

View Previous Capita & Big Picture ***

From: 26/04/2024 ; Target met. In the event of Darktrace Plc enjoying further trades beyond 624, the share should experience improved acceleration toward an initial 744p with secondary (if initial bettered) at 829p. It would require trading BELOW 345 to invariably lead to 290p with secondary, if broken, at 232p.

View Previous Darktrace Plc & Big Picture ***

2018=35

From: 6/11/2024 ; Target met. In the event Diageo experiences weakness below 2288 it calculates with a drop potential of 2222p with secondary (if broken) at a longer term 1501p. The share requires to trade ABOVE 2677p to improve acceleration toward an initial 2706p with secondary (if initial exceeded) at 2868p.

View Previous Diageo & Big Picture ***

From: 16/10/2024 ; Target met. In the event ECO (Atlantic) O & G experiences weakness below 9.2 it calculates with a drop potential of 8.75p with secondary (if broken) at a longer term 7p. The share requires to sneak ABOVE 14p to improve acceleration toward an initial 16p with secondary (if initial exceeded) at 19p.

View Previous ECO (Atlantic) O & G & Big Picture ***

2017=17

From: 22/10/2024 ; Weakness on Empyrean below 0.2 will invariably lead to 0 as this now represents an ultimate bottom. The share requires to move ABOVE 0.36 to cancel the immediate drop potentials and allow improvement to 0.42 with our secondary, if bettered, a game changing 0.56. Closure above 0.56 shall prove critical for the long term, finally placing the share in a zone where some recovery can be dreamt of.

View Previous Empyrean & Big Picture ***

2018=35

From: 31/10/2024 ; If MAN experiences continued weakness below 197, it will invariably lead to 195p with secondary (if broken) at a longer term 185p. The share requires to move ABOVE 279 should improve the share value to firstly 295p with secondary (if initial bested) at 310p.

View Previous MAN & Big Picture ***

From: 31/01/2025 ; Target met. Continued trades against EXPN with a mid-price ABOVE 4021 should improve the share value to firstly 4027p with secondary (if initial bested) at 4187p. The price would require to slip BELOW 2366 will invariably lead to 2355p with secondary (if broken) at a longer term 2259p.

View Previous Experian & Big Picture ***

2018=35

From: 12/12/2024 ; Target met. Further movement against EasyJet ABOVE 590.8 should improve acceleration toward an initial 598p with secondary (if initial bettered) at 685p. The share would require to weaken BELOW 474p to ring the changes, allowing wealness to an eventual 430p.

View Previous EasyJet & Big Picture ***

2018=23

From: 4/11/2024 ; Target met. In the event Firstgroup experiences weakness below 128.6 it calculates with a drop potential of 125p with secondary (if broken) at a longer term 73p. The share requires to move ABOVE 177 should be useful, allowing for movement to an initial 187 with secondary, if beaten, at 201p.

View Previous Firstgroup & Big Picture ***

2018=35

From: 11/11/2024 ; If Foxtons experiences continued weakness below 52, it will invariably lead to 51p with secondary (if broken) at a longer term 44.5p. Foxtons share price requires to recover ABOVE 71.4 should improve the share value to firstly 73p with secondary (if initial bested) at 89p.

View Previous Foxtons & Big Picture ***

2018=35

From: 23/10/2024 ; Target met. Continued trades against FRES with a mid-price ABOVE 781 should improve the share value to firstly 806p with secondary (if initial bested) at 981p. It would require trading BELOW 435p it calculates with a drop potential of 425p with secondary (if broken) at a longer term 405p.

View Previous Fresnillo & Big Picture ***

2018=10

From: 28/01/2025 ; If Genel experiences continued weakness below 57.6, it will invariably lead to 55p with secondary (if broken) at a longer term 29p. Genel share price requires to recover ABOVE 103 to improve acceleration toward an initial 104p initially with secondary, if beaten, at 120p.

View Previous Genel & Big Picture ***

From: 13/01/2025 ; Continued weakness against GRG taking the price below 2028 calculates as leading to an initial 1977p with secondary (if broken) at a longer term 1685p. The share requires to move ABOVE 3250, the share should experience improved acceleration toward an initial 3255p with secondary (if initial bettered) at 3510p.

View Previous Greggs & Big Picture ***

2018=14

From: 31/01/2025 ; Continued trades against HIK with a mid-price ABOVE 2296 should improve the share value to firstly 2309p with secondary (if initial exceeded) at 2421p. The price would require to slip BELOW 1757, it will invariably lead to 1732p with secondary (if broken) at a longer term 1551p.

View Previous Hikma & Big Picture ***

2018=18

From: 20/06/2024 ; In the event of Hargreaves Lansdown enjoying further trades beyond 1169, the share should experience improved acceleration toward an initial 1185p with secondary (if initial exceeded) at 1244p. The mid-price would require to trade BELOW 688, it will invariably lead to 674p with secondary (if broken) at a longer term 601p.

View Previous Hargreaves Lansdown & Big Picture ***

2018=14

From: 31/01/2025 ; Target met. Further movement against HSBC ABOVE 849.8 should improve acceleration toward an initial 896p with secondary (if initial bettered) at 980p. The mid-price would require to trade BELOW 613p and heading to an initial 585p with secondary, if broken, at 540p and hopefully a rebound.

View Previous HSBC & Big Picture ***

2018=23

From: 30/01/2025 ; Continued trades against IDS with a mid-price ABOVE 366.2 should improve the share value to firstly 375p with secondary (if initial bettered) at 495p. Otherwise, now below 289 risks a visit to 278 with secondary, when broken, at 270 and a probable rebound.

View Previous International Distribution & Big Picture ***

2018=23

From: 23/01/2025 ; Target met. All IG Group needs are mid-price trades ABOVE 1106 to improve acceleration toward an initial 1140p with secondary (if initial exceeded) at 1287p. The mid-price would require to trade BELOW 608p it calculates with a drop potential of 606p with secondary (if broken) at a longer term 573p.

View Previous IG Group & Big Picture ***

2018=8

From: 31/01/2025 ; Continued trades against IHG with a mid-price ABOVE 10910 should improve the share value to firstly 10932p with secondary (if initial bettered) at 11030p. The mid-price would require to trade BELOW 9988 will invariably lead to 9388p with secondary (if broken) at a longer term 8978p.

View Previous Intercontinental Hotels Group & Big Picture ***

2018=18

From: 20/12/2024 ; Continued weakness against IPF taking the price below 124.5 calculates as leading to an initial 120p with secondary (if broken) at a longer term 112p. The share requires to sneak ABOVE 139 to suggest coming recovery to an initial 145 with our secondary, if bettered, at 155p.

View Previous International Personal Finance & Big Picture ***

2018=10

From: 18/11/2024 ; Target met. If IQE experiences continued weakness below 8.61, it will invariably lead to 6.14p with secondary (if broken) at a longer term 5p. The share requires to trade ABOVE 32p as this should provoke recovery to an initial 35.5 with secondary, if bettered, at 43.5p

View Previous IQE & Big Picture ***

From: 2/12/2024 ; In the event ITM Power experiences weakness below 32.46 it calculates with a drop potential of 31p with secondary (if broken) at a longer term 25p. ITM Power share price requires to recover ABOVE 68p to improve acceleration toward an initial 73p with secondary (if initial exceeded) at 79p.

View Previous ITM Power & Big Picture ***

From: 27/09/2024 ; Target met. Continued trades against ITRK with a mid-price ABOVE 5235 should improve the share value to firstly 5346p with secondary (if initial bested) at 5549p. It would require trading BELOW 3820 risks promoting reversal down to an initial 3540p with secondary, if broken, at 3211p.

View Previous Intertek & Big Picture ***

2018=18

From: 8/11/2024 ; Target met. Weakness on ITV below 61.3 will invariably lead to 56p with secondary (if broken) at a longer term 48p. The share requires to sneak ABOVE 89 to promote recovery to an initial 94p with secondary, if beaten, at a longer term 111p.

View Previous ITV & Big Picture ***

From: 9/12/2024 ; In the event of Just Eat enjoying further trades beyond 1384, the share should experience improved acceleration toward an initial 1396p with secondary (if initial bested) at 1462p. It would require trading BELOW 861, it will invariably lead to 838p with secondary (if broken) at a longer term 821p and a probable bottom.

View Previous Just Eat & Big Picture ***

2018=23

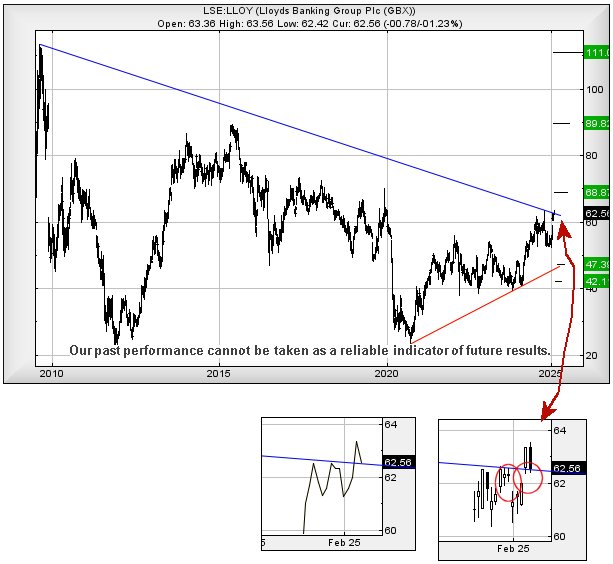

From: 10/01/2025 ; Weakness on Lloyds Grp. below 52.44 will invariably lead to 51.3p with secondary (if broken) at a longer term 48.2p. Lloyds Grp. share price requires to recover ABOVE 63.46, the share should experience improved acceleration toward an initial 64p with secondary (if initial bettered) at 65.8p but we’re a bit reticent about it

View Previous Lloyds Grp. & Big Picture ***

2018=18

From: 6/11/2024 ; Target met. Further movement against Marks and Spencer ABOVE 415.2 should improve acceleration toward an initial 430p with secondary (if initial bettered) at 501p. The price would require to slip BELOW 210p to allow reversal to 172p with secondary, if broken, at 153p.

View Previous Marks and Spencer & Big Picture ***

From: 6/12/2024 ; Continued trades against MMAG with a mid-price ABOVE 9.41 should improve the share value to firstly 9.75p with secondary (if initial bettered) at 11.75p. The mid-price would require to trade BELOW 5 calculates as leading to an initial 4.6p with secondary (if broken) at a longer term 2.7p.

View Previous Music Magpie & Big Picture ***

2018=14

From: 14/01/2025 ; Target met. Weakness on National Glib below 909.8 will invariably lead to 898p with secondary (if broken) at a longer term 863p. It needs above the 10 quid mark to hopefully trigger an initial 1052p with our secondary, if bettered, at 1117p.

Visually, it’s going down.

View Previous National Glib & Big Picture ***

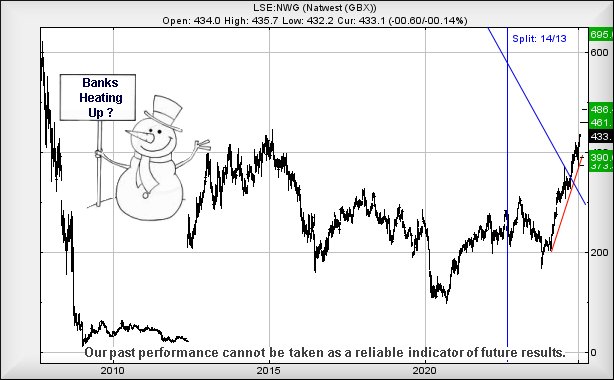

From: 29/01/2025 ; In the event of Natwest enjoying further trades beyond 436.5, the share should experience improved acceleration toward an initial 439p with secondary (if initial bested) at 468p. The mid-price would require to trade BELOW 230, calculating as leading to an initial 201p with secondary (if broken) at a longer term 153p.

View Previous Natwest & Big Picture ***

From: 13/01/2025 ; Continued weakness against OCDO taking the price below 270.1 calculates as leading to an initial 248p with secondary (if broken) at a longer term 214p.The share requires to move ABOVE 411, the share should experience improved acceleration toward an initial 480p with our secondary, if bettered, working out at 551p.

View Previous Ocado Plc & Big Picture ***

2017=28

From: 20/11/2024 ; Weakness on OPG Power Ventures below 4.15 will invariably lead to 3.7p with secondary (if broken) at a longer term 2.24p. The share requires to trade ABOVE 12p (Blue trend) now calculates with the potential of a lift to 12.76p with secondary, if bettered, at 14p.

View Previous OPG Power Ventures & Big Picture ***

2018=10

From: 11/10/2024 ; Weakness on Oxford Instruments below 1932 will invariably lead to 1853p with secondary (if broken) at a longer term 1760p. The share requires to sneak ABOVE 2765, the share should experience improved acceleration toward an initial 2771p with secondary (if initial bettered) at 2996p.

View Previous Oxford Instruments & Big Picture ***

From: 9/01/2025 ; Target met. Continued weakness against PHP taking the price below 85.4 calculates as leading to an initial 84p with secondary (if broken) at a longer term 75p. Primary Health share price requires to recover ABOVE 105, the share should experience improved acceleration toward an initial 108p with secondary (if initial bettered) at 114p.

View Previous Primary Health & Big Picture ***

2018=70

From: 12/12/2024 ; Target met. Further movement against Parkmead ABOVE 24.5 should improve acceleration toward an initial 28p with secondary (if initial bettered) at 30p. The price would require to slip BELOW 7.75 it calculates with a drop potential of 7.25p with secondary (if broken) at a longer term 0.5p.

View Previous Parkmead & Big Picture ***

2018=10

From: 3/01/2025 ; Target met. All Quadrise needs are mid-price trades ABOVE 7.98 to improve acceleration toward an initial 8.3p with secondary (if initial exceeded) at 12p. The mid-price would require to trade BELOW 2 for panic, giving the threat of reversal to an initial .95p with secondary, if broken, at 0.61p.

View Previous Quadrise & Big Picture ***

2017=42

From: 20/01/2025 ; Further movement against Rockhopper ABOVE 42 should improve acceleration toward an initial 44p with secondary (if initial exceeded) at 52p. The mid-price would require to trade BELOW 10p calculates as leading to an initial 9.5p with secondary (if broken) at a longer term 5p.

View Previous Rockhopper & Big Picture ***

2018=23

From: 24/01/2025 ; Target met. Continued trades against RR. with a mid-price ABOVE 624.6 should improve the share value to firstly 646p with secondary (if initial bested) at 722p. The share would require to weaken BELOW 466p to bring 348p with secondary, if broken, at 286p.

View Previous Rolls Royce & Big Picture ***

2018=23

From: 14/11/2024 ; Target met. Continued weakness against SBRY taking the price below 237.8 calculates as leading to an initial 231.5p with secondary (if broken) at a longer term 226p. The share requires to sneak ABOVE 302p should improve acceleration toward an initial 314p with secondary (if initial exceeded) at 323p.

View Previous Sainsbury & Big Picture ***

2018=18

From: 14/01/2025 ; Continued weakness against SCLP taking the price below 9.25 calculates as leading to an initial 8p with secondary, if broken, at a bottom of just 5p. Scancell share price requires to recover ABOVE 19.5 should improve the share value to firstly 20.5p with secondary (if initial exceeded) at 33p.

View Previous Scancell & Big Picture ***

From: 31/01/2025 ; All Scottish Mortgage Investment Trust needs are mid-price trades ABOVE 1088 to improve acceleration toward an initial 1095p with secondary (if initial bettered) at 1156p. The mid-price would require to trade BELOW 604p calculates as leading to an initial 601p with secondary (if broken) at a longer term 596p.

View Previous Scottish Mortgage Investment Trust & Big Picture ***

From: 31/10/2024 ; In the event Spirent Comms experiences weakness below 166.2 it calculates with a drop potential of 160p possible. If broken, our secondary is at 145p. The share requires to move ABOVE 201 should improve acceleration toward an initial 206.5p with secondary (if initial bettered) at 237p.

View Previous Spirent Comms & Big Picture ***

From: 13/11/2024 ; Continued weakness against SPX taking the price below 6355 calculates as leading to an initial 6213p with secondary (if broken) at a longer term 5792p. The share requires to move ABOVE 11280 should improve acceleration toward an initial 11673p with secondary (if initial bettered) at 12233p.

View Previous Spirax & Big Picture ***

From: 29/07/2024 ; Target met. In the event of Serco enjoying further trades beyond 195.4, the share should experience improved acceleration toward an initial 203p with secondary (if initial bettered) at 213p. The share would require to weaken BELOW 135p, it will invariably lead to 134p with secondary (if broken) at a longer term 122p and a vague hope of a bounce.

View Previous Serco & Big Picture ***

2018=12

From: 31/01/2025 ; Continued trades against STAN with a mid-price ABOVE 1097 should improve the share value to firstly 1103p with secondary (if initial bettered) at 1202p. The share would require to weaken BELOW 629p to potentially trigger reversal to an initial 578p with secondary, if broken, at a bottom of 545p.

View Previous Standard Chartered & Big Picture ***

2018=70

From: 12/11/2024 ; Target met. Further movement against Star Energy ABOVE 9.74 should improve acceleration toward an initial 10p with secondary (if initial bettered) at 13p. The price would require to slip BELOW 6p it calculates with a drop potential of 5.6p with secondary (if broken) at a longer term 4.9p.

View Previous Star Energy & Big Picture ***

From: 27/01/2025 ; Above just 1.85 now looks capable of triggering an initial 2.15 with our secondary, if bettered, at 3.17 – perhaps even 4p if a rise is powered by good news. Alternately, below 1.3 looks troubling, allowing for an initial 1p with secondary a bottom now at 0.71p

View Previous Tern Plc & Big Picture ***

From: 12/12/2024 ; All The Trainline needs are mid-price trades ABOVE 442.2 to improve acceleration toward an initial 452p with secondary (if initial bettered) at 470p. The share would require to weaken BELOW 293p calculates as leading to an initial 290p with secondary (if broken) at a longer term 278p and perhaps a bounce.

View Previous The Trainline & Big Picture ***

2018=23

From: 16/12/2024 ; In the event of Tesco enjoying further trades beyond 375.1, the share should experience improved acceleration toward an initial 380p with secondary (if initial bested) at 486p. The share would require to weaken BELOW 272p calculates as leading to an initial 263p initially and a very probable bounce. However, should 263p break, our secondary is down at 255p.

View Previous Tesco & Big Picture ***

2018=23

From: 9/01/2025 ; In the event Taylor Wimpey experiences weakness below 106.8 it calculates with a drop potential of 98p with secondary (if broken) at a longer term 90p. The share requires to sneak ABOVE 169p to improve acceleration toward an initial 175p with secondary (if initial bettered) at 209p.

View Previous Taylor Wimpey & Big Picture ***

2018=18

From: 17/09/2024 ; Continued trades against VOD with a mid-price ABOVE 79.5 should improve the share value to firstly 81p with secondary (if initial exceeded) at 85p. The price would require to slip BELOW 64p for panic, giving the potential of weakness to an initial 56p with secondary, if broken, at 52p and hopefully a bottom.

View Previous Vodafone & Big Picture ***

From: 27/01/2025 ; Continued weakness against ZOO taking the price below 27.5 calculates as leading to an initial 25 with our secondary, if broken, a bottom of 20p. The share requires to move ABOVE 40 should hit an initial 45 with secondary, if beaten, at 48.75p.

View Previous Zoo Digital & Big Picture ***

Many thanks for taking the time to read this and good luck for today. Please feel free to mention us after something goes right!

Risk Warning & Notice to Investors

Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Trends and Targets will NOT be responsible for any losses that may be incurred as a result of following a trading idea.