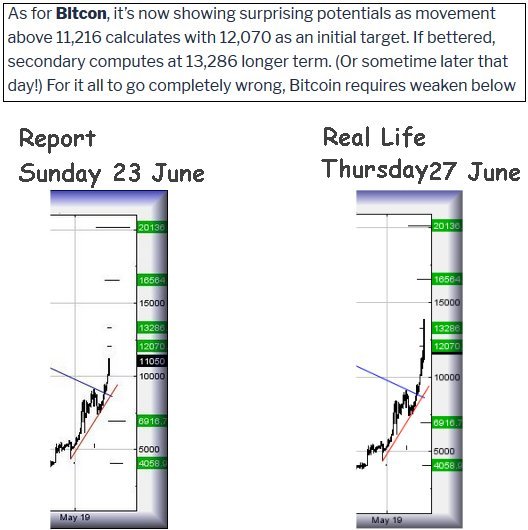

We’re not fond of #Bitcoin but our report on Sunday at http://www.trendsandtargets.com/index.php/2019/06/23/bitcoin-etc-for-24-06-2019/ proved rather prophetic. insert; smug gits image

That was very fast, once again proving we’re not Time Lords!

We’re not fond of #Bitcoin but our report on Sunday at http://www.trendsandtargets.com/index.php/2019/06/23/bitcoin-etc-for-24-06-2019/ proved rather prophetic. insert; smug gits image

That was very fast, once again proving we’re not Time Lords!

#SP500 #CAC40 Sometimes we rabbit on about “horizontal trends” and nowhere is the feature quite as demonstrated as Barclays share price since 2011. We’ve shown it with a Purple line on the chart, though perhaps it may be Magenta. Surprisingly, there was even military conflict regarding this, The Battle of Magenta between the French and the Austrians in 1859!

Spoiling the story, the colour conflict had nothing to do with the battle, especially as the dye was discovered in 1859 and named in honour of the event. It is interesting to note the leader of French forces was actually of Irish descent, his family driven out of Ireland due to English property confiscations, opting to settle in France. Patrice de MacMahon (Paddy to his mates) eventually became President of France!

Aside from a whimsical wander through history, along with an ongoing in-house debate regarding Purple or Magenta, we should really discuss what’s happening (or rather NOT happening) with Barclays share price.

Last time we reviewed it, we waxed lyrical about the dangers of 148.823p, if the share had the temerity to close below this level. Such a disaster has happened 3 times in the last week, salt being rubbed on the wound by the price also trading below 147p (apparently the final drop trigger) for a few hours. Yet, the price has not plunged into the abyss of doom, instead appearing to find some sort of excuse for a bounce.

Alas, this is where the Purple (or Magenta) line comes into play, a horizontal trend dating back 8 years and one we’d ignored, due to Barclays share price habit of dipping below this 147p line, only to recovery sharply thereafter. Only in 2016 – following the Brexit vote (circled) – did the price conclusively dip below this line but once again, sharply recovered. It’s important to accept therefore this trend can be broken. The situation now, from a Big Picture perspective, is of weakness below 146p now entering a cycle down to an initial 134p. Secondary, when broken, is a bottom, hopefully, of 114p.

To a degree, it feels we are clutching at straws, perplexed Barclays has avoided the opportunity to drive off a cliff. The answer to our confusion doubtless lies with politics and political uncertainty as we await white smoke coming from 10 Downing St chimney to tell us which bus driver has been anointed to actually steer the nation.

Currently, Barclays share price requires above 162p to suggest it has actually bottomed, in doing so entering a region where a cycle to 175p should commence. If bettered, a longer term 192p is now possible.

If we adhere to our “normal” rules, we must accept 114p looks like the eventual drop target.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:13:33PM |

BRENT |

65.52 |

Success | ||||||||

|

10:15:00PM |

GOLD |

1409.66 |

‘cess | ||||||||

|

10:16:56PM |

FTSE |

7399.76 |

Shambles | ||||||||

|

10:19:28PM |

FRANCE |

5495.5 |

5492 |

5464.5 |

5425 |

5533 |

5533 |

5544 |

5561 |

5500 |

Shambles |

|

10:21:51PM |

GERMANY |

12239.42 | |||||||||

|

10:23:47PM |

US500 |

2910 |

2909 |

2902.5 |

2882 |

2927 |

2934 |

2942 |

2953 |

2914 |

‘cess |

|

10:26:14PM |

DOW |

26522 | |||||||||

|

10:33:12PM |

NASDAQ |

7614.37 |

‘cess | ||||||||

|

10:38:42PM |

JAPAN |

21094 |

Sorry |

#SP500 #NK225 Our monthly visit to a favourite Banking Sector candidate, Lloyds, once again permitted self congratulation for a prior report. (Link Here) Alas, the next few sessions are liable to prove “interesting”, thanks to the potentials if the price manages to stumble below 56p. We moaned, previously, of banking shares dancing to Brexit tunes and this remains the case.

In fact, if we review the overall banking sector, FTSE:NMX8250, at time of writing it’s trading at 3781 and is flirting with some fairly nasty dangers. It only requires weakness below 3730 to trigger some misery down to an initial 3600 with secondary, when broken, at a bottom (hopefully) of 3212 points. Crucially, similar to Lloyds, it has not yet broken its final immolation trigger, so hope remains.

In the case of Lloyds, below 56p now calculates with travel down to 51.8 next. This ambition coincides with a long term uptrend which implies a bounce can be expected, should such a level make an appearance. Our secondary, if 51.8 breaks, is down at 46.8p, a point where there’s almost a requirement for a rebound. The “however” is quite dangerous, thanks to 46.8 taking the share into a region where the Big Picture computes with 41p as a pretty major expectation, along with an eventual journey down to 26p.

Our suspicion is we shall witness 51.8p eventually and this should co-incide with the overall sector at the 3600 level. And hopefully, everything should rebound.

At present, we require Lloyds to exceed 62.25p as this should calculate with a genuine bounce, propelling the share into a region where an initial 67p is supposed to be real. According to the tea leaves, our secondary of 71.25p risks being game changing for the longer term, allowing some fairly impressive (and unheard of for nearly 10 years) longer term target levels.

For now, while we can hope 51.8p shall be “it”, historical behaviour in the banking sector makes us fear the worst.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:28:35PM |

BRENT |

64.45 | |||||||||

|

9:30:48PM |

GOLD |

1422.93 |

Success | ||||||||

|

9:41:09PM |

FTSE |

7396 |

Shambles | ||||||||

|

9:42:50PM |

FRANCE |

5494.7 | |||||||||

|

9:44:58PM |

GERMANY |

12188.79 |

‘cess | ||||||||

|

9:47:02PM |

US500 |

2918.29 |

2915 |

2913 |

2896 |

2937 |

2937 |

2942 |

2951 |

2920 |

Success |

|

9:49:46PM |

DOW |

26558.5 |

‘cess | ||||||||

|

9:52:07PM |

NASDAQ |

7601.75 |

Success | ||||||||

|

9:54:34PM |

JAPAN |

21094 |

21058 |

20994 |

20787 |

21188 |

21223 |

21253 |

21318 |

21112 |

‘cess |

#Gold #SP500 A bloke at B&Q (owned by Kingfisher) provided part of the reason many folk in the UK voted for Brexit. Buying a replacement WC turned into a headache with the discovery EU Regulations apparently intrude in the toilet. Modern loos, such as sold in B&Q and every other bathroom showroom I was dragged around, don’t flush properly. Everyone knows but no-one has addressed the issue.

The problem, apparently, came from Brussels and a demand we embrace “water saving”, enforced with a 4 litre or 6 litre flush. It would be difficult to find a plumber who approves of these modern designs and a need to flush the things 2 or 3 times. Thanks to Google, it was quickly established our existing loo had a 13 litre flush and we’d be daft replacing it. The bloke at B&Q was convinced dodgy toilets formed a convincing reason for people voting to leave! It can be safely assumed I did not go into last weekend with the expectation of learning about toilet flushes. It is even the case regulations only apparently effect new installations, whereas the bulk of sales will be for folk upgrading existing installations of bathroom furniture.

Surely, the Daily Mail must embrace a headline about “Brussels and A Busted Flush!”

We’re not entirely convinced B&Q’s choice of stocking EU Approved WC’s is entirely the reason for their falling share price, despite the company not stocking a single WC which matches UK slightly less restrictive regulations. For now, it appears our downstairs loo is fated to remain with its peculiar square seat design, thanks to a company called Shires with a sense of design humour.

It appears weakness now below 201p on Kingfisher shares should flush the price down to 184p next, a point at which we’d expect some sort of rebound. But take extreme care, should 184p break as it could easily drain down to 166p next. Worse, from a Big Picture perspective, the share price is already trading in a region where negative news could drip the value down to a bottom, hopefully, at 142p in a blink.

For any near term bounce to prove viable, the share price requires exceed 222p to enter a cycle toward an initial 235p. If exceeded, we’ll be suitably convinced bottom is “in” (for now) and hope, if 235p bettered, our calculation of secondary at 249p shall prove valid.

Finally, apparently there is a vibrant market for 2nd hand toilets with “proper” flush capability, though it does not come close to matching cross border illicit trade between USA (regulated toilets) and Canada (unregulated toilets)…

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:46:44PM |

BRENT |

64.23 |

‘cess | ||||||||

|

9:50:20PM |

GOLD |

1418.61 |

1400 |

1395 |

1386 |

1412 |

1422 |

1430 |

1438 |

1411 |

‘cess |

|

10:03:45PM |

FTSE |

7406 |

‘cess | ||||||||

|

10:07:11PM |

FRANCE |

5509.5 | |||||||||

|

10:09:06PM |

GERMANY |

12257 | |||||||||

|

10:10:59PM |

US500 |

2947.02 |

2943 |

2935.5 |

2926 |

2956 |

2956 |

2959.5 |

2965 |

2945 | |

|

10:13:06PM |

DOW |

26747.5 | |||||||||

|

10:16:33PM |

NASDAQ |

7729.62 | |||||||||

|

10:18:36PM |

JAPAN |

21201 |

Bitcoin and Last Week Reviewed. The stunt we pulled with Gold last Monday was pleasing to say the least. If it now betters 1398, then an initial 1401 still looks possible but realistically, it could power on to 1416. Tuesdays GBPUSD has proven boring with nothing major triggering YET. As for Wednesdays Barr Group, thoughts of 860p and a bounce remain valid.

Berkeley Group Holdings, reviewed on Thursday, thus far failed do anything of interest but keeping a weather eye for the longer term, along with 2680 making an appearance, should not be time wasted.

Friday and our analysis of the FTSE successfully produced an initial 26 point drop, breaking our initial target on the first surge and therefore making our secondary at 7365 hopefully capable of provoking some sort of bounce. It was rather annoying waiting from 2pm until 4:25pm before the initial drop completed. Suddenly, as if shocked out of its boredom, the FTSE indeed provided a short lived bounce back to the 7399 level, then dropped further for the final two minutes of trade. It results in a suspicion Monday shall commence the session slightly down, hopefully bouncing from our 7365 level. But should 7365 break, we do not expect the FTSE to achieve an UP day. Quite the converse.

As for Bitcon, it’s now showing surprising potentials as movement above 11,216 calculates with 12,070 as an initial target. If bettered, secondary computes at 13,286 longer term. (Or sometime later that day!) For it all to go completely wrong, Bitcoin requires weaken below 8,800 as this will tend nullify all longer term ambitions on the immediate cycle. Instead, it opens a trapdoor to 6,916 initially with secondary a return to 4,058.

For now, we suspect 12,070 shall prove capable of providing some hesitation.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

5:58:04PM |

BRENT |

64.75 |

63.75 |

63.55 |

63.01 |

64.96 |

65.21 |

65.64 |

65.75 |

63.4 |

‘cess |

|

6:08:02PM |

GOLD |

1399.83 |

‘cess | ||||||||

|

6:09:55PM |

FTSE |

7364.02 |

‘cess | ||||||||

|

6:11:35PM |

FRANCE |

5505 |

Shambles | ||||||||

|

6:19:20PM |

GERMANY |

12250 |

12244 |

12202 |

12123 |

12328 |

12423 |

12436.5 |

12501 |

12302 |

Success |

|

6:21:05PM |

US500 |

2944.67 | |||||||||

|

6:23:18PM |

DOW |

26670 |

Shambles | ||||||||

|

6:30:17PM |

NASDAQ |

7720 | |||||||||

|

6:32:20PM |

JAPAN |

21177 |

‘cess |

#DOW #CAC40 Rocketman, A Snake, and a Fast Birthday also feature. Plus, of course, some updated thoughts on Gold. But to deal with Rocketman first, the movie threw into sharp relief just how superior the recent Freddy Mercury film was. Unfortunately for Elton John, his brilliant soundtrack didn’t stop us getting bored and leaving early. Perhaps it will be better on telly.

Another of this weeks highlights was ‘The Snake in The Grass’ (nothing to do with the Conservative Leadership) Charging around the lawn on a little red tractor, panic ensued at the sight of a silvery white snake about 2 feet long winding its way across my path. Even from the illusory safety of a tractor seat, absolute terror ensued as snakes are uncommon in Scotland to say the least. Faced with the choice of mincing the beast or running away, selecting reverse and spinning the big rear wheels was the only consideration. Later, from the comfort of a computer, it became plain the snake was actually a slow-worm which is not actually a worm. Instead, it’s a legless lizard. Now, I need explain the trenches in the lawn, dug in panic reverse mode.

To remain whimsical, marriage is often built on a sense of humour and this weekend, a joke which smouldered for 10 years has become available. It is Mrs T&T’s birthday, her very last chance to have a party which lasts under a minute. Obviously, it is her 50 second birthday, giving her 50 seconds to answer treasure hunt questions, then another 50 seconds to find a batch of joke gifts. She’ll hate it.

It has been “that” sort of week and who wants to read about the markets all the time anyway!

As for Gold, we started the week warning of the dangers if the metal bettered 1,357 dollars. It did, rapidly achieving our initial target of 1,385. In fact, using our argument which favours watching the initial surge, at 2am the price shot above 1,385 for a few moments, hitting 1,394 before rapidly falling back to the 1,385 level. This proved we were watching the correct trend, signalling movement next above 1,394 remains with the ambition of 1,401 next. If bettered, our secondary calculation is now at 1,416 dollars.

The FTSE has experienced another oddball week, going into Friday roughly 75 points higher than it started the week. Compare this with the 4x larger DOW and its 600 point volatility. Or the 1.6x larger DAX and its near 300 point range. The FTSE is failing to impress with any real strength, constantly underperforming compared with other markets. Perhaps it’s a symptom of the UK’s fragility, effectively leaderless and about to step into a new trading environment. Talking to folk who trade the markets, there is a broad expectation of severe trouble coming to the FTSE. If this is indeed the case, it shall prove worth watching for an illogical upward surge taking place first as the market rarely gives free gifts. We’d be very suspicious if any FTSE movement above 7,650 was capable of sticking. Quite the converse as a drop should follow.

Near term, below 7425 looks capable of an initial 7399 points. If broken, our secondary calculates at 7365 pints and hopefully some sort of bounce. There are longer term implications of any break of 7365 as the market would be viewed as entering a cycle down to 7247 points. The tightest stop looks like 7461 points.

Above 7461 should prove capable of an initial 7493 points. If bettered, secondary is at 7527 points. Stop can be 7425.

#Gold #Nasdaq Sometimes, the stock market loves its little “gotcha” moments and we suspect Berkeley share price is about to illustrate this nasty trend. After announcing a slump in annual profits, a bunch of traders doubtless expected the share price to follow the trajectory of a brick dropped from a height. Instead, the share closed the session down just 0.2%!

Does this mean Berkeley’s share price is concealing inherent strength, especially as it reached a high of 3777 during the session, closing at 3552 eventually?

We really doubt it, instead suspecting the market has simply delayed the drop until sufficient number of investors reassure themselves Berkeley is “safe”, a concept reserved for the ridiculously naive when discussing share prices. Instead, the suspect is shall prove worth watching for movement below 3441 anytime soon as this should drive the price down to an initial 3352p. Secondary, if (when) broken, should be 3221p and hopefully a bounce. Unfortunately, there are some fairly severe longer term implications should 3221 break as it will take the price into “lower low” territory, as a consequence forcing us to accept a calculation of 2680p as the eventual bottom ambition. This would also match the uptrend since the start of price recovery from 2009’s fun and games.

It’s pretty amazing we still must regard an event 10 years ago as the benchmark for current share price movements.

For BKG to signal it’s climbing out of trouble, the price currently needs exceed BLUE on the chart, 3890p at present.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:56:38PM |

BRENT |

61.75 |

‘cess | ||||||||

|

10:04:45PM |

GOLD |

1361 |

1341 |

1334.5 |

1325 |

1353 |

1363 |

1364.5 |

1375 |

1347 |

‘cess |

|

10:07:00PM |

FTSE |

7411.77 | |||||||||

|

10:20:11PM |

FRANCE |

5525 |

‘cess | ||||||||

|

10:27:43PM |

GERMANY |

12317 |

Shambles | ||||||||

|

10:39:20PM |

US500 |

2926.77 |

‘cess | ||||||||

|

10:41:16PM |

DOW |

26506 |

‘cess | ||||||||

|

10:43:28PM |

NASDAQ |

7668.49 |

7600 |

7564 |

7523 |

7659 |

7687 |

7693 |

7724 |

7605 | |

|

10:45:17PM |

JAPAN |

21327 |

‘cess |