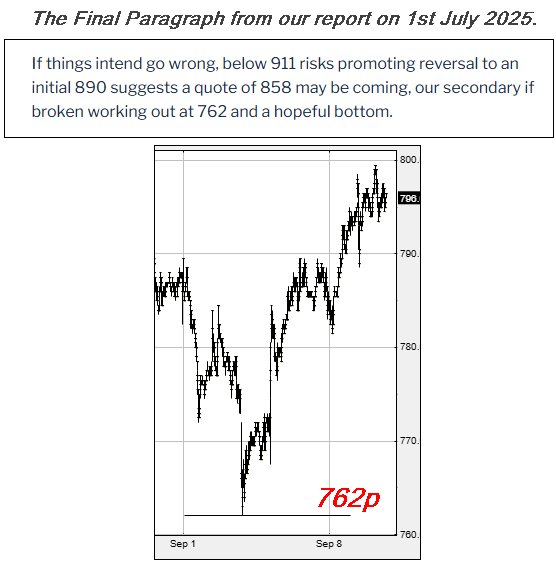

#Gold #Nasdaq The UK AIM market has essentially been on holiday since the start of June! With everything going on in the world, it was something of a surprise to note the AIM index spent over three months moving by just 12 points above and below a midpoint of around 768 points. While this is obviously very frustrating, along being questionable behaviour, there is one significant detail we can mention. In the event the AIM market staggers above 783 points, we shall deem it as breaking free from the current malaise, ideally heading to an initial 838 points with our secondary, if beaten, at 883 points and some probable hesitation. We feel this prediction is probably worth printing out and sticking on the wall as it should highlight a period where members of the AIM market enjoy some much deserved movements. The AIM would need slink below 688 to utterly crush our hopes.

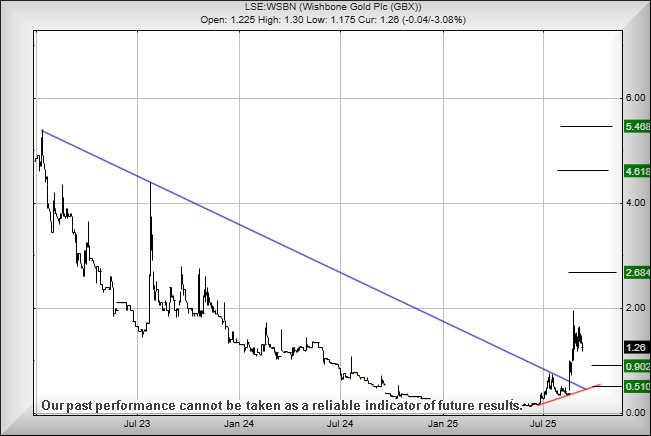

Wishbone Gold Plc are perhaps one of the AIM constituents trapped in the current sludge of share price action feeling quite restricted. This, despite the company being named after a pretty good soft rock band! (Wishbone Ash) However, their share price position currently stinks a little bit as movement below 1.17p risks promoting further reversal to an initial 0.90p with our secondary, if broken, at 0.51. Even though reversal looks fairly inevitable, we’d hope for a real bounce around the 0.9p level rather than exhibit proper weakness to our secondary target.

Surprisingly, if the share price manages above 1.63p anytime soon, this would certainly tick the first box to allow the share price to move positively, giving an initial target level at a very useful 2.68p. We’ve considerable doubts about our longer term secondary at 4.6p sometime in the future. It is certainly a puzzle how their share price has (so far) failed to benefit from the change in the price of Gold, despite its current sojourn around 3,600 dollars, a price level which has ensured sobriety tests have been needed in Nome, Alaska, an area where Gold divers literally have never had it so good. One of the miners, owning a diving and dredging vessel, has even opted to abandon her very profitable YouTube channel to focus entirely on maximising her “take” from the floor of the Bering Sea.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:21:16PM | BRENT | 6748 | |||||||||

| 11:30:10PM | GOLD | 3640.41 | 3620 | 3606 | 3589 | 3641 | 3650 | 3659 | 3672 | 3630 | |

| 11:32:37PM | FTSE | 9241.8 | ‘cess | ||||||||

| 11:35:05PM | STOX50 | 5355.8 | |||||||||

| 11:38:05PM | GERMANY | 23602.6 | ‘cess | ||||||||

| 11:40:22PM | US500 | 6534.2 | ‘cess | ||||||||

| 11:42:56PM | DOW | 45501.8 | Shambles | ||||||||

| 11:46:53PM | NASDAQ | 23856.4 | 23824 | 23763 | 23681 | 23884 | 23973 | 24021 | 24204 | 23859 | Success |

| 11:49:39PM | JAPAN | 43887 | ‘cess |

10/09/2025 FTSE Closed at 9225 points. Change of -0.18%. Total value traded through LSE was: £ 5,802,988,432 a change of 11.05%

9/09/2025 FTSE Closed at 9242 points. Change of 0.23%. Total value traded through LSE was: £ 5,225,634,176 a change of 25.23%

8/09/2025 FTSE Closed at 9221 points. Change of 0.14%. Total value traded through LSE was: £ 4,172,667,369 a change of -14.19%

5/09/2025 FTSE Closed at 9208 points. Change of -0.09%. Total value traded through LSE was: £ 4,862,590,557 a change of 7.19%

4/09/2025 FTSE Closed at 9216 points. Change of 0.42%. Total value traded through LSE was: £ 4,536,344,047 a change of -21.07%

3/09/2025 FTSE Closed at 9177 points. Change of 0.67%. Total value traded through LSE was: £ 5,747,395,783 a change of -1.83%

2/09/2025 FTSE Closed at 9116 points. Change of -0.87%. Total value traded through LSE was: £ 5,854,446,717 a change of 77.93%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AAL Anglo American** **LSE:HIK Hikma** **LSE:HSBA HSBC** **LSE:IAG British Airways** **LSE:IGG IG Group** **LSE:IQE IQE** **LSE:SMT Scottish Mortgage Investment Trust** **

********

Updated charts published on : Anglo American, Hikma, HSBC, British Airways, IG Group, IQE, Scottish Mortgage Investment Trust,

LSE:AAL Anglo American. Close Mid-Price: 2531 Percentage Change: + 1.65% Day High: 2581 Day Low: 2480

Further movement against Anglo American ABOVE 2581 should improve acceler ……..

</p

View Previous Anglo American & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1664 Percentage Change: -1.60% Day High: 1695 Day Low: 1662

Continued weakness against HIK taking the price below 1662 calculates as ……..

</p

View Previous Hikma & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 996.8 Percentage Change: + 1.82% Day High: 999 Day Low: 985.6

Target met. All HSBC needs are mid-price trades ABOVE 999 to improve acce ……..

</p

View Previous HSBC & Big Picture ***

LSE:IAG British Airways Close Mid-Price: 381.7 Percentage Change: -4.07% Day High: 398.1 Day Low: 382.1

All British Airways needs are mid-price trades ABOVE 398.1 to improve ac ……..

</p

View Previous British Airways & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 1149 Percentage Change: + 0.35% Day High: 1161 Day Low: 1150

Target met. Continued trades against IGG with a mid-price ABOVE 1161 shou ……..

</p

View Previous IG Group & Big Picture ***

LSE:IQE IQE Close Mid-Price: 7.6 Percentage Change: -2.56% Day High: 7.9 Day Low: 7.51

Continued weakness against IQE taking the price below 7.51 calculates as ……..

</p

View Previous IQE & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 1120 Percentage Change: + 0.90% Day High: 1120.5 Day Low: 1112

All Scottish Mortgage Investment Trust needs are mid-price trades ABOVE 1 ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***