#Brent #Germany The weekend only brought one surprise. The Grand Prix from Baku ran just about as expected, a truly entertaining qualifying session followed by a race which was pretty indifferent, lacking any excuse for chaos. But the surprise came from my decision in invent “whisky wine”, almost providing my non-drinker wife with an excuse to sample anything I try to ferment. In theory (in my head) I had a really good idea, to make Finnish Sugar Wine (Kilju) with a twist. The sneaky addition of a couple of mugs of porridge oats and some barley, a few drops of vanilla, a few drops of toffee flavouring, and tossing in some oak shavings to give that authentic “whisky barrel” flavour. 25 litres of the stuff was left to ferment for a week, then decanted into a sterilised container where it was allowed to clarify in a dark, cool, place for a few weeks. Following fermentation, it was giving an alcohol reading of around 20º, so I’d high hopes for the final product, intending a low alcohol whisky flavoured drink!

On Sunday afternoon, during the boredom of the Grand Prix, with three weeks since the fermentation process started, it was judged my Kilju variant could be safely tried. On the first sip, it was “okay but unusual”, second sip confirmed absolutely zero whisky flavour, third sip provoked “this is a bit strange” and by the fourth sip, it was time to put the wine glass down and go make a coffee. Nothing was happening on the race track anyway and within a few minutes, I’d a perfect coffee from my wonderful “bean to cup” machine. It’s always nice to have a nibble, when enjoying a coffee, and human nature made me reach for the wine glass! The penny dropped, somehow or other I’d managed to produce “Cookie Flavoured Wine”, an utterly abhorrent concept. Aside from the salient detail my wife actually likes cookie flavoured things, like Ben & Gerri’s Ice Cream. She tried the dreadful wine, suggested around 5 bottles are produced, and the rest poured into the garden stream. By the time the Baku Grand Prix ended, 5 bottles labelled “Cookie Wine” were laid down in the garden shed wine rack, the rest poured into the stream. I’m pretty certain my wife shall take a single glass at Xmas, then whisper I should pour the rest away…

Hopefully this infusion of alcohol into the stream shall coax out the mystery ginger/golden animal spotted last week. We now suspect it may be a Mink, perhaps auditioning to be the precursor of a local fur coat industry here in Argyll! Surely no-one would complain as they’re an invasive species and we’ve some excellent local restaurants too!

Natwest delivered a gift wrapped surprise on September 15th, the market choosing to open the share at 534p, a penny above our previous initial target level at 533p. We were quite chuffed, treating this as an indication “they” were following a similar set of rules to ourselves, perhaps even opting to round the target level up, rather than employ our habit of playing safe. Of course, what happened since has been messy, though not quite as murderous as it could be. The price of Natwest needs CLOSE below 480p before we shall indulge in panic, giving the potential of weakness to an initial 463 with our secondary, if broken, an eventual sticky bottom of 410p. In other words, we’d not be terribly comfortable predicting a bounce from such a level. Instead, we suspect the current trajectory shall probably bounce around 488p, keeping the share price fluttering around in a zone where some considerable hope is possible.

There’s a funny thing about Natwest, a “secret” long term target level we’re almost afraid to admit exists.

For the long term, we’re calculating the ruling influence as coming from a ridiculously attractive sounding 1055p!

Should things intend turn positive for Natwest, above 534 now looks capable of triggering movement to an initial 551p with our secondary, if exceeded, at an eventual 577p. Such a target would be a really big deal for the future, creating a proper official “higher high” and making a third level ambition at 686p. And at such a level, our silly sounding distant 1055p doesn’t sound quite as daft.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

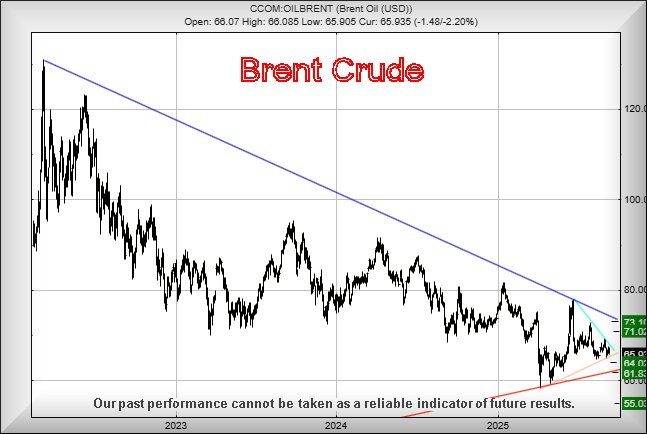

| 2:30:07AM | BRENT | 6632.8 | 6688 | 6606 | 6524 | 6670 | 6722 | 6746 | 6790 | 6681 |

| 2:33:29AM | GOLD | 3684.7 | ||||||||

| 9:21:42PM | FTSE | 9222.5 | ||||||||

| 11:05:41PM | STOX50 | 5458.5 | ||||||||

| 11:08:15PM | GERMANY | 23633.6 | 23597 | 23524 | 23436 | 23707 | 23788 | 23889 | 24091 | 23650 |

| 11:11:43PM | US500 | 6656.8 | ||||||||

| 11:15:30PM | DOW | 46237 | ||||||||

| 11:18:55PM | NASDAQ | 24600 | ||||||||

| 11:21:40PM | JAPAN | 45291 |

19/09/2025 FTSE Closed at 9216 points. Change of -0.13%. Total value traded through LSE was: £ 14,406,950,391 a change of 163.35%

18/09/2025 FTSE Closed at 9228 points. Change of 0.22%. Total value traded through LSE was: £ 5,470,749,356 a change of 5.44%

17/09/2025 FTSE Closed at 9208 points. Change of 0.14%. Total value traded through LSE was: £ 5,188,517,809 a change of -11.11%

16/09/2025 FTSE Closed at 9195 points. Change of -0.88%. Total value traded through LSE was: £ 5,836,701,503 a change of 13.9%

15/09/2025 FTSE Closed at 9277 points. Change of -0.06%. Total value traded through LSE was: £ 5,124,504,308 a change of 3.82%

12/09/2025 FTSE Closed at 9283 points. Change of -0.15%. Total value traded through LSE was: £ 4,936,038,879 a change of -3.79%

11/09/2025 FTSE Closed at 9297 points. Change of 0.78%. Total value traded through LSE was: £ 5,130,576,096 a change of -11.59%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BARC Barclays** **LSE:BBY BALFOUR BEATTY** **LSE:HSBA HSBC** **LSE:SMT Scottish Mortgage Investment Trust** **

********

Updated charts published on : Barclays, BALFOUR BEATTY, HSBC, Scottish Mortgage Investment Trust,

LSE:BARC Barclays Close Mid-Price: 381.65 Percentage Change: -0.75% Day High: 388.65 Day Low: 377.8

All Barclays needs are mid-price trades ABOVE 388.65 to improve accelerat ……..

</p

View Previous Barclays & Big Picture ***

LSE:BBY BALFOUR BEATTY Close Mid-Price: 629.5 Percentage Change: -1.25% Day High: 643.5 Day Low: 624

Target met. Continued trades against BBY with a mid-price ABOVE 644p shou ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 1027.8 Percentage Change: + 0.88% Day High: 1030.6 Day Low: 1014.2

Continued trades against HSBA with a mid-price ABOVE 1030.6 should improv ……..

</p

View Previous HSBC & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 1141 Percentage Change: + 0.00% Day High: 1148 Day Low: 1139

In the event of Scottish Mortgage Investment Trust enjoying further trade ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***