Our FTSE for FRIDAY (FTSE:UKX) Trading around 9508 at time of writing.

When we’re getting cheesed off about how poorly many shares on the UK stock market are performing, habitually we add to our depression by running a comparison with what’s going on elsewhere, especially in countries where the government doesn’t regard arresting people for Twitter or Facebook comments as the most important facet of their job. A recent statistic revealed 30 folk are being arrested a day for what are essentially imaginary crimes, a level of sustained crackdown which placed the campaign against democracy protestors in Hong Kong into the shade.

Successive governments in the UK continue to avoid doing anything useful, often more intent on feeding politicians ego rather than risk doing anything positive for the country and business. The recent ridiculous “photo op” investment for a maritime facility to import cheap Chinese electric vehicles in the north of England provides a perfect example of how hard UK politicians work to damage the country, an initiative which will harm the residual UK vehicle industry, along with reducing imports from Europe. After all, why buy VW or whatever, if there’s a Chinese alternative available at 1/2 the price.

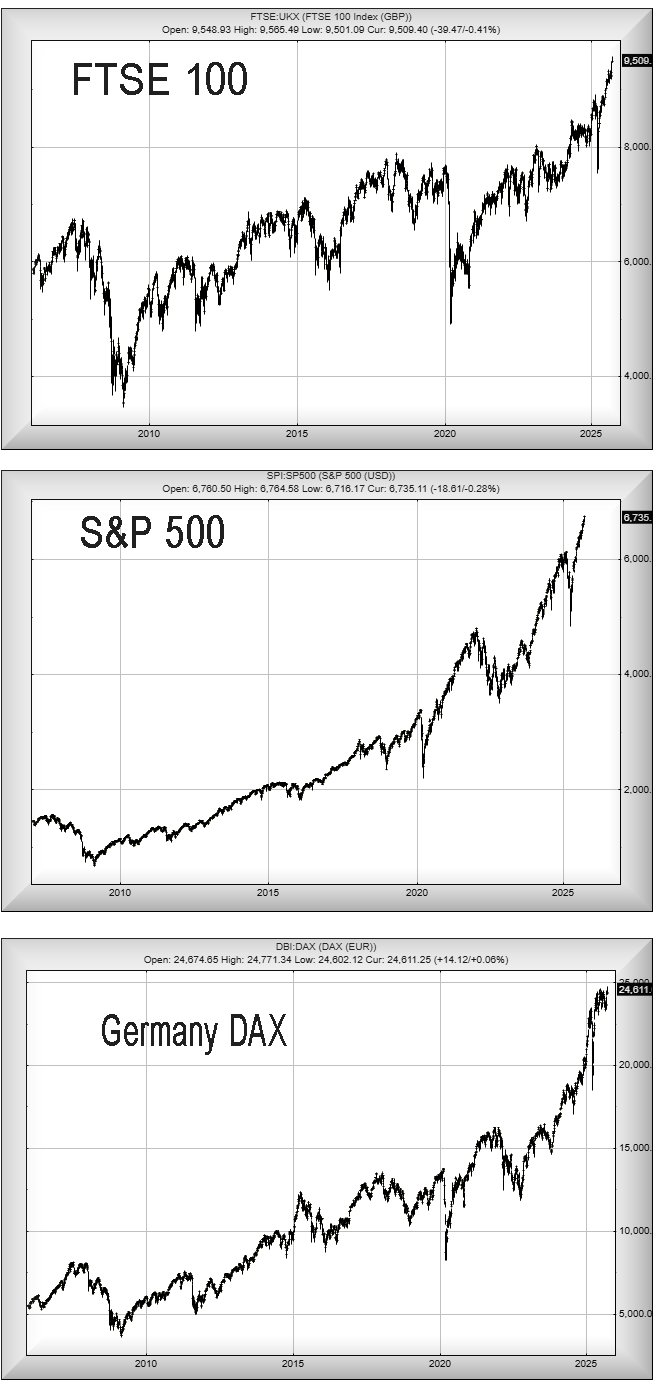

The charts below tell a story suitable for Halloween. Since 2010, the value of the UK stock market has increased by almost double. The FTSE needs be just below 12000 points to make the rise a solid 2x fold gain.

However, the US S&P500 chart below is a bit more interesting, showing a 5x fold increase for exactly the same period. And our local neighbour, Germany, is also showing a near 5x fold increase…

These figures are nothing to do with Brexit, our frustration and irritation with the UK dating back to the market crash of 2009, along with the realisation UK politicians didn’t know what to do about the mess our country was in. While every other country worked hard to leave the financial crisis behind, British governments revelled in the fact they’d something else to blame, giving plenty of reasons for inactivity. It’s still the case the financial crash of 2009 gets trotted out, when a politician is trying to assign blame for their incompetence and inaction. But they are proud 30 folk are being arrested daily for “wrong think” on social media, making the UK a world leader in the field..

As for our FTSE for FRIDAY, there are many suggestions the UK market should be heading upward. There has been a certain lethargy of movements this week, so hoping for a positive day on Friday may be an error but given recent world news of movement in the Middle East and the Nobel Committee due to announce who deserves this years Peace Price, perhaps things may get exciting for the market. We suspect Mr Trump shall not be lauded as his efforts have been too late for consideration this year.

If things intend go wrong for the FTSE, it’s now the case where weakness below 9501 points risks promoting reversals down to an initial 9471 points with our “longer term” secondary, if broken, at 9436 points and hopefully a bounce point, given the underlying pressure remains upward. If this scenario triggers, the tightest stop is at 9537 points.

Should things intend turn positive, the UK index needs wander above 9566 points to promote the idea of gains to an initial 9629 points with our secondary, if beaten, an unlikely (in the same day) 9650 points. Our expectation is for a day of mild reversals while the FTSE embraces a flat spell prior to the BoE announcing a surprise Interest Rate reduction on November 6th.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:37:22PM | BRENT | 6509 | 6486 | 6440 | 6531 | 6644 | 6678 | 6562 | Success | ||

| 10:40:10PM | GOLD | 3976.61 | 3944 | 3920 | 3990 | 4030 | 4062 | 3999 | Success | ||

| 10:43:24PM | FTSE | 9493.2 | 9483 | 9447 | 9512 | 9535 | 9546 | 9505 | |||

| 10:46:28PM | STOX50 | 5621.5 | 5613 | 5608 | 5638 | 5638 | 5646 | 5620 | Shambles | ||

| 10:52:49PM | GERMANY | 24612 | 24570 | 24538 | 24630 | 24673 | 24733 | 24595 | ‘cess | ||

| 11:11:12PM | US500 | 6734.7 | 6716 | 6705 | 6737 | 6762 | 6779 | 6744 | |||

| 11:14:40PM | DOW | 46383.2 | 46264 | 46006 | 46478 | 46684 | 46805 | 46488 | ‘cess | ||

| 11:18:00PM | NASDAQ | 25105.8 | 25028 | 24974 | 25080 | 25140 | 25184 | 25026 | |||

| 11:21:20PM | JAPAN | 48525 | 48420 | 48292 | 48632 | 48726 | 48840 | 48550 | ‘cess |

9/10/2025 FTSE Closed at 9509 points. Change of -0.41%. Total value traded through LSE was: £ 6,502,012,274 a change of 0.62%

8/10/2025 FTSE Closed at 9548 points. Change of 0.69%. Total value traded through LSE was: £ 6,461,813,888 a change of 28.82%

7/10/2025 FTSE Closed at 9483 points. Change of 10436.67%. Total value traded through LSE was: £ 5,016,195,038 a change of -1.86%

6/10/2025 FTSE Closed at 90 points. Change of -99.05%. Total value traded through LSE was: £ 5,111,279,215 a change of -21.54%

3/10/2025 FTSE Closed at 9491 points. Change of 0.68%. Total value traded through LSE was: £ 6,514,116,921 a change of 8.6%

2/10/2025 FTSE Closed at 9427 points. Change of -0.2%. Total value traded through LSE was: £ 5,998,175,981 a change of -12.05%

1/10/2025 FTSE Closed at 9446 points. Change of 1.03%. Total value traded through LSE was: £ 6,819,950,477 a change of -0.05%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AAL Anglo American** **LSE:AML Aston Martin** **LSE:BBY BALFOUR BEATTY** **LSE:CAR Carclo** **LSE:FRES Fresnillo** **LSE:GLEN Glencore Xstra** **LSE:IAG British Airways** **LSE:IHG Intercontinental Hotels Group** **LSE:SRP Serco** **LSE:STAN Standard Chartered** **

********

Updated charts published on : Anglo American, Aston Martin, BALFOUR BEATTY, Carclo, Fresnillo, Glencore Xstra, British Airways, Intercontinental Hotels Group, Serco, Standard Chartered,

LSE:AAL Anglo American. Close Mid-Price: 2963 Percentage Change: + 2.17% Day High: 3008 Day Low: 2926

Target met. Continued trades against AAL with a mid-price ABOVE 3008 shou ……..

</p

View Previous Anglo American & Big Picture ***

LSE:AML Aston Martin Close Mid-Price: 58.55 Percentage Change: -12.61% Day High: 67.05 Day Low: 58.5

Target met. If Aston Martin experiences continued weakness below 58.5, it ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 655 Percentage Change: + 0.08% Day High: 662 Day Low: 654

Target met. In the event of BALFOUR BEATTY enjoying further trades beyond ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:CAR Carclo. Close Mid-Price: 69.8 Percentage Change: + 5.76% Day High: 69.2 Day Low: 66

Target met. Continued trades against CAR with a mid-price ABOVE 69.2 shou ……..

</p

View Previous Carclo & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 2394 Percentage Change: + 1.10% Day High: 2438 Day Low: 2342

Target met. Further movement against Fresnillo ABOVE 2438 should improve ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 357.15 Percentage Change: + 0.39% Day High: 363 Day Low: 354.3

In the event of Glencore Xstra enjoying further trades beyond 363, the sh ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 412.8 Percentage Change: + 3.20% Day High: 416 Day Low: 399.9

Target met. In the event of British Airways enjoying further trades beyo ……..

</p

View Previous British Airways & Big Picture ***

LSE:IHG Intercontinental Hotels Group Close Mid-Price: 9174 Percentage Change: -0.28% Day High: 9292 Day Low: 9118

All Intercontinental Hotels Group needs are mid-price trades ABOVE 9292 t ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:SRP Serco Close Mid-Price: 238 Percentage Change: -0.42% Day High: 241.6 Day Low: 236.8

In the event of Serco enjoying further trades beyond 241.6, the share sho ……..

</p

View Previous Serco & Big Picture ***

LSE:STAN Standard Chartered Close Mid-Price: 1455 Percentage Change: -1.66% Day High: 1514.5 Day Low: 1459.5

Target met. Continued trades against STAN with a mid-price ABOVE 1514.5 s ……..

</p

View Previous Standard Chartered & Big Picture ***