#Brent #Germany With the retail banks moving above their immediate layer of low cloud, we’ve been working hard at viewing the clouds from both sides now, in an attempt to come up with a reasonable set of predictions for members of the banking sectors future. This has thrown up a few things which should perhaps have been obvious to us already but quite bizarrely, when we take cognisance of events when the markets were manipulated due to Covid-19, there is a pretty firm conclusion to be made that with Lloyds, the market decided to employ the downtrend since 1998, twenty two years earlier.

On the big picture chart below, we’ve zoomed in on 2020 to show market movements in respect of the long term downtrend and there’s little argument the market was – for some insane reason – playing attention to this trend line! To be plain, this means we are now supposed to believe a cycle to a long term 201p has commenced but we prefer to throw some further criteria into the mix. However, we can cough politely and point out the market needs fall below 28p to cancel the prospects of a future 201p making an appearance.

Then again, there’s the inset on the chart below, another Blue downtrend but one which dates back to 2009 before the financial crisis grew really frothy. If relying on this trend, the current implication is for movement above 92.25 triggering a nearer term rise to an initial 112p with our secondary, if bettered, at 122p. The close proximity of these target levels implies some hesitation can be anticipated in this area but, from a Big Picture argument, closure above 122p shall now be viewed as triggering the share price to leave the cloud cover behind and soar to the 201p level eventually.

The share price needs retreat below 60p to spoil this overflow of optimism.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 10:22:40PM | BRENT | 6359 | 6275 | 6199 | 6065 | 6441 | 6486 | 6554 | 6647 | 6368 |

| 10:24:44PM | GOLD | 4000.19 | ||||||||

| 10:28:00PM | FTSE | 9731.3 | ||||||||

| 10:30:40PM | STOX50 | 5616.8 | ||||||||

| 10:32:47PM | GERMANY | 23763.9 | 23451 | 23172 | 22638 | 23679 | 23840 | 23955 | 24123 | 23655 |

| 10:38:07PM | US500 | 6740.9 | ||||||||

| 10:41:39PM | DOW | 47056 | ||||||||

| 10:45:02PM | NASDAQ | 25120.2 | ||||||||

| 10:48:13PM | JAPAN | 50440 |

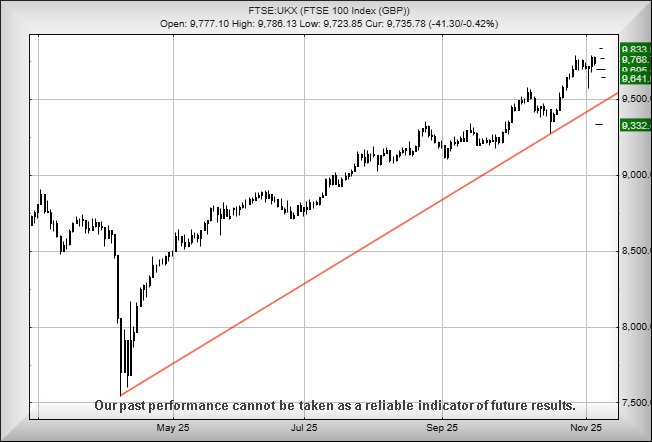

7/11/2025 FTSE Closed at 9682 points. Change of -0.54%. Total value traded through LSE was: £ 5,826,630,107 a change of -16.85%

6/11/2025 FTSE Closed at 9735 points. Change of 896.42%. Total value traded through LSE was: £ 7,007,707,852 a change of 6.36%

5/11/2025 FTSE Closed at 977 points. Change of -89.94%. Total value traded through LSE was: £ 6,588,542,661 a change of 10.12%

4/11/2025 FTSE Closed at 9714 points. Change of 0.13%. Total value traded through LSE was: £ 5,983,302,378 a change of 21.14%

3/11/2025 FTSE Closed at 9701 points. Change of -0.16%. Total value traded through LSE was: £ 4,939,105,432 a change of -3.2%

31/10/2025 FTSE Closed at 9717 points. Change of -0.44%. Total value traded through LSE was: £ 5,102,481,430 a change of -19.1%

30/10/2025 FTSE Closed at 9760 points. Change of 0.04%. Total value traded through LSE was: £ 6,306,885,149 a change of 3.02%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:BARC Barclays** **LSE:BME B & M** **LSE:HIK Hikma** **LSE:IHG Intercontinental Hotels Group** **LSE:OCDO Ocado Plc** **LSE:WG. Wood Group** **

********

Updated charts published on : Asos, Barclays, B & M, Hikma, Intercontinental Hotels Group, Ocado Plc, Wood Group,

LSE:ASC Asos Close Mid-Price: 223 Percentage Change: -4.29% Day High: 233 Day Low: 222.5

If Asos experiences continued weakness below 222.5, it will invariably le ……..

</p

View Previous Asos & Big Picture ***

LSE:BARC Barclays Close Mid-Price: 404.7 Percentage Change: -1.24% Day High: 414.55 Day Low: 403.9

In the event of Barclays enjoying further trades beyond 414.55, the share ……..

</p

View Previous Barclays & Big Picture ***

LSE:BME B & M Close Mid-Price: 163.7 Percentage Change: -0.73% Day High: 167.8 Day Low: 162.6

Target met. Weakness on B & M below 162.6 will invariably lead to 160p wi ……..

</p

View Previous B & M & Big Picture ***

LSE:HIK Hikma. Close Mid-Price: 1582 Percentage Change: + 3.94% Day High: 1602 Day Low: 1525

Weakness on Hikma below 1525 will invariably lead to 1449p with secondary ……..

</p

View Previous Hikma & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 9738 Percentage Change: + 2.31% Day High: 9764 Day Low: 9554

Target met. Further movement against Intercontinental Hotels Group ABOVE ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:OCDO Ocado Plc Close Mid-Price: 197 Percentage Change: -1.10% Day High: 200.8 Day Low: 189.3

Weakness on Ocado Plc below 189.3 will invariably lead to 186p with secon ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:WG. Wood Group. Close Mid-Price: 21.5 Percentage Change: + 7.50% Day High: 22.2 Day Low: 20.5

All Wood Group needs are mid-price trades ABOVE 22.2 to improve accelerat ……..

</p

View Previous Wood Group & Big Picture ***