#FTSE #JAPAN Recent news Frasers Group are considering the purchase of Braehead Shopping Centre near Glasgow should be interesting. The shopping centre, on the banks of the River Clyde, has always managed to avoid taking advantage of a fantastic resource on its literal doorstep. During the Covid-19 years, the place even managed to enjoy 3 cruise liners parked in an adjacent dock for several years, yet the penny failed to drop that they could be the only shopping centre in the UK capable of accepting cruise ship visits. Perhaps Frasers Group shall bring an epiphany, if only due to Frasers introducing fitness centres in some stores. There’s certainly something deliciously funny at the idea of folk trying on clothes, then rushing to the in-store gym to quickly work on their waistline, thighs, or wherever, so the clothes might fit by the time they get home!

This year has certainly not been kind to Frasers share price, it essentially flatlining when compared with historical performance. There are some signs this period of laziness is about to come to a halt as movement below 669 risks triggering a drop down to 615p with its secondary, if broken, down at 594p and hopefully a rebound, a viable possibility given the Red uptrend since 2020. Unfortunately, there’s a serious risk of danger, should the share price manage to close below 594p for any reason as the Big Picture mentions this as being the first tick in a box which should lead to a bottom of 415p.

If things intend turn happy, perhaps with Santa mooring his ship outside the latest Frasers acquisition, the share price needs exceed 765 to give an indication things are about to improve, giving the hope of a visit to an initial 860p and visually some almost certain hesitation. With closure above 860p, our long term recovery scenario gives a future 969p as a sane target level.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:05:41PM | BRENT | 6465 | |||||||||

| 9:09:55PM | GOLD | 4070.7 | |||||||||

| 10:33:18PM | FTSE | 9565.8 | 9537 | 9505 | 9363 | 9586 | 9605 | 9636 | 9679 | 9555 | ‘cess |

| 10:37:37PM | STOX50 | 5534 | ‘cess | ||||||||

| 10:40:11PM | GERMANY | 23170 | ‘cess | ||||||||

| 10:44:16PM | US500 | 6606.5 | ‘cess | ||||||||

| 11:08:52PM | DOW | 46038 | ‘cess | ||||||||

| 11:14:33PM | NASDAQ | 24513 | ‘cess | ||||||||

| 11:17:09PM | JAPAN | 48661 | 48355 | 48168 | 47862 | 48753 | 49086 | 49337 | 49667 | 48884 | Success |

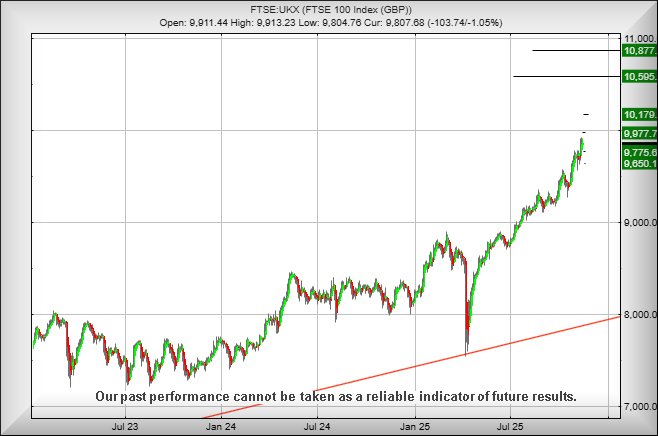

18/11/2025 FTSE Closed at 9552 points. Change of -1.27%. Total value traded through LSE was: £ 6,826,015,429 a change of 18.51%

17/11/2025 FTSE Closed at 9675 points. Change of -0.24%. Total value traded through LSE was: £ 5,759,759,832 a change of -8.67%

14/11/2025 FTSE Closed at 9698 points. Change of -1.11%. Total value traded through LSE was: £ 6,306,721,574 a change of 10.93%

13/11/2025 FTSE Closed at 9807 points. Change of -1.05%. Total value traded through LSE was: £ 5,685,178,464 a change of -6.33%

12/11/2025 FTSE Closed at 9911 points. Change of 0.12%. Total value traded through LSE was: £ 6,069,423,545 a change of -4.91%

11/11/2025 FTSE Closed at 9899 points. Change of 1.14%. Total value traded through LSE was: £ 6,382,591,388 a change of 4.7%

10/11/2025 FTSE Closed at 9787 points. Change of 1.08%. Total value traded through LSE was: £ 6,095,878,551 a change of 4.62%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:AVCT Avacta** **LSE:AZN Astrazeneca** **LSE:BME B & M** **LSE:EXPN Experian** **LSE:GRG Greggs** **LSE:OCDO Ocado Plc** **LSE:QED Quadrise** **LSE:RR. Rolls Royce** **LSE:WG. Wood Group** **

********

Updated charts published on : Aston Martin, Avacta, Astrazeneca, B & M, Experian, Greggs, Ocado Plc, Quadrise, Rolls Royce, Wood Group,

LSE:AML Aston Martin Close Mid-Price: 59.7 Percentage Change: -0.83% Day High: 59.55 Day Low: 57.35

In the event Aston Martin experiences weakness below 57.35 it calculates ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:AVCT Avacta Close Mid-Price: 80 Percentage Change: -1.23% Day High: 82.5 Day Low: 79.5

Continued trades against AVCT with a mid-price ABOVE 82.5 should improve ……..

</p

View Previous Avacta & Big Picture ***

LSE:AZN Astrazeneca Close Mid-Price: 13566 Percentage Change: -0.19% Day High: 13884 Day Low: 13466

Target met. In the event of Astrazeneca enjoying further trades beyond 13 ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BME B & M Close Mid-Price: 156.55 Percentage Change: -1.51% Day High: 158 Day Low: 154

Continued weakness against BME taking the price below 154 calculates as l ……..

</p

View Previous B & M & Big Picture ***

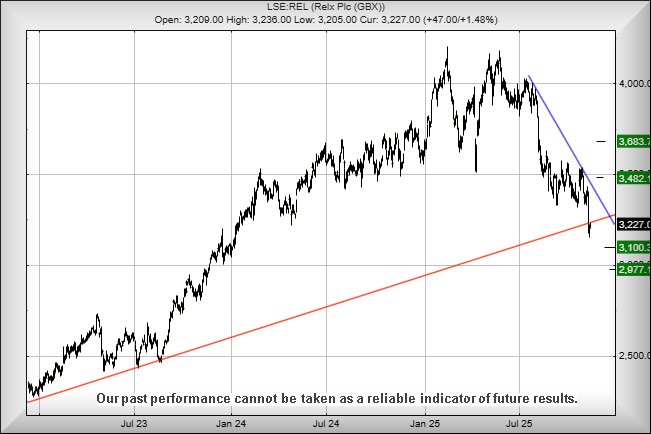

LSE:EXPN Experian. Close Mid-Price: 3290 Percentage Change: + 0.03% Day High: 3295 Day Low: 3227

Continued weakness against EXPN taking the price below 3227 calculates as ……..

</p

View Previous Experian & Big Picture ***

LSE:GRG Greggs Close Mid-Price: 1489 Percentage Change: -1.06% Day High: 1507 Day Low: 1478

If Greggs experiences continued weakness below 1478, it will invariably l ……..

</p

View Previous Greggs & Big Picture ***

LSE:OCDO Ocado Plc Close Mid-Price: 179.9 Percentage Change: -17.40% Day High: 216.3 Day Low: 166

Target met. Continued weakness against OCDO taking the price below 166 ca ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:QED Quadrise Close Mid-Price: 2.68 Percentage Change: -7.59% Day High: 2.75 Day Low: 2.6

If Quadrise experiences continued weakness below 2.6, it will invariably ……..

</p

View Previous Quadrise & Big Picture ***

LSE:RR. Rolls Royce Close Mid-Price: 1073.5 Percentage Change: -1.92% Day High: 1088.5 Day Low: 1057.5

Weakness on Rolls Royce below 1057.5 will invariably lead to 904 with our ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:WG. Wood Group. Close Mid-Price: 24 Percentage Change: + 9.09% Day High: 25.5 Day Low: 23.26

All Wood Group needs are mid-price trades ABOVE 25.5 to improve accelerat ……..

</p

View Previous Wood Group & Big Picture ***