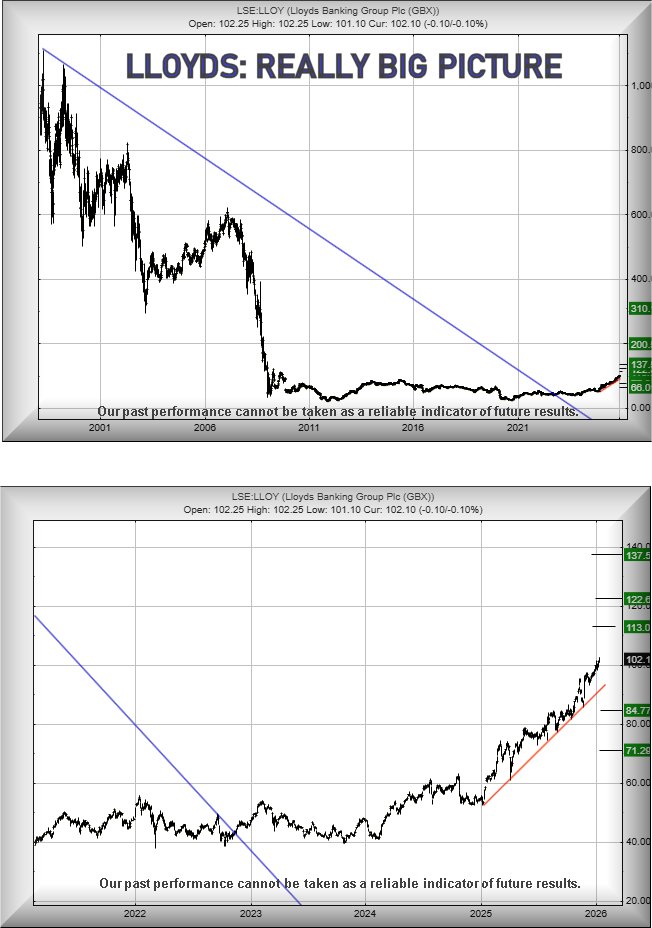

#Brent #WallSt As the writer is loaded with a particularly unpleasant cold, it was tempting to be exceedingly brief in our outlook for Lloyds. We could say now above 104p should brings a gain to an initial 113p with our secondary, if bettered, at 122p. And we’ll be back in three weeks, without a stinking cold, hopefully able to write something more interesting. But…. we like searching for straws to clutch.

Blue on the chart delineates a downtrend since April 1998. If we extend this downtrend to the current period, it seems Lloyds share price needs dwindle below 40p to indicate the onset of trouble. Otherwise, a quite fascinating scenario exists and if we pretend this Big Picture is important, apparently above 104p should – for the terminally patient – suggest a cycle has commenced to a future 200p with our LONG term secondary, if bettered, at 316p. In fact, we can calculate quite a bit higher but dreams of Lloyds turning into an 8 quid share are probably best left on the shelf.

Our lower chart is probably more realistic, with its suggestion of above 104 triggering some real recovery within conventional timeframes, effectively proposing the potential of a future 122p provoking some hesitation in a rising cycle.

An inevitable alternate scenario suggests weakness below 91 risks promoting reversal to an initial 84 with our secondary, if broken, at 71p. Visually, there’s quite a strong suggestion any visit to the 84 level shall doubtless provoke a rebound.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 10:49:55PM | BRENT | 6371.1 | 6295 | 6125 | 5879 | 6388 | 6872 | 6619 | 6871 | 6277 |

| 10:53:03PM | GOLD | 4596.19 | ||||||||

| 11:18:06PM | FTSE | 10206 | ||||||||

| 11:02:52PM | STOX50 | 6032.8 | ||||||||

| 11:05:17PM | GERMANY | 25078.7 | ||||||||

| 11:14:18PM | US500 | 6897 | ||||||||

| 11:22:27PM | DOW | 49002.9 | 48975 | 48832 | 48574 | 49065 | 49376 | 49560 | 49755 | 49240 |

| 11:49:31PM | NASDAQ | 25264.7 | ||||||||

| 11:51:23PM | JAPAN | 53244 |

16/01/2026 FTSE Closed at 10235 points. Change of -0.03%. Total value traded through LSE was: £ 9,203,782,063 a change of 3.12%

15/01/2026 FTSE Closed at 10238 points. Change of 0.53%. Total value traded through LSE was: £ 8,925,069,676 a change of 39.46%

14/01/2026 FTSE Closed at 10184 points. Change of 0.46%. Total value traded through LSE was: £ 6,399,572,065 a change of -4.73%

13/01/2026 FTSE Closed at 10137 points. Change of -0.03%. Total value traded through LSE was: £ 6,717,140,321 a change of 16.41%

12/01/2026 FTSE Closed at 10140 points. Change of 0.16%. Total value traded through LSE was: £ 5,770,093,543 a change of -6.73%

9/01/2026 FTSE Closed at 10124 points. Change of 0.8%. Total value traded through LSE was: £ 6,186,252,560 a change of -4.13%

8/01/2026 FTSE Closed at 10044 points. Change of -0.04%. Total value traded through LSE was: £ 6,452,774,443 a change of -6.4%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BBY BALFOUR BEATTY** **LSE:EMG MAN** **LSE:NG. National Glib** **LSE:OXIG Oxford Instruments** **LSE:PHP Primary Health** **LSE:SRP Serco** **LSE:STAN Standard Chartered** **

********

Updated charts published on : BALFOUR BEATTY, MAN, National Glib, Oxford Instruments, Primary Health, Serco, Standard Chartered,

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 735 Percentage Change: + 2.15% Day High: 736 Day Low: 717.5

All BALFOUR BEATTY needs are mid-price trades ABOVE 736 to improve accele ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:EMG MAN. Close Mid-Price: 271.8 Percentage Change: + 1.12% Day High: 272.2 Day Low: 263.8

All MAN needs are mid-price trades ABOVE 272.2 to improve acceleration to ……..

</p

View Previous MAN & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1201.5 Percentage Change: + 1.74% Day High: 1198.5 Day Low: 1175.5

In the event of National Glib enjoying further trades beyond 1198.5, the ……..

</p

View Previous National Glib & Big Picture ***

LSE:OXIG Oxford Instruments. Close Mid-Price: 2410 Percentage Change: + 3.66% Day High: 2415 Day Low: 2325

Target met. Continued trades against OXIG with a mid-price ABOVE 2415 sho ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:PHP Primary Health. Close Mid-Price: 104.5 Percentage Change: + 0.00% Day High: 105.1 Day Low: 104.4

All Primary Health needs are mid-price trades ABOVE 105.1 to improve acce ……..

</p

View Previous Primary Health & Big Picture ***

LSE:SRP Serco Close Mid-Price: 295 Percentage Change: -0.14% Day High: 297.2 Day Low: 292.2

Target met. All Serco needs are mid-price trades ABOVE 297.2 to improve a ……..

</p

View Previous Serco & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 1878.5 Percentage Change: + 1.51% Day High: 1877.5 Day Low: 1848

Continued trades against STAN with a mid-price ABOVE 1877.5 should improv ……..

</p

View Previous Standard Chartered & Big Picture ***