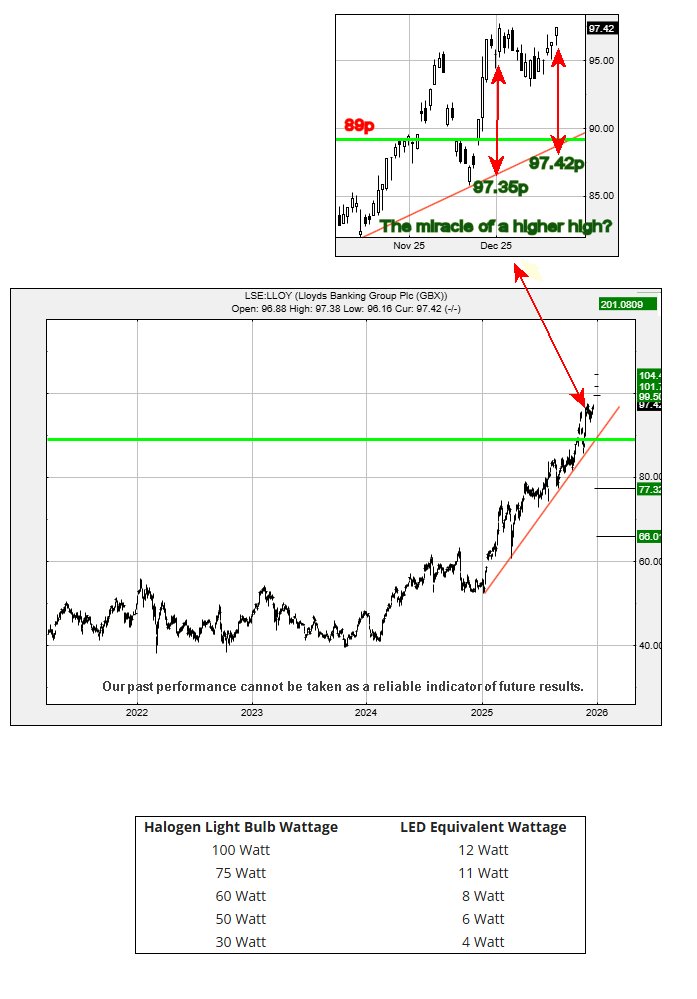

#BrentCrude #GermanyDax It seems, since the start of November this year, quite a lot has been happening for Lloyds share price. Firstly, it has closed above the Green line on the chart, a “horizontal trend” around 89p, which dates confidently back to November 26th 2009. This was when the bank did their magical “placing”, giving existing share holders the chance to buy additional shares at a discount. Unlike with a Rights Issue, this was a decision taken by each shareholder and while the share value changed the next day, it couldn’t be an “across the board” thing as many shareholders chose not to take advantage of the opportunity, seeing the market gapped down to 56p the next morning without the dubious benefit of the enter historical value being changed, because it wasn’t. Folk who’d bought before the market placing could still proudly proclaim they’d bought at 89p plus, despite the market gapping everything down to 56p.

It was a complex scenario, one which denied Lloyds the opportunity of a vertical line on their chart highlighting the event and adjusting the historic share price, along with a drastic logical change in the shares worth. Instead, Lloyds were forced to “enjoy” a gap down from 87 to 56p, a value which reflected both the discounted shares on sale, along with the percentage of share holders who were sufficiently gullible to trap their hard earned shareholding below the purchase price for the next 15 years. However, on November 25th this year, the share price was gapped up above this green Horizontal Trend and finally looks like the share price may be recovering!

Now, we can move onto the immediate picture for Lloyds share price, especially as it just achieved another “higher high” since piercing our Green Horizontal Line since 2009.

The immediate situation suggests movement above 97.74 should promote gains in the direction of a confident sounding 99.5 with our secondary, if bettered, now at 101.7p and some hesitation. While “betting on the banking sector” is a bit like betting on the timing of temporary traffic lights, movement to our eventual 104 level looks comfortable. Here in our bit of Argyll with effectively no traffic lights, every time workmen chuck up a set of temporary lights, it becomes a game and after a couple of days, locals learn to treat them as advisory if the sensors don’t work as they should. It’s rare there’s ever an accident, especially as local police cars usually participate in the “been Red for too long” game. Thankfully, with winter, we also have the advantage of oncoming headlights to warn if a dreadful mistake has been made.

There is another detail, worthy of mention, and it’s akin to playing with temporary traffic lights in Argyll… Once Lloyds share price manages to actually close a session above our 104p level, long term recovery to around 201p shall be seen as commencing. Hopefully, should this be the case, we don’t see the lights on an oncoming idiot getting ready to spoil the transit upward.

And finally, remaining on the subject of oncoming headlights, the issue is becoming serious due to folk with LED lamps legally lighting up the road before them. The issue stems back to outdated UK regulations, where Dip headlights had to be 45w and main beam 55w. Makers of car headlamps were thus able to use this as a rule of thumb, giving electric vehicles and 8 watt dip and a 10 watt main beam, remaining fully within regulations while the rest of us are blinded by oncoming traffic. Locally, the safest idea has been to slow down before triggering our own Tungsten directional headlights from a near standstill. It’s a bit of an “Empire Fights Back” thing which doubtless has a few electric vehicle victims scurrying to their garage to ask for their headlights to be aligned safely, in addition to legally. Our ridiculously cheap VW EOS, designed to be top of the VW range and a firm favourite for our dogs, continues to surprise with the features fitted as standard. Aside from the unpleasant detail it needs a new automatic gearbox, the thing is great…

The table below gives the equivalent Halogen Light Wattage, along with potential equivalents fitted by manufacturers awaiting UK Law clarification. Those very few of us with Tungsten lamps will probably be ignored, bulb replacement being more than the value of the vehicle!

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 3:25:20AM | BRENT | 6034.7 | 5858 | 5817 | 5556 | 6058 | 6048 | 6079 | 6102 | 6003 |

| 3:33:14AM | GOLD | 4338.43 | ||||||||

| 10:59:20PM | FTSE | 9871.8 | ||||||||

| 11:02:47PM | STOX50 | 5753.3 | ||||||||

| 11:05:01PM | GERMANY | 24313 | 24124 | 24016 | 23908 | 24193 | 24340 | 24356 | 24407 | 24255 |

| 11:09:20PM | US500 | 6850.1 | ||||||||

| 11:12:15PM | DOW | 48210.3 | ||||||||

| 11:15:06PM | NASDAQ | 25399.2 | ||||||||

| 11:17:40PM | JAPAN | 50328 |

19/12/2025 FTSE Closed at 9897 points. Change of 0.61%. Total value traded through LSE was: £ 17,521,574,490 a change of 151.82%

18/12/2025 FTSE Closed at 9837 points. Change of 0.64%. Total value traded through LSE was: £ 6,957,992,172 a change of -2.38%

17/12/2025 FTSE Closed at 9774 points. Change of 0.93%. Total value traded through LSE was: £ 7,127,448,786 a change of 18.41%

16/12/2025 FTSE Closed at 9684 points. Change of -0.69%. Total value traded through LSE was: £ 6,019,317,961 a change of 4.57%

15/12/2025 FTSE Closed at 9751 points. Change of 1.06%. Total value traded through LSE was: £ 5,756,132,548 a change of -4.78%

12/12/2025 FTSE Closed at 9649 points. Change of -0.56%. Total value traded through LSE was: £ 6,045,049,250 a change of 2.55%

11/12/2025 FTSE Closed at 9703 points. Change of 0.5%. Total value traded through LSE was: £ 5,894,528,793 a change of -21.51%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BARC Barclays** **LSE:CCL Carnival** **LSE:EMG MAN** **LSE:FRES Fresnillo** **LSE:GLEN Glencore Xstra** **LSE:HSBA HSBC** **LSE:IGG IG Group** **LSE:IHG Intercontinental Hotels Group** **LSE:NWG Natwest** **LSE:SAGA SAGA Plc** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:SRP Serco** **LSE:STAN Standard Chartered** **LSE:STAR Star Energy** **

********

Updated charts published on : Barclays, Carnival, MAN, Fresnillo, Glencore Xstra, HSBC, IG Group, Intercontinental Hotels Group, Natwest, SAGA Plc, Scottish Mortgage Investment Trust, Serco, Standard Chartered, Star Energy,

LSE:BARC Barclays. Close Mid-Price: 468.95 Percentage Change: + 1.22% Day High: 470.15 Day Low: 464.85

Target met. Further movement against Barclays ABOVE 470.15 should improve ……..

</p

View Previous Barclays & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 2313 Percentage Change: + 16.64% Day High: 2326 Day Low: 1886

Target met. Further movement against Carnival ABOVE 2326 should improve a ……..

</p

View Previous Carnival & Big Picture ***

LSE:EMG MAN. Close Mid-Price: 223.2 Percentage Change: + 0.09% Day High: 226.2 Day Low: 220.8

In the event of MAN enjoying further trades beyond 226.2, the share shoul ……..

</p

View Previous MAN & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 3170 Percentage Change: + 2.86% Day High: 3154 Day Low: 3036

Target met. All Fresnillo needs are mid-price trades ABOVE 3154 to improv ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 389.55 Percentage Change: + 0.71% Day High: 393 Day Low: 384.55

All Glencore Xstra needs are mid-price trades ABOVE 393 to improve accele ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 1167 Percentage Change: + 1.44% Day High: 1166.6 Day Low: 1147

In the event of HSBC enjoying further trades beyond 1166.6, the share sho ……..

</p

View Previous HSBC & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 1302 Percentage Change: -0.53% Day High: 1315 Day Low: 1297

Continued trades against IGG with a mid-price ABOVE 1315 should improve t ……..

</p

View Previous IG Group & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 10585 Percentage Change: + 1.24% Day High: 10635 Day Low: 10440

Target met. Continued trades against IHG with a mid-price ABOVE 10635 sho ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 644.8 Percentage Change: + 0.62% Day High: 648.6 Day Low: 638

All Natwest needs are mid-price trades ABOVE 648.6 to improve acceleratio ……..

</p

View Previous Natwest & Big Picture ***

LSE:SAGA SAGA Plc. Close Mid-Price: 381 Percentage Change: + 3.11% Day High: 385 Day Low: 368.5

Target met. In the event of SAGA Plc enjoying further trades beyond 385, ……..

</p

View Previous SAGA Plc & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 1177 Percentage Change: + 0.47% Day High: 1187.5 Day Low: 1167

All Scottish Mortgage Investment Trust needs are mid-price trades ABOVE 1 ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 278 Percentage Change: + 1.24% Day High: 276.8 Day Low: 272

Target met. All Serco needs are mid-price trades ABOVE 276.8 to improve a ……..

</p

View Previous Serco & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 1788.5 Percentage Change: + 0.85% Day High: 1808.5 Day Low: 1779

All Standard Chartered needs are mid-price trades ABOVE 1808.5 to improve ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:STAR Star Energy. Close Mid-Price: 9.26 Percentage Change: + 2.89% Day High: 9.5 Day Low: 9

Target met. Further movement against Star Energy ABOVE 9.5 should improve ……..

</p

View Previous Star Energy & Big Picture ***