#FTSE #Nasdaq The ongoing intercepts with the US military and drug runners in the Pacific certainly inspire a thought. Because we’ve the secret submarine base on our doorstep and fairly frequent Royal Marine exercises going on, surely the British military would be able to spend time intercepting people who use Jet Ski’s on Sunday mornings. A lazy Sunday, spiced up by the odd explosion, wouldn’t be the hardest thing to endure and it’d give the military plenty of practice.

Meanwhile, Italy, a country unable to get its cars across the finish line in the Brazilian Grand Prix, has perhaps better reason to celebrate, their stock market now trading higher than any point since 2007. There are some signs its gains should continue, though we fear some hesitation is probable around the 45,000 level. It is certainly doing well but the proximity of our secondary at 46,737 tends suggests the Italian index risks stutters fairly soon. Perhaps this will come, if their Ferrari donkeys finally exhibit some strength and start winning races in Formula 1. Currently trading around 44,439 points, it need only exceed 44,500 to suggest an imminent cycle to 45,047 points, perhaps coinciding with the next Grand Prix!

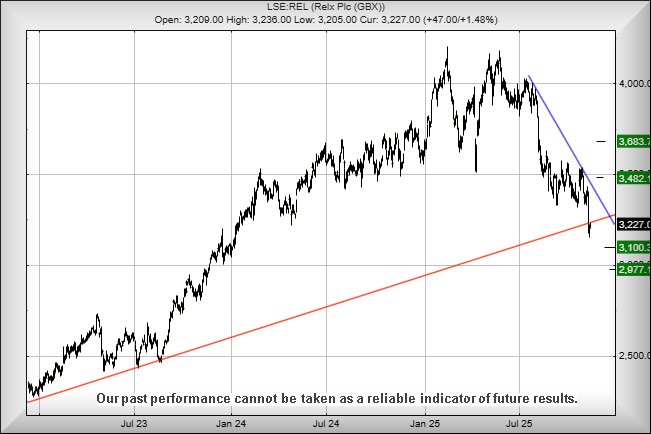

As for Relx Plc, the share price is doing something interesting and has been the focus of a few comments anticipating some upward travel. At first glance, we’d conventionally ridicule such a notion but price movements in the last couple of days tend suggest the market may have a sneaky plan.

The share price broke the upward trend on Friday, raising eyebrows as a reversal cycle to 2977p looked like it had commenced. But, while the trend break occurred at 3,222 points, by closing at 3,227 points, the share price has exceeded the level of trend break and – quite amazingly – closed a session at bang on the trend line. One of our bigger rules is to distrust anything pointing at reversals, if a share price exceeds the point of trend break. By just 5p, a ridiculous sum, the strong implication is that we should look for surprise recovery…

The situation now threatens movement above 3,236 as bringing movement to an initial 3,482p with our longer term secondary, if beaten, at 3,683p.

We suspect this shall prove worthy of a glance.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:09:26PM | BRENT | 6501.5 | Success | ||||||||

| 11:26:38PM | GOLD | 4134.4 | |||||||||

| 11:30:33PM | FTSE | 9901.3 | 9574 | 9497 | 9358 | 9734 | 9914 | 9925 | 10212 | 9632 | |

| 11:33:10PM | STOX50 | 5738.2 | 5677 | 5652 | 5621 | 5705 | 5744 | 5752 | 5818 | 5714 | |

| 11:38:39PM | GERMANY | 24183.5 | |||||||||

| 11:41:10PM | US500 | 6850.3 | |||||||||

| 11:46:39PM | DOW | 47933 | ‘cess | ||||||||

| 11:51:38PM | NASDAQ | 25565 | |||||||||

| 11:54:02PM | JAPAN | 51077 | Shambles |

11/11/2025 FTSE Closed at 9899 points. Change of 1.14%. Total value traded through LSE was: £ 6,382,591,388 a change of 4.7%

10/11/2025 FTSE Closed at 9787 points. Change of 1.08%. Total value traded through LSE was: £ 6,095,878,551 a change of 4.62%

7/11/2025 FTSE Closed at 9682 points. Change of -0.54%. Total value traded through LSE was: £ 5,826,630,107 a change of -16.85%

6/11/2025 FTSE Closed at 9735 points. Change of 896.42%. Total value traded through LSE was: £ 7,007,707,852 a change of 6.36%

5/11/2025 FTSE Closed at 977 points. Change of -89.94%. Total value traded through LSE was: £ 6,588,542,661 a change of 10.12%

4/11/2025 FTSE Closed at 9714 points. Change of 0.13%. Total value traded through LSE was: £ 5,983,302,378 a change of 21.14%

3/11/2025 FTSE Closed at 9701 points. Change of -0.16%. Total value traded through LSE was: £ 4,939,105,432 a change of -3.2%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AZN Astrazeneca** **LSE:BARC Barclays** **LSE:BP. BP PLC** **LSE:HSBA HSBC** **LSE:LLOY Lloyds Grp.** **LSE:NWG Natwest** **LSE:OXIG Oxford Instruments** **LSE:STAN Standard Chartered** **LSE:TSCO Tesco** **LSE:VOD Vodafone** **

********

Updated charts published on : Astrazeneca, Barclays, BP PLC, HSBC, Lloyds Grp., Natwest, Oxford Instruments, Standard Chartered, Tesco, Vodafone,

LSE:AZN Astrazeneca. Close Mid-Price: 13466 Percentage Change: + 2.59% Day High: 13508 Day Low: 13286

Target met. In the event of Astrazeneca enjoying further trades beyond 13 ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 422.85 Percentage Change: + 1.34% Day High: 426.1 Day Low: 420

Target met. All Barclays needs are mid-price trades ABOVE 426.1 to improv ……..

</p

View Previous Barclays & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 476.15 Percentage Change: + 2.59% Day High: 476.2 Day Low: 467.15

Target met. In the event of BP PLC enjoying further trades beyond 476.2, ……..

</p

View Previous BP PLC & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 1099.4 Percentage Change: + 0.96% Day High: 1102.6 Day Low: 1093.6

Continued trades against HSBA with a mid-price ABOVE 1102.6 should improv ……..

</p

View Previous HSBC & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 94.62 Percentage Change: + 1.83% Day High: 95.1 Day Low: 93.24

Continued trades against LLOY with a mid-price ABOVE 95.1 should improve ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 617.8 Percentage Change: + 1.41% Day High: 620.4 Day Low: 612.4

Further movement against Natwest ABOVE 620.4 should improve acceleration ……..

</p

View Previous Natwest & Big Picture ***

LSE:OXIG Oxford Instruments. Close Mid-Price: 2060 Percentage Change: + 14.96% Day High: 2090 Day Low: 1814

All Oxford Instruments needs are mid-price trades ABOVE 2090 to improve a ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:STAN Standard Chartered Close Mid-Price: 1631 Percentage Change: -0.18% Day High: 1653.5 Day Low: 1627.5

Target met. Further movement against Standard Chartered ABOVE 1653.5 shou ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:TSCO Tesco Close Mid-Price: 461.9 Percentage Change: -2.88% Day High: 480.5 Day Low: 457.3

Further movement against Tesco ABOVE 480.5 should improve acceleration to ……..

</p

View Previous Tesco & Big Picture ***

LSE:VOD Vodafone. Close Mid-Price: 96.32 Percentage Change: + 8.32% Day High: 96.32 Day Low: 91.3

Target met. In the event of Vodafone enjoying further trades beyond 96.32 ……..

</p

View Previous Vodafone & Big Picture ***