#FTSE #Gold Well, that went wrong!

It had been pretty clear the FTSE was anticipating the Bank of England making an effort in favour of the UK by reducing Interest Rates. However, the central bank continued its failed experiment by continuing to smother the country, increasing costs with their inactivity. Hopefully, the next meeting of the policy committee in 6 weeks time shall find sufficient excuse to bring rates down. We had to grimace at the banks comment, warning of “persistent weak growth” while not pausing to consider their role in creating such a climate.

Unfortunately, Rachel from Accounts is unveiling her Budget at the end of November and if she applies her famed competence, there’s unfortunately a good chance the UK shall be falling apart by Xmas.

For light relief, choosing to read “Quantum Computing for Dummies” has been ‘interesting’. Personally, regarding the hype about Artificial Intelligence as a publicity bubble which will burst, it seemed a good idea to scratch the surface of a type of computer science which is difficult to comprehend. Artificial Intelligence is just software with a good publicity agent but Quantum Computing is different. To put it simply, “Quantum Computing makes use of the quantum states of subatomic particles to store and process information”. Thankfully, this makes it easy to understand <joke> but actually does open the door for quite a dangerous thought.

Remaining on the subject of sub atomic particles, when the folk in America exploded their first atomic bomb (Trinity, Los Alamos), the grown ups with their finger on the big red button all had a nagging thought in mind. Essentially, there was a theoretical risk setting the thing off could trigger a worldwide chain reaction. On balance, there was a fair chance it would simply destroy a few scorpions in the desert bomb range but when the scientists opened their eyes after the test to discover they still were alive, it was fairly clear all atoms are not connected. Quite a similar mental question mark existed when the guys at CERN turned on their particle collider!

This little aside should prove worthwhile for the future as we strongly believe companies involved in Quantum shall surge, once the current AI bubble bursts. Quantum Computing is the real deal, perhaps capable of making AI work the way science fiction writers describe. But of course, there’s a problem. Should Quantum move into the real world and escape the realm of theoretical, any working Quantum Computer will be able to know everything any other Quantum Computer knows as it’s going to be taking advantage of the “worldwide chain reaction” theory which was theoretically possible with the atomic bomb or the CERN particle collider. It’s a String Theory thing, where everything is connected. Fans of the telly show “The Big Bang Theory” should be fully educated on the subject. <Another joke>

But anyone stumbling across a UK company mucking around with Quantum should pay some attention to them. That’s the theory…

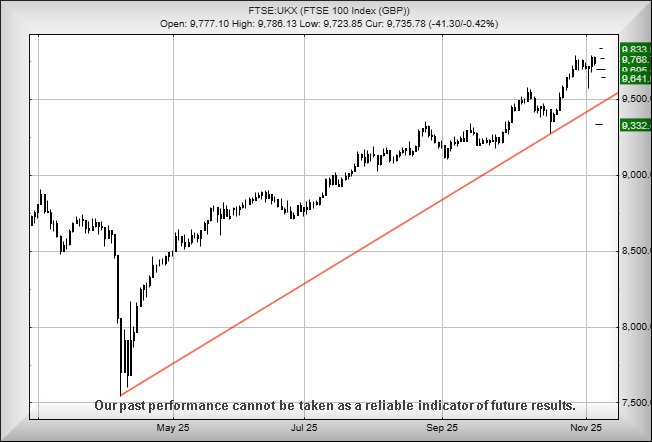

The UK FTSE has been behaving as if they “knew” the BoE were about to do something sensible but news the bank was intending to continue to harm the economy wasn’t great. To be clear, we side with Mr Trump on this issue as similar to the USA, the UK shouldn’t be held ransom to someone else’s ideology. For both countries, it’s a theory from the World Economic Forum central bank interest rates will control inflation and government plans.

For now, the FTSE looks very capable of weakness below 9721 bringing travel down to an initial 9685 points with our secondary, if broken, at 9841 points. Things become terribly dangerous as trouble below 9841 will suggest an eventual 9332 is exerting an influence.

Should things intend be positive, essentially parking the FTSE for another 6 weeks, above 9750 should trigger an initial 9768 points with our secondary, if bettered, at 9833 points.

Have a good weekend, It’s the Brazilian Grand Prix, always amusing at the number of drivers scratching their groin area. Usually, it is quite a good race, though they’ve chosen to confundle the weekend with one of the ridiculous “Sprint” events. We’ve got grandchildren, along with guitars, as they want to learn something (ruin my weekend). Tip: try not to be the cool grandparent!

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:19:54PM | BRENT | 6342 | 6275 | 6250 | 6333 | 6424 | 6472 | 6366 | ‘cess | ||

| 10:23:45PM | GOLD | 3976.84 | 3965 | 3950 | 3990 | 4020 | 4030 | 4002 | Success | ||

| 10:26:50PM | FTSE | 9720.2 | 9700 | 9680 | 9729 | 9785 | 9805 | 9735 | |||

| 10:31:51PM | STOX50 | 5620.3 | 5598 | 5573 | 5629 | 5674 | 5694 | 5640 | ‘cess | ||

| 10:42:25PM | GERMANY | 23765 | 23682 | 23579 | 23810 | 24056 | 24182 | 23926 | ‘cess | ||

| 10:49:57PM | US500 | 6737 | 6706 | 6683 | 6751 | 6818 | 6860 | 6777 | Success | ||

| 10:54:39PM | DOW | 46984.8 | 46782 | 46579 | 46925 | 47379 | 47621 | 47189 | Success | ||

| 10:58:18PM | NASDAQ | 25192.3 | 25081 | 24943 | 25265 | 25426 | 25543 | 25201 | Success | ||

| 11:00:42PM | JAPAN | 50270 | 49995 | 49739 | 50224 | 50580 | 50753 | 50361 |

6/11/2025 FTSE Closed at 9735 points. Change of 896.42%. Total value traded through LSE was: £ 7,007,707,852 a change of 6.36%

5/11/2025 FTSE Closed at 977 points. Change of -89.94%. Total value traded through LSE was: £ 6,588,542,661 a change of 10.12%

4/11/2025 FTSE Closed at 9714 points. Change of 0.13%. Total value traded through LSE was: £ 5,983,302,378 a change of 21.14%

3/11/2025 FTSE Closed at 9701 points. Change of -0.16%. Total value traded through LSE was: £ 4,939,105,432 a change of -3.2%

31/10/2025 FTSE Closed at 9717 points. Change of -0.44%. Total value traded through LSE was: £ 5,102,481,430 a change of -19.1%

30/10/2025 FTSE Closed at 9760 points. Change of 0.04%. Total value traded through LSE was: £ 6,306,885,149 a change of 3.02%

29/10/2025 FTSE Closed at 9756 points. Change of 0.62%. Total value traded through LSE was: £ 6,121,713,518 a change of 7.72%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:AZN Astrazeneca** **LSE:BARC Barclays** **LSE:BLOE Block Energy PLC** **LSE:BME B & M** **LSE:DGE Diageo** **LSE:HIK Hikma** **LSE:HSBA HSBC** **LSE:IHG Intercontinental Hotels Group** **LSE:LLOY Lloyds Grp.** **LSE:NG. National Glib** **LSE:NWG Natwest** **LSE:OCDO Ocado Plc** **LSE:PHP Primary Health** **LSE:SBRY Sainsbury** **LSE:STAN Standard Chartered** **LSE:TSCO Tesco** **LSE:WG. Wood Group** **

********

Updated charts published on : AFC Energy, Astrazeneca, Barclays, Block Energy PLC, B & M, Diageo, Hikma, HSBC, Intercontinental Hotels Group, Lloyds Grp., National Glib, Natwest, Ocado Plc, Primary Health, Sainsbury, Standard Chartered, Tesco, Wood Group,

LSE:AFC AFC Energy Close Mid-Price: 8.38 Percentage Change: -6.37% Day High: 9.18 Day Low: 8.3

Weakness on AFC Energy below 8.3 will invariably lead to 7.7p with our se ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:AZN Astrazeneca. Close Mid-Price: 12834 Percentage Change: + 3.08% Day High: 12994 Day Low: 12330

All Astrazeneca needs are mid-price trades ABOVE 12994 to improve acceler ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 409.8 Percentage Change: + 1.00% Day High: 412.9 Day Low: 407.45

Further movement against Barclays ABOVE 412.9 should improve acceleration ……..

</p

View Previous Barclays & Big Picture ***

LSE:BLOE Block Energy PLC Close Mid-Price: 0.72 Percentage Change: -14.71% Day High: 0.8 Day Low: 0.72

Weakness on Block Energy PLC below 0.72 will invariably lead to 0.69p wit ……..

</p

View Previous Block Energy PLC & Big Picture ***

LSE:BME B & M Close Mid-Price: 164.9 Percentage Change: -2.08% Day High: 169.9 Day Low: 164

Continued weakness against BME taking the price below 164 calculates as l ……..

</p

View Previous B & M & Big Picture ***

LSE:DGE Diageo Close Mid-Price: 1680 Percentage Change: -6.54% Day High: 1766.5 Day Low: 1664.5

If Diageo experiences continued weakness below 1664.5, it will invariably ……..

</p

View Previous Diageo & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1522 Percentage Change: -14.06% Day High: 1641 Day Low: 1531

Target met. If Hikma experiences continued weakness below 1531, it will i ……..

</p

View Previous Hikma & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 1088.8 Percentage Change: + 0.28% Day High: 1099 Day Low: 1086

Target met. Further movement against HSBC ABOVE 1099 should improve accel ……..

</p

View Previous HSBC & Big Picture ***

LSE:IHG Intercontinental Hotels Group Close Mid-Price: 9518 Percentage Change: -0.36% Day High: 9646 Day Low: 9498

Target met. Continued trades against IHG with a mid-price ABOVE 9646 shou ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 91.14 Percentage Change: + 1.76% Day High: 91.9 Day Low: 90.56

Target met. In the event of Lloyds Grp. enjoying further trades beyond 91 ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1160.5 Percentage Change: + 0.78% Day High: 1183.5 Day Low: 1139.5

Target met. In the event of National Glib enjoying further trades beyond ……..

</p

View Previous National Glib & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 600.8 Percentage Change: + 2.11% Day High: 606.4 Day Low: 597.8

Target met. Continued trades against NWG with a mid-price ABOVE 606.4 sho ……..

</p

View Previous Natwest & Big Picture ***

LSE:OCDO Ocado Plc Close Mid-Price: 199.2 Percentage Change: -4.41% Day High: 212.7 Day Low: 200.9

In the event Ocado Plc experiences weakness below 200.9 it calculates wit ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:PHP Primary Health. Close Mid-Price: 96.95 Percentage Change: + 1.36% Day High: 97.3 Day Low: 95.35

Further movement against Primary Health ABOVE 97.3 should improve acceler ……..

</p

View Previous Primary Health & Big Picture ***

LSE:SBRY Sainsbury. Close Mid-Price: 355.8 Percentage Change: + 5.52% Day High: 360.2 Day Low: 326.4

Target met. Further movement against Sainsbury ABOVE 360.2 should improve ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 1609 Percentage Change: + 1.58% Day High: 1612.5 Day Low: 1597

Target met. All Standard Chartered needs are mid-price trades ABOVE 1612. ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:TSCO Tesco. Close Mid-Price: 474.4 Percentage Change: + 1.74% Day High: 478.6 Day Low: 465.3

Target met. All Tesco needs are mid-price trades ABOVE 478.6 to improve a ……..

</p

View Previous Tesco & Big Picture ***

LSE:WG. Wood Group. Close Mid-Price: 20 Percentage Change: + 8.46% Day High: 26 Day Low: 19.1

Now above 20.5 should bring further recovery to an initial 23.2 with our s ……..

</p

View Previous Wood Group & Big Picture ***