#Gold #Nasdaq We reviewed this back in March, opting to use our usual “kiss of death” final paragraph to give an optimistic outlook. It worked out rather precisely, JP Sports share price closing at 104.55p on October 6th, just last month! Their share price has certainly experienced some hesitation in the weeks since and now, we’re being supplied ample ammunition for a doze of collywobbles. In this article, we shall again use our final paragraph to provide an optimistic scenario as the weight of negatives currently couldn’t be alleviated with a weight loss injection.

Currently, we’re not terribly convinced about JD Sports share price future. Retailers, generally speaking, are failing to flourish and while this lot seem to be swimming against the trend. It is said JD Sports benefit from clothing designed for sports becoming everyday wear. The horrid term, “athleisure wear” is used to describe this trend, though we suspect the reality is of people realising they’d spent an absurd sum on sportswear, deciding to get their moneys worth out of it! It’s funny, for dog walking, I wear an old tatty waxed cotton jacket, the real deal which comes to life a couple of times a year when it gets rewaxed. Visiting a friend down in Salford, I apologised for my scruffy jacket when we went out for dinner and she was aghast, telling me if I wanted to sell it, she’s pay top dollar.

It’s fairly clear there’s something about clothing this writer simply doesn’t understand. I’ve some old socks and older ties, now curious if there’s a market out there.

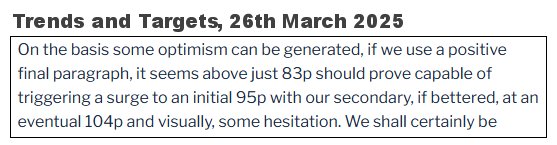

Currently, below just 83p has the potential of triggering reversal to an initial 77p with our secondary, if broken, at a bottom (hopefully) of 68p. Things become seriously dangerous at such a level, the price now lurking in a zone where an ultimate bottom of 48p becomes possible, a price level below which we cannot calculate.

Our converse scenario demands the share price stumble above 93p as, from our perspective, this would mince all our drop targets and instead, nudge open the door marked ‘optimism’. A movement such as this would create an initial target at 115p with our secondary, if beaten, at 118p. Obviously, the proximity of these numbers indicates a price level where some flatlining shall probably occur but it’s worth mentioning that closure above 118p shall imply a Big Picture 142p is exerting an influence on the price.

Here’s hoping but unfortunately, for now it looks like some reversal is probable.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:30:00PM | BRENT | 6344.2 | Shambles | ||||||||

| 11:03:41PM | GOLD | 3976.5 | 3956 | 3951 | 3938 | 3985 | 3991 | 3994 | 4014 | 3972 | |

| 11:06:26PM | FTSE | 9761.1 | ‘cess | ||||||||

| 11:10:21PM | STOX50 | 5661.8 | ‘cess | ||||||||

| 11:13:07PM | GERMANY | 24025.7 | |||||||||

| 11:15:50PM | US500 | 6788.5 | |||||||||

| 11:20:15PM | DOW | 47287.3 | ‘cess | ||||||||

| 11:23:53PM | NASDAQ | 25534 | 25494 | 25431 | 25324 | 25640 | 25755 | 25841 | 25940 | 25588 |

5/11/2025 FTSE Closed at 977 points. Change of -89.94%. Total value traded through LSE was: £ 6,588,542,661 a change of 10.12%

4/11/2025 FTSE Closed at 9714 points. Change of 0.13%. Total value traded through LSE was: £ 5,983,302,378 a change of 21.14%

3/11/2025 FTSE Closed at 9701 points. Change of -0.16%. Total value traded through LSE was: £ 4,939,105,432 a change of -3.2%

31/10/2025 FTSE Closed at 9717 points. Change of -0.44%. Total value traded through LSE was: £ 5,102,481,430 a change of -19.1%

30/10/2025 FTSE Closed at 9760 points. Change of 0.04%. Total value traded through LSE was: £ 6,306,885,149 a change of 3.02%

29/10/2025 FTSE Closed at 9756 points. Change of 0.62%. Total value traded through LSE was: £ 6,121,713,518 a change of 7.72%

28/10/2025 FTSE Closed at 9696 points. Change of 0.45%. Total value traded through LSE was: £ 5,683,126,613 a change of 7.14%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:BBY BALFOUR BEATTY** **LSE:BME B & M** **LSE:BP. BP PLC** **LSE:HSBA HSBC** **LSE:IHG Intercontinental Hotels Group** **LSE:ITRK Intertek** **LSE:QED Quadrise** **LSE:RR. Rolls Royce** **LSE:STAR Star Energy** **LSE:TSCO Tesco** **

********

Updated charts published on : Aston Martin, BALFOUR BEATTY, B & M, BP PLC, HSBC, Intercontinental Hotels Group, Intertek, Quadrise, Rolls Royce, Star Energy, Tesco,

LSE:AML Aston Martin. Close Mid-Price: 61.7 Percentage Change: + 5.65% Day High: 61.85 Day Low: 58

Weakness on Aston Martin below 58 will invariably lead to 55p with second ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 675 Percentage Change: + 0.22% Day High: 686 Day Low: 669.5

All BALFOUR BEATTY needs are mid-price trades ABOVE 686 to improve accele ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:BME B & M Close Mid-Price: 168.4 Percentage Change: -1.81% Day High: 171.6 Day Low: 167.45

In the event B & M experiences weakness below 167.45 it calculates with a ……..

</p

View Previous B & M & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 461.3 Percentage Change: + 1.80% Day High: 462.45 Day Low: 447.45

Continued trades against BP. with a mid-price ABOVE 462.45 should improve ……..

</p

View Previous BP PLC & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 1085.8 Percentage Change: + 1.00% Day High: 1087.6 Day Low: 1066.4

Target met. All HSBC needs are mid-price trades ABOVE 1087.6 to improve a ……..

</p

View Previous HSBC & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 9552 Percentage Change: + 2.60% Day High: 9548 Day Low: 9314

In the event of Intercontinental Hotels Group enjoying further trades bey ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:ITRK Intertek. Close Mid-Price: 5130 Percentage Change: + 0.59% Day High: 5145 Day Low: 5075

Further movement against Intertek ABOVE 5145 should improve acceleration ……..

</p

View Previous Intertek & Big Picture ***

LSE:QED Quadrise. Close Mid-Price: 2.85 Percentage Change: + 1.79% Day High: 2.9 Day Low: 2.8

Continued weakness against QED taking the price below 2.8 calculates as l ……..

</p

View Previous Quadrise & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 1157 Percentage Change: + 0.83% Day High: 1159 Day Low: 1140.5

This looks like it may have more gains tucked away. Now above 1181 should ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:STAR Star Energy. Close Mid-Price: 9 Percentage Change: + 1.12% Day High: 8.55 Day Low: 8.5

Further movement against Star Energy ABOVE 8.55 should improve accelerati ……..

</p

View Previous Star Energy & Big Picture ***

LSE:TSCO Tesco. Close Mid-Price: 466.3 Percentage Change: + 1.26% Day High: 467.4 Day Low: 460.3

Target met. Continued trades against TSCO with a mid-price ABOVE 467.4 sh ……..

</p

View Previous Tesco & Big Picture ***