#FTSE #WallSt This weekends Grand Prix is one of our favourites, Mexico. One of the bigger attractions, aside from some decent racing, will be the excuse for Mexican food on Sunday during the race, though we’ll resist knocking back Tequila every time the most successful Mexican Formula 1 driver, Sergio Perez, (who isn’t racing) is mentioned. Unfortunately, the biggest problem locally with Nacho’s is finding the right cheese, as Argyll outlets tend eschew the idea of stocking Monterrey Jack and Fontina. Invariably, we end up using Cheddar…

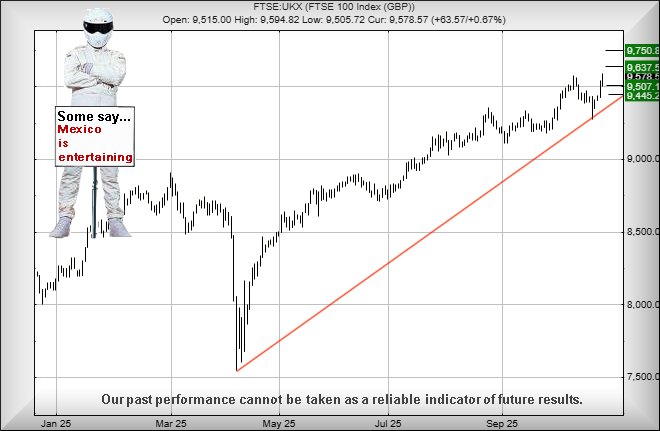

We’re about to stumble into the last week of October and there are plenty of signs the market is getting as enthusiastic for the future as we are for the coming Grand Prix. The FTSE is currently trading at its highest levels ever, though many shares remain with prices trudging in misery. The AIM market is a case in point, flatlining with a spirit reminiscent of the current UK government, feeling like it’s afraid to actually do anything useful. We’re surprised at the AIM as it’s ignoring the current perception of success elements of the FTSE is enjoying.

Our immediate hope is for movement above 9595 on the FTSE triggering a surge toward an initial 9637 points. The feels like a perfectly viable ambition and our secondary, if such a level is exceeded, works out at a future 9750 points. This would prove quite a major jump from current levels, one which we suspect shall not occur until the BoE makes an effort reduce interest rates on 6th November. Then again, there is always the risk the market shall grow on potential of an interest rate cut, rather than surge on the day a cut is announced. It certainly suggests the next 10 trading sessions may prove interesting. If our upward cycle theory triggers, the tightest stop loss looks like 9530 points.

Our scenario, if 9530 breaks, threatens FTSE reversal down to an initial 9507 points with our secondary, if broken, at 9445 points and hopefully a bounce, given the proximity of the uptrend since the start of this year.

Have a good weekend, enjoy the Grand Prix, and remember to eat Mexican…

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:05:14PM | BRENT | 6517.1 | 6420 | 6344 | 6482 | 6600 | 6659 | 6509 | Success | ||

| 10:31:00PM | GOLD | 4126.58 | 4073 | 3968 | 4119 | 4164 | 4225 | 4124 | |||

| 10:42:01PM | FTSE | 9584.2 | 9511 | 9489 | 9454 | 9558 | 9595 | 9635 | 9704 | 9525 | ‘cess |

| 10:52:31PM | STOX50 | 5672.9 | 5639 | 5635 | 5665 | 5680 | 5714 | 5661 | |||

| 10:55:47PM | GERMANY | 24215.4 | 24036 | 23978 | 24150 | 24240 | 24288 | 24169 | |||

| 11:00:37PM | US500 | 6740.8 | 6683 | 6661 | 6710 | 6750 | 6770 | 6725 | ‘cess | ||

| 11:06:02PM | DOW | 46733 | 46546 | 46437 | 46316 | 46736 | 46800 | 46873 | 47026 | 46706 | |

| 11:10:51PM | NASDAQ | 25144.4 | 24783 | 24656 | 24917 | 25154 | 25172 | 25030 | Success | ||

| 11:14:44PM | JAPAN | 48954 | 48524 | 48426 | 48815 | 49035 | 49231 | 48942 |

23/10/2025 FTSE Closed at 9578 points. Change of 0.66%. Total value traded through LSE was: £ 5,128,914,273 a change of -30.05%

22/10/2025 FTSE Closed at 9515 points. Change of 0.94%. Total value traded through LSE was: £ 7,332,238,538 a change of 33.6%

21/10/2025 FTSE Closed at 9426 points. Change of 0.24%. Total value traded through LSE was: £ 5,488,291,268 a change of 12.47%

20/10/2025 FTSE Closed at 9403 points. Change of 0.52%. Total value traded through LSE was: £ 4,879,963,453 a change of -30.6%

17/10/2025 FTSE Closed at 9354 points. Change of -0.87%. Total value traded through LSE was: £ 7,031,145,247 a change of 41.83%

16/10/2025 FTSE Closed at 9436 points. Change of 0.13%. Total value traded through LSE was: £ 4,957,299,333 a change of -9.18%

15/10/2025 FTSE Closed at 9424 points. Change of -0.3%. Total value traded through LSE was: £ 5,458,430,377 a change of -17.04%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BP. BP PLC** **LSE:CNA Centrica** **LSE:FOXT Foxtons** **LSE:IHG Intercontinental Hotels Group** **LSE:ITRK Intertek** **LSE:NG. National Glib** **LSE:SRP Serco** **

********

Updated charts published on : BP PLC, Centrica, Foxtons, Intercontinental Hotels Group, Intertek, National Glib, Serco,

LSE:BP. BP PLC. Close Mid-Price: 436.95 Percentage Change: + 3.69% Day High: 438.3 Day Low: 430.8

Further movement against BP PLC ABOVE 438.3 should improve acceleration t ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 178.6 Percentage Change: + 2.17% Day High: 179.1 Day Low: 175.1

Target met. All Centrica needs are mid-price trades ABOVE 179.1 to improv ……..

</p

View Previous Centrica & Big Picture ***

LSE:FOXT Foxtons Close Mid-Price: 55 Percentage Change: -2.48% Day High: 55.1 Day Low: 50.1

If Foxtons experiences continued weakness below 50.1, it will invariably ……..

</p

View Previous Foxtons & Big Picture ***

LSE:IHG Intercontinental Hotels Group Close Mid-Price: 9220 Percentage Change: -1.24% Day High: 9364 Day Low: 9158

Continued trades against IHG with a mid-price ABOVE 9364 should improve t ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:ITRK Intertek. Close Mid-Price: 5020 Percentage Change: + 1.21% Day High: 5030 Day Low: 4962

Further movement against Intertek ABOVE 5030 should improve acceleration ……..

</p

View Previous Intertek & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1147 Percentage Change: + 0.17% Day High: 1151.5 Day Low: 1138.5

Further movement against National Glib ABOVE 1151.5 should improve accele ……..

</p

View Previous National Glib & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 255 Percentage Change: + 2.33% Day High: 255.4 Day Low: 249.8

Target met. Further movement against Serco ABOVE 255.4 should improve acc ……..

</p

View Previous Serco & Big Picture ***