#Gold #SP500 The schoolboy humour within always wonders if Wizz Air give out free Tena Lady or Tena Men to their clients, just in case anyone misconstrues the company name. Back in olden days, taking an internal Aeroflot flight in the Soviet Union often came with a passenger cabin smelling like the worst sort of public bar, the scent of cheap booze mixed in with the odour of their toilets which probably couldn’t be emptied, because the airline had been awaiting a replacement valve or seal for weeks. A quite spirited flight into Togliatti to visit the Lada factory once provided my one and only experience with communist era aviation, the return to Moscow thankfully accomplished by driving a luxurious and glacial smooth Lada Niva, fresh from the production line… This was still in the days, when the British Airways flight back to Gatwick would announce the aircraft leaving Soviet airspace, a ripple of applause heard around the cabin.

One of our favourite recent headlines is below;

While we’re less than confident about their proposed “fully qualified in 3 years” ambition, the underlying astounding suggestion being of a massive expansion in the airlines operations which they expect to be able to fund by 2028. Unless, perhaps, they really intend a game show type of training process, where a prospective pilot who lands on the M25 rather than Heathrow is immediately disqualified and bumped from the program. And hopefully, applicants who employ a plurality of pronouns are equally discarded, rather than being given some sort of career advantage such as currently occurs with media, charities, and local councils in the UK.

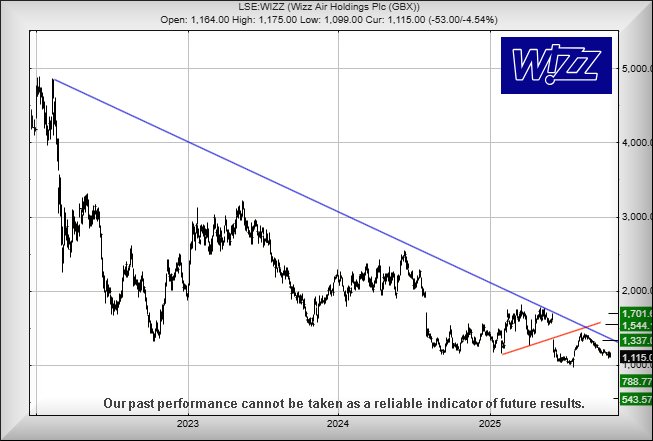

Due to their potential hiring ambition (okay, we all know it is utter nonsense, given out as a press release to distract attention from something else), if we examine near term potentials, above 1,220p should be capable of triggering movement to an initial 1,337p. This initial hope challenges the downtrend since 2022 and shall doubtless provoke some hesitation. However, with closure above this Blue downtrend, we’re calculating a longer term 1,701p as a viable aspiration for some point in the future, almost certainly providing stutters while the share price level challenges the prior highs of 2025.

If things intend go wrong, below 1,000p risks catastrophe as it calculates with the risk of reversal to an initial 788p with our secondary, if broken, at 543p and ideally a bottom level which shall provide sufficient reason for a bounce.

However, we do enjoy a suspicion the market holds a cunning plan for the share price. When we see a price following a trend line from afar, such as occurring right now with Wizz, it’s often the case any upward movement proves sudden and quite sharp, so this shall perhaps prove worth keeping an eye on.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:05:13PM | BRENT | 6077.5 | |||||||||

| 10:08:52PM | GOLD | 4364 | 4336 | 4328 | 4310 | 4355 | 4382 | 4426 | 4506 | 4336 | ‘cess |

| 10:45:55PM | FTSE | 9432.3 | ‘cess | ||||||||

| 10:51:05PM | STOX50 | 5694.4 | Success | ||||||||

| 10:54:03PM | GERMANY | 24335.9 | Success | ||||||||

| 10:57:17PM | US500 | 6740 | 6657 | 6639 | 6604 | 6710 | 6745 | 6773 | 6853 | 6722 | Success |

| 11:02:18PM | DOW | 46738.3 | ‘cess | ||||||||

| 11:06:33PM | NASDAQ | 25163.4 | |||||||||

| 11:10:00PM | JAPAN | 49620 | Success |

20/10/2025 FTSE Closed at 9403 points. Change of 0.52%. Total value traded through LSE was: £ 4,879,963,453 a change of -30.6%

17/10/2025 FTSE Closed at 9354 points. Change of -0.87%. Total value traded through LSE was: £ 7,031,145,247 a change of 41.83%

16/10/2025 FTSE Closed at 9436 points. Change of 0.13%. Total value traded through LSE was: £ 4,957,299,333 a change of -9.18%

15/10/2025 FTSE Closed at 9424 points. Change of -0.3%. Total value traded through LSE was: £ 5,458,430,377 a change of -17.04%

14/10/2025 FTSE Closed at 9452 points. Change of 0.11%. Total value traded through LSE was: £ 6,579,322,985 a change of -18.86%

13/10/2025 FTSE Closed at 9442 points. Change of 0.16%. Total value traded through LSE was: £ 8,108,848,236 a change of 21.17%

10/10/2025 FTSE Closed at 9427 points. Change of -0.86%. Total value traded through LSE was: £ 6,691,897,297 a change of 2.92%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BME B & M** **LSE:CAR Carclo** **LSE:ECO ECO (Atlantic) O & G** **LSE:EMG MAN** **LSE:NG. National Glib** **LSE:SRP Serco** **

********

Updated charts published on : B & M, Carclo, ECO (Atlantic) O & G, MAN, National Glib, Serco,

LSE:BME B & M Close Mid-Price: 167.7 Percentage Change: -22.75% Day High: 191.05 Day Low: 162.05

Target met. In the event B & M experiences weakness below 162.05 it calcu ……..

</p

View Previous B & M & Big Picture ***

LSE:CAR Carclo. Close Mid-Price: 73 Percentage Change: + 12.31% Day High: 73 Day Low: 68

Target met. Further movement against Carclo ABOVE 73 should improve accel ……..

</p

View Previous Carclo & Big Picture ***

LSE:ECO ECO (Atlantic) O & G Close Mid-Price: 7.1 Percentage Change: -2.74% Day High: 7.25 Day Low: 7.05

Continued weakness against ECO taking the price below 7.05 calculates as ……..

</p

View Previous ECO (Atlantic) O & G & Big Picture ***

LSE:EMG MAN. Close Mid-Price: 202.8 Percentage Change: + 1.45% Day High: 202.4 Day Low: 197.9

Continued trades against EMG with a mid-price ABOVE 202.4 should improve ……..

</p

View Previous MAN & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1132 Percentage Change: + 0.18% Day High: 1136.5 Day Low: 1125.5

Continued trades against NG. with a mid-price ABOVE 1136.5 should improve ……..

</p

View Previous National Glib & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 244.2 Percentage Change: + 0.16% Day High: 248.2 Day Low: 242.8

Target met. All Serco needs are mid-price trades ABOVE 248.2 to improve a ……..

</p

View Previous Serco & Big Picture ***