One of the things about living in an area where people go to die (aka retirement central) can be utterly ridiculous projects. One of the West Coasts best top secret salmon rivers is on our dog walking route and when the Victorian cast iron fisherman’s bridge managed to be washed away in floods a couple of years ago, the angling community were not going to be denied the chance of reaching the other side of the often ankle deep river. And so, they decided to KNIT a new bridge out of rope as shown below. To be fair, it is a serious masterpiece, only lacking Indiana Jones and a bunch of Nazi’s fighting each other. And it has given pause to consider our current hobby of making wines, while not as mad as knitting a bridge, it’s perhaps an indicator of the soporific lifestyle here in Argyll.

One funny thing about this Argyll river. In 15 years of walking the banks with the dogs almost daily, I’ve not once come across someone who’s actually caught a fish. However, in a remarkably similar period, the UK’s retail banks look like doing something useful, perhaps giving another meaning to the term “walking the banks!”

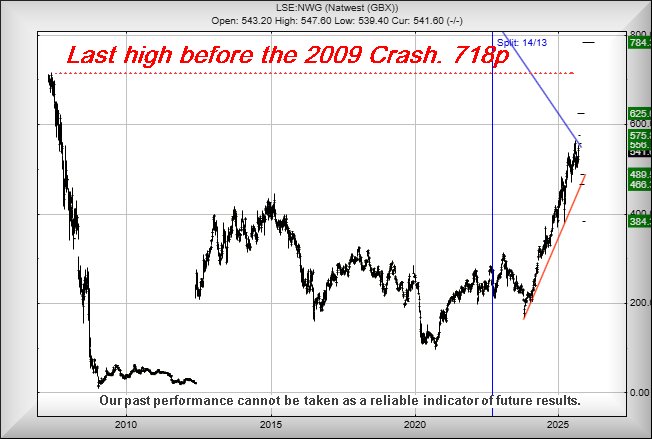

We’ve long been cynical about the banking sector but for now, some very real hope is almost available. Last time we reviewed Lloyds, we gave 551p as an initial target, an ambition achieved on three occasions in the last few sessions. However, there is a problem as the share price failed to CLOSE a session at or above 551p, the best achieved at the end of a day being 550.2p last Wednesday. Despite during the day reaching a high of 553.6p, it conspicuously failed to close above 551p which is a bit of a concern, hinting the market may have decided “now” is not the time for some rabid acceleration. Our Gold Standard for movement remains a price actually closing a trading session above one of our trading targets. ‘Mixed feelings’ best describes our thoughts at present, this share price achieving our initial target yet, from our perspective, still failing to impress us. About the best we dare suggest in the implication if the share price exceeds the most recent high of 553.6p, it should go up to an initial useless target of 556.7p. Such an ambition would exceed a downtrend since 2007, giving substantial hope things should be changing gear.

We now can concede our secondary target above 556.7p has a secondary target of 575p. From our perspective, this would propel the share price into a zone we call “The Big Picture”, where some real movement becomes very possible. From a Big Picture perspective, share price closure above 575p now calculates with an ambition of a future 625 with our secondary, if bettered, working out at a long term secondary of 784p.

This Big Picture secondary ambition is a seriously Big Deal, taking the share price above the market high just before the Financial Crash of 2009, a share price value of 718p. With closure above such a point, the square mile in London shall be flooded with drunken idiots setting off party poppers and sipping cheap champagne, finally believing the UK is back of track to become the financial capital of the world. Our suspicion is those folk shall prove as successful as the multitudes of folk wearing waders, standing in the middle of our local river and hoping for the impossible.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 10:41:25PM | BRENT | 6204 | 6199 | 5991 | 5344 | 6655 | 6655 | 6792 | 6989 | 6380 |

| 10:43:41PM | GOLD | 4017.23 | ||||||||

| 10:47:55PM | FTSE | 9379.5 | ||||||||

| 10:49:40PM | STOX50 | 5501.7 | ||||||||

| 10:52:56PM | GERMANY | 24173.4 | ||||||||

| 10:56:16PM | US500 | 6511.8 | 6499 | 6488 | 6396 | 6590 | 6592 | 6623 | 6664 | 6547 |

| 11:55:47PM | DOW | 45253.7 | ||||||||

| 11:57:48PM | NASDAQ | 24533.9 | ||||||||

| 11:48:10PM | JAPAN | 46322 |

10/10/2025 FTSE Closed at 9427 points. Change of -0.86%. Total value traded through LSE was: £ 6,691,897,297 a change of 2.92%

9/10/2025 FTSE Closed at 9509 points. Change of -0.41%. Total value traded through LSE was: £ 6,502,012,274 a change of 0.62%

8/10/2025 FTSE Closed at 9548 points. Change of 0.69%. Total value traded through LSE was: £ 6,461,813,888 a change of 28.82%

7/10/2025 FTSE Closed at 9483 points. Change of 10436.67%. Total value traded through LSE was: £ 5,016,195,038 a change of -1.86%

6/10/2025 FTSE Closed at 90 points. Change of -99.05%. Total value traded through LSE was: £ 5,111,279,215 a change of -21.54%

3/10/2025 FTSE Closed at 9491 points. Change of 0.68%. Total value traded through LSE was: £ 6,514,116,921 a change of 8.6%

2/10/2025 FTSE Closed at 9427 points. Change of -0.2%. Total value traded through LSE was: £ 5,998,175,981 a change of -12.05%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BBY BALFOUR BEATTY** **LSE:CPI Capita** **LSE:IQE IQE** **LSE:NG. National Glib** **LSE:TRN The Trainline** **

********

Updated charts published on : BALFOUR BEATTY, Capita, IQE, National Glib, The Trainline,

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 655.5 Percentage Change: + 0.08% Day High: 669 Day Low: 649

Target met. Further movement against BALFOUR BEATTY ABOVE 669 should impr ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:CPI Capita. Close Mid-Price: 350.5 Percentage Change: + 8.35% Day High: 363.5 Day Low: 323.5

In the event of Capita enjoying further trades beyond 363.5, the share sh ……..

</p

View Previous Capita & Big Picture ***

LSE:IQE IQE Close Mid-Price: 6.51 Percentage Change: -4.26% Day High: 6.8 Day Low: 6.5

Target met. If IQE experiences continued weakness below 6.5, it will inva ……..

</p

View Previous IQE & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1105.5 Percentage Change: + 0.64% Day High: 1105.5 Day Low: 1098.5

Continued trades against NG. with a mid-price ABOVE 1105.5 should improve ……..

</p

View Previous National Glib & Big Picture ***

LSE:TRN The Trainline Close Mid-Price: 261.4 Percentage Change: -4.18% Day High: 273.4 Day Low: 260.6

If The Trainline experiences continued weakness below 260.6, it will inva ……..

</p

View Previous The Trainline & Big Picture ***