#BrentFutures #DAX Our absurd idea to solve the UK’s economic woes is starting to feel less silly by the day. With ‘Rachel from Accounts’ thinking charging homeowners a windfall tax on the perceived value of property, along with a tranche of other daft capital asset ideas, our concept of returning to slavery starts to make some sense. If every illegal immigrant in the last year was fined “just” £1,000,000 for having the stupidity to visit the UK, the Treasury could suddenly adopt a debt of around of around £28Bn for this years arrivals alone. All these people could be sold off, to work away their indentured debt which, at minimum wage levels, should take each one around 9 years unless they opt to pay for food or whatever.

This is where slavery becomes attractive, local councils doubtless embracing the idea of folk who can pick up litter, remove graffiti, fill holes in the ground, all the sort of thing which councils are supposed to do anyway! But a council, with around 1,000 indentured slaves, would quickly boast about the £1bn debt they now own…

Okay, we’re a little bit left wing on this subject, both abhorring unbridled immigration and also the concept of “minimum wage”, feeling this latter has been adopted as a way of keeping wage rates low, rather than producing the perceived “safety net” folk think it means.

To explain, back in the day when the “minimum wage” was introduced, we were employing 28 retail staff and our oil company pressured retailers to pay staff a fair living wage. To be honest, the oil company also introduced a change in profit percentage to allow retailers to actually pay their staff. We were in a rather different position, having eschewed the meagre profit from selling petrol as the driving force, instead constantly working hard to maximise profit from other areas, whether it was from the shop or from seasonal junk being sold in the forecourt. At one point, we even developed selling a line in “river rocks”, collected every weekend from a drive into the Scottish countryside!

Our staff, understandably, were somewhat against their hourly rate being reduced to match the proposed “minimum wage” so we declined the pressure from the oil company but cheerfully accepts the increase in fuel margins!

The issue with our retail sites came from McDonalds, Sainsbury, and a single Esso station, each paying hourly rates we decided to beat. We wanted good staff and we didn’t intend to compete on wages, so ensured we were the best with probably the most attractive working situations. In plain English, we treated our staff the way we prefer to be treated ourselves, the attitude reciprocated. Generally, any bad apples were quickly highlighted by our team, concerned if anyone was rocking the boat. It wasn’t unknown for a potential new hire making their way to the interview office, a staff member discretely drawing a finger across their throat behind them. This often made interviewing easier…

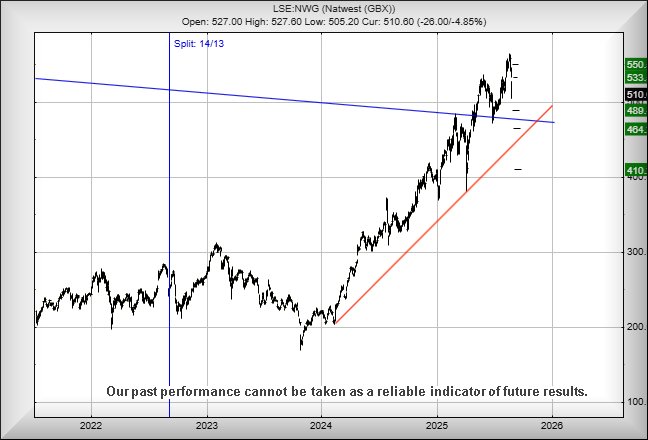

Natwest, the originator of the “clown sector” moniker for the banking industry, has entered a cycle which suggests weakness below 505p shall trigger reversals to an initial 489p, a potential fake bounce, and if broken an eventual potential bottom at 464p. The danger comes as we don’t regard 464p as a “bottom”, suspecting a longer term drift down to an eventual 410p shall prove possible, if the 464p level breaks. Visually, a visit to 410 makes more sense than a sober politician.

In the unlikely event things intend go right for NWG share price, above 527 should next trigger recovery to an initial 533p with our secondary, if beaten, an eventual 550p. Neither ambition is attractive, instead leaning to an eventual share price being trapped between the 5 and 6 quid levels for a while until a reasonable excuse is given to break free.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 1:27:22AM | BRENT | 6740.7 | 6475 | 5954 | 5292 | 6835 | 6848 | 6988 | 7158 | 6641 |

| 1:29:17AM | GOLD | 3447.76 | ||||||||

| 1:32:28AM | FTSE | 9192.7 | ||||||||

| 1:35:19AM | STOX50 | 5356.7 | ||||||||

| 1:46:09AM | GERMANY | 23934.4 | 23882 | 23651 | 23356 | 24072 | 24206 | 24286 | 24423 | 23980 |

| 1:49:31AM | US500 | 6463 | ||||||||

| 1:57:52AM | DOW | 45565.5 | ||||||||

| 2:00:13AM | NASDAQ | 23404.6 | ||||||||

| 2:02:50AM | JAPAN | 42087 |

29/08/2025 FTSE Closed at 9187 points. Change of -0.31%. Total value traded through LSE was: £ 5,855,483,777 a change of 30.98%

28/08/2025 FTSE Closed at 9216 points. Change of -0.42%. Total value traded through LSE was: £ 4,470,443,849 a change of -4.77%

27/08/2025 FTSE Closed at 9255 points. Change of -0.11%. Total value traded through LSE was: £ 4,694,536,884 a change of -52.24%

26/08/2025 FTSE Closed at 9265 points. Change of -0.6%. Total value traded through LSE was: £ 9,830,321,527 a change of 125.64%

22/08/2025 FTSE Closed at 9321 points. Change of 0.13%. Total value traded through LSE was: £ 4,356,702,954 a change of 17.66%

21/08/2025 FTSE Closed at 9309 points. Change of 0.23%. Total value traded through LSE was: £ 3,702,661,970 a change of -40.14%

20/08/2025 FTSE Closed at 9288 points. Change of 1.08%. Total value traded through LSE was: £ 6,185,994,315 a change of -5.2%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AVCT Avacta** **LSE:BBY BALFOUR BEATTY** **LSE:FRES Fresnillo** **LSE:RKH Rockhopper** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : Avacta, BALFOUR BEATTY, Fresnillo, Rockhopper, Scottish Mortgage Investment Trust, Taylor Wimpey,

LSE:AVCT Avacta. Close Mid-Price: 61.5 Percentage Change: + 11.82% Day High: 63 Day Low: 54.5

Target met. Further movement against Avacta ABOVE 63 should improve accel ……..

</p

View Previous Avacta & Big Picture ***

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 593.5 Percentage Change: + 1.11% Day High: 599.5 Day Low: 585.5

Target met. Continued trades against BBY with a mid-price ABOVE 599.5 sho ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 1788 Percentage Change: + 2.00% Day High: 1792 Day Low: 1754

All Fresnillo needs are mid-price trades ABOVE 1792 to improve accelerati ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:RKH Rockhopper. Close Mid-Price: 80 Percentage Change: + 6.95% Day High: 80.8 Day Low: 75.6

In the event of Rockhopper enjoying further trades beyond 80.8, the share ……..

</p

View Previous Rockhopper & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust Close Mid-Price: 1098 Percentage Change: -0.36% Day High: 1107 Day Low: 1094.5

Further movement against Scottish Mortgage Investment Trust ABOVE 1107 sh ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 95.74 Percentage Change: -1.60% Day High: 97.4 Day Low: 95.84

Continued weakness against TW. taking the price below 95.84 calculates as ……..

</p

View Previous Taylor Wimpey & Big Picture ***