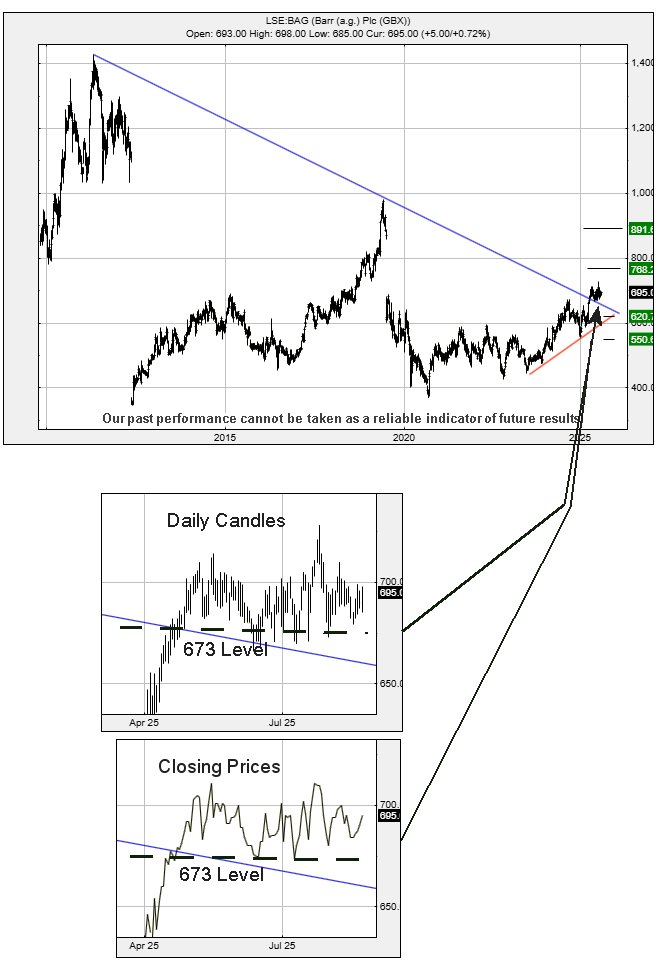

#Gold #SP500 We often take some pains to illustrate it’s not the trend which is important but rather, how a share price or index reacts to the trend, once it’s been broken. This logic applies, regardless whether it’s a Blue downtrend or Red uptrend and the key is always the price level at which a trend has been broken. In the case of a Blue downtrend, should the trend be broken at 6 for instance, if the price closes below 6 thereafter, it’s a pretty good sign the trend wasn’t important and can probably be ignored. Instead, we always anticipate some further price reductions.

Similarly, with a Red uptrend, if the price breaks the trend again at 6 and closes above 6 shortly afterwards, the trend break is generally a fake and further gains can usually be planned on. For the sake of safety and sanity, we always prefer demanding a price actually closes Below or Above which type of trend line you are playing with. Of course, the difficult bit can be defining just where to draw a trend but, in the case of A G Barr below, it’s fairly easy for the Blue downtrend.

A G Barr, famed manufacturers of funny Irn Bru commercials, has a well defined Blue downtrend which dates back to 2011, this trend being broken at 673p in April of this year. As the chart extracts show, despite some flamboyant movements during the day, the share price has failed to close below the 673p level. It’s a bit irritating to admit, thanks to various movement gaps, this number “could” be 651p but as the extracts show, it seems the market is happy to rely on a painted line, rather than a fussy calculation. Our inclination, as “the market always knows”, is to accept 673p risks becoming a trigger level for reversals.

Currently, closure below 673 calculates with the potential of reversals to an initial 620p with our secondary, if broken, at a future 550p. Perhaps, in this scenario, it shall experience a bounce.

More likely, it feels like movement above 711p should generate price recovery to an initial 768 with our secondary, if beaten, an eventual 891p and an urgent need to revisit the share price.

For the present, we’re fairly optimistic about their share price. If only they’d produce a whisky flavoured Irn Bru… And as can be noticed, absolutely no conventional chart indicators were harmed in production of this scenario.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:55:17PM | BRENT | 6651.6 | Success | ||||||||

| 9:57:58PM | GOLD | 3347.56 | 3320 | 3308 | 3294 | 3330 | 3350 | 3358 | 3373 | 3338 | |

| 10:20:29PM | FTSE | 9305.8 | Success | ||||||||

| 10:23:24PM | STOX50 | 5474.8 | |||||||||

| 10:25:47PM | GERMANY | 24293.8 | |||||||||

| 10:28:04PM | US500 | 6395.8 | 6345 | 6319 | 6263 | 6394 | 6411 | 6438 | 6469 | 6390 | Success |

| 11:45:48PM | DOW | 44893.2 | |||||||||

| 11:48:57PM | NASDAQ | 23237 | Success | ||||||||

| 11:51:09PM | JAPAN | 42850 | Success |

20/08/2025 FTSE Closed at 9288 points. Change of 1.08%. Total value traded through LSE was: £ 6,185,994,315 a change of -5.2%

19/08/2025 FTSE Closed at 9189 points. Change of 0.35%. Total value traded through LSE was: £ 6,525,328,498 a change of 36.03%

18/08/2025 FTSE Closed at 9157 points. Change of 0.21%. Total value traded through LSE was: £ 4,796,925,972 a change of -21.07%

15/08/2025 FTSE Closed at 9138 points. Change of -0.42%. Total value traded through LSE was: £ 6,077,567,012 a change of 24.32%

14/08/2025 FTSE Closed at 9177 points. Change of 0.13%. Total value traded through LSE was: £ 4,888,645,281 a change of -12.34%

13/08/2025 FTSE Closed at 9165 points. Change of 0.2%. Total value traded through LSE was: £ 5,576,963,719 a change of 12.35%

12/08/2025 FTSE Closed at 9147 points. Change of 0.2%. Total value traded through LSE was: £ 4,963,866,673 a change of 14.87%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CPI Capita** **LSE:SPX Spirax** **LSE:TERN Tern Plc** **LSE:VOD Vodafone** **

********

Updated charts published on : Capita, Spirax, Tern Plc, Vodafone,

LSE:CPI Capita. Close Mid-Price: 232.5 Percentage Change: + 0.87% Day High: 234 Day Low: 224

Continued weakness against CPI taking the price below 224 calculates as l ……..

</p

View Previous Capita & Big Picture ***

LSE:SPX Spirax Close Mid-Price: 7220 Percentage Change: -0.48% Day High: 7255 Day Low: 7165

In the event of Spirax enjoying further trades beyond 7255, the share sho ……..

</p

View Previous Spirax & Big Picture ***

LSE:TERN Tern Plc Close Mid-Price: 0.68 Percentage Change: -18.18% Day High: 0.82 Day Low: 0.68

Target met. Continued weakness against TERN taking the price below 0.68 c ……..

</p

View Previous Tern Plc & Big Picture ***

LSE:VOD Vodafone. Close Mid-Price: 88.42 Percentage Change: + 1.42% Day High: 88.78 Day Low: 86.74

Target met. In the event of Vodafone enjoying further trades beyond 88.78 ……..

</p

View Previous Vodafone & Big Picture ***