#Gold #SP500 With recent events in Iran, it is certainly likely the country shall be in the running to develop new suppliers of uranium. Who knows, perhaps the North American portfolio of Metals One which includes uranium exploration projects, shall benefit as the world falls back into its normal mode of operation. Something the worlds media seem to be wilfully ignoring was the amazing co-incidence of Iran choosing to fire some missiles at the largest military base in the area, the US base in Qatar. With extraordinary perception, the US military had evacuated the (heavily defended) base 5 days earlier – well before the assault on Irans nuclear facilities! Many news articles questioned what was going on but the end result looks transparent, a probable agreement with Iran on how they would respond, well before the B2 bombers did their magic on the enrichment facilities. MSN News even published before & after satellite views of the US base.

The level of choreography of this conflict is becoming worse than the original script for “Weapons of Mass Destruction” as used by Blair and Bush… In our very sceptical opinion anyway!

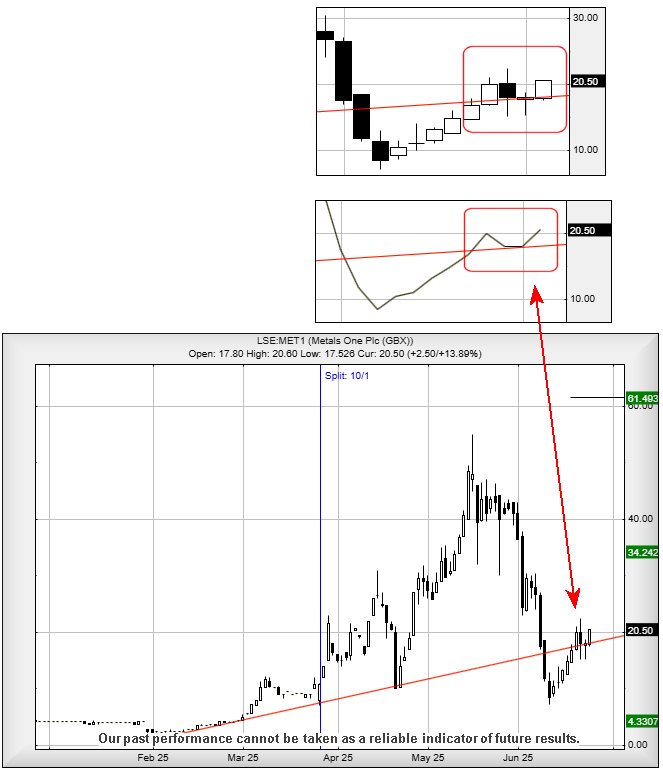

We’ve received a few emails asking our opinion on Metals One share price movements. Recent dance steps are proving fascinating, suggesting something is going on with the market potentially intending to reverse the recent damage of this dip down to 7.2p. The extracts below show the care being taken to ensure the share price closes above the historical Red uptrend, generally a sign someone has a cunning plan.

From a near term perspective, there is a suggestion movement above just 22.6 should trigger movement to around 27.7p. This should prove critical, taking the share price into a region where a future 34.2 becomes a longer term attraction with a future, slightly mad looking 61p making itself known as our Big Picture secondary target.

Like everything to do with share prices which can prove substantially less stable than enriched uranium, movement below 15p would now be required to incite concern. In fact, even share price closure below 17p would be worrisome, allowing a painful 4.3p to make itself known as the ultimate drop target. We cannot calculate below such a level without introducing minus signs.

But for now, we suspect this shall deserve some optimism in the period ahead.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:13:11PM | BRENT | 6679.2 | ‘cess | ||||||||

| 11:21:25PM | GOLD | 3320.6 | 3315 | 3292 | 3239 | 3325 | 3356 | 3379 | 3407 | 3315 | Success |

| 11:31:57PM | FTSE | 8756.7 | ‘cess | ||||||||

| 11:35:22PM | STOX50 | 5306.6 | ‘cess | ||||||||

| 11:38:34PM | GERMANY | 23689.5 | Success | ||||||||

| 11:41:12PM | US500 | 6089.4 | 6052 | 6043 | 6023 | 6071 | 6103 | 6128 | 6160 | 6056 | ‘cess |

| 11:45:34PM | DOW | 43069.7 | ‘cess | ||||||||

| 11:48:24PM | NASDAQ | 22170 | ‘cess | ||||||||

| 11:51:53PM | JAPAN | 38800 |

24/06/2025 FTSE Closed at 8758 points. Change of 0%. Total value traded through LSE was: £ 7,507,244,124 a change of 60.9%

23/06/2025 FTSE Closed at 8758 points. Change of -0.18%. Total value traded through LSE was: £ 4,665,666,044 a change of -66.2%

20/06/2025 FTSE Closed at 8774 points. Change of -0.19%. Total value traded through LSE was: £ 13,804,431,161 a change of 245.4%

19/06/2025 FTSE Closed at 8791 points. Change of -0.59%. Total value traded through LSE was: £ 3,996,665,836 a change of -22.28%

18/06/2025 FTSE Closed at 8843 points. Change of 0.1%. Total value traded through LSE was: £ 5,142,450,151 a change of -29%

17/06/2025 FTSE Closed at 8834 points. Change of -0.46%. Total value traded through LSE was: £ 7,242,544,038 a change of 37.46%

16/06/2025 FTSE Closed at 8875 points. Change of 0.28%. Total value traded through LSE was: £ 5,269,012,608 a change of 2.72%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:BT.A British Telecom** **LSE:CCL Carnival** **LSE:CPI Capita** **LSE:DGE Diageo** **LSE:FGP Firstgroup** **LSE:IPF International Personal Finance** **LSE:ITRK Intertek** **LSE:RR. Rolls Royce** **LSE:STAN Standard Chartered** **

********

Updated charts published on : Aviva, British Telecom, Carnival, Capita, Diageo, Firstgroup, International Personal Finance, Intertek, Rolls Royce, Standard Chartered,

LSE:AV. Aviva. Close Mid-Price: 618.8 Percentage Change: + 0.16% Day High: 630.2 Day Low: 619.4

Target met. All Aviva needs are mid-price trades ABOVE 630.2 to improve a ……..

</p

View Previous Aviva & Big Picture ***

LSE:BT.A British Telecom. Close Mid-Price: 191.9 Percentage Change: + 0.21% Day High: 192.5 Day Low: 187.65

Target met. Further movement against British Telecom ABOVE 192.5 should i ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 1722.5 Percentage Change: + 11.81% Day High: 1754.5 Day Low: 1614

Target met. In the event of Carnival enjoying further trades beyond 1754. ……..

</p

View Previous Carnival & Big Picture ***

LSE:CPI Capita. Close Mid-Price: 300 Percentage Change: + 8.30% Day High: 304 Day Low: 276.5

In the event of Capita enjoying further trades beyond 304, the share shou ……..

</p

View Previous Capita & Big Picture ***

LSE:DGE Diageo. Close Mid-Price: 1859 Percentage Change: + 0.57% Day High: 1892.5 Day Low: 1835

Continued weakness against DGE taking the price below 1835 calculates as ……..

</p

View Previous Diageo & Big Picture ***

LSE:FGP Firstgroup. Close Mid-Price: 230 Percentage Change: + 2.13% Day High: 231.2 Day Low: 215.6

Continued trades against FGP with a mid-price ABOVE 231.2 should improve ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 164.8 Percentage Change: + 2.62% Day High: 164.8 Day Low: 160.6

All International Personal Finance needs are mid-price trades ABOVE 164.8 ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:ITRK Intertek. Close Mid-Price: 4744 Percentage Change: + 0.55% Day High: 4824 Day Low: 4750

Further movement against Intertek ABOVE 4824 should improve acceleration ……..

</p

View Previous Intertek & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 909.2 Percentage Change: + 2.55% Day High: 912.8 Day Low: 888.4

Continued trades against RR. with a mid-price ABOVE 912.8 should improve ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 1190.5 Percentage Change: + 2.41% Day High: 1202 Day Low: 1182.5

All Standard Chartered needs are mid-price trades ABOVE 1202 to improve a ……..

</p

View Previous Standard Chartered & Big Picture ***