#FTSE #SP500 The decision by Boohoo to rebrand themselves as Debenhams has probably caused a sharp intake of breath among the online fashion industry. Boohoo, a brand predominantly aimed at the younger sector of the market, are surely liable to wonder why they’re no longer attractive, Debenhams historically being associated with older buyers. It is easier to suspect Boohoo have simply enjoyed their day in the sun and it’s now time for another newbie to become the next online industry “one hit wonder”.

Currently, Boohoo Plc share price isn’t in a happy place, the famously fashion conscious stock market obviously questioning their latest decision.

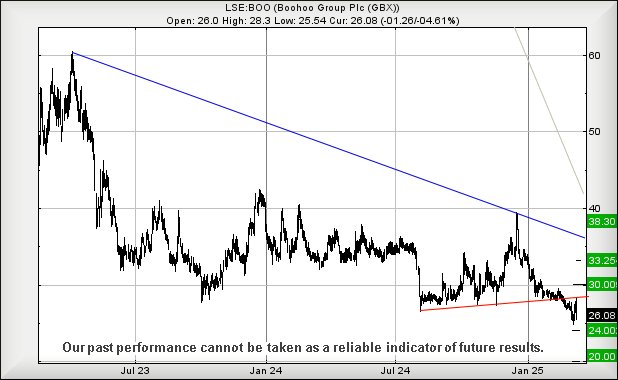

From a chart perspective – probably the safest stance from folk who regard waxed cotton jackets and wide brimmed hates as the pinnacle of style – Boohoo (or Debenhams as the renaming had immediate effect) are seriously in a pretty unhappy place. At present, weakness below 25.5 indicates the potential of reversal to an initial 24p with our secondary, if broken, at 20p. We cannot calculate any target level below 20p without emplacing a minus sign in front of any number, such is the precarious position of Boohoo.

Currently trading around 26p, Boohoo share price needs (from our perspective) to exceed 26.25p, ideally triggering recovery toward an initial 30p with our secondary, if bettered, at 33.25p. Movement such as this would be significant, placing the share price in danger of achieving a distant game changing 38 and a return to long term optimism.

Unlike this weekends Australian Grand Prix, we think Boohoo shall prove worth watching. The comedy of the first “back to school” race of the F1 season has grown tiring over the years, drivers and pit crews making errors under pressure which give unrealistic expectations for the rest of the year.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:34:24PM | BRENT | 6982 | ‘cess | ||||||||

| 10:40:17PM | GOLD | 2916.72 | ‘cess | ||||||||

| 10:44:50PM | FTSE | 8509.8 | 8462 | 8357 | 8172 | 8543 | 8595 | 8654 | 8718 | 8565 | ‘cess |

| 10:48:25PM | STOX50 | 5337 | ‘cess | ||||||||

| 10:51:50PM | GERMANY | 22461 | ‘cess | ||||||||

| 11:05:58PM | US500 | 5582.4 | 5529 | 5468 | 5240 | 5646 | 5660 | 5700 | 5757 | 5608 | Shambles |

| 11:09:23PM | DOW | 41505.5 | |||||||||

| 11:12:21PM | NASDAQ | 19442.9 | |||||||||

| 11:17:20PM | JAPAN | 36880 | Success |

11/03/2025 FTSE Closed at 8496 points. Change of -1.21%. Total value traded through LSE was: £ 7,372,262,809 a change of -3.66%

10/03/2025 FTSE Closed at 8600 points. Change of -0.91%. Total value traded through LSE was: £ 7,652,125,992 a change of 21.38%

7/03/2025 FTSE Closed at 8679 points. Change of -0.03%. Total value traded through LSE was: £ 6,304,463,649 a change of -17.82%

6/03/2025 FTSE Closed at 8682 points. Change of -0.83%. Total value traded through LSE was: £ 7,671,130,291 a change of 6.49%

5/03/2025 FTSE Closed at 8755 points. Change of -0.05%. Total value traded through LSE was: £ 7,203,655,204 a change of -19.84%

4/03/2025 FTSE Closed at 8759 points. Change of -1.26%. Total value traded through LSE was: £ 8,986,196,002 a change of 22.76%

3/03/2025 FTSE Closed at 8871 points. Change of 0.7%. Total value traded through LSE was: £ 7,320,378,637 a change of -49.26%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:IHG Intercontinental Hotels Group** **LSE:ITM ITM Power** **LSE:OXIG Oxford Instruments** **LSE:TLW Tullow** **

********

Updated charts published on : Asos, Intercontinental Hotels Group, ITM Power, Oxford Instruments, Tullow,

LSE:ASC Asos Close Mid-Price: 269.2 Percentage Change: -2.46% Day High: 284 Day Low: 266.6

Target met. Weakness on Asos below 266.6 will invariably lead to 255p wit ……..

</p

View Previous Asos & Big Picture ***

LSE:IHG Intercontinental Hotels Group Close Mid-Price: 8754 Percentage Change: -3.80% Day High: 8978 Day Low: 8660

Target met. If Intercontinental Hotels Group experiences continued weakne ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:ITM ITM Power Close Mid-Price: 25.62 Percentage Change: -3.90% Day High: 27.28 Day Low: 25.26

Target met. Weakness on ITM Power below 25.26 will invariably lead to 24p ……..

</p

View Previous ITM Power & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 1804 Percentage Change: -1.85% Day High: 1860 Day Low: 1802

If Oxford Instruments experiences continued weakness below 1802, it will ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:TLW Tullow Close Mid-Price: 13.03 Percentage Change: -3.34% Day High: 13.83 Day Low: 12.89

Target met. In the event Tullow experiences weakness below 12.89 it calcu ……..

</p

View Previous Tullow & Big Picture ***