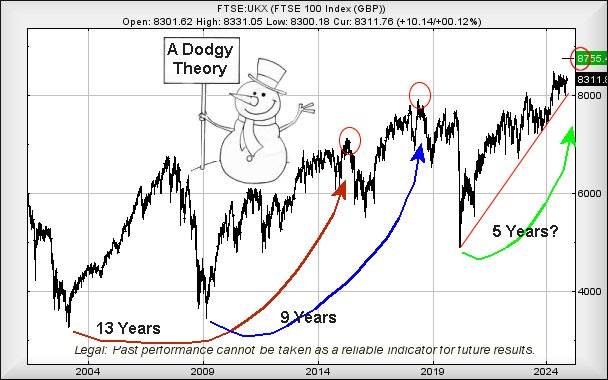

#FTSE #GOLD When we look back in time, the FTSE has produced some interesting patterns of behaviour, creating a situation which may actually become useful. When we review how long it took for the index to recover from its 2003 Tech Crash low, 13 years slithered by before our calculation proved correct. Then, we’d the Financial Crash of 2009, a disaster which took 9 years before we could regard recovery as complete. While it’s always stupid to draw assumptions from a single data result, if we extrapolate using this gap between recoveries, we may embrace 2025 as the year when we should hope the market achieves a high of around 8,755 points, then invariably experience some reversals.

Another interesting facet from extrapolating data irresponsibly like this is being able to present the year 2036, this being the next point when the world should anticipate a major market crash. Our inclinations is to regard such seriously long term predictions as far from trustworthy, just as bad as taking a government economists predictions as sane. However, it is worth remembering the Asteroid Apophis will pass fairly close to Earth in 2026, just 5 million miles away apparently.

We like playing with numbers but the idea of a “top” around 8,755 points next year is attractive, certainly suggesting a point where opening a short with a seriously tight stop will make some sense!

As for the FTSE near term, we’re looking for arguments which favour market recovery above 8334 as heading to an initial 8376 points. If bettered, our secondary now calculates at 8461 points though we’re not inclined to expect both target levels to appear within a single day. Additionally, our secondary offers the prospect of being “game changing”, taking the UK index solidly above 8400 points, being introduced as a nonsense solid barrier. Market traders will be perfectly aware there’s no such thing as a ceiling or floor but with the FTSE, bettering the 8400 level certainly looks like a free gift to optimistic traders.

Unfortunately, for those taking the plunge with longer term Big Picture hopes, the tightest stop – if 8334 is triggered – is ridiculous at 8260 points.

Our converse scenario demands the index slip below 8250 points, triggering reversal to an initial 8225 points with our secondary, if broken, at 8171 points.

Enjoy the weekend, only 93 days until the next Grand Prix weekend. To be honest, the contrived nature of “the sport” is making it harder to maintain enthusiasm.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:29:03PM | BRENT | 7324.4 | 7236 | 7191 | 7320 | 7392 | 7418 | 7318 | ‘cess | ||

| 11:33:59PM | GOLD | 2680.62 | 2676 | 2664 | 2690 | 2720 | 2731 | 2702 | |||

| 11:37:47PM | FTSE | 8296.1 | 8288 | 8272 | 8305 | 8332 | 8344 | 8303 | |||

| 11:42:21PM | STOX50 | 4961.4 | 4953 | 4947 | 4963 | 4976 | 4982 | 4963 | |||

| 11:44:35PM | GERMANY | 20415.3 | 20363 | 20334 | 20418 | 20458 | 20491 | 20392 | |||

| 11:33:44PM | US500 | 6058 | 6047 | 6039 | 6063 | 6080 | 6089 | 6060 | |||

| 11:37:38PM | DOW | 43894 | 43878 | 43701 | 44085 | 44200 | 44293 | 44057 | |||

| 11:39:53PM | NASDAQ | 21716 | 21578 | 21534 | 21662 | 21740 | 21780 | 21645 | ‘cess | ||

| 11:42:35PM | JAPAN | 39724 | 39552 | 39443 | 39667 | 39804 | 39883 | 39631 | ‘cess |

12/12/2024 FTSE Closed at 8311 points. Change of 0.12%. Total value traded through LSE was: £ 4,660,074,740 a change of -19.71%

11/12/2024 FTSE Closed at 8301 points. Change of 0.25%. Total value traded through LSE was: £ 5,804,184,495 a change of 29.66%

10/12/2024 FTSE Closed at 8280 points. Change of -0.86%. Total value traded through LSE was: £ 4,476,630,300 a change of -11.71%

9/12/2024 FTSE Closed at 8352 points. Change of 0.53%. Total value traded through LSE was: £ 5,070,546,042 a change of 9.1%

6/12/2024 FTSE Closed at 8308 points. Change of -0.49%. Total value traded through LSE was: £ 4,647,469,843 a change of -11.07%

5/12/2024 FTSE Closed at 8349 points. Change of 0.17%. Total value traded through LSE was: £ 5,225,818,106 a change of -2.92%

4/12/2024 FTSE Closed at 8335 points. Change of -0.29%. Total value traded through LSE was: £ 5,383,163,281 a change of 3.03%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:BARC Barclays** **LSE:EZJ EasyJet** **LSE:GENL Genel** **LSE:HSBA HSBC** **LSE:IAG British Airways** **LSE:NG. National Glib** **LSE:PMG Parkmead** **LSE:TRN The Trainline** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : Aviva, Barclays, EasyJet, Genel, HSBC, British Airways, National Glib, Parkmead, The Trainline, Taylor Wimpey,

LSE:AV. Aviva Close Mid-Price: 471 Percentage Change: -0.63% Day High: 476 Day Low: 471.7

If Aviva experiences continued weakness below 471.7, it will invariably l ……..

</p

View Previous Aviva & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 270.7 Percentage Change: + 1.52% Day High: 272.05 Day Low: 267.55

All Barclays needs are mid-price trades ABOVE 272.05 to improve accelerat ……..

</p

View Previous Barclays & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 583 Percentage Change: + 0.97% Day High: 590.8 Day Low: 574.6

Target met. Further movement against EasyJet ABOVE 590.8 should improve a ……..

</p

View Previous EasyJet & Big Picture ***

LSE:GENL Genel Close Mid-Price: 62.6 Percentage Change: -1.88% Day High: 64.5 Day Low: 63

Weakness on Genel below 63 will invariably lead to 60p with secondary (if ……..

</p

View Previous Genel & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 761.1 Percentage Change: + 0.69% Day High: 762 Day Low: 755.5

In the event of HSBC enjoying further trades beyond 762, the share should ……..

</p

View Previous HSBC & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 291.8 Percentage Change: + 1.32% Day High: 295.6 Day Low: 289

All British Airways needs are mid-price trades ABOVE 295.6 to improve ac ……..

</p

View Previous British Airways & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 940.2 Percentage Change: + 0.06% Day High: 943.4 Day Low: 934.2

If National Glib experiences continued weakness below 934.2, it will inva ……..

</p

View Previous National Glib & Big Picture ***

LSE:PMG Parkmead. Close Mid-Price: 19.4 Percentage Change: + 33.79% Day High: 24.5 Day Low: 18

Target met. Further movement against Parkmead ABOVE 24.5 should improve a ……..

</p

View Previous Parkmead & Big Picture ***

LSE:TRN The Trainline. Close Mid-Price: 434.8 Percentage Change: + 0.32% Day High: 442.2 Day Low: 432.6

All The Trainline needs are mid-price trades ABOVE 442.2 to improve accel ……..

</p

View Previous The Trainline & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 125.85 Percentage Change: -0.51% Day High: 127 Day Low: 125.35

If Taylor Wimpey experiences continued weakness below 125.35, it will inv ……..

</p

View Previous Taylor Wimpey & Big Picture ***