#Gold #SP500 Currently the temperature outside here in Argyll is -1c. Thankfully, there’s no wind, meaning it’s just cold as opposed to feeling utterly dreadful. This tends highlight the fly in the ointment with the windfarms which pollute many views in Scotland as they face generating nothing when power is most needed. During winter, the wind will generally be too strong to allow the windmills to turn or alternately, it stops blowing. Famously, in 2011, we’d a period of around 4 months where temperatures in Argyll were around -10c with absolutely no wind. It’s called a “blocking high”, producing some decent ski conditions, making many lochs perfect destinations for ice skating. While we watched a sheet of ice moving with the tide outside the house, not a single windfarms blade was turning. On the plus side, we’d a huge pile of logs ready to burn and somehow, with some forethought, we’ve a years supply of logs awaiting being chopped up.

As always, this paragraph has absolutely nothing to do with Serco Group, aside from their dismal reputation running ferry services in Scotland. It’s worth pointing out the only folk with a worse reputation than Serco is literally everyone else as trying to run ferries in a country where even the weather plots against you must be difficult! In our bit of Argyll, we spend winter admiring a bunch of parked ferries 2 miles across the sea in the safe haven provided by the local marina.

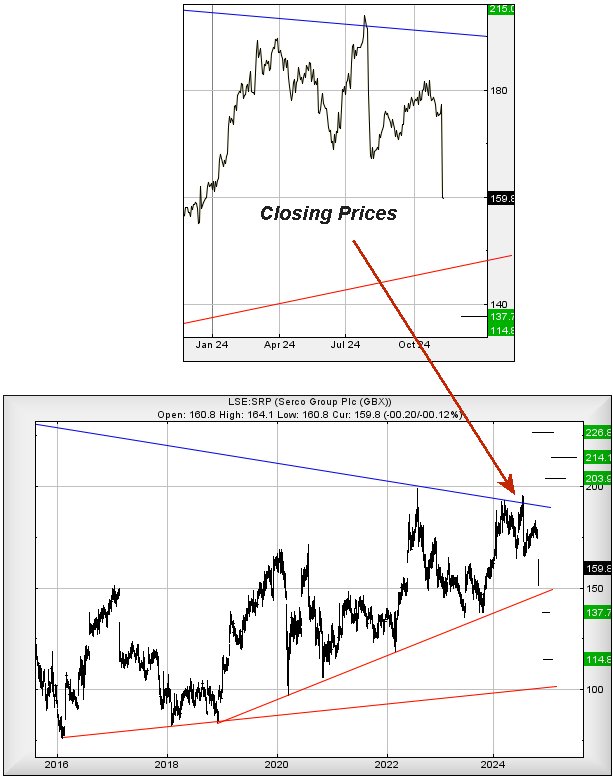

Visually, Serco share price isn’t in a happy place. It was massively gapped down on November 8th with news they’d misplaced a massive contract to control the number of folk who still think Australia to be a good destination. It’s strange, how places like New Zealand, Canada, and Australia, which emplaced the hardest possible legislation against their own people during the pandemic. It was a pleasant surprise, despite some draconian efforts in the UK, the most radical ideas were shot down fairly quickly. Perhaps it was the case UK politicians were more serious in trying to line their own pockets during the crisis, rather than passing successful legislation.

We read a few articles questioning why folk at board level in Serco have been selling their shares. According to the numbers, board members ditched nearly 1/2 million shares in the last year, while just over 19,000 shares were bought by folk within the company who must notify of their action. It’s one of these ‘make of it what you will’ statistics. Collectively, only around 0.2% of Serco shares are owned by folk at board level or below, again one of the “make of it what you will” numbers.

Currently trading around 159p, the share price looks like it faces a trigger level for trouble at 153p as movement below such a point risks triggering reversals to an initial 137p with our secondary, if broken, at a possible bouncy bottom of 114p. When we view closing share price levels, things certainly don’t look great as shown in the closing price insert.

If things intend turn happy for Serco, their share price needs exceed 185p to give the first sign of hope, allowing for recovery to an initial 203p with secondary if bettered, at a longer term 214p.

For now, we’re not sure but will not be surprised if the 137p level is used to provoke a share price rebound.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:15:55PM | BRENT | 7185 | |||||||||

| 11:18:10PM | GOLD | 2623 | 2617 | 2609 | 2575 | 2627 | 2677 | 2704 | 2735 | 2659 | |

| 11:20:58PM | FTSE | 8103.1 | |||||||||

| 11:23:32PM | STOX50 | 4834.8 | |||||||||

| 11:27:47PM | GERMANY | 19386.7 | ‘cess | ||||||||

| 11:46:27PM | US500 | 5998.6 | 5985 | 5982 | 5967 | 6007 | 6027 | 6038 | 6059 | 6004 | |

| 11:48:22PM | DOW | 44226 | |||||||||

| 11:51:38PM | NASDAQ | 21105 | Shambles | ||||||||

| 11:54:42PM | JAPAN | 39710 | Success |

11/11/2024 FTSE Closed at 8125 points. Change of 0.66%. Total value traded through LSE was: £ 4,651,326,032 a change of -15.42%

8/11/2024 FTSE Closed at 8072 points. Change of -0.84%. Total value traded through LSE was: £ 5,499,106,289 a change of -11.31%

7/11/2024 FTSE Closed at 8140 points. Change of -0.32%. Total value traded through LSE was: £ 6,200,390,802 a change of -20.9%

6/11/2024 FTSE Closed at 8166 points. Change of -0.07%. Total value traded through LSE was: £ 7,838,528,249 a change of 73.08%

5/11/2024 FTSE Closed at 8172 points. Change of -0.15%. Total value traded through LSE was: £ 4,528,854,324 a change of 6.29%

4/11/2024 FTSE Closed at 8184 points. Change of 0.09%. Total value traded through LSE was: £ 4,260,964,543 a change of -16.92%

1/11/2024 FTSE Closed at 8177 points. Change of 0.83%. Total value traded through LSE was: £ 5,128,610,563 a change of -23.79%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BARC Barclays** **LSE:CCL Carnival** **LSE:FOXT Foxtons** **LSE:IAG British Airways** **LSE:IHG Intercontinental Hotels Group** **LSE:SBRY Sainsbury** **LSE:SMT Scottish Mortgage Investment Trust** **

********

Updated charts published on : Barclays, Carnival, Foxtons, British Airways, Intercontinental Hotels Group, Sainsbury, Scottish Mortgage Investment Trust,

LSE:BARC Barclays. Close Mid-Price: 260.65 Percentage Change: + 3.64% Day High: 261.6 Day Low: 253.8

Target met. Continued trades against BARC with a mid-price ABOVE 261.6 sh ……..

</p

View Previous Barclays & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 1708.5 Percentage Change: + 1.70% Day High: 1718 Day Low: 1674.5

All Carnival needs are mid-price trades ABOVE 1718 to improve acceleratio ……..

</p

View Previous Carnival & Big Picture ***

LSE:FOXT Foxtons Close Mid-Price: 53 Percentage Change: -2.93% Day High: 56 Day Low: 52

If Foxtons experiences continued weakness below 52, it will invariably le ……..

</p

View Previous Foxtons & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 239.6 Percentage Change: + 2.17% Day High: 240.1 Day Low: 233.5

Target met. In the event of British Airways enjoying further trades beyo ……..

</p

View Previous British Airways & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 9374 Percentage Change: + 1.25% Day High: 9390 Day Low: 9304

Target met. Continued trades against IHG with a mid-price ABOVE 9390 shou ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:SBRY Sainsbury Close Mid-Price: 243.4 Percentage Change: -2.33% Day High: 250.4 Day Low: 243

If Sainsbury experiences continued weakness below 243, it will invariably ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 927.2 Percentage Change: + 2.39% Day High: 928.6 Day Low: 915

Continued trades against SMT with a mid-price ABOVE 928.6 should improve ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***