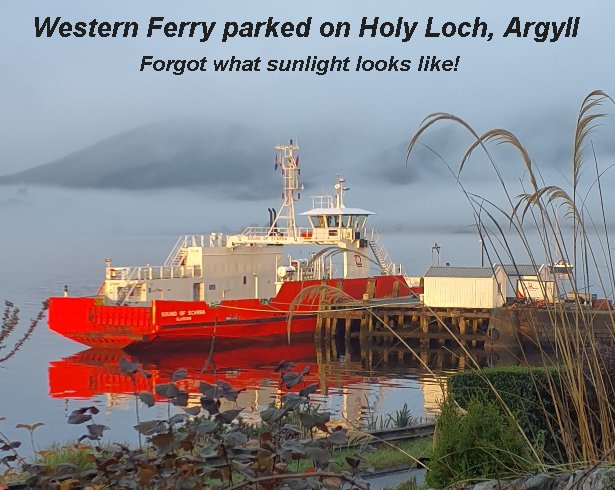

#Gold #S&P500 Of all the days where we needed Argyll to do something stupid and provide padding for our headline article, Monday failed totally. The only standout event of the day was at 8am, when a beam of light broke through the clouds, illuminating a ferry moored outside and making it look like it was the subject of a filming session. This brief reminder of the suns existence doubtless will have inspired the ferry company, giving them a sunlight excuse for another price increase for the hideously expensive return trip across to the mainland. The trip can be as quick as 10 minutes but more commonly 15 minutes, the company charging 49 quid for a car & driver trip, a 30%+ increase over the last couple of years and one which shall doubtless not be reversed despite all other prices coming down.

As for Shell share price, things have become a little messy, the price needing to close a session above 2642p to escape the immediate shambolic behaviour. To be fair. Shells share price is mimicking the price of crude oil, behaving like a Golden Retriever who wants to go out, so she can want to come in again. Brent Crude wants to go down, yet continues to fall into any sort of logical trap as the markets feel determined not to be caught out by a crisis in the Middle East.

To be blunt, it’s all starting to feel a bit like Ukraine, a world situation where the world has essentially grown bored with what’s going on.

If we pretend optimism, Shell share price closing a session above 2642p should be important, potentially triggering share price recovery to an initial 2800p with our secondary, if bettered, at an unlikely 3048p and a new high.

More probable, if things intend go wrong, below 2400p should next trigger reversal to an initial 2261 with our secondary, if broken, at 1959p and hopefully a rebound.

If summary, their share price movements are as chaotic as Western Ferries ticket price gouging, a Norwegian company anxious to extract as must profit as possible from the area.. But their shipboard staff are simply the best folk around, a considerable change from their admin staff who are forced to adhere to corporate policy. (Attending hospital on the mainland, 4 days a week for 5 weeks, became expensive very quickly)

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:25:24PM | BRENT | 7163.2 | Success | ||||||||

| 10:28:01PM | GOLD | 2740.97 | 2725 | 2720 | 2712 | 2735 | 2746 | 2751 | 2759 | 2738 | ‘cess |

| 10:31:41PM | FTSE | 8291.2 | ‘cess | ||||||||

| 10:34:31PM | STOX50 | 4966.9 | Success | ||||||||

| 10:38:04PM | GERMANY | 19521.4 | ‘cess | ||||||||

| 10:41:15PM | US500 | 5825.2 | 5823 | 5817 | 5806 | 5837 | 5849 | 5861 | 5894 | 5828 | |

| 10:44:02PM | DOW | 42384.9 | |||||||||

| 10:47:17PM | NASDAQ | 20365.5 | |||||||||

| 10:51:00PM | JAPAN | 38562 |

28/10/2024 FTSE Closed at 8285 points. Change of 1.68%. Total value traded through LSE was: £ 4,639,447,546 a change of -2.07%

25/10/2024 FTSE Closed at 8148 points. Change of -1.46%. Total value traded through LSE was: £ 4,737,422,038 a change of -5.81%

24/10/2024 FTSE Closed at 8269 points. Change of 0.13%. Total value traded through LSE was: £ 5,029,789,282 a change of 1.28%

23/10/2024 FTSE Closed at 8258 points. Change of -0.58%. Total value traded through LSE was: £ 4,966,414,850 a change of 16.11%

22/10/2024 FTSE Closed at 8306 points. Change of -0.14%. Total value traded through LSE was: £ 4,277,437,819 a change of 11.53%

21/10/2024 FTSE Closed at 8318 points. Change of -0.48%. Total value traded through LSE was: £ 3,835,225,981 a change of -24.37%

18/10/2024 FTSE Closed at 8358 points. Change of -0.32%. Total value traded through LSE was: £ 5,071,129,740 a change of -4.53%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CCL Carnival** **LSE:FOXT Foxtons** **LSE:IAG British Airways** **LSE:IQE IQE** **LSE:STAN Standard Chartered** **LSE:TRN The Trainline** **

********

Updated charts published on : Carnival, Foxtons, British Airways, IQE, Standard Chartered, The Trainline,

LSE:CCL Carnival. Close Mid-Price: 1518 Percentage Change: + 4.22% Day High: 1551 Day Low: 1472

Target met. All Carnival needs are mid-price trades ABOVE 1551 to improve ……..

</p

View Previous Carnival & Big Picture ***

LSE:FOXT Foxtons Close Mid-Price: 59 Percentage Change: -2.32% Day High: 60.2 Day Low: 58.6

Continued weakness against FOXT taking the price below 58.6 calculates as ……..

</p

View Previous Foxtons & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 215.3 Percentage Change: + 1.80% Day High: 217.1 Day Low: 212

All British Airways needs are mid-price trades ABOVE 217.1 to improve ac ……..

</p

View Previous British Airways & Big Picture ***

LSE:IQE IQE Close Mid-Price: 14.6 Percentage Change: -1.75% Day High: 14.96 Day Low: 14.5

In the event IQE experiences weakness below 14.5 it calculates with a dro ……..

</p

View Previous IQE & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 865.8 Percentage Change: + 1.50% Day High: 869.2 Day Low: 854

Target met. Continued trades against STAN with a mid-price ABOVE 869.2 sh ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:TRN The Trainline. Close Mid-Price: 368 Percentage Change: + 9.20% Day High: 378 Day Low: 340

Further movement against The Trainline ABOVE 378 should improve accelerat ……..

</p

View Previous The Trainline & Big Picture ***