LSE:BA. & LSE:JD. currently 1298p & 140p. #Gold #WallSt In an almost funny phase of self flagellation, Tuesday evening was spent deciding whether to lead with BAE or JD Sports, both companies suddenly showing some interesting potentials. But the really difficult bit was attempting to figure out how to blend a close encounter with a new snowy owl into our efforts. Over the years, a massive snowy owl has been a regular visitor, reliably coming when I give a whistle. Tonight, the Golden Retrievers brain was exploding as she barked at “something” she had trapped in an ash tree. The dog regards a bird perched on the branches watching her as a win and this time, she was obviously at the top of the class.

Suddenly, something jumped out of the tree, dropping around 1 metre before opening its wings and taking flight. It was a small snowy owl, obviously trying hard not to damage its feathers in the close confines of the forest, making me suspect it was on a brand new flying licence. Perhaps it’s the case the monster owl has now become a parent and it was showing the young bird where the favourite places to annoy dogs were. But I’ve certainly never seen a bird jump out from a tree.

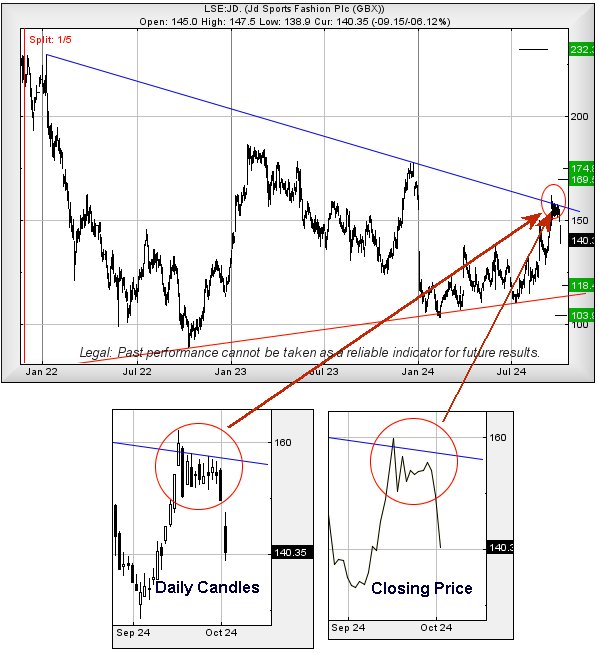

To start with JD Sports, their share price has followed the lesson from our little owl, throwing itself off a Blue downtrend which commenced back in 2021 is quite fascinating. The extract on the chart below is of interest, the share price exuberantly exceeding the trend on 17th September, only to be smacked back into place the following day as if the market already knew it had a cunning plan for the days ahead.

The situation now suggests ongoing weakness below 138p risks promoting reversals down to an initial 118p with our secondary, if broken, an eventual bottom of 103p and hopefully a rebound.

If things intend turn positive, the share price now needs above 158p to hint at a trigger movement toward an initial 169p with our secondary, if beaten, at 174p and a need for us to revisit our calculations. Alas, for now we suspect it intends to drop, hopefully with a bottom at 103p as the market certainly appears to be enacting a secret scenario.

In a world without any shortage of regional conflicts, perhaps it’s the time to take a hard look at BAE Systems again. After all, should the USA go a little crazy following their Guy Fawkes Election on 5th November and not know who they are supposed to be selling weaponry to, surely any pause in US arms supply could be filled from the UK as our country hosts one of the largest weapon suppliers in the world. The only problem is the UK’s lack of available skilled workers for the defence industry, not really a surprise as they made many of them redundant while attempting to defend executive pay levels…

However, BAE is suddenly looking pretty interesting. Movement above just 1308 should now trigger price recovery to an initial 1330p with our longer term secondary, if beaten, at a future 1457p.

If trouble is planned, below 1221p risks triggering reversals to an initial 1166p with our secondary, if broken, at a potential bottom of 1070p.

For now, we think BAE Systems share price intends some gains.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:58:44PM | BRENT | 7463 | |||||||||

| 11:04:58PM | GOLD | 2658.18 | 2644 | 2638 | 2626 | 2654 | 2662 | 2675 | 2692 | 2641 | |

| 11:07:43PM | FTSE | 8274 | ‘cess | ||||||||

| 11:18:04PM | STOX50 | 4962.5 | |||||||||

| 11:13:14PM | GERMANY | 19171 | ‘cess | ||||||||

| 11:16:58PM | US500 | 5717.8 | ‘cess | ||||||||

| 11:21:15PM | DOW | 42227.3 | 41958 | 41856 | 41718 | 42086 | 42332 | 42450 | 42619 | 42222 | |

| 11:23:48PM | NASDAQ | 19833.4 | |||||||||

| 11:26:01PM | JAPAN | 38694 |

2/10/2024 FTSE Closed at 8290 points. Change of 0.17%. Total value traded through LSE was: £ 5,393,073,396 a change of -18.14%

1/10/2024 FTSE Closed at 8276 points. Change of 0.49%. Total value traded through LSE was: £ 6,588,507,831 a change of -4.69%

30/09/2024 FTSE Closed at 8236 points. Change of -1.01%. Total value traded through LSE was: £ 6,912,406,295 a change of 9.55%

27/09/2024 FTSE Closed at 8320 points. Change of 0.43%. Total value traded through LSE was: £ 6,309,682,763 a change of -12.79%

26/09/2024 FTSE Closed at 8284 points. Change of 0.19%. Total value traded through LSE was: £ 7,235,455,984 a change of 30.14%

25/09/2024 FTSE Closed at 8268 points. Change of -0.17%. Total value traded through LSE was: £ 5,559,537,162 a change of 3.34%

24/09/2024 FTSE Closed at 8282 points. Change of 0.28%. Total value traded through LSE was: £ 5,379,835,021 a change of 25.1%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AAL Anglo American** **LSE:AML Aston Martin** **LSE:AVCT Avacta** **LSE:EME Empyrean** **LSE:FGP Firstgroup** **LSE:MMAG Music Magpie** **

********

Updated charts published on : Anglo American, Aston Martin, Avacta, Empyrean, Firstgroup, Music Magpie,

LSE:AAL Anglo American. Close Mid-Price: 2478 Percentage Change: + 1.43% Day High: 2492.5 Day Low: 2444

In the event of Anglo American enjoying further trades beyond 2492.5, the ……..

</p

View Previous Anglo American & Big Picture ***

LSE:AML Aston Martin Close Mid-Price: 108.5 Percentage Change: -7.42% Day High: 117.3 Day Low: 106.8

Target met. Weakness on Aston Martin below 106.8 will invariably lead to ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:AVCT Avacta Close Mid-Price: 44.2 Percentage Change: -1.78% Day High: 45.5 Day Low: 42

Target met. Continued weakness against AVCT taking the price below 42 cal ……..

</p

View Previous Avacta & Big Picture ***

LSE:EME Empyrean Close Mid-Price: 0.25 Percentage Change: -7.41% Day High: 0.25 Day Low: 0.21

In the event Empyrean experiences weakness below 0.21 it calculates with ……..

</p

View Previous Empyrean & Big Picture ***

LSE:FGP Firstgroup Close Mid-Price: 140.6 Percentage Change: -1.95% Day High: 144.3 Day Low: 140.1

If Firstgroup experiences continued weakness below 140.1, it will invaria ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:MMAG Music Magpie. Close Mid-Price: 8.66 Percentage Change: + 50.61% Day High: 8.6 Day Low: 8.25

Target met. All Music Magpie needs are mid-price trades ABOVE 8.6 to impr ……..

</p

View Previous Music Magpie & Big Picture ***