#FTSE #GOLD Thursday was slightly interesting, the UK’s FTSE providing a pretty tame day against a backdrop of other markets looking strong. Of course, fully to blame for the lack of enthusiasm was the Bank of England, the organisation looking increasingly invested in keeping the country struggling, rather than use the tools at its disposal by decreasing interest rates. Meanwhile, across the pond, the USA suffered a vile 0.5% cut in rates. Even the European Central Bank opted for action, reducing their rate to 3.5% while the UK continues to be stifled at 5%.

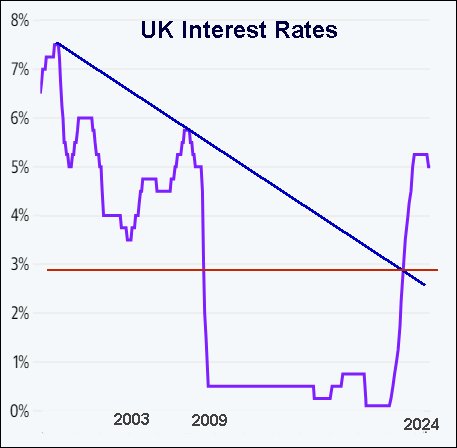

It was unusual, noting BoE claimed the drop in inflation to 2.2% was due to Inflationary Pressures easing due to the previous cut in rates. As a result, they somehow decided this was a perfect reason to further delay rate reductions for the present. What’s doubly foul is the trend suggests the UK should head to around 2.9%, this being our best guess due to the historical level of the trend break in 2021, when the BoE decided the best way to challenge inflation was to force prices up. It’s almost a surprise they didn’t advocate another increase in VAT or Fuel Duty in an attempt to further fight inflation by making the country poorer. At times, it feels like the Bank of England are populated by the type of people who often gravitate into politics, where the most important qualification seems to be active hatred of your own country!

We’d like to advocate Friday as looking quite positive for the FTSE but unfortunately, at time of writing, FTSE Futures are experiencing a bit of a hammering, trading around 8294 at time of writing. In many ways, this isn’t terribly encouraging carrying a vague threat of reversal down to 8270 points or so. Our current expectation is for the market to open down on Friday, ideally above 8270 points and spend the rest of the day exhibiting some recovery. On the basis the UK opens around 8300 points, we shall hope for gains during the morning toward an initial 8340 points. If bettered, our secondary is at 8374 points but we should also admit this gets close to a bigger picture value at 7403 and a visual chance of some hesitation, at least until next week.

If this triggers, the tightest stop loss level looks like 8270 points, an extremely kind risk/reward potential.

Our converse scenario looks at the risks should 8270 break as reversals to an initial 8236 points looks possible with our secondary, if broken, calculating at a less likely 8129 points.

Have a good weekend. Hopefully the Singapore Grand Prix produces its usual level of chaos and controversy…

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:16:40PM | BRENT | 7435.6 | 7255 | 7171 | 7322 | 7482 | 7584 | 7368 | |||

| 10:23:10PM | GOLD | 2586.34 | 2552 | 2526 | 2568 | 2595 | 2610 | 2560 | |||

| 11:00:58PM | FTSE | 8317.2 | 8299 | 8284 | 8337 | 8374 | 8392 | 8324 | Success | ||

| 11:04:09PM | STOX50 | 4934.5 | 4872 | 4848 | 4901 | 4957 | 4964 | 4919 | Success | ||

| 11:17:40PM | GERMANY | 18972 | 18806 | 18743 | 18900 | 19047 | 19168 | 18946 | Success | ||

| 11:24:50PM | US500 | 5712.5 | 5637 | 5597 | 5677 | 5735 | 5744 | 5708 | Success | ||

| 11:34:20PM | DOW | 42054.5 | 41571 | 41543 | 41785 | 42179 | 42304 | 41977 | ‘cess | ||

| 11:38:42PM | NASDAQ | 19818 | 19724 | 19663 | 19845 | 19960 | 20201 | 19819 | Success | ||

| 11:42:43PM | JAPAN | 37687 | 37033 | 36732 | 37370 | 37929 | 38233 | 37560 | Success |

19/09/2024 FTSE Closed at 8328 points. Change of 0.91%. Total value traded through LSE was: £ 6,494,685,893 a change of -5.91%

18/09/2024 FTSE Closed at 8253 points. Change of -0.67%. Total value traded through LSE was: £ 6,902,679,441 a change of 22.65%

17/09/2024 FTSE Closed at 8309 points. Change of 0.37%. Total value traded through LSE was: £ 5,628,109,018 a change of 50.11%

16/09/2024 FTSE Closed at 8278 points. Change of 0.06%. Total value traded through LSE was: £ 3,749,335,232 a change of -16.44%

13/09/2024 FTSE Closed at 8273 points. Change of 0.4%. Total value traded through LSE was: £ 4,486,905,265 a change of -19.07%

12/09/2024 FTSE Closed at 8240 points. Change of 0.57%. Total value traded through LSE was: £ 5,544,211,682 a change of 9.81%

11/09/2024 FTSE Closed at 8193 points. Change of -0.15%. Total value traded through LSE was: £ 5,048,721,179 a change of -0.13%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:BBY BALFOUR BEATTY** **LSE:CNA Centrica** **LSE:EXPN Experian** **LSE:FGP Firstgroup** **LSE:GRG Greggs** **LSE:IAG British Airways** **LSE:MKS Marks and Spencer** **LSE:OCDO Ocado Plc** **LSE:PMG Parkmead** **LSE:RR. Rolls Royce** **

********

Updated charts published on : Aston Martin, BALFOUR BEATTY, Centrica, Experian, Firstgroup, Greggs, British Airways, Marks and Spencer, Ocado Plc, Parkmead, Rolls Royce,

LSE:AML Aston Martin. Close Mid-Price: 169 Percentage Change: + 2.61% Day High: 171 Day Low: 162.8

Target met. In the event of Aston Martin enjoying further trades beyond 1 ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 436.6 Percentage Change: + 1.63% Day High: 439.8 Day Low: 430

Target met. Further movement against BALFOUR BEATTY ABOVE 439.8 should im ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 118.35 Percentage Change: + 0.17% Day High: 121.4 Day Low: 115.85

Continued weakness against CNA taking the price below 115.85 calculates a ……..

</p

View Previous Centrica & Big Picture ***

LSE:EXPN Experian. Close Mid-Price: 3878 Percentage Change: + 2.29% Day High: 3892 Day Low: 3801

Target met. All Experian needs are mid-price trades ABOVE 3892 to improve ……..

</p

View Previous Experian & Big Picture ***

LSE:FGP Firstgroup Close Mid-Price: 153.8 Percentage Change: -1.73% Day High: 156.8 Day Low: 145.7

In the event Firstgroup experiences weakness below 145.7 it calculates wi ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:GRG Greggs. Close Mid-Price: 3190 Percentage Change: + 0.76% Day High: 3222 Day Low: 3168

Further movement against Greggs ABOVE 3222 should improve acceleration to ……..

</p

View Previous Greggs & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 208.1 Percentage Change: + 0.87% Day High: 209.8 Day Low: 207.5

All British Airways needs are mid-price trades ABOVE 209.8 to improve ac ……..

</p

View Previous British Airways & Big Picture ***

LSE:MKS Marks and Spencer. Close Mid-Price: 369.2 Percentage Change: + 0.49% Day High: 376.1 Day Low: 367.5

Further movement against Marks and Spencer ABOVE 376.1 should improve acc ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:OCDO Ocado Plc. Close Mid-Price: 359.3 Percentage Change: + 2.77% Day High: 411 Day Low: 355.8

In the event of Ocado Plc enjoying further trades beyond 411, the share s ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:PMG Parkmead Close Mid-Price: 8.25 Percentage Change: -10.81% Day High: 9.25 Day Low: 8.25

Target met. Continued weakness against PMG taking the price below 8.25 ca ……..

</p

View Previous Parkmead & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 525 Percentage Change: + 5.85% Day High: 525 Day Low: 499

Target met. In the event of Rolls Royce enjoying further trades beyond 52 ……..

</p

View Previous Rolls Royce & Big Picture ***