#FTSE #WallSt As the world dangerously sneaks up on the awful August break from Formula1 with only the usually chaotic Belgian GP to follow Hungary this weekend, then a hiatus for four boring weeks. Usually, we dread August for another reason as it’s generally clear the markets are really on holiday with interns manning the controls. Unfortunately, this has felt to be the case since the start of June this year but there’s been a couple of notable differences.

For instance, on Thursday, we advised clients the FTSE expected gains but the USA looked quite dodgy. This is quite unusual as the FTSE will generally exploit whatever has given the US a doze of collywobbles, ensuring a terrible session. Instead, as expected, the FTSE ended the day in positive territory while North American markets were clearly being guarded by the countries Secret Service, all ending the session in the Red. And oddly, that sentence was not a carefully contrived joke! Anyway, in more important news, it’s possible Scotland has exported some wet weather to Hungary, so perhaps this Grand Prix shall also be worth watching.

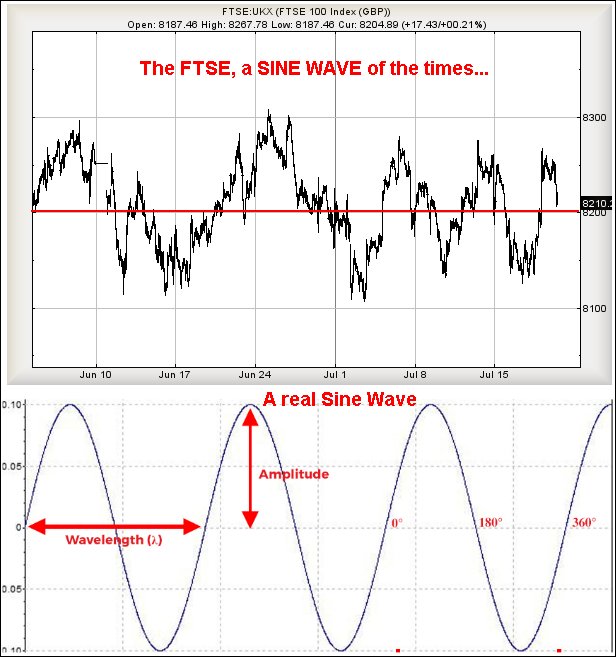

As for the FTSE, market behaviour since the start of June has been truly awful. The chart below shows in minute-by-minute mode, how pathetic the market has been. We’d initially assumed this was something to do with the UK General Election but such a notion looks erroneous. Are we to experience an even worse August or did everyone decide to take 3 months off this year? We want to make fun of the movement pattern, calling it a Sine Wave but a Sine Wave should be measurable in Wavelength, the distance between two peaks, and the FTSE clearly dodges such an accusation. However, it does come close in terms of Amplitude, the distance between the median and the highs. About the only conclusion which can be drawn is of time not mattering to the markets, only the variance above and below a roughly 8200 points pivot level.

What’s the point of knowing this?

When it happens, a trader can enjoy a (usually brief) period when switching from short to long positions. Our rule of thumb is to allow for 3 peaks, then distrust everything. But in this instance, the FTSE has been playing ball through an amazing 5 peaks so far. And if our suspicion of August being pretty rubbish, this state of affairs could easily continue, after a doubtless short period when the market will throw all the toys out before reverting to placid behaviour again.

FTSE for FRIDAY. If we’re right with the voodoo science above, it will actually make a fair bit of sense if the FTSE opens Friday around 8195 points, then experiences a surprising bounce to around 8223 points. If bettered, our secondary works out at 8244 points and a price level where the market could stutter a bit. While visually this makes zero sense, it is certainly a theory and one which allows a super tight stop loss at 8187 points. Our reasoning behind this outlandish idea is due to the market having a history since June of reverting to the median level of 8200, then bouncing before a proper reversal.

Of course, we’ve a converse scenario we can present and it kicks into life, if the FTSE (do remember, we are talking about the actual market, not before or after hours futures) manages below 8187 points, it risks triggering reversal to an initial 8147 with our secondary, if broken, at 8105 points.

Hopefully it’s a good weekend for everyone, hopefully its a good Grand Prix and Louis Hamilton wins again, and hopefully we don’t end up covered in egg due to the scenario above!

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:25:58PM | BRENT | 8422 | 8375 | 8343 | 8512 | 8532 | 8565 | 8411 | |||

| 11:29:20PM | GOLD | 2444.24 | 2440 | 2432 | 2453 | 2484 | 2489 | 2456 | ‘cess | ||

| 11:32:12PM | FTSE | 8173.9 | 8158 | 8148 | 8190 | 8205 | 8224 | 8183 | Success | ||

| 11:35:04PM | STOX50 | 4870 | 4869 | 4854 | 4887 | 4894 | 4905 | 4866 | |||

| 11:39:39PM | GERMANY | 18333.4 | 18290 | 18280 | 18381 | 18381 | 18423 | 18336 | |||

| 11:48:17PM | DOW | 40704 | 40590 | 40486 | 40760 | 40949 | 41093 | 40794 | |||

| 11:45:26PM | US500 | 5555.2 | 5542 | 5526 | 5567 | 5568 | 5580 | 5542 | Success | ||

| 12:01:44AM | NASDAQ | 19778.5 | 19735 | 19587 | 19833 | 19973 | 20140 | 19832 | ‘cess | ||

| 12:06:00AM | JAPAN | 40127 | 39863 | 39770 | 40164 | 40421 | 40586 | 40187 | ‘cess |

18/07/2024 FTSE Closed at 8204 points. Change of 0.21%. Total value traded through LSE was: £ 4,278,080,573 a change of -5.62%

17/07/2024 FTSE Closed at 8187 points. Change of 0.28%. Total value traded through LSE was: £ 4,532,847,996 a change of 7.45%

16/07/2024 FTSE Closed at 8164 points. Change of -0.22%. Total value traded through LSE was: £ 4,218,485,938 a change of -1.45%

15/07/2024 FTSE Closed at 8182 points. Change of -0.85%. Total value traded through LSE was: £ 4,280,715,319 a change of 2.74%

12/07/2024 FTSE Closed at 8252 points. Change of 0.35%. Total value traded through LSE was: £ 4,166,551,953 a change of -13.98%

11/07/2024 FTSE Closed at 8223 points. Change of 0.37%. Total value traded through LSE was: £ 4,843,565,860 a change of 2.51%

10/07/2024 FTSE Closed at 8193 points. Change of 0.66%. Total value traded through LSE was: £ 4,725,141,160 a change of -14.23%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BARC Barclays** **LSE:BBY BALFOUR BEATTY** **LSE:BLOE Block Energy PLC** **LSE:CEY Centamin** **LSE:IDS International Distribution** **LSE:ITV ITV** **LSE:NWG Natwest** **LSE:SBRY Sainsbury** **LSE:TSCO Tesco** **

********

Updated charts published on : Barclays, BALFOUR BEATTY, Block Energy PLC, Centamin, International Distribution, ITV, Natwest, Sainsbury, Tesco,

LSE:BARC Barclays Close Mid-Price: 228.6 Percentage Change: -0.91% Day High: 234.3 Day Low: 228.4

Target met. All Barclays needs are mid-price trades ABOVE 234.3 to improv ……..

</p

View Previous Barclays & Big Picture ***

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 413.6 Percentage Change: + 1.27% Day High: 415.6 Day Low: 408

Further movement against BALFOUR BEATTY ABOVE 415.6 should improve accele ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:BLOE Block Energy PLC Close Mid-Price: 0.92 Percentage Change: -7.50% Day High: 1 Day Low: 0.92

Weakness on Block Energy PLC below 0.92 will invariably lead to 0.82p wit ……..

</p

View Previous Block Energy PLC & Big Picture ***

LSE:CEY Centamin Close Mid-Price: 132.9 Percentage Change: -0.23% Day High: 134.1 Day Low: 131.8

In the event of Centamin enjoying further trades beyond 134.1, the share ……..

</p

View Previous Centamin & Big Picture ***

LSE:IDS International Distribution. Close Mid-Price: 342 Percentage Change: + 1.79% Day High: 342.8 Day Low: 335

All International Distribution needs are mid-price trades ABOVE 342.8 to ……..

</p

View Previous International Distribution & Big Picture ***

LSE:ITV ITV. Close Mid-Price: 84.5 Percentage Change: + 1.38% Day High: 85.5 Day Low: 83.3

Target met. In the event of ITV enjoying further trades beyond 85.5, the ……..

</p

View Previous ITV & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 336.3 Percentage Change: + 2.41% Day High: 337.2 Day Low: 330.6

Target met. Continued trades against NWG with a mid-price ABOVE 337.2 sho ……..

</p

View Previous Natwest & Big Picture ***

LSE:SBRY Sainsbury. Close Mid-Price: 271 Percentage Change: + 1.80% Day High: 270.8 Day Low: 266.6

Target met. In the event of Sainsbury enjoying further trades beyond 270. ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:TSCO Tesco. Close Mid-Price: 324.9 Percentage Change: + 1.03% Day High: 324.3 Day Low: 321.2

Target met. All Tesco needs are mid-price trades ABOVE 324.3 to improve a ……..

</p

View Previous Tesco & Big Picture ***