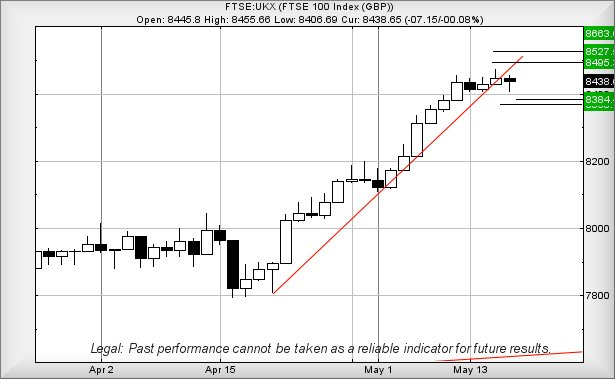

#FTSE #GOLD For some reason, since May 10th the FTSE feels like it has decided to stop useful movement. To judge by the immediate uptrend, it looks like we’re supposed to believe everything is about to go wrong, the FTSE piercing the red uptrend line. As always, we’ve got a “however” we can wheel out and and dust off as we’re not entirely convinced by the market hesitation.

With the shambolic UK political situation managing to echo the USA with the none of the leaders or prospective leaders covering themselves in glory, it’s difficult to believe FTSE behaviour can be influenced by political promises and rumours. Perhaps this shall change, once the UK discovers the courage to actually call an election and once this kicks off, it’ll doubtless only be a matter of days before one of the UK protagonists looks at America and comes out with a good idea, building a big wall down the middle of the English Channel or resurrecting some of the WW2 invasion defences on the southern shoreline of the UK…

Whatever the real reason for the current FTSE hiatus, our inclination is to suspect we’re simply watching a “pause for thought” on a market which has underlying upward force. About the biggest danger (aside from world events) faced still looks like Brent Crude wants to retreat to the $77 level. Obviously, should this occur, a knock-on effect against the price of oil sector shares shall doubtless provoke a stall on the FTSE but until oil makes its move downward, we’re not holding our breath.

Near term, it feels like above 8471 points should next trigger FTSE growth to an initial 8495 points with our secondary, if bettered, at 8527 points. Should this scenario kick into life, the tightest stop loss level is almost too attractive at just 8450 points.

Our converse scenario is equally tight, reversals below just 8417 risking triggering a drop to an initial 8384 points with our secondary, if broken, at a nearby 8368 points. The close proximity of these target levels suggest some sort of surprise bounce should be expected.

As the month continues, one interesting feature is making itself known and that’s the “ruling target” level, a number which has been repeatedly calculated just above the 8600 level. Finally, we managed to retrieve the same answer against several different scenario and it’s giving 8663 points as the overall point of interest on the current cycle, a market level where some volatility can be expected. Hopefully it’s not caused by rioting outside the BBC, when they next televise the newest terrible Dr Who production.

Have a good weekend and enjoy the Grand Prix.

,

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:40:56PM | BRENT | 8328 | 8282 | 8095 | 7736 | 8380 | 8320 | 8355 | 8401 | 8290 | ‘cess |

| 10:44:00PM | GOLD | 2376.01 | 2371 | 2361 | 2349 | 2384 | 2399 | 2407 | 2426 | 2380 | ‘cess |

| 10:54:06PM | FTSE | 8423.1 | 8420 | 8398 | 8370 | 8440 | 8458 | 8480 | 8505 | 8438 | ‘cess |

| 10:57:41PM | STOX50 | 5048.4 | 5053 | 5044 | 5034 | 5071 | 5093 | 5102 | 5173 | 5073 | ‘cess |

| 11:02:14PM | GERMANY | 18678.5 | 18680 | 18653 | 18592 | 18757 | 18763 | 18794 | 18832 | 18712 | ‘cess |

| 11:06:15PM | US500 | 5296 | 5292 | 5287 | 5274 | 5313 | 5326 | 5356 | 5418 | 5292 | |

| 11:08:43PM | DOW | 39864.5 | 39844 | 39814 | 39733 | 39980 | 40057 | 40084 | 40164 | 39965 | |

| 11:11:54PM | NASDAQ | 18548 | 18542 | 18521 | 18495 | 18594 | 18654 | 18700 | 18753 | 18584 | |

| 11:13:58PM | JAPAN | 38539 | 38525 | 38400 | 38208 | 38635 | 38641 | 38684 | 38738 | 38575 | ‘cess |

16/05/2024 FTSE Closed at 8438 points. Change of -0.08%. Total value traded through LSE was: £ 5,669,902,118 a change of -17.37%

15/05/2024 FTSE Closed at 8445 points. Change of 0.2%. Total value traded through LSE was: £ 6,861,663,966 a change of 1.88%

14/05/2024 FTSE Closed at 8428 points. Change of 0.17%. Total value traded through LSE was: £ 6,735,233,272 a change of 43.21%

13/05/2024 FTSE Closed at 8414 points. Change of -0.23%. Total value traded through LSE was: £ 4,703,191,844 a change of -3.6%

10/05/2024 FTSE Closed at 8433 points. Change of 0.62%. Total value traded through LSE was: £ 4,878,616,617 a change of -3.08%

9/05/2024 FTSE Closed at 8381 points. Change of 0.32%. Total value traded through LSE was: £ 5,033,811,028 a change of -35.46%

8/05/2024 FTSE Closed at 8354 points. Change of -100%. Total value traded through LSE was: £ 7,799,424,670 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:FOXT Foxtons** **LSE:HL. Hargreaves Lansdown** **LSE:IGG IG Group** **LSE:IQE IQE** **LSE:NG. National Glib** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:STAN Standard Chartered** **

********

Updated charts published on : Foxtons, Hargreaves Lansdown, IG Group, IQE, National Glib, Scottish Mortgage Investment Trust, Standard Chartered,

LSE:FOXT Foxtons Close Mid-Price: 67.2 Percentage Change: -1.75% Day High: 69.6 Day Low: 67

Target met. Further movement against Foxtons ABOVE 70p should improve acce ……..

</p

View Previous Foxtons & Big Picture ***

LSE:HL. Hargreaves Lansdown. Close Mid-Price: 903.2 Percentage Change: + 0.20% Day High: 905.8 Day Low: 880

Target met. All Hargreaves Lansdown needs are mid-price trades ABOVE 905. ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 791.5 Percentage Change: + 0.38% Day High: 794.5 Day Low: 789

Further movement against IG Group ABOVE 794.5 should improve acceleration ……..

</p

View Previous IG Group & Big Picture ***

LSE:IQE IQE Close Mid-Price: 32.25 Percentage Change: -0.15% Day High: 33.25 Day Low: 31.65

Further movement against IQE ABOVE 33.25 should improve acceleration towa ……..

</p

View Previous IQE & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1142.5 Percentage Change: + 0.53% Day High: 1144.5 Day Low: 1133.5

All National Glib needs are mid-price trades ABOVE 1144.5 to improve acce ……..

</p

View Previous National Glib & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust Close Mid-Price: 894.6 Percentage Change: -0.25% Day High: 901.6 Day Low: 891

Further movement against Scottish Mortgage Investment Trust ABOVE 901.6 s ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 785.8 Percentage Change: + 1.50% Day High: 796 Day Low: 772.8

Target met. All Standard Chartered needs are mid-price trades ABOVE 796 t ……..

</p

View Previous Standard Chartered & Big Picture ***