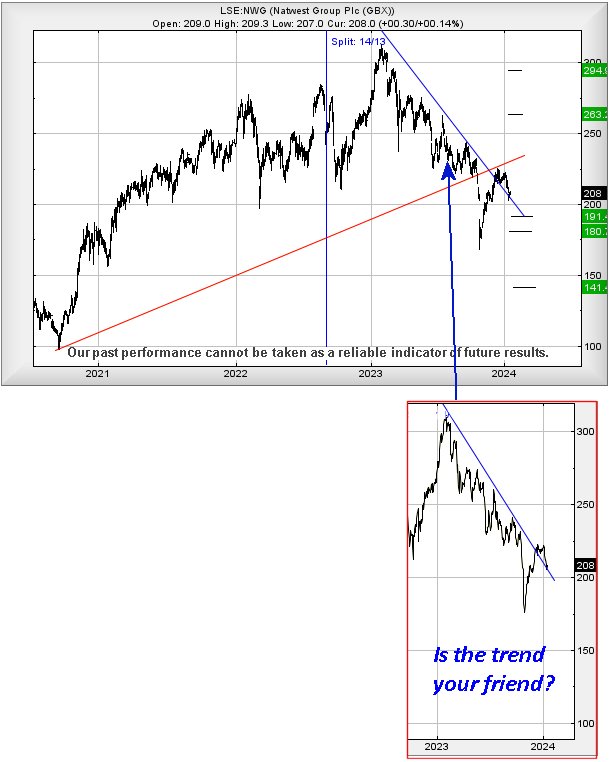

#Brent #WallSt March 2007 was an interesting year, a time which gave birth to the Blue downtrend on the NatWest chart. It’d be reasonable to question whether a ridiculous 18 year old chart has any relevance but when we delve into how the market was treating Natwest during 2023 and current, you’d need the moral intellect of a Post Office senior manager to deny the evidence of the last 12 months.

As someone who’s been involved with software design for rather a long time, the original article in Computer Weekly made fascinating reading, a memorable disaster clearly waiting to happen. It was obvious the sub-post masters were the victims of a corporate body determined to defend a faulty product, rather than take any action. As the years went by and prosecutions and deaths continued, any occasional article in the media was once again rebutted by the Post Office defending their “robust” system. Essentially, it was a case where no-one now dared admit to a terrible mistake and now, it’s unlikely anyone senior in the organisation shall suffer the deserved consequences of their often corrupt practices.

Which takes us back to 2007 and the dawn of the banking shambles. Aside from the odd knighthood being rescinded, the banking industry in the UK managed to find itself insulated from blame, a quite different set of circumstances to Europe and the USA. Even Iceland discovered the urge to charge several senior members of their banking community.

If this Blue line is the stick with which Natwest continues to be beaten, the market has been doing a fascinating job assuring us of its importance. In December, the share price broke above the trend but price movements in recent days indicate some alarm, almost promising weakness next below 203p shall provoke reversal to an initial 191p with secondary, if broken, at 180p and hopefully a rebound. There’s a dangerous implication, should the share value close a session below 180p and a sharp reversal to a bottom at 141p becomes possible.

However, the index has been throwing plenty of trend break signals at us, all of which conspire to suggest above 225p shall promote price recovery to 263p with secondary, if beaten, an encouraging 294p along with an urgent need for us to again review the tea leaves.

For now, we think it intends 180p.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 10:45:45PM | BRENT | 7341.3 | 7320 | 7303 | 7250 | 7356 | 7405 | 7461 | 7628 | 7342 |

| 10:48:25PM | GOLD | |||||||||

| 10:50:24PM | FTSE | |||||||||

| 10:52:58PM | STOX50 | |||||||||

| 10:54:44PM | GERMANY | |||||||||

| 11:34:11PM | US500 | |||||||||

| 11:37:30PM | DOW | 37900.8 | 37423 | 37208 | 36962 | 37560 | 37940 | 38037 | 38166 | 37833 |

| 11:42:16PM | NASDAQ | |||||||||

| 11:44:10PM | JAPAN |

19/01/2024 FTSE Closed at 7461 points. Change of 0.03%. Total value traded through LSE was: £ 6,017,076,844 a change of 5.37%

18/01/2024 FTSE Closed at 7459 points. Change of 0.17%. Total value traded through LSE was: £ 5,710,434,313 a change of 4.63%

17/01/2024 FTSE Closed at 7446 points. Change of -1.48%. Total value traded through LSE was: £ 5,457,663,350 a change of -3.81%

16/01/2024 FTSE Closed at 7558 points. Change of -0.47%. Total value traded through LSE was: £ 5,673,801,232 a change of 52.3%

15/01/2024 FTSE Closed at 7594 points. Change of -0.39%. Total value traded through LSE was: £ 3,725,366,941 a change of -35.31%

12/01/2024 FTSE Closed at 7624 points. Change of 0.63%. Total value traded through LSE was: £ 5,758,721,485 a change of -30.28%

11/01/2024 FTSE Closed at 7576 points. Change of -0.98%. Total value traded through LSE was: £ 8,259,450,269 a change of 68.77%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:DGE Diageo** **LSE:FRES Fresnillo** **LSE:GLEN Glencore Xstra** **LSE:IHG Intercontinental Hotels Group** **LSE:ITM ITM Power** **

********

Updated charts published on : Diageo, Fresnillo, Glencore Xstra, Intercontinental Hotels Group, ITM Power,

LSE:DGE Diageo Close Mid-Price: 2715.5 Percentage Change: -0.62% Day High: 2762.5 Day Low: 2699.5

Weakness on Diageo below 2699.5 will invariably lead to 2603p with second ……..

</p

View Previous Diageo & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 477 Percentage Change: -1.16% Day High: 490.4 Day Low: 476.7

Continued weakness against FRES taking the price below 476.7 calculates a ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GLEN Glencore Xstra Close Mid-Price: 412.3 Percentage Change: -1.80% Day High: 421.95 Day Low: 411.45

In the event Glencore Xstra experiences weakness below 411.45 it calculat ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 7422 Percentage Change: + 1.06% Day High: 7474 Day Low: 7282

Target met. Continued trades against IHG with a mid-price ABOVE 7474 shou ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:ITM ITM Power Close Mid-Price: 46.95 Percentage Change: -8.01% Day High: 51.72 Day Low: 46.87

Target met. Weakness on ITM Power below 46.87 will invariably lead to 44. ……..

</p

View Previous ITM Power & Big Picture ***