#FTSE #Stoxx50 We’ve had a flurry of email requests and decided to bundle these two together as they are completely diverse. Chemring, a company which should flourish in an era of armed conflict and Eurobox, a company whose only area of conflict is with good taste. Their existence is based on the hideous modern design of warehouses, the big flat box design forgetting humans have to interact with the lack of visual aesthetics.

By all means, the interior shape should be logical but the exterior could reflect tasteful architecture rather than exhibit less design than an empty Amazon box. However, it’s easy to suspect we shall witness more of this abandonment of taste as the current demise of “WeWork” permeates, the move to working from home rendering city tower offices a thing of the past in an incredibly short period of time. But nothing is standing in the way of these flat pack office complexes, quickly thrown up in the suburbs.

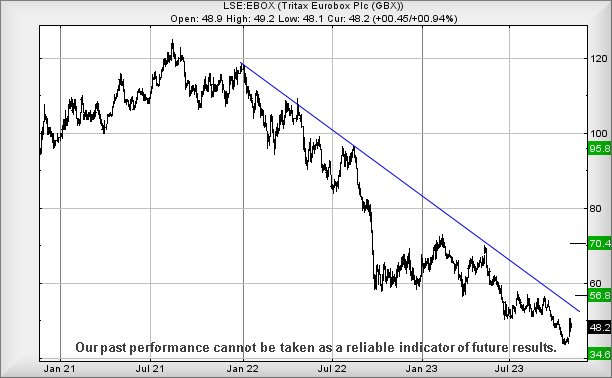

There’s a particular type of price reversal we intensely dislike, often suspecting it’s to do with market manipulation rather than any solid excuse for reversal. Obviously, this is the UK and as such, such a scenario is impossible, but if it were to happen, Ebox presents a perfect “case in point”. Logically it shouldn’t have reached the 43p level recently but it did, thanks to what feels like a very obvious level of manual control. The 43p level has certainly provoked a half hearted bounce but the greater danger comes with any future break of 43p as further reversal to an ultimate bottom 34p is expected, along with another attempt at a rebound.

However, the lacklustre bounce from 43p does provide some immediate hope as above 51p now calculates with the potential of a lift to an initial 56p with our longer term secondary, if exceeded, coming in at a more useful 70p, along with some hesitation in any rise, if only due to the share price experiencing historical reticence at such a level. This time around, we’d suspect any stutters shall prove to be short lived as the price shall be viewed as breaking free from the downtrend since the start of 2022.

Chemring Group, doubtless doing well due to the wars taking place, have a website which is surely worth a visit. They are a company we’ve long known about, yet been unaware of the extent to their activities. They even make the countermeasure flares for F-35 aircraft, probably the most sophisticated fireworks on the planet. From a personal perspective, it’s nice how they reframe the word “explosive” as “energetic materials”, making me wonder if I could get away with describing one of my compressed air cola bottle targets as “an energetic material” when it detonates with a flurry of chalk powder going everywhere. Somehow, it’s doubtful my wife would accept the name change for the hysterical bang.

Their share price has proven quite tranquil during 2023. From looking at the pattern of price movement, it looks like the share need only exceed 299p to trigger fairly near term gains to an initial 325p with out longer term secondary, if exceeded, working out at a future 365p.

If everything intends go wrong, the share price requires to descend below 265p to potentially trigger reversal to an initial 235p with our secondary, if broken, calculating at an impossible looking 130p. Who knows, it may be the case military organisations are still using their stored “energetic materials” and fireworks, not yet in the position of re-ordering stocks for their warehouses?

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:21:52PM | BRENT | 81.6 | Success | ||||||||

| 9:25:25PM | GOLD | 1969.29 | Success | ||||||||

| 9:54:04PM | FTSE | 7407 | 7394 | 7385 | 7368 | 7414 | 7438 | 7460 | 7482 | 7407 | |

| 9:57:04PM | STOX50 | 4153 | 4133 | 4120 | 4095 | 4163 | 4168 | 4175 | 4189 | 4142 | ‘cess |

| 10:03:51PM | GERMANY | 15158 | Shambles | ||||||||

| 10:06:21PM | US500 | 4383 | |||||||||

| 10:08:38PM | DOW | 34171.9 | |||||||||

| 10:10:41PM | NASDAQ | 15308 | ‘cess | ||||||||

| 10:13:26PM | JAPAN | 32478 | Success |

7/11/2023 FTSE Closed at 7410 points. Change of -0.09%. Total value traded through LSE was: £ 4,375,663,657 a change of 7.72%

6/11/2023 FTSE Closed at 7417 points. Change of 0%. Total value traded through LSE was: £ 4,062,204,136 a change of -15.12%

3/11/2023 FTSE Closed at 7417 points. Change of -0.39%. Total value traded through LSE was: £ 4,785,653,725 a change of -23.42%

2/11/2023 FTSE Closed at 7446 points. Change of 1.42%. Total value traded through LSE was: £ 6,249,429,649 a change of 34.92%

1/11/2023 FTSE Closed at 7342 points. Change of 0.29%. Total value traded through LSE was: £ 4,632,018,053 a change of -20.08%

31/10/2023 FTSE Closed at 7321 points. Change of -0.08%. Total value traded through LSE was: £ 5,795,517,732 a change of 15.68%

30/10/2023 FTSE Closed at 7327 points. Change of 0.49%. Total value traded through LSE was: £ 5,010,011,648 a change of 25.72%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:AZN Astrazeneca** **LSE:BDEV Barrett Devs** **LSE:CPI Capita** **LSE:QED Quadrise** **LSE:RR. Rolls Royce** **

********

Updated charts published on : Asos, Astrazeneca, Barrett Devs, Capita, Quadrise, Rolls Royce,

LSE:ASC Asos. Close Mid-Price: 397.9 Percentage Change: + 2.10% Day High: 403 Day Low: 386.3

In the event of Asos enjoying further trades beyond 403, the share should ……..

</p

View Previous Asos & Big Picture ***

LSE:AZN Astrazeneca Close Mid-Price: 10230 Percentage Change: -0.45% Day High: 10290 Day Low: 10146

Continued weakness against AZN taking the price below 10146 calculates as ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BDEV Barrett Devs. Close Mid-Price: 449.7 Percentage Change: + 2.25% Day High: 453.8 Day Low: 437.9

Continued trades against BDEV with a mid-price ABOVE 453.8 should improve ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:CPI Capita. Close Mid-Price: 18.12 Percentage Change: + 0.89% Day High: 18.44 Day Low: 17.68

Continued trades against CPI with a mid-price ABOVE 18.44 should improve ……..

</p

View Previous Capita & Big Picture ***

LSE:QED Quadrise. Close Mid-Price: 1.34 Percentage Change: + 9.84% Day High: 1.4 Day Low: 1.24

Further movement against Quadrise ABOVE 1.4 should improve acceleration t ……..

</p

View Previous Quadrise & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 226 Percentage Change: + 0.85% Day High: 227.1 Day Low: 223.7

All Rolls Royce needs are mid-price trades ABOVE 227.1 to improve acceler ……..

</p

View Previous Rolls Royce & Big Picture ***