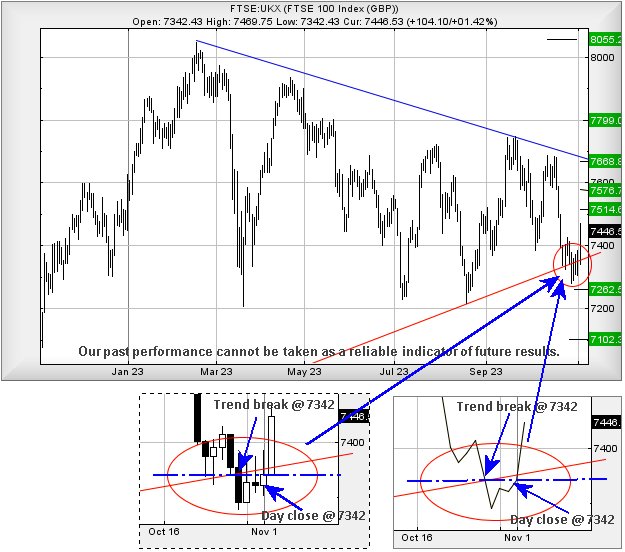

#FTSE #GOLD We often comment about the markets sense of humour and in this instance, the FTSE has everyone laughing in the aisles. Last Friday, the FTSE made a movement which looked like the first shot in triggering a period of severe reversals with a drop target level around 7100 points. The reversal potentials were even confirmed as recently as Wednesday with the index closing the day at 7342 points, quite literally exactly the level of trend break.

This sort of thing, from our “charty” perspective, is quite a big deal. We always argue if a price closes a session above the level of trend break, in the immediate instance of the FTSE, the market wasn’t giving anything away until Thursday. Despite intraday values scurrying above the trend, we’ve learned to treat a break seriously until such time the market closes above the level of the break and in this instance, it was at 7342 points. As we mentioned, we regard the index as having a sense of humour, often suspecting intraday spikes are designed to confuse traders and in this case, “they” played a blinder. It for this reason we insist on playing safe with our demand to see a price CLOSE above certain levels, rather than blithely trust intraday traffic.

The foregoing suggests we should anticipate market gains for Friday, if only due to the FTSE undoing the damage from a week ago. We work on the basis we’re not the only folk with a drawer of Red crayons and it’s likely some optimism will enter the day. If anyone is feeling nervous, we’re happy to supply some “Lucky White Heather” as this year, our garden has produced indecent amounts of the stuff. Though we suspect it’s probably got more to do with the incessant rain here in Argyll… Perhaps also, the fact a personal issue with insect bites ensured the bush beds in the garden were assiduously avoided this year from June onward, the risk of sepsis being a very real issue if further numbers of insects chose to dine on this writers very desirable blood. While this has created an “out of control” visual, a brutal add-on to the garden strimmer is about to resolve the issue and thankfully, we’ve got the sea outside in which to dump plant debris.

In the event the FTSE exceeds 7474 points, ideally NOT with a spike upward in the opening second of trade, it’s liable to trigger market gains in the direction of an initial 7514 points. Should such a level be exceeded, our secondary works out at 7576 points. In a normal situation, we’d be quite reticent about this secondary ambition as the FTSE tends not to be a market which gifts back to back 100+ point days but in this instance, we’ll dispense with our usual cautionary statements, instead hoping for the best. Unfortunately, if positive movement does trigger, the tightest safe stop loss level is quite silly, down at 7360 points. There’s a chance below 7380 will give early warning of things going utterly wrong but, with the level of gains available, ‘with great reward comes great risk’, to paraphrase Spiderman.

Below 7360 would certainly be troubling, risking triggering reversal down to an initial 7262 with secondary, if broken, now calculating at 7102 points. Visually this scenario appears unlikely but, as the Covid-19 enquiry is showing, things are rarely what they seem.

Have a good weekend and hopefully the Brazil Grand Prix turns out to be a good one.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 8:52:42PM | BRENT | 8665 | 8447 | 8409 | 8554 | 8689 | 8722 | 8648 | ‘cess | ||

| 8:55:54PM | GOLD | 1985.2 | 1976 | 1969 | 1982 | 1992 | 1996 | 1985 | |||

| 8:58:48PM | FTSE | 7467.8 | 7374 | 7333 | 7400 | 7474 | 7506 | 7434 | Success | ||

| 9:00:59PM | STOX50 | 4187 | 4114 | 4082 | 4131 | 4190 | 4204 | 4160 | |||

| 9:09:14PM | GERMANY | 15219.4 | 15122 | 15093 | 15192 | 15228 | 15263 | 15124 | Success | ||

| 9:12:41PM | US500 | 4314.3 | 4244 | 4211 | 4265 | 4321 | 4355 | 4291 | Success | ||

| 9:15:17PM | DOW | 33839 | 33285 | 33173 | 33401 | 33868 | 33947 | 33603 | Success | ||

| 9:18:28PM | NASDAQ | 14890.9 | 14706 | 14683 | 14783 | 14941 | 15112 | 14836 | ‘cess | ||

| 9:21:42PM | JAPAN | 32321 | 31829 | 31698 | 31989 | 32361 | 32645 | 32115 |

2/11/2023 FTSE Closed at 7446 points. Change of 1.42%. Total value traded through LSE was: £ 6,249,429,649 a change of 34.92%

1/11/2023 FTSE Closed at 7342 points. Change of 0.29%. Total value traded through LSE was: £ 4,632,018,053 a change of -20.08%

31/10/2023 FTSE Closed at 7321 points. Change of -0.08%. Total value traded through LSE was: £ 5,795,517,732 a change of 15.68%

30/10/2023 FTSE Closed at 7327 points. Change of 0.49%. Total value traded through LSE was: £ 5,010,011,648 a change of 25.72%

27/10/2023 FTSE Closed at 7291 points. Change of -0.86%. Total value traded through LSE was: £ 3,985,095,310 a change of -23.59%

26/10/2023 FTSE Closed at 7354 points. Change of -0.81%. Total value traded through LSE was: £ 5,215,729,676 a change of -2.48%

25/10/2023 FTSE Closed at 7414 points. Change of 0.34%. Total value traded through LSE was: £ 5,348,410,782 a change of 19.98%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CPI Capita** **LSE:FGP Firstgroup** **LSE:IAG British Airways** **LSE:RR. Rolls Royce** **LSE:SCLP Scancell** **LSE:TRN The Trainline** **

********

Updated charts published on : Capita, Firstgroup, British Airways, Rolls Royce, Scancell, The Trainline,

LSE:CPI Capita. Close Mid-Price: 17.25 Percentage Change: + 2.01% Day High: 17.44 Day Low: 16.58

Further movement against Capita ABOVE 17.44 should improve acceleration t ……..

</p

View Previous Capita & Big Picture ***

LSE:FGP Firstgroup. Close Mid-Price: 163.2 Percentage Change: + 1.56% Day High: 162.3 Day Low: 158.6

Target met. All Firstgroup needs are mid-price trades ABOVE 162.3 to impr ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 147.7 Percentage Change: + 2.04% Day High: 149.85 Day Low: 145.85

Continued trades against IAG with a mid-price ABOVE 149.85 should improve ……..

</p

View Previous British Airways & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 223.6 Percentage Change: + 1.50% Day High: 225.6 Day Low: 221.5

Further movement against Rolls Royce ABOVE 225.6 should improve accelerat ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SCLP Scancell Close Mid-Price: 12.25 Percentage Change: -1.01% Day High: 12.38 Day Low: 12.12

Continued weakness against SCLP taking the price below 12.12 calculates a ……..

</p

View Previous Scancell & Big Picture ***

LSE:TRN The Trainline. Close Mid-Price: 284.2 Percentage Change: + 8.14% Day High: 296 Day Low: 264

Target met. Continued trades against TRN with a mid-price ABOVE 296 shoul ……..

</p

View Previous The Trainline & Big Picture ***