#FTSE #Nasdaq UK merchant banker, Close Brothers, are fascinating. Regular readers will know of our weakness for the TV program Gold Rush but we were completely unaware Close Brothers made it all possible. It all started, when they bunged the US Government 10 thousand pounds for the right to build a railway into the heart of the Yukon in Alaska. From reading about the task, they’d probably have found constructing an upside down full replica of the Great Pyramid easier.

The company ever financed steamboats to transport budding millionaires up the River Yukon to the main goldfields, where most would return empty handed. The Close Brothers website provides a vastly cut down version of the story. One questionable date in their history came in 1985 with their “rescue” of Acorn Computers from the brink of collapse. It’s questionable, due to the writing being on the wall (and everywhere else) for the dreadful Acorn architecture, clinging to an idea which had died and been buried 4 years earlier with the IBM XT rollout. A personal memory of standing in the rain on a pavement in Edinburgh, similar to some Apple Cult sado nowadays, back in 1981 waiting to purchase an IBM (which were in short supply) will never go away. As the youngest person in the company, I was deemed safe to be sent out with £3k in cash as I’d be the one learning about computers! After driving back to the office, a baptism of fire followed due to everything needing installed for the very first time on the “massive” 10mb hard disk. Even then, buying an Acorn seems a strange decision, akin to Close Brothers choosing to save a horseshoe company from the predations of the motor car.

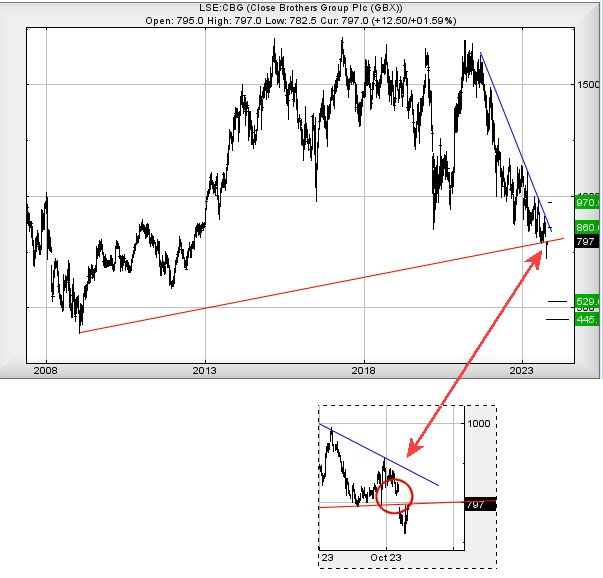

In common with many entities within the financial sector, Close Brothers share price isn’t in the happiest visual place. The recent decision to gap the price below their Red uptrend (circled) since 2009 in an obvious concern, along with a source of hope. To view the positive first, we’ve given a little extract of movements since July.

The share price clearly respected this Red line with the implication it need only trade above 800p currently to suggest something positive may be happening. As always, our preference will be for the share price to actually close a session above Red but we’ve a sneaking suspicion some sort of excuse shall be found to gap (manipulate) the price back above Red and if this should be the case, there’s quite a strong argument favouring happy days ahead. In this instance, we can cautiously calculate above 800p should make an attempt at an initial 860p with secondary, if exceeded, a long term 970p and a need to re-examine the tea leaves.

Alternately, below 723p risks being controversial, possibly triggering reversals down to an initial 529p with our secondary, if broken, at 445p and a bottom, a price level below which we cannot currently calculate.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:18:18PM | BRENT | 8531 | ‘cess | ||||||||

| 9:22:45PM | GOLD | 1983.45 | Success | ||||||||

| 9:25:39PM | FTSE | 7325 | 7308 | 7289 | 7260 | 7338 | 7382 | 7413 | 7464 | 7345 | Shambles |

| 9:47:01PM | STOX50 | 4068 | |||||||||

| 10:05:12PM | GERMANY | 14839.9 | Success | ||||||||

| 10:10:22PM | US500 | 4183.5 | ‘cess | ||||||||

| 10:14:38PM | DOW | 32990.5 | ‘cess | ||||||||

| 10:16:36PM | NASDAQ | 14378.3 | 14232 | 14178 | 14097 | 14287 | 14422 | 14445 | 14476 | 14333 | |

| 10:21:10PM | JAPAN | 31335 | Success |

31/10/2023 FTSE Closed at 7321 points. Change of -0.08%. Total value traded through LSE was: £ 5,795,517,732 a change of 15.68%

30/10/2023 FTSE Closed at 7327 points. Change of 0.49%. Total value traded through LSE was: £ 5,010,011,648 a change of 25.72%

27/10/2023 FTSE Closed at 7291 points. Change of -0.86%. Total value traded through LSE was: £ 3,985,095,310 a change of -23.59%

26/10/2023 FTSE Closed at 7354 points. Change of -0.81%. Total value traded through LSE was: £ 5,215,729,676 a change of -2.48%

25/10/2023 FTSE Closed at 7414 points. Change of 0.34%. Total value traded through LSE was: £ 5,348,410,782 a change of 19.98%

24/10/2023 FTSE Closed at 7389 points. Change of 0.2%. Total value traded through LSE was: £ 4,457,908,651 a change of 13.65%

23/10/2023 FTSE Closed at 7374 points. Change of -0.38%. Total value traded through LSE was: £ 3,922,414,231 a change of -25.79%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CASP Caspian** **LSE:CPI Capita** **LSE:IQE IQE** **LSE:ITM ITM Power** **LSE:SCLP Scancell** **

********

Updated charts published on : Caspian, Capita, IQE, ITM Power, Scancell,

LSE:CASP Caspian Close Mid-Price: 2.8 Percentage Change: -8.20% Day High: 2.95 Day Low: 2.7

If Caspian experiences continued weakness below 2.7, it will invariably l ……..

</p

View Previous Caspian & Big Picture ***

LSE:CPI Capita. Close Mid-Price: 16.77 Percentage Change: + 0.72% Day High: 17.1 Day Low: 16.63

In the event of Capita enjoying further trades beyond 17.1, the share sho ……..

</p

View Previous Capita & Big Picture ***

LSE:IQE IQE Close Mid-Price: 13.64 Percentage Change: -6.32% Day High: 14.76 Day Low: 13.6

In the event IQE experiences weakness below 13.6 it calculates with a dro ……..

</p

View Previous IQE & Big Picture ***

LSE:ITM ITM Power. Close Mid-Price: 64.62 Percentage Change: + 1.54% Day High: 65.74 Day Low: 62.5

Target met. If ITM Power experiences continued weakness below 62.5, it wi ……..

</p

View Previous ITM Power & Big Picture ***

LSE:SCLP Scancell Close Mid-Price: 12.38 Percentage Change: -2.94% Day High: 13.38 Day Low: 12.25

Weakness on Scancell below 12.25 will invariably lead to 6.2p with second ……..

</p

View Previous Scancell & Big Picture ***