#DAX #NK225 It’s be nice to say our visit to Polar Cap was inspired by local events on Wednesday but the reality was easier, a couple of emails asking our opinion on where bottom may be! The local events? Using an angle grinder to remove/install a tumble drier vent, during snow & hail storms, and sunny weather. Also, glancing at the lawn, an unpleasant realisation the grass needs cut already…

Thanks to Argyll’s changeable weather, a job which should have taken maybe 30 minutes managed to spin out to a few hours. I’m one of these people who dislikes using electrical tools in wet weather, jumping at the chance of being “rained off” any unpleasant task. Attacking a six inch vent pipe, during a snowstorm, gave a rock solid excuse but unfortunately, every time the weather turned, by the time all the electrical equipment was safe, the sun would invariably come out. The day started to feel like the weather was playing a practical joke and worse, by the time the old vent was removed, it became apparent the new vent was going to need cemented in place and cement doesn’t harden well in freezing conditions. As a result, our tumble drier now vents into a pair of lady’s tights, the only thing immediately available to cover the hole in the outside wall until the weather improves.

We’ve never covered Polar Capital before and glanced at their website to discover what they’re up to. They choose to describe themselves as;

“Polar Capital is an investment-led, integrated multi-boutique that is a boutique itself. It is a specialist active fund management business whose culture is characterised as meritocratic and collaborative.“

Due to an intense dislike of buzzword-prose, it was easy to stop reading at this point but would guess, given their range of locations along with 16 investment teams operating autonomously, the company are pretty good in their field.

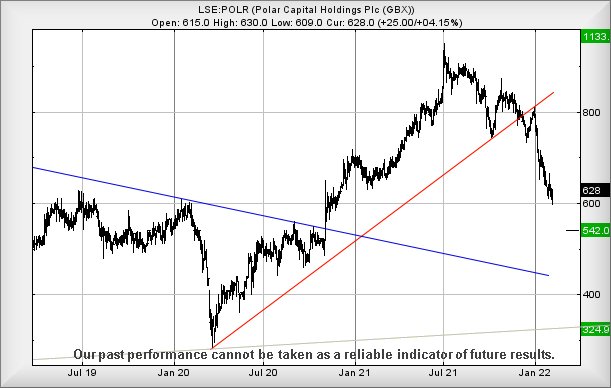

The company share price has performed pretty nicely since the pandemic plunge, recovering from a low of 282p to a high of 950p and is currently trading around 628p. Curiously, our calculated recovery target worked out at 916p and once again, we’re seeing a share which exceeded target intraday, yet failed to actually close a session above 916p. The highest closing price achieved was 915p and once again, we find another share where we fear this perceived weakness allows reversals.

The immediate situation is fairly straightforward as weakness below 598p should eventually make a visit down to 542p. We’d hope for a bounce at such a level but warn, if 542p breaks on any initial surge downward, our eventual secondary calculates at a hopeful bottom of 324p. If we rely on the visuals, it appears 542p would certainly provide a reasonable floor level on the current reversal cycle.

Needing a small miracle, the share price requires exceed 800p to nullify the foregoing conclusions, especially as this would imply the potential of a visit to a longer term 1133p and a new all time high. Hopefully our ‘functional, logic-based, projection‘ of a bottom at 542p proves accurate. (Our thanks to Honeywell for their rather ancient Buzzword Generator)

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:41:47PM | BRENT | 91.31 | |||||||||

| 9:44:03PM | GOLD | 1833.39 | ‘cess | ||||||||

| 9:46:34PM | FTSE | 7663.75 | ‘cess | ||||||||

| 10:17:20PM | FRANCE | 7151.4 | Success | ||||||||

| 10:20:02PM | GERMANY | 15537 | 15407 | 15380 | 15324 | 15509 | 15548 | 15593 | 15670 | 15439 | Success |

| 10:22:13PM | US500 | 4589.42 | Success | ||||||||

| 10:25:43PM | DOW | 35826.9 | Success | ||||||||

| 10:27:58PM | NASDAQ | 15065 | Success | ||||||||

| 10:30:13PM | JAPAN | 27830 | 27386 | 27348 | 27186 | 27540 | 27836 | 27855 | 27985 | 27658 | Success |

.

9/02/2022 FTSE Closed at 7643 points. Change of 1%. Total value traded through LSE was: £ 6,627,688,349 a change of 1.84%

8/02/2022 FTSE Closed at 7567 points. Change of -0.08%. Total value traded through LSE was: £ 6,508,230,293 a change of 10.94%

7/02/2022 FTSE Closed at 7573 points. Change of 0.76%. Total value traded through LSE was: £ 5,866,179,162 a change of 4.27%

4/02/2022 FTSE Closed at 7516 points. Change of 3.55%. Total value traded through LSE was: £ 5,625,836,746 a change of -14.55%

3/02/2022 FTSE Closed at 7258 points. Change of -4.29%. Total value traded through LSE was: £ 6,584,025,295 a change of 21.45%

2/02/2022 FTSE Closed at 7583 points. Change of 0.64%. Total value traded through LSE was: £ 5,421,060,269 a change of -9.84%

1/02/2022 FTSE Closed at 7535 points. Change of 0.95%. Total value traded through LSE was: £ 6,012,900,236 a change of -1.21%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:BT.A British Telecom** **LSE:CAR Carclo** **LSE:CCL Carnival** **LSE:CNA Centrica** **LSE:EZJ EasyJet** **LSE:IAG British Airways** **LSE:IQE IQE** **LSE:ITM ITM Power** **LSE:QFI Quadrise** **

********

Updated charts published on : Aviva, British Telecom, Carclo, Carnival, Centrica, EasyJet, British Airways, IQE, ITM Power, Quadrise,

LSE:AV. Aviva. Close Mid-Price: 445.5 Percentage Change: + 0.29% Day High: 447 Day Low: 441.4

In the event of Aviva enjoying further trades beyond 447, the share shoul ……..

</p

View Previous Aviva & Big Picture ***

LSE:BT.A British Telecom. Close Mid-Price: 198.5 Percentage Change: + 0.53% Day High: 199.85 Day Low: 196.65

Target met. Continued trades against BT.A with a mid-price ABOVE 199.85 s ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CAR Carclo Close Mid-Price: 31.3 Percentage Change: -7.94% Day High: 32 Day Low: 30.4

If Carclo experiences continued weakness below 30.4, it will invariably l ……..

</p

View Previous Carclo & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 1550.8 Percentage Change: + 3.08% Day High: 1566.8 Day Low: 1503.4

Target met. Continued trades against CCL with a mid-price ABOVE 1566.8 sh ……..

</p

View Previous Carnival & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 78.9 Percentage Change: + 0.82% Day High: 79.48 Day Low: 78.34

In the event of Centrica enjoying further trades beyond 79.48, the share ……..

</p

View Previous Centrica & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 699.8 Percentage Change: + 3.58% Day High: 718.4 Day Low: 685

Target met. All EasyJet needs are mid-price trades ABOVE 718.4 to improve ……..

</p

View Previous EasyJet & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 174.96 Percentage Change: + 4.67% Day High: 174.98 Day Low: 167.54

Further movement against British Airways ABOVE 174.98 should improve acc ……..

</p

View Previous British Airways & Big Picture ***

LSE:IQE IQE. Close Mid-Price: 35.75 Percentage Change: + 5.15% Day High: 36.5 Day Low: 34.35

Target met. All IQE needs are mid-price trades ABOVE 36.5 to improve acce ……..

</p

View Previous IQE & Big Picture ***

LSE:ITM ITM Power. Close Mid-Price: 278.8 Percentage Change: + 12.33% Day High: 287.4 Day Low: 251.4

This might be important, I’m not entirely sure thanks to the level of cont ……..

</p

View Previous ITM Power & Big Picture ***

LSE:QFI Quadrise Close Mid-Price: 1.8 Percentage Change: -2.70% Day High: 1.9 Day Low: 1.8

If Quadrise experiences continued weakness below 1.8, it will invariably ……..

</p

View Previous Quadrise & Big Picture ***