With Valentines Day approaching, we wonder if Cellular Goods shall reap any benefit from their cannabis lotions and creams. Recent findings reveal substantial skin improvements with the application of CBD products. There are few gestures more romantic than saying to a loved one; “Your face is bloated, sagging and looked old. Here’s a cream!”

All kidding aside, it’s easy to suspect CBD products will join many beauty regimes, especially as they actually work. From a personal standpoint, I’ve been using Oil of Ulay for nearly 30 years and can confirm it doesn’t work. I’m still as ugly now as I was then… Quite seriously, the last 10 years brought a need for moisturisers and skin care products, due to repeated chemotherapy. All the needles and lines leave substantial damage, provoking a repeated fight as nurses require undamaged skin to allow them to continue their routine abuse. Medical plumbing which once could be attached to the back of a hand gradually migrates up the arm, the wounds not healing in time for the next session. Then the nurse discovers you’ve another arm! While thankfully now receiving treatment (very successfully) which requires none of the invasive drips and transfusions, if I were, I’d be eager to try Cellular Goods CBD infused products.

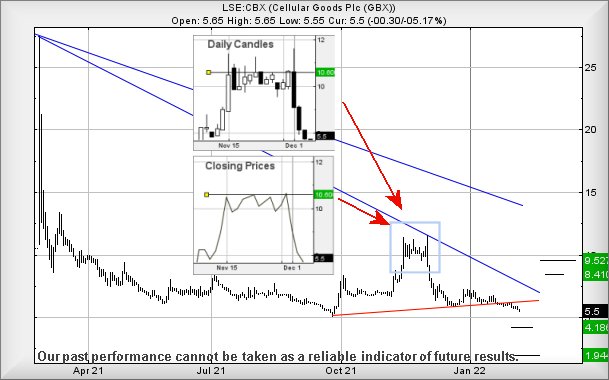

Last time we reviewed Cellular Goods in October 2021, we appear to have gotten everything right but now, it’s all going horribly wrong for some reason. It’s interesting we’d proposed a potential high of 10.6p, the share price cheerfully exceeding this for 7 sessions toward the end of November but there was a crucial detail which is noteworthy. We often bang on about the need for a price to actually CLOSE above our target levels and in the case of LSE:CBX, despite reaching 11.6p, the highest the price closed at was 10.66p on November 30th. It’s silly to get excited at the extra 6/100th’s of a penny as we round our numbers down. The result is a perfect example of the need for targets to be exceeded, before making assumptions the door is open for a positive future. We’ve shown an inset on the chart which clearly highlights the drama at the 10.6p level last year.

By failing to exceed our 10.6p calculation, the first box was ticked in a scenario which allowed for potential weakness. When the share price managed to flutter below the Red uptrend at the end of last month, the 2nd box pointing at continued weakness was ticked and now, we must concede there’s a real problem. Should the share price now manage to wander below 5p, it risks reversal down to an initial 4.1p with secondary, if broken, at a hopeful bouncy bottom of 1.9p. To escape this mess, the share requires exceed Blue on the chart, presently around 7.6p as this should promote recovery to 9.5p. Above such a level and we’ll take another look at future potentials.

Who knows, perhaps the share will be a surprise Valentines day gift?

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:06:00PM | BRENT | 90.77 | Success | ||||||||

| 10:07:47PM | GOLD | 1827.21 | ‘cess | ||||||||

| 10:11:19PM | FTSE | 7594.29 | |||||||||

| 10:14:39PM | FRANCE | 7035.1 | 6984 | 6949 | 6904 | 7039 | 7071 | 7089 | 7121 | 7020 | ‘cess |

| 10:16:32PM | GERMANY | 15298.8 | ‘cess | ||||||||

| 10:52:11PM | US500 | 4526.17 | Shambles | ||||||||

| 10:54:28PM | DOW | 35500 | ‘cess | ||||||||

| 10:58:15PM | NASDAQ | 14788 | 14628 | 14487 | 14225 | 14638 | 14791 | 14869 | 14999 | 14649 | ‘cess |

| 11:00:08PM | JAPAN | 27395 | ‘cess |

8/02/2022 FTSE Closed at 7567 points. Change of -0.08%. Total value traded through LSE was: £ 6,508,230,293 a change of 10.94%

7/02/2022 FTSE Closed at 7573 points. Change of 0.76%. Total value traded through LSE was: £ 5,866,179,162 a change of 4.27%

4/02/2022 FTSE Closed at 7516 points. Change of 3.55%. Total value traded through LSE was: £ 5,625,836,746 a change of -14.55%

3/02/2022 FTSE Closed at 7258 points. Change of -4.29%. Total value traded through LSE was: £ 6,584,025,295 a change of 21.45%

2/02/2022 FTSE Closed at 7583 points. Change of 0.64%. Total value traded through LSE was: £ 5,421,060,269 a change of -9.84%

1/02/2022 FTSE Closed at 7535 points. Change of 0.95%. Total value traded through LSE was: £ 6,012,900,236 a change of -1.21%

31/01/2022 FTSE Closed at 7464 points. Change of -0.03%. Total value traded through LSE was: £ 6,086,283,575 a change of -43.89%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:AV. Aviva** **LSE:AVCT Avacta** **LSE:BP. BP PLC** **LSE:CBX Cellular Goods** **LSE:ECO ECO (Atlantic) O & G** **LSE:EZJ EasyJet** **LSE:GKP Gulf Keystone** **LSE:HSBA HSBC** **LSE:MKS Marks and Spencer** **LSE:OCDO Ocado Plc** **LSE:OXIG Oxford Instruments** **LSE:PPC President Energy** **LSE:QFI Quadrise** **LSE:SCLP Scancell** **LSE:STAN Standard Chartered** **LSE:VOD Vodafone** **

********

Updated charts published on : Aston Martin, Aviva, Avacta, BP PLC, Cellular Goods, ECO (Atlantic) O & G, EasyJet, Gulf Keystone, HSBC, Marks and Spencer, Ocado Plc, Oxford Instruments, President Energy, Quadrise, Scancell, Standard Chartered, Vodafone,

LSE:AML Aston Martin Close Mid-Price: 1114.5 Percentage Change: -1.46% Day High: 1138 Day Low: 1090

Weakness on Aston Martin below 1090 will invariably lead to 1014 with sec ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:AV. Aviva. Close Mid-Price: 444.2 Percentage Change: + 1.12% Day High: 446 Day Low: 439.4

Continued trades against AV. with a mid-price ABOVE 446 should improve th ……..

</p

View Previous Aviva & Big Picture ***

LSE:AVCT Avacta Close Mid-Price: 67 Percentage Change: -10.07% Day High: 75 Day Low: 66.5

If Avacta experiences continued weakness below 66.5, it will invariably l ……..

</p

View Previous Avacta & Big Picture ***

LSE:BP. BP PLC Close Mid-Price: 399 Percentage Change: -2.36% Day High: 418 Day Low: 398.35

Continued trades against BP. with a mid-price ABOVE 418 should improve th ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 5.5 Percentage Change: -5.17% Day High: 5.65 Day Low: 5.55

Continued weakness against CBX taking the price below 5.55 calculates as ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:ECO ECO (Atlantic) O & G. Close Mid-Price: 31 Percentage Change: + 3.33% Day High: 32.5 Day Low: 31

Further movement against ECO (Atlantic) O & G ABOVE 32.5 should improve a ……..

</p

View Previous ECO (Atlantic) O & G & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 675.6 Percentage Change: + 4.00% Day High: 680 Day Low: 651.2

Target met. In the event of EasyJet enjoying further trades beyond 680, t ……..

</p

View Previous EasyJet & Big Picture ***

LSE:GKP Gulf Keystone Close Mid-Price: 235 Percentage Change: -1.47% Day High: 244.5 Day Low: 234.5

Further movement against Gulf Keystone ABOVE 244.5 should improve acceler ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 563.5 Percentage Change: + 1.19% Day High: 566.1 Day Low: 556.9

Target met. In the event of HSBC enjoying further trades beyond 566.1, th ……..

</p

View Previous HSBC & Big Picture ***

LSE:MKS Marks and Spencer Close Mid-Price: 195.05 Percentage Change: -1.24% Day High: 197 Day Low: 191.6

Continued weakness against MKS taking the price below 191.6 calculates as ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:OCDO Ocado Plc Close Mid-Price: 1225 Percentage Change: -12.94% Day High: 1307 Day Low: 1140.5

Target met. In the event Ocado Plc experiences weakness below 1140.5 it c ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 2040 Percentage Change: -1.69% Day High: 2080 Day Low: 2025

Weakness on Oxford Instruments below 2025 will invariably lead to 2005 wi ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:PPC President Energy Close Mid-Price: 1.57 Percentage Change: -8.70% Day High: 1.75 Day Low: 1.57

Continued weakness against PPC taking the price below 1.57 calculates as ……..

</p

View Previous President Energy & Big Picture ***

LSE:QFI Quadrise Close Mid-Price: 1.85 Percentage Change: -3.90% Day High: 1.9 Day Low: 1.85

Continued weakness against QFI taking the price below 1.85 calculates as ……..

</p

View Previous Quadrise & Big Picture ***

LSE:SCLP Scancell Close Mid-Price: 16.62 Percentage Change: -3.62% Day High: 17.45 Day Low: 16.62

Target met. If Scancell experiences continued weakness below 16.62, it wi ……..

</p

View Previous Scancell & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 571.4 Percentage Change: + 0.53% Day High: 573.6 Day Low: 565.6

Target met. All Standard Chartered needs are mid-price trades ABOVE 573.6 ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 137.22 Percentage Change: -0.13% Day High: 139.66 Day Low: 136.26

Target met. Continued trades against VOD with a mid-price ABOVE 139.66 sh ……..

</p

View Previous Vodafone & Big Picture ***