FTSE for FRIDAY (FTSE:UKX)

With all the bad stuff going on in the world, often only mitigated by the comic relief provided by the UK’s Prime Minister, we decided it may be worth going back in time and looking at how the market has recovered from previous trauma. The Tech Crash, the Financial Crash, both followed a similar playbook for recovery and we’re curious as to whether the Covid Crash shall mimic a similar path.

Currently, there are certainly plenty of reasons to be nervous. For instance, at time of writing, the Nasdaq is down -4.6% and also, Germany and France managed a day of reversals below -1.5%. For a change, the FTSE proved less sluggish, ‘only’ achieving -0.7% down for the day. As we’ve seen the FTSE often outperform other markets in gain strength during January, it appears reasonable to assume the FTSE remains in a recovery cycle, intending to catch up with the rest of the world. Whereas other markets appear to be experiencing retreats from all time highs. It’s all very strange…

By way of experiment, we decided to apply recovery strengths given in previous cycles in an attempt to figure out where the FTSE intends head. Always assuming Russia refrains from taking a holiday in Ukraine and the UK PM continues to wear an invisible big red clown nose. The consensus calculates with an initial target level around 8,100 points with secondary, if bettered, being a little more argumentative. When we apply the Tech Crash model, our secondary calculates at 8,355 points as providing a level where we should anticipate FTSE fireworks next. However, with the model from the Financial Crash – along with the 2016 Brexit Crash – we can now work out an eventual 8,860 as the level where the FTSE should experience real volatility. But amongst all this, we remains truly surprised at the broad agreement of the FTSE currently viewed as heading to the 8,100 level.

It certainly feels silly, proposing a further 500 points for the UK against a backdrop of other markets experiencing serious volatility. We can hope.

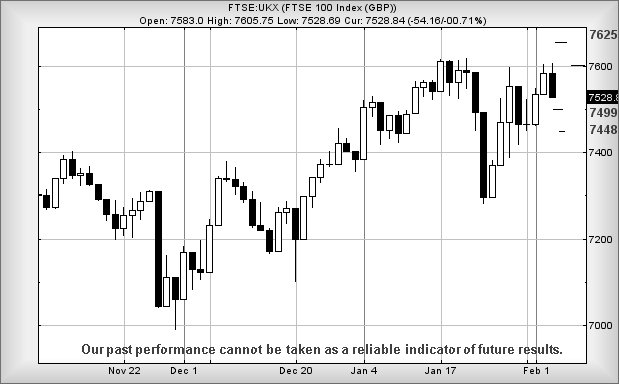

As for the FTSE for FRIDAY, despite international hysterics, we’re feeling strangely hopeful for some near term gains. To be blunt, while the market closed at 7528 on Thursday, we hope “they” gap the index up above 7565 at the open on Friday. If “they” opt to spike the market up rather than a gap, things could be unpleasant next week.

Working on the basis the market is gapped above 7565 at the open, we suspect a cycle to 7600 shall commence. If bettered, our near term secondary calculates at 7625 points. And if things get really frothy, the index could easily charge uphill to an impossible 7655 eventually! If triggered, the tightest stop level looks like Thursdays closing price of 7528 points.

Our alternate scenario demands weakness below 7528 to risk triggering reversal to an initial 7499 points. If broken, our secondary (and hopefully bounce point) works out at 7,448 points.

Have a good weekend. Now just 44 days until the Bahrain Grand Prix. And I’m getting my 4th Covid jag on Saturday!

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:51:09PM | BRENT | 90.84 | 87.82 | 87.18 | 89.5 | 91.15 | 91.46 | 88 | Shambles | ||

| 10:53:37PM | GOLD | 1805.27 | 1793 | 1786 | 1805 | 1809 | 1816.5 | 1800 | |||

| 10:56:06PM | FTSE | 7568 | 7510 | 7479 | 7562 | 7604 | 7618 | 7530 | Success | ||

| 10:58:53PM | FRANCE | 6975.4 | 6969 | 6964 | 6997 | 7022 | 7073 | 6982 | Success | ||

| 11:01:34PM | GERMANY | 15431.2 | 15368 | 15348 | 15445 | 15548 | 15574 | 15349 | Success | ||

| 11:05:51PM | US500 | 4521 | 4471 | 4427 | 4520 | 4544 | 4559 | 4501 | Success | ||

| 11:08:25PM | DOW | 35277 | 35156 | 35081 | 35286 | 35395 | 35506 | 35194 | ‘cess | ||

| 11:10:51PM | NASDAQ | 14779 | 14670 | 14561 | 14755 | 14891 | 14957 | 14724 | ‘cess | ||

| 11:12:48PM | JAPAN | 27143 | 26940 | 26848 | 27168 | 27300 | 27342 | 27140 | Success |

3/02/2022 FTSE Closed at 7258 points. Change of -4.29%. Total value traded through LSE was: £ 6,584,025,295 a change of 21.45%

2/02/2022 FTSE Closed at 7583 points. Change of 0.64%. Total value traded through LSE was: £ 5,421,060,269 a change of -9.84%

1/02/2022 FTSE Closed at 7535 points. Change of 0.95%. Total value traded through LSE was: £ 6,012,900,236 a change of -1.21%

31/01/2022 FTSE Closed at 7464 points. Change of -0.03%. Total value traded through LSE was: £ 6,086,283,575 a change of -43.89%

28/01/2022 FTSE Closed at 7466 points. Change of -1.16%. Total value traded through LSE was: £ 10,846,360,111 a change of 33.05%

27/01/2022 FTSE Closed at 7554 points. Change of 1.14%. Total value traded through LSE was: £ 8,151,826,198 a change of 20.71%

26/01/2022 FTSE Closed at 7469 points. Change of 1.33%. Total value traded through LSE was: £ 6,753,491,510 a change of 0.93%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CBX Cellular Goods** **LSE:HSBA HSBC** **LSE:NG. National Glib** **LSE:NWG Natwest** **LSE:ODX Omega Diags** **LSE:QFI Quadrise** **LSE:STAN Standard Chartered** **LSE:VOD Vodafone** **LSE:ZOL Zoldav** **

********

Updated charts published on : Cellular Goods, HSBC, National Glib, Natwest, Omega Diags, Quadrise, Standard Chartered, Vodafone, Zoldav,

LSE:CBX Cellular Goods. Close Mid-Price: 5.8 Percentage Change: + 0.00% Day High: 5.85 Day Low: 5.75

Target met. If Cellular Goods experiences continued weakness below 5.75, ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:HSBA HSBC Close Mid-Price: 546.3 Percentage Change: -0.02% Day High: 552.3 Day Low: 543.3

All HSBC needs are mid-price trades ABOVE 552.3 to improve acceleration t ……..

</p

View Previous HSBC & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 1097 Percentage Change: -0.71% Day High: 1105.6 Day Low: 1087.8

Continued trades against NG. with a mid-price ABOVE 1105.6 should improve ……..

</p

View Previous National Glib & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 252.6 Percentage Change: + 0.04% Day High: 258.1 Day Low: 246.3

Further movement against Natwest ABOVE 258.1 should improve acceleration ……..

</p

View Previous Natwest & Big Picture ***

LSE:ODX Omega Diags. Close Mid-Price: 10.88 Percentage Change: + 14.47% Day High: 12.88 Day Low: 10.5

Target met. In the event of Omega Diags enjoying further trades beyond 12 ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:QFI Quadrise Close Mid-Price: 1.97 Percentage Change: -2.72% Day High: 2 Day Low: 1.94

Weakness on Quadrise below 1.94 will invariably lead to 1.9 initially wit ……..

</p

View Previous Quadrise & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 554.8 Percentage Change: + 0.51% Day High: 564.4 Day Low: 548.2

Further movement against Standard Chartered ABOVE 564.4 should improve ac ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:VOD Vodafone. Close Mid-Price: 133.58 Percentage Change: + 0.95% Day High: 134.26 Day Low: 130.04

Continued trades against VOD with a mid-price ABOVE 134.26 should improve ……..

</p

View Previous Vodafone & Big Picture ***

LSE:ZOL Zoldav Close Mid-Price: 17.5 Percentage Change: -10.26% Day High: 19.5 Day Low: 17.5

Target met. Continued weakness against ZOL taking the price below 17.5 ca ……..

</p

View Previous Zoldav & Big Picture ***