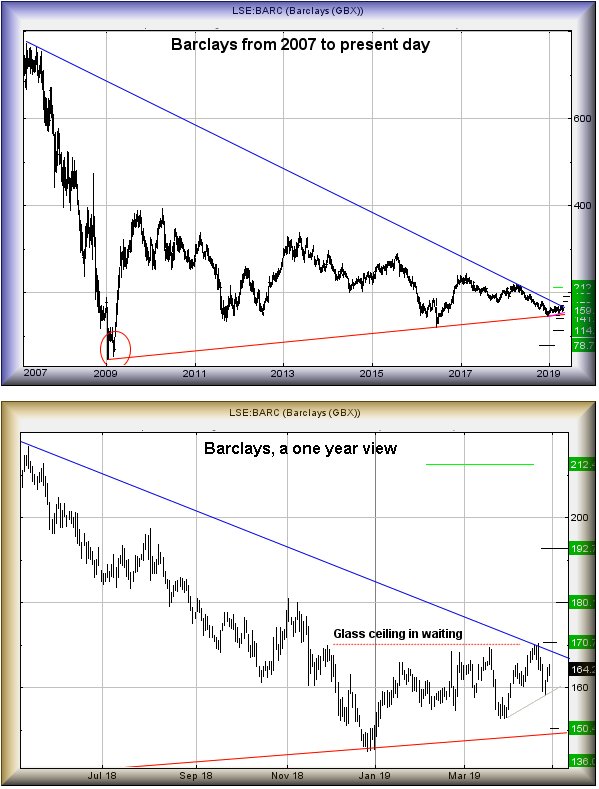

Barclays (LSE:BARC) #FTSE #SP500 We’re tempted to tear up our rule book against the retail banks. Despite bank shares pretending to be interesting, share prices have backed themselves into a corner, resulting in a situation where either sharp reversal shall be required or, more probably, logical trends broken but prices becoming rangebound.

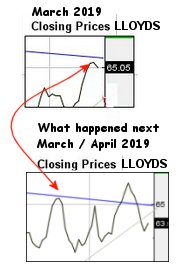

This was also our conclusion the other day, when reviewing Lloyds Group and there’s nothing about Barclays suggesting it shall prove different.

At present, the downtrend since June 2007, shown as BLUE on each chart, is at 168.49p. Normal rules demand a price close above this level before enthusiastically hoping for better times ahead. Barclays currently exhibits some indication for a rise as theoretically, now above 165p is supposed to bring recovery to an initial 170.75p. Movement such as this would give every hope the price shall close above the long term downtrend but the fly in the ointment – similar to Lloyds – is the presence of a “glass ceiling in waiting” around the 170p level, shown on the lower chart.

Visually, this creates a suspicion that, even with a trend break, Barclays intends oscillate between the 170p level and the 155p level until something resolves Brexit issues. Only with closure above the 170.75p level will we dare succumb to hope, giving an initial 180p ambition with secondary, if bettered, of 192p. Or more probably beyond.

Until such time the share price manages a solid movement, while it languishes below BLUE there’s the threat of weakness below 159p driving the price down to 150.5p. Extreme danger is possible with trades below the 150p level, due to “bottom” calculating at 136p.

In the event anything interesting happens, we should revisit the retails banks and refresh our Big Picture perspective, sometime in June.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:59:41PM |

BRENT |

71.68 | |||||||||

|

10:16:38PM |

GOLD |

1284.18 | |||||||||

|

10:19:13PM |

FTSE |

7450.82 |

7391 |

7374.5 |

7346 |

7435 |

7456 |

7466.25 |

7477 |

7420 |

‘cess |

|

10:32:16PM |

FRANCE |

5595 | |||||||||

|

10:34:12PM |

GERMANY |

12370 | |||||||||

|

10:43:02PM |

US500 |

2953.12 |

2923 |

2912 |

2898 |

2944 |

2955 |

2960 |

2965 |

2933 |

Shambles |

|

10:45:31PM |

DOW |

26646.3 |

‘cess | ||||||||

|

10:48:05PM |

NASDAQ |

7832.77 |

Success | ||||||||

|

10:50:12PM |

JAPAN |

22409 |

‘cess |

30/04/2019 FTSE Closed at 7418 points. Change of -0.3%.

Total value traded through LSE was: £ 6,143,157,298 a change of 41.83%