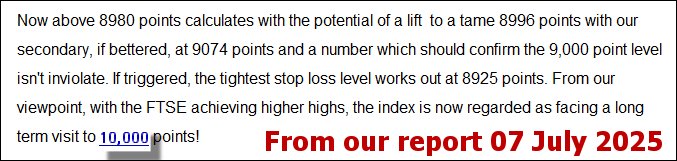

#FTSE #GOLD Since 7th July last year, the FTSE has grown by 18.2% in a fairly unrelenting climb. The reason the 7th of July is important turns out to be fairly simple. You could have opened a Long Position at 8,882 points with a stop loss of just 8,880 points and the stop loss would not have been bothered. Instead, the market grew to its recent 10,535 points and provided a nice little earner of 1,653 points. In fact, our “FTSE for FRIDAY” mentioned this aspect of the markets, an extract of which is shown below. It leaves the big question, what exactly is “Long Term” as this analysis was only provided 7 months ago?

We’ve now a bit of an issue at the current level, due to the fact we cannot safely calculate anything above 10,890 points on the current cycle of index movements. This is quite a big deal, suggesting unless “they” start gapping the FTSE up, it should produce some turbulence any time soon. Visually, it’s getting close to our theoretical maximum target and therefore, we’re inclined to focus on potential points of interest which may become traps which trigger a reversal!

However, we cannot entirely ignore the detail the index remains with an upward cycle and this creates an immediate scenario, where above 10,472 points calculates with the potential of a visit to 10,524 next with our secondary, if bettered, working out at 10,644 points. If triggered, the tightest stop looks like 10,421 points.

Unfortunately, the index suffered a strange looking reversal of 60 points in the final thirty minutes of trade, this artificial feeling movement indicating a chance of movement below 10,391 points heading toward an initial 10,364 points with our secondary, if broken, working out at a probable bounce point of 10,308 points.

Have a good weekend.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:54:39PM | BRENT | 6724.4 | 6685 | 6611 | 6750 | 6817 | 6869 | 6762 | Success | ||

| 10:58:12PM | GOLD | 4916.5 | 4879 | 4866 | 4948 | 4983 | 5012 | 4932 | Success | ||

| 11:00:22PM | FTSE | 10432.9 | 10376 | 10364 | 10419 | 10472 | 10504 | 10447 | |||

| 11:41:04PM | STOX50 | 5999.8 | 5997 | 5987 | 6028 | 6033 | 6043 | 6007 | ‘cess | ||

| 11:15:19PM | GERMANY | 24884 | 24811 | 24734 | 24926 | 24974 | 25035 | 24895 | Success | ||

| 11:17:46PM | US500 | 6827.8 | 6823 | 6758 | 6860 | 6879 | 6895 | 6823 | Shambles | ||

| 11:25:20PM | DOW | 49397 | 49395 | 49198 | 49668 | 49806 | 49919 | 49630 | Shambles | ||

| 11:28:39PM | NASDAQ | 24645 | 24642 | 24590 | 24774 | 24876 | 24952 | 24727 | ‘cess | ||

| 11:31:08PM | JAPAN | 56816 | 56502 | 56213 | 56965 | 57135 | 57344 | 56800 |

12/02/2026 FTSE Closed at 10402 points. Change of -0.67%. Total value traded through LSE was: £ 8,571,766,423 a change of 6.33%

11/02/2026 FTSE Closed at 10472 points. Change of 1.15%. Total value traded through LSE was: £ 8,061,814,273 a change of -0.89%

10/02/2026 FTSE Closed at 10353 points. Change of -0.32%. Total value traded through LSE was: £ 8,133,860,971 a change of 2.3%

9/02/2026 FTSE Closed at 10386 points. Change of 0.16%. Total value traded through LSE was: £ 7,950,643,906 a change of 17.72%

6/02/2026 FTSE Closed at 10369 points. Change of 0.58%. Total value traded through LSE was: £ 6,754,046,507 a change of -27.29%

5/02/2026 FTSE Closed at 10309 points. Change of -0.89%. Total value traded through LSE was: £ 9,288,693,358 a change of 0.23%

4/02/2026 FTSE Closed at 10402 points. Change of 0.85%. Total value traded through LSE was: £ 9,267,141,152 a change of 9.85%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AZN Astrazeneca** **LSE:BBY BALFOUR BEATTY** **LSE:EXPN Experian** **LSE:FOXT Foxtons** **LSE:HSBA HSBC** **LSE:NG. National Glib** **LSE:SPX Spirax** **

********

Updated charts published on : Astrazeneca, BALFOUR BEATTY, Experian, Foxtons, HSBC, National Glib, Spirax,

LSE:AZN Astrazeneca. Close Mid-Price: 14906 Percentage Change: + 0.59% Day High: 15028 Day Low: 14782

Continued trades against AZN with a mid-price ABOVE 15028 should improve ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 758 Percentage Change: + 0.53% Day High: 771 Day Low: 755

Target met. In the event of BALFOUR BEATTY enjoying further trades beyond ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:EXPN Experian. Close Mid-Price: 2408 Percentage Change: + 1.39% Day High: 2439 Day Low: 2353

In the event Experian experiences weakness below 2353 it calculates with ……..

</p

View Previous Experian & Big Picture ***

LSE:FOXT Foxtons Close Mid-Price: 50.5 Percentage Change: -0.98% Day High: 50.7 Day Low: 49.3

If Foxtons experiences continued weakness below 49.3, it will invariably ……..

</p

View Previous Foxtons & Big Picture ***

LSE:HSBA HSBC Close Mid-Price: 1266.6 Percentage Change: -2.97% Day High: 1322.6 Day Low: 1269.4

In the event of HSBC enjoying further trades beyond 1322.6, the share sho ……..

</p

View Previous HSBC & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1352.5 Percentage Change: + 1.77% Day High: 1345.5 Day Low: 1311

All National Glib needs are mid-price trades ABOVE 1345.5 to improve acce ……..

</p

View Previous National Glib & Big Picture ***

LSE:SPX Spirax Close Mid-Price: 7760 Percentage Change: -2.51% Day High: 8030 Day Low: 7740

Further movement against Spirax ABOVE 8030 should improve acceleration to ……..

</p

View Previous Spirax & Big Picture ***