#FTSE #SP500 The wilful economic suicide being embraced by Europe and the UK was recently thrown into stark relief by a girl with a YouTube channel called “Itchy Boots”. This Dutch lady is riding her motorbike around the world and following the new Silk Road trade route with China, about to leave Kyrgystan to enter China. To even approach the crossing into China, she had to ride past a 25 kilometres tailback of EMPTY heavy goods vehicles, around 1/2 of which were configured to carry cars. The seemingly interminable queue of empty trucks highlighted trade with China is far from a two way affair. The West has decided to impoverish its industry in favour of shiny trinkets from China, tending to throw President Trumps tariff attitude into the foreground as he’s clearly got a point. Our political system isn’t reacting to this situation and, to be fair, it’s probably already too late. From a personal stance, using my 3d Printer to design a gizmo had lots of folk saying I should market it. Refusal was easy, due to countless tales of folk “going to market” with their products, only to find counterfeit items available from China within weeks and copyright complaints failing utterly.

The Dutch motorcyclist, simply let her Helmet Cam film the never ending tailback of truckers, overwhelming the Chinese border with their intention of collecting more nails to hammer into the coffin of industry in Europe and elsewhere. We wonder if the price of Gold is part of this trade imbalance as China apparently does buy Gold internationally.

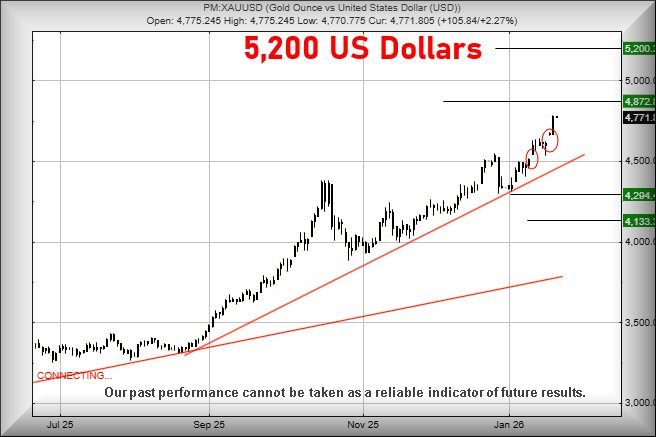

Whatever the reason, we’re starting to openly speculate on $5,000 US being a sane target for the price of Gold! Usually we avoid clickbait types of headline targets but in this instance, it’s becoming difficult to ignore the prospect of further gains in the price of the yellow metal.

From our obscure arithmetic perspective, GOLD now needs close a day above 4,783 dollars an this now risks suggesting ongoing gains to an initial 4,872 dollars. Our secondary, if this target is exceeded, now calculates at $5,200 and a pretty solid nod above the 5k level. It’s perhaps important to mention we cannot calculate above $5,200 and suspect achieving such a level shall introduce some volatility. However (this is important) if the market starts nudging the price of the metal up with little gaps at the open (such as occurred twice recently – circled) could easily ensure our 5,200 dollar ambition may prove to be another footnote in the price of Gold.

Should things intend go wrong, below 4,450 provides for reversal to an initial 4,294 with our secondary, if broken, at 4,133 dollars and perhaps a bounce.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:56:51PM | BRENT | 6355 | |||||||||

| 11:00:35PM | GOLD | 4763.25 | |||||||||

| 11:04:58PM | FTSE | 10100 | 10043 | 10009 | 9928 | 10142 | 10232 | 10353 | 10454 | 10157 | Success |

| 11:29:16PM | STOX50 | 5868.7 | Success | ||||||||

| 11:32:13PM | GERMANY | 24603.5 | Success | ||||||||

| 11:35:30PM | US500 | 6805.9 | 6769 | 6746 | 6662 | 6884 | 6878 | 6910 | 6958 | 6851 | Success |

| 11:40:14PM | DOW | 48548 | Success | ||||||||

| 11:42:43PM | NASDAQ | 25018.4 | |||||||||

| 11:45:39PM | JAPAN | 52135 | Success |

20/01/2026 FTSE Closed at 10126 points. Change of -0.68%. Total value traded through LSE was: £ 9,752,396,465 a change of 107.45%

19/01/2026 FTSE Closed at 10195 points. Change of -0.39%. Total value traded through LSE was: £ 4,701,087,965 a change of -48.92%

16/01/2026 FTSE Closed at 10235 points. Change of -0.03%. Total value traded through LSE was: £ 9,203,782,063 a change of 3.12%

15/01/2026 FTSE Closed at 10238 points. Change of 0.53%. Total value traded through LSE was: £ 8,925,069,676 a change of 39.46%

14/01/2026 FTSE Closed at 10184 points. Change of 0.46%. Total value traded through LSE was: £ 6,399,572,065 a change of -4.73%

13/01/2026 FTSE Closed at 10137 points. Change of -0.03%. Total value traded through LSE was: £ 6,717,140,321 a change of 16.41%

12/01/2026 FTSE Closed at 10140 points. Change of 0.16%. Total value traded through LSE was: £ 5,770,093,543 a change of -6.73%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:EXPN Experian** **LSE:FRES Fresnillo** **LSE:SCLP Scancell** **LSE:SRP Serco** **

********

Updated charts published on : Experian, Fresnillo, Scancell, Serco,

LSE:EXPN Experian Close Mid-Price: 3227 Percentage Change: -0.68% Day High: 3232 Day Low: 3175

If Experian experiences continued weakness below 3175, it will invariably ……..

</p

View Previous Experian & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 3976 Percentage Change: -0.50% Day High: 4076 Day Low: 3924

Target met. Further movement against Fresnillo ABOVE 4076 should improve ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:SCLP Scancell. Close Mid-Price: 13 Percentage Change: + 0.00% Day High: 13.88 Day Low: 13

All Scancell needs are mid-price trades ABOVE 13.88 to improve accelerati ……..

</p

View Previous Scancell & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 298.8 Percentage Change: + 0.40% Day High: 301.6 Day Low: 294.2

Target met. Further movement against Serco ABOVE 301.6 should improve acc ……..

</p

View Previous Serco & Big Picture ***