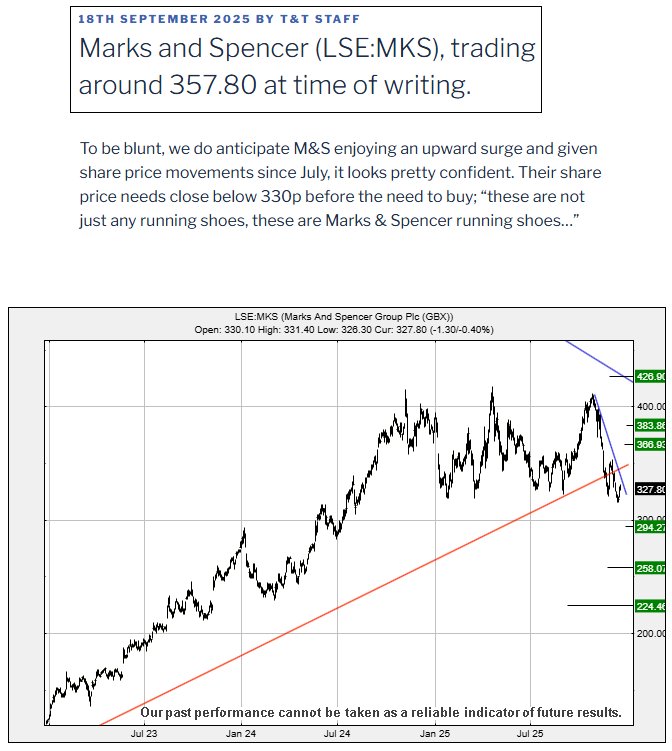

#GOLD #WallSt We reviewed M&S back in mid-September, giving one of our very rare “no-brainer” price movement predictions. Within days, it fulfilled the requirements detailed in our scenario, achieving our 393p target and even, somewhat hesitantly, taking the first step on a path to 428p. But alas, doubtless due to their rubbish clichéd Christmas telly advert, the share price has now managed to cancel out serious Big Picture optimism by closing below 330p. From our perspective, numerically this is a hanging offence, perhaps due to an advertising agency relying on a 40 year old tune and a TV star whose career has aged unlike a 25 year old whisky, matching when she was last on TV as an actress. Okay, to be honest, you really need to be cruel to criticise Dawn French as in the opinion of this writer, she’s brilliant. But the Vicar of Dribbled was interred 25 years ago, given an occasional heartbeat with 45 second clips on YouTube shorts.!

Now, the situation with M&S demands the price close above 342p to escape its visual doom as it feels like trouble is ahead for 2026. At present, it looks like weakness below 315 shall trigger reversals down to an initial 294 with our secondary, if broken, calculating at ideally a bounce before 256p. We should mention, closure below 256 implies a future bottom awaits at 224p but our suspicion is the market shall declare an “oops” moment before our secondary target of 294 being broken.

Of course, there’s always the risk M&S shall somehow find something positive to say about life in the UK, meaning above 342 should trigger an attempt at 366 with our secondary, if beaten, at a future 383p. With regret, about the best we can suggest is those who profited with our September gain scenario remain wearing their M&S running shoes as it looks like further dips are ahead.

Then again, perhaps the speculated BoE Interest Rate reduction today shall diminish the cost of taking a mortgage before experiencing M&S’s pricing policies, thus giving immediate hope for an improvement in their retail sales in the months ahead. We suspect the converse. And we also wonder, if they returned to their classic Lingerie adverts, would M&S share price improve. After all, Formula One managed to experience a decline in viewers, once they exterminated their Grid Girls in 2017, nowadays experiencing a resurgence in viewers with USA viewers demanding such despicable pageantry to appeal to base male instincts.

While forgetting the vast majority of their worldwide audience is male and the ridiculous effort to appeal to future Asian tracks also provoked a drop in viewing audience from the likes of Abu Dhabi, Saudi, Bahrain, and Qatar. But on the plus side, Guardian readers and BBC controllers were happy. If only our local Argyll hero from Oban, Susie Wolff, had competed in F1 wearing a swimming costume, rather than taking the more difficult route of establishing The F1 Academy to give women another way of accessing the sport. (Susie Wolff, married to Toto Wolff, the Mercedes guy and ‘best friend’ of unemployable Christian Horner…)

Finally, as for 2026, we’ve heard some gossip Ferrari may actually be a “thing” for a change as there are enormous changes taking place. Not least being a requirement to speak English in an effort to establish a common language for the team. Who know’s? Ferrari are the only team known for having more reverse gear positions than forward gears, an Italian cliché once applied to their World War Two tanks.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:12:25PM | BRENT | 6051.5 | |||||||||

| 11:18:07PM | GOLD | 4337.25 | 4307 | 4296 | 4278 | 4324 | 4347 | 4348 | 4362 | 4328 | ‘cess |

| 11:23:58PM | FTSE | 9761.5 | Success | ||||||||

| 11:26:22PM | STOX50 | 5673.1 | ‘cess | ||||||||

| 11:28:36PM | GERMANY | 23903.7 | ‘cess | ||||||||

| 11:31:37PM | US500 | 6733 | ‘cess | ||||||||

| 11:35:38PM | DOW | 47908.5 | 47864 | 47801 | 47606 | 48000 | 48100 | 48136 | 48226 | 47940 | Shambles |

| 11:39:23PM | NASDAQ | 24747 | Shambles | ||||||||

| 11:41:56PM | JAPAN | 48960 |

17/12/2025 FTSE Closed at 9774 points. Change of 0.93%. Total value traded through LSE was: £ 7,127,448,786 a change of 18.41%

16/12/2025 FTSE Closed at 9684 points. Change of -0.69%. Total value traded through LSE was: £ 6,019,317,961 a change of 4.57%

15/12/2025 FTSE Closed at 9751 points. Change of 1.06%. Total value traded through LSE was: £ 5,756,132,548 a change of -4.78%

12/12/2025 FTSE Closed at 9649 points. Change of -0.56%. Total value traded through LSE was: £ 6,045,049,250 a change of 2.55%

11/12/2025 FTSE Closed at 9703 points. Change of 0.5%. Total value traded through LSE was: £ 5,894,528,793 a change of -21.51%

10/12/2025 FTSE Closed at 9655 points. Change of 0.13%. Total value traded through LSE was: £ 7,510,310,269 a change of 17.31%

9/12/2025 FTSE Closed at 9642 points. Change of -0.03%. Total value traded through LSE was: £ 6,402,100,858 a change of 23.04%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BARC Barclays** **LSE:EMG MAN** **LSE:FRES Fresnillo** **LSE:HSBA HSBC** **LSE:IGG IG Group** **LSE:IPF International Personal Finance** **LSE:NWG Natwest** **LSE:SAGA SAGA Plc** **LSE:SRP Serco** **LSE:STAN Standard Chartered** **

********

Updated charts published on : Barclays, MAN, Fresnillo, HSBC, IG Group, International Personal Finance, Natwest, SAGA Plc, Serco, Standard Chartered,

LSE:BARC Barclays. Close Mid-Price: 458.15 Percentage Change: + 1.71% Day High: 464.1 Day Low: 455.45

Target met. All Barclays needs are mid-price trades ABOVE 464.1 to improv ……..

</p

View Previous Barclays & Big Picture ***

LSE:EMG MAN. Close Mid-Price: 219.2 Percentage Change: + 0.09% Day High: 221.4 Day Low: 215.4

Continued trades against EMG with a mid-price ABOVE 221.4 should improve ……..

</p

View Previous MAN & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 2952 Percentage Change: + 0.96% Day High: 3044 Day Low: 2958

In the event of Fresnillo enjoying further trades beyond 3044, the share ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 1141.8 Percentage Change: + 2.70% Day High: 1159.6 Day Low: 1125.4

Continued trades against HSBA with a mid-price ABOVE 1159.6 should improv ……..

</p

View Previous HSBC & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 1284 Percentage Change: + 1.50% Day High: 1296 Day Low: 1265

Target met. All IG Group needs are mid-price trades ABOVE 1296 to improve ……..

</p

View Previous IG Group & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 218 Percentage Change: + 5.31% Day High: 225 Day Low: 214

Target met. Further movement against International Personal Finance ABOVE ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 637.8 Percentage Change: + 0.66% Day High: 646.4 Day Low: 636.2

Continued trades against NWG with a mid-price ABOVE 646.4 should improve ……..

</p

View Previous Natwest & Big Picture ***

LSE:SAGA SAGA Plc. Close Mid-Price: 366 Percentage Change: + 3.10% Day High: 380 Day Low: 354.5

Target met. Further movement against SAGA Plc ABOVE 380 should improve ac ……..

</p

View Previous SAGA Plc & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 270.8 Percentage Change: + 7.38% Day High: 273 Day Low: 254.2

Target met. Continued trades against SRP with a mid-price ABOVE 273 shoul ……..

</p

View Previous Serco & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 1763 Percentage Change: + 0.51% Day High: 1804.5 Day Low: 1765

Target met. Continued trades against STAN with a mid-price ABOVE 1804.5 s ……..

</p

View Previous Standard Chartered & Big Picture ***