#Gold #Nasdaq It’s interesting Chariot have moved into “wind” with a substantial Wind Power financing agreement. With reports of considerable problems in South Africa with their conventional electricity generation systems, it certainly appears more Wind Power shall be required immediately in the country, doubtless providing a reasonable income stream for the company. Here in Argyll, we’re have an opposite problem, local communities rebelling against plans to install a Wind Farm with 250 metre blades. It’s hard to disagree with their arguments as tourism is a major part of the economy as people come to enjoy the mountains, rather than have scenery obscured by massive windmills. Of course, electricity locally is generated by Hydro-electric plants which means there is no local need for wind farm power generation.

However, it’s sane to assume South Africa has plenty of room for big wind turbines, time spent driving through the country giving plenty of opportunity to become bored with the complete lack of scenery which could only be improved with the growth of wind generators. Hopefully Chariot Oil shall experience a profitable future with this initiative.

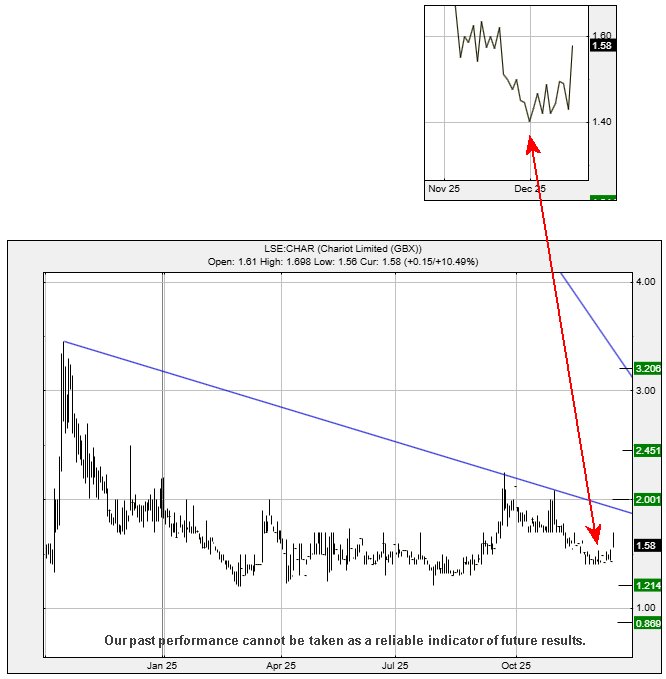

As for their share price, despite it enjoying a day in the sun with news of their new contracts, the share price failed to close in a zone where we’d be cheerfully promoting the idea of big things coming. But the chart extract below which shows the share closing the day at 1.58 highlights the problem, the price failing to achieve a “higher high” by closing just a little higher above 1.62p. While it is only 4/100ths of a penny, the visuals give plenty of reason for a degree of concern. We certainly hope the days ahead shall give the price the opportunity to close above 1.62p should be capable of triggering some reasonable price movement.

Such a scenario calculates with an initial target of 2p with our secondary, if bettered, at 2.45p. Significantly, this would take the share price into a zone where the big picture trend from April 2022 intrudes and gives a third level long term target at an impressive 3.2p.

Of course, there’s always a converse scenario and in this instance, it requires Chariot to close below 1.40p as this risks a visit to an initial 1.2p and hopefully a bounce. Our secondary, if broken, works out at 0.8p and the risk of the share price finding itself trapped until there’s a material change in the company prospects. At present, there are absolutely no signals suggesting this shall be the case but it’s always worth remembering.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:46:24PM | BRENT | 6030.3 | |||||||||

| 10:53:46PM | GOLD | 4305.13 | 4285 | 4269 | 4241 | 4318 | 4351 | 4375 | 4405 | 4318 | |

| 10:58:46PM | FTSE | 9751.2 | Success | ||||||||

| 11:05:32PM | STOX50 | 5749.9 | |||||||||

| 11:47:10PM | GERMANY | 24199.3 | |||||||||

| 11:52:04PM | US500 | 6814.3 | |||||||||

| 11:55:23PM | DOW | 48423 | |||||||||

| 11:29:25PM | NASDAQ | 25039 | 25022 | 24955 | 24858 | 25108 | 25252 | 25346 | 25454 | 25102 | ‘cess |

| 11:31:51PM | JAPAN | 49956 | 49871 | 49709 | 49492 | 50090 | 50211 | 50341 | 50498 | 50025 |

15/12/2025 FTSE Closed at 9751 points. Change of 1.06%. Total value traded through LSE was: £ 5,756,132,548 a change of -4.78%

12/12/2025 FTSE Closed at 9649 points. Change of -0.56%. Total value traded through LSE was: £ 6,045,049,250 a change of 2.55%

11/12/2025 FTSE Closed at 9703 points. Change of 0.5%. Total value traded through LSE was: £ 5,894,528,793 a change of -21.51%

10/12/2025 FTSE Closed at 9655 points. Change of 0.13%. Total value traded through LSE was: £ 7,510,310,269 a change of 17.31%

9/12/2025 FTSE Closed at 9642 points. Change of -0.03%. Total value traded through LSE was: £ 6,402,100,858 a change of 23.04%

8/12/2025 FTSE Closed at 9645 points. Change of -0.23%. Total value traded through LSE was: £ 5,203,421,137 a change of 3.99%

5/12/2025 FTSE Closed at 9667 points. Change of -0.44%. Total value traded through LSE was: £ 5,003,675,648 a change of -20.4%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BARC Barclays** **LSE:HIK Hikma** **LSE:IGG IG Group** **LSE:SAGA SAGA Plc** **LSE:STAN Standard Chartered** **

********

Updated charts published on : Barclays, Hikma, IG Group, SAGA Plc, Standard Chartered,

LSE:BARC Barclays. Close Mid-Price: 454.25 Percentage Change: + 2.23% Day High: 456.95 Day Low: 448.15

In the event of Barclays enjoying further trades beyond 456.95, the share ……..

</p

View Previous Barclays & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1503 Percentage Change: -0.86% Day High: 1510 Day Low: 1482

If Hikma experiences continued weakness below 1482, it will invariably le ……..

</p

View Previous Hikma & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 1166 Percentage Change: + 1.13% Day High: 1177 Day Low: 1155

Continued trades against IGG with a mid-price ABOVE 1177 should improve t ……..

</p

View Previous IG Group & Big Picture ***

LSE:SAGA SAGA Plc. Close Mid-Price: 353.5 Percentage Change: + 4.90% Day High: 353.5 Day Low: 338

Continued trades against SAGA with a mid-price ABOVE 353.5 should improve ……..

</p

View Previous SAGA Plc & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 1760.5 Percentage Change: + 1.94% Day High: 1772 Day Low: 1741

Further movement against Standard Chartered ABOVE 1772 should improve acc ……..

</p

View Previous Standard Chartered & Big Picture ***