#Gold #SP500 The race in Abu Dhabi this weekend finally promises to be interesting, the mostly boring 2025 season finishing with a three way possibility for the World Champion title. Alas, Ferrari shall not be in the running as they’ve been involved in a lively battle with themselves while trying to ignore their current cars are simply not good enough. But, to quote Jeremy Clarkson, “in the years when Ferrari have rotten F1 cars, their road cars are always pretty good!”. Should this be the case, it’s probably safe to stop procrastinating about a sports car and rush out and buy a Ferrari before Christmas…

Here in Scotland, there has been an ongoing battle with the weather as our mechanical roof is due a service with winter grease and lubricants, hideously expensive liquids from the car maker. It has become clear the dog transport car should be regarded as a mobile mechanical steel and glass roof, this “transformer” aspect being more important than the car below it. For a few hours on Monday, the rain stopped, the sun shone, and the temperature exceeded 12c outside, meaning we had the right conditions to lubricate the roof. It grudgingly wheezed open and exposed all the bits needing greased, then finished the job and transformed the vehicle into a sports open top car. Compressed air was quickly blown through the drainage channels, then the magic button was pressed to return it to a closed position. And as usual, a small group of passing pedestrians paused to watch the process of various layers of metal sliding back into place and return the vehicle into being a bland two door coupe, the EOS.

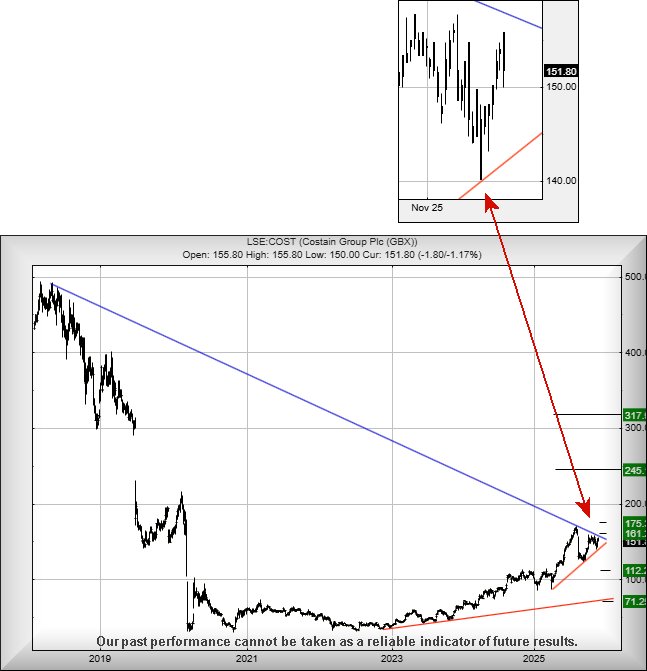

The news Costain have received further contracts related to the UK’s chaotic nuclear program gives considerable hope, assuming the UK regulators are serious in their efforts to change the level of Red Tape inhibiting nuclear development in this country. Apparently, the UK has the worst, toughest, and most impossible set of regulations in the G20 which were established to demonise the nuclear industry. Now, the realisation nuclear is the safest, cheapest, and most effective source of green energy, has shaken things within the “green fanatic sect”, giving hope there shall be a real change coming. Which will not hurt Costain in the slightest due to their relationships within the sector.

Currently, something quite curious – from our perspective – is happening with Costain share price. It is reacting to a trend line which doesn’t exist. If it were bobbing along the current Blue downtrend, the share price would be at around .157p but instead, it’s a country mile away. This situation has been ongoing since October and it’s a scenario we quite like. Historically, where a share price is reacting to a “trend from afar”, it’s proven to be a fairly reliable signal an irrational jump upward is coming. In the case of Costain, above 157 should trigger movement to an initial 161p with our secondary, if beaten, at 175p.

When we introduce a Big Picture scenario, movement such as this should prove very significant, launching the share into a zone where it shall be seen as being attracted to a long term 317p, a price level not seen since the fake & contrived Covid19 drops of 2020.

Should the market decide to move in a contrary direction, below 140 would be needed to introduce trouble, giving the potential of reversals down to an initial 112p with our secondary, if broken, an equally unlikely bottom at 71p!

For now, we suspect Costain are somewhere close to introducing a surprise lift in price.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:33:29PM | GOLD | 4234.29 | |||||||||

| 10:44:47PM | BRENT | 6328.8 | 6269 | 6232 | 6183 | 6328 | 6380 | 6425 | 6472 | 6301 | ‘cess |

| 10:48:40PM | FTSE | 9690.9 | |||||||||

| 10:51:19PM | STOX50 | 5662 | ‘cess | ||||||||

| 10:54:03PM | GERMANY | 23559.5 | Success | ||||||||

| 10:59:29PM | US500 | 6815.4 | 6810 | 6787 | 6765 | 6844 | 6843 | 6865 | 6890 | 6818 | ‘cess |

| 11:02:06PM | DOW | 47267.8 | |||||||||

| 11:04:54PM | NASDAQ | 25344 | |||||||||

| 11:07:01PM | JAPAN | 49441 |

1/12/2025 FTSE Closed at 9702 points. Change of -0.19%. Total value traded through LSE was: £ 6,008,942,669 a change of 26.85%

28/11/2025 FTSE Closed at 9720 points. Change of 0.28%. Total value traded through LSE was: £ 4,737,137,664 a change of -21.39%

27/11/2025 FTSE Closed at 9693 points. Change of 0.02%. Total value traded through LSE was: £ 6,026,345,245 a change of -20.1%

26/11/2025 FTSE Closed at 9691 points. Change of 0.85%. Total value traded through LSE was: £ 7,542,003,610 a change of 18.39%

25/11/2025 FTSE Closed at 9609 points. Change of 0.79%. Total value traded through LSE was: £ 6,370,501,929 a change of -51.58%

24/11/2025 FTSE Closed at 9534 points. Change of -0.05%. Total value traded through LSE was: £ 13,156,523,796 a change of 87.85%

21/11/2025 FTSE Closed at 9539 points. Change of 0.13%. Total value traded through LSE was: £ 7,003,826,108 a change of 23.05%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CASP Caspian** **LSE:FRES Fresnillo** **LSE:STAN Standard Chartered** **LSE:TRN The Trainline** **

********

Updated charts published on : Caspian, Fresnillo, Standard Chartered, The Trainline,

LSE:CASP Caspian. Close Mid-Price: 2.55 Percentage Change: + 18.60% Day High: 2.85 Day Low: 1.75

Target met. Weakness on Caspian below 1.75 will invariably lead to 1.25p ……..

</p

View Previous Caspian & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 2820 Percentage Change: + 7.06% Day High: 2848 Day Low: 2622

Target met. Continued trades against FRES with a mid-price ABOVE 2848 sho ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 1681 Percentage Change: + 0.45% Day High: 1688.5 Day Low: 1667.5

Further movement against Standard Chartered ABOVE 1688.5 should improve a ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:TRN The Trainline Close Mid-Price: 230.4 Percentage Change: -2.46% Day High: 235.2 Day Low: 231.8

If The Trainline experiences continued weakness below 231.8, it will inva ……..

</p

View Previous The Trainline & Big Picture ***