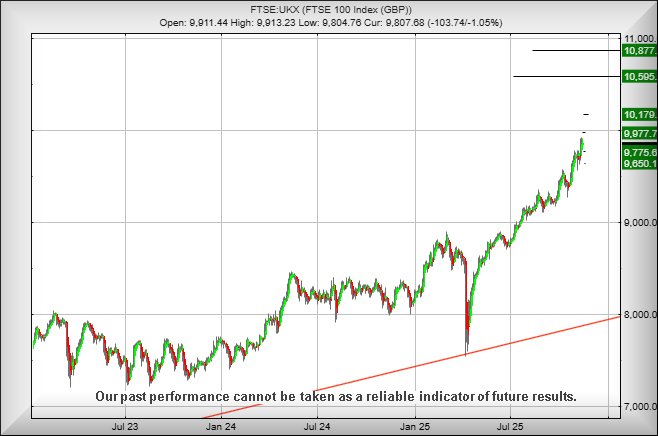

#FTSE #GOLD It will be party time if the FTSE manages to wander above 10179 points, a level which seems attainable, despite near term dramatics. To explain, the Nasdaq managed to undo the Covid-19 drop of March 2020 in December of that year. The German DAX managed the same feat in September 2024 while Wall St kicked the Covid damage in August 2024. The S&P 500 took until the end of 2022 and Australia still suffers from the artificial Covid19 drop, needing above 9890 points to depart the economic trauma imposed by Covid19 manipulation. Even Brazil, where the nuts come from, still suffers its own version of Long Covid, needing above 171,300 points to free itself from the 2020 misery.

Judging by the behaviour of those markets which have broken above the arithmetic restrictions imposed by the worldwide synchronised Covid19 drop of March 2020, we’re almost excited for the FTSE Next Year as while things are certainly looking good. For the near term, FTSE closure above 9915 looks like being a big deal, calculating with the potential of a market lift to 9977 points with our secondary, if bettered, calculating at 10179. This secondary is a really big deal level, holding the implication the UK FTSE shall have shuffled from “recovery” to “growth”, a Big Picture cycle which should lead to an initial 10595 with our long term secondary calculating at an impressive 10877 points and some almost certain hesitation.

In other words, the signs in the tea leaves at the bottom of the cup indicate a potentially rather good 2026, at least until 10,877 points makes a guessed appearance… We do currently have a bit of a problem, due to an inability to calculate above 10,877 with our FTSE data which extends back 40 years. For this reason, we’re essentially suggesting the UK has the potential for another 1,000 points above current levels, then things risk running out of steam. Perhaps the UK political class shall do the country a favour, resign en-mass, and be replaced by a bunch of smartphones running a Pound Shop AI.

From a near term perspective, it seems likely weakness below 9800 points shall trigger reversal to an initial 9775 points with our secondary, if broken, at a less likely 9650 points. Our paranoia is embracing the notion the market is enacting some reversals, prior to yet another upward surge. If things intend to get better, a near term movement above 9872 should tick the first box for a surprise change of direction, giving a reasonable stop loss level.

Finally, we finally discovered something more interesting than watching (or not watching) Formula1. There’s a sport called Mountain Carts which should be offered at every ski resort off season. The things are three wheeled unpowered go carts, running downhill on mountain roads from the top of chair lifts. It’s absolutely hypnotic to watch with “races” taking from 4 to 15 minutes and the participants seem to range from corporate bonding sessions, stag or hen outings, and some serious competition between some fanatics, most of whom get beaten by a first timer who has just started working in a call centre! Hopefully the sport finds a home in Scotland, the skier within anxiously twitching for a chance to compete.

Search YouTube for “Mountain Carts – First, Grindelwald” to spend 4 minutes viewing more entertainment than a Monaco Grand Prix could ever offer.

And have a good weekend! It’s my birthday, officially allowed to do sod all on Sunday!

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:49:41PM | BRENT | 6296.5 | 6222 | 6180 | 6312 | 6333 | 6373 | 6288 | |||

| 10:52:46PM | GOLD | 4185.32 | 4145 | 4115 | 4185 | 4244 | 4278 | 4176 | |||

| 10:56:36PM | FTSE | 9756.1 | 9723 | 9682 | 9782 | 9916 | 9985 | 9868 | Success | ||

| 11:00:31PM | STOX50 | 5726.4 | 5706 | 5696 | 5735 | 5753 | 5781 | 5721 | Success | ||

| 11:02:56PM | GERMANY | 24061.8 | 23931 | 23836 | 24074 | 24263 | 24414 | 24192 | Success | ||

| 11:06:26PM | US500 | 6744.3 | 6737 | 6720 | 6770 | 6784 | 6804 | 6758 | Success | ||

| 11:09:11PM | DOW | 47512.5 | 47412 | 47120 | 47650 | 47895 | 48054 | 47740 | Success | ||

| 11:14:16PM | NASDAQ | 25018.9 | 24911 | 24896 | 25068 | 25404 | 25598 | 25183 | Success | ||

| 11:17:39PM | JAPAN | 50405 | 49986 | 49607 | 50206 | 50466 | 50587 | 50228 | Success |

13/11/2025 FTSE Closed at 9807 points. Change of -1.05%. Total value traded through LSE was: £ 5,685,178,464 a change of -6.33%

12/11/2025 FTSE Closed at 9911 points. Change of 0.12%. Total value traded through LSE was: £ 6,069,423,545 a change of -4.91%

11/11/2025 FTSE Closed at 9899 points. Change of 1.14%. Total value traded through LSE was: £ 6,382,591,388 a change of 4.7%

10/11/2025 FTSE Closed at 9787 points. Change of 1.08%. Total value traded through LSE was: £ 6,095,878,551 a change of 4.62%

7/11/2025 FTSE Closed at 9682 points. Change of -0.54%. Total value traded through LSE was: £ 5,826,630,107 a change of -16.85%

6/11/2025 FTSE Closed at 9735 points. Change of 896.42%. Total value traded through LSE was: £ 7,007,707,852 a change of 6.36%

5/11/2025 FTSE Closed at 977 points. Change of -89.94%. Total value traded through LSE was: £ 6,588,542,661 a change of 10.12%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AVCT Avacta** **LSE:BARC Barclays** **LSE:BME B & M** **LSE:HSBA HSBC** **LSE:IHG Intercontinental Hotels Group** **LSE:NWG Natwest** **LSE:OXIG Oxford Instruments** **LSE:SAGA SAGA Plc** **LSE:SPX Spirax** **LSE:STAN Standard Chartered** **LSE:WG. Wood Group** **

********

Updated charts published on : Avacta, Barclays, B & M, HSBC, Intercontinental Hotels Group, Natwest, Oxford Instruments, SAGA Plc, Spirax, Standard Chartered, Wood Group,

LSE:AVCT Avacta. Close Mid-Price: 81.5 Percentage Change: + 5.03% Day High: 81.5 Day Low: 77

In the event of Avacta enjoying further trades beyond 81.5, the share sho ……..

</p

View Previous Avacta & Big Picture ***

LSE:BARC Barclays Close Mid-Price: 427.25 Percentage Change: -0.42% Day High: 430.65 Day Low: 425.85

Target met. In the event of Barclays enjoying further trades beyond 430.6 ……..

</p

View Previous Barclays & Big Picture ***

LSE:BME B & M. Close Mid-Price: 165.1 Percentage Change: + 0.67% Day High: 167.95 Day Low: 155.6

Target met. In the event B & M experiences weakness below 155.6 it calcul ……..

</p

View Previous B & M & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 1120 Percentage Change: + 0.23% Day High: 1126 Day Low: 1115.4

All HSBC needs are mid-price trades ABOVE 1126 to improve acceleration to ……..

</p

View Previous HSBC & Big Picture ***

LSE:IHG Intercontinental Hotels Group Close Mid-Price: 9836 Percentage Change: -1.32% Day High: 10045 Day Low: 9876

Continued trades against IHG with a mid-price ABOVE 10045 should improve ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:NWG Natwest Close Mid-Price: 623.2 Percentage Change: -0.19% Day High: 626.6 Day Low: 620.2

Target met. Continued trades against NWG with a mid-price ABOVE 626.6 sho ……..

</p

View Previous Natwest & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 2090 Percentage Change: -1.18% Day High: 2160 Day Low: 2085

Target met. Further movement against Oxford Instruments ABOVE 2160 should ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:SAGA SAGA Plc Close Mid-Price: 245 Percentage Change: -4.11% Day High: 254 Day Low: 244

Weakness on SAGA Plc below 244 will invariably lead to 235 with our drop ……..

</p

View Previous SAGA Plc & Big Picture ***

LSE:SPX Spirax. Close Mid-Price: 7160 Percentage Change: + 1.06% Day High: 7450 Day Low: 7140

Continued trades against SPX with a mid-price ABOVE 7450 should improve t ……..

</p

View Previous Spirax & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 1646.5 Percentage Change: + 0.27% Day High: 1663.5 Day Low: 1647.5

Continued trades against STAN with a mid-price ABOVE 1663.5 should improv ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:WG. Wood Group. Close Mid-Price: 21.96 Percentage Change: + 2.43% Day High: 22.56 Day Low: 21.88

Continued trades against WG. with a mid-price ABOVE 24.04 should improve ……..

</p

View Previous Wood Group & Big Picture ***