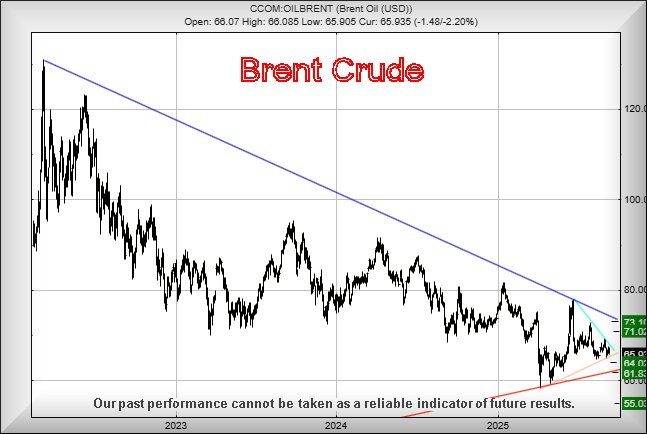

#FreeFutures! The price of crude oil has been frustrating us this year. We always harp on about the important detail it’s impossible to apply timeframes to the marketplace but this is getting frustrating, every time weakness looking like it is settling into place, the world discovering an excuse to derail any fall. Surely this must become more difficult as it’s unlikely the Greta Thunberg flotilla shall offer sufficient excuse to affect oil price movements, regardless of how many artificial stories they sell to the media.

This may turn around to bite us but we’re now showing a potential 55 dollars as a bottom, the product needing an excuse to move above 75 dollars to escape the path and destroy our scribbled notes on a napkin… More likely, it feels like below 65 dollars should next trigger weakness to an initial $64 with our secondary, if (when) broken at 61.8 and a probably short lived bounce. But overall, should 61.8 eventually break, a visit to 55 dollars looks probable.

With our FTSE for FRIDAY, it’s the same as above, only different! We’ve a strong argument favouring movement above 9.800 points, the only fly in the ointment being the FTSE has resolutely refused to co-operate with our calculations. This week there has been some early signs of proper steps in the correct direction but realistically, we demand above 9358 points to make things inevitable.

From a near term perspective, there is now some real hope as above 9298 points has the potential of triggering further FTSE movement toward an initial 9342 points. Our secondary, considerably less likely in the near term, calculates at 9494 points. While we’re a little dubious about this as an immediate target, such an influence however perhaps capable of moving things above our 9358 point trigger for the longer term where our future 9873 point target awaits, gleefully rubbing its hands.

But similar to Brents failure to head down, the FTSE has thus far failed to move up solidly but we’re not giving up hope.

If things intend go wrong, below 9150 points looks like a sensible point capable of triggering reversal to an initial 9027 points with our secondary, if broken, an unlikely looking 8919 points.

Have a good weekend, despite the lack of a Grand Prix for entertainment. Here in Argyll, it looks like it’s time to start building an Ark but then again, it’s maybe just winter.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:37:21PM | BRENT | 6618 | 6604 | 6566 | 6648 | 6649 | 6664 | 6621 | |||

| 10:40:14PM | GOLD | 3633.74 | 3612 | 3601 | 3625 | 3643 | 3648 | 3630 | |||

| 10:43:19PM | FTSE | 9314.1 | 9218 | 9204 | 9254 | 9318 | 9325 | 9304 | ‘cess | ||

| 10:46:02PM | STOX50 | 5397.8 | 5363 | 5348 | 5390 | 5401 | 5408 | 5389 | ‘cess | ||

| 10:48:19PM | GERMANY | 23749.7 | 23637 | 23601 | 23730 | 23792 | 23878 | 23702 | |||

| 10:51:05PM | US500 | 6585.1 | 6530 | 6503 | 6556 | 6594 | 6616 | 6575 | ‘cess | ||

| 10:54:07PM | DOW | 46102 | 45380 | 45302 | 45608 | 46137 | 46331 | 46039 | Success | ||

| 10:56:00PM | NASDAQ | 23979.1 | 23828 | 23767 | 23893 | 24018 | 24077 | 23965 | |||

| 10:58:06PM | JAPAN | 44767 | 44004 | 43730 | 44393 | 44823 | 44933 | 44670 | Success |

11/09/2025 FTSE Closed at 9297 points. Change of 0.78%. Total value traded through LSE was: £ 5,130,576,096 a change of -11.59%

10/09/2025 FTSE Closed at 9225 points. Change of -0.18%. Total value traded through LSE was: £ 5,802,988,432 a change of 11.05%

9/09/2025 FTSE Closed at 9242 points. Change of 0.23%. Total value traded through LSE was: £ 5,225,634,176 a change of 25.23%

8/09/2025 FTSE Closed at 9221 points. Change of 0.14%. Total value traded through LSE was: £ 4,172,667,369 a change of -14.19%

5/09/2025 FTSE Closed at 9208 points. Change of -0.09%. Total value traded through LSE was: £ 4,862,590,557 a change of 7.19%

4/09/2025 FTSE Closed at 9216 points. Change of 0.42%. Total value traded through LSE was: £ 4,536,344,047 a change of -21.07%

3/09/2025 FTSE Closed at 9177 points. Change of 0.67%. Total value traded through LSE was: £ 5,747,395,783 a change of -1.83%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BARC Barclays** **LSE:BBY BALFOUR BEATTY** **LSE:FRES Fresnillo** **LSE:HIK Hikma** **LSE:HSBA HSBC** **LSE:IQE IQE** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:STAN Standard Chartered** **

********

Updated charts published on : Barclays, BALFOUR BEATTY, Fresnillo, Hikma, HSBC, IQE, Scottish Mortgage Investment Trust, Standard Chartered,

LSE:BARC Barclays. Close Mid-Price: 379.55 Percentage Change: + 1.20% Day High: 380.75 Day Low: 373.5

Further movement against Barclays ABOVE 380.75 should improve acceleratio ……..

</p

View Previous Barclays & Big Picture ***

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 622 Percentage Change: + 0.97% Day High: 625 Day Low: 616.5

Further movement against BALFOUR BEATTY ABOVE 625 should improve accelera ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 2196 Percentage Change: + 1.01% Day High: 2244 Day Low: 2184

All Fresnillo needs are mid-price trades ABOVE 2244 to improve accelerati ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1660 Percentage Change: -0.24% Day High: 1672 Day Low: 1651

In the event Hikma experiences weakness below 1651 it calculates with a d ……..

</p

View Previous Hikma & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 1011.8 Percentage Change: + 1.50% Day High: 1009.8 Day Low: 997.8

Further movement against HSBC ABOVE 1009.8 should improve acceleration to ……..

</p

View Previous HSBC & Big Picture ***

LSE:IQE IQE Close Mid-Price: 7.4 Percentage Change: -2.63% Day High: 7.72 Day Low: 7.37

In the event IQE experiences weakness below 7.37 it calculates with a dro ……..

</p

View Previous IQE & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust Close Mid-Price: 1115 Percentage Change: -0.45% Day High: 1121.5 Day Low: 1110.5

Continued trades against SMT with a mid-price ABOVE 1121.5 should improve ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 1423.5 Percentage Change: + 0.25% Day High: 1436 Day Low: 1409.5

All Standard Chartered needs are mid-price trades ABOVE 1436 to improve a ……..

</p

View Previous Standard Chartered & Big Picture ***