#Brent #SP500 Regular reads will know we’re quite attached to our “Gap Down / Gap Up” arguments, a fairly solid track record almost making us comfortable in proposing price movements based on such an obscure price dance by the UK market. When these arguments are applied to Wall St and S&P500 shares, the results are almost as reliable but only when a few other of our weird rules are applied. Sometimes we wish the weather could be as reliable, tonight when -6c was forecast in Argyll. According to the big thermometer on the office window, it’s actually 8c, the heavy snow which was also forecast being a clickbait headline from the folk at the weather company, anxious to validate their existence.

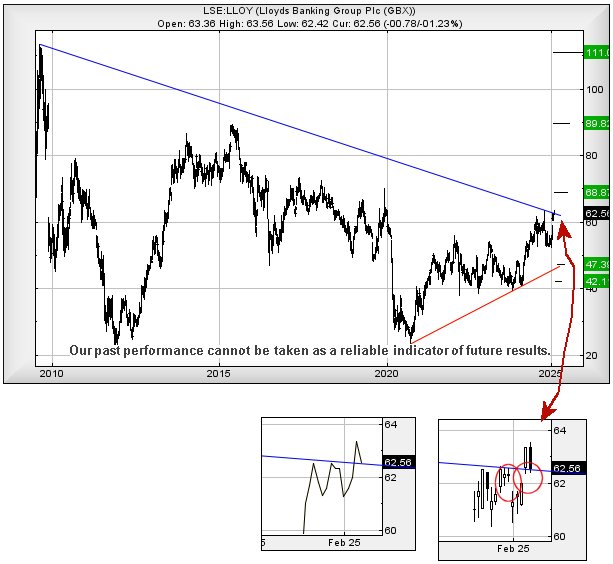

Our irritation over this state of affairs is a preference to avoid headlines to attract the gullible. It’s be nice to say (with vague justification) Lloyds Bank are now trading in a zone, where a long term cycle to 111p looks viable. It certainly makes for a great headline and may prove possible but the unpleasant reality of timeframes intrudes.

Our Gap Down / Gap Up (GaGa) logic implies Lloyds share price wants to head to 64.85p on the current cycle, so we shall be more comfortable discussing what the future may hold, should 64.85p be exceeded. On Friday 7th, Lloyds managed to spike to 63.56p at the open, even repeating the feat 30 minutes later to prove it wasn’t a mistake. Amazingly, this little dance actually allows for another fascinating detail to enter the picture. If we draw a downtrend since 2009, it runs through the high of last October, providing some quite interesting share price twitches which attempt to validate this downtrend as being viable.

Should this be the case, share price movements bettering 64.85p now exhibit interesting potentials, giving an initial target level at 68.8p with our secondary, if beaten, a visually believable longer term 89p, along with almost certain hesitation. And even more fascinating, it actually would place the share on a cycle to an eventual 111p, matching a high of 2009 and the year of the Financial Crisis!

If things intend go horribly wrong for Lloyds, their share price needs slink below 52p as this could easily trigger reversals to an initial 47p with our secondary, if broken, a bottom at 42p. But for now, we’re strangely enthusiastic…

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 6:17:28PM | BRENT | 7454.2 | 7395 | 7310 | 7003 | 7622 | 7525 | 7562 | 7618 | 7446 |

| 6:19:04PM | GOLD | 2860.12 | ||||||||

| 6:20:56PM | FTSE | 8685.3 | ||||||||

| 6:28:20PM | STOX50 | 5314.6 | ||||||||

| 6:31:53PM | GERMANY | 21736 | ||||||||

| 6:55:15PM | US500 | 6027.8 | 6020 | 6014 | 5985 | 6036 | 6074 | 6088 | 6111 | 6054 |

| 6:59:34PM | DOW | 44309 | ||||||||

| 7:03:02PM | NASDAQ | 21481 | ||||||||

| 9:56:32PM | JAPAN | 38414 |

7/02/2025 FTSE Closed at 8700 points. Change of -0.31%. Total value traded through LSE was: £ 7,762,890,923 a change of 38.28%

6/02/2025 FTSE Closed at 8727 points. Change of 1.21%. Total value traded through LSE was: £ 5,614,005,205 a change of 8.54%

5/02/2025 FTSE Closed at 8623 points. Change of 0.62%. Total value traded through LSE was: £ 5,172,324,533 a change of -3.31%

4/02/2025 FTSE Closed at 8570 points. Change of -0.15%. Total value traded through LSE was: £ 5,349,281,975 a change of 10.8%

3/02/2025 FTSE Closed at 8583 points. Change of -1.04%. Total value traded through LSE was: £ 4,827,982,037 a change of -38.35%

31/01/2025 FTSE Closed at 8673 points. Change of 0.31%. Total value traded through LSE was: £ 7,830,859,911 a change of 58.83%

30/01/2025 FTSE Closed at 8646 points. Change of 1.04%. Total value traded through LSE was: £ 4,930,240,161 a change of -10.24%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:DGE Diageo** **LSE:HSBA HSBC** **LSE:IAG British Airways** **LSE:LLOY Lloyds Grp.** **LSE:OXIG Oxford Instruments** **LSE:SMT Scottish Mortgage Investment Trust** **

********

Updated charts published on : Diageo, HSBC, British Airways, Lloyds Grp., Oxford Instruments, Scottish Mortgage Investment Trust,

LSE:DGE Diageo Close Mid-Price: 2222 Percentage Change: -1.35% Day High: 2262.5 Day Low: 2218.5

Target met. In the event Diageo experiences weakness below 2218.5 it calc ……..

</p

View Previous Diageo & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 854 Percentage Change: + 0.71% Day High: 854.1 Day Low: 845.1

Continued trades against HSBA with a mid-price ABOVE 854.1 should improve ……..

</p

View Previous HSBC & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 366.3 Percentage Change: + 0.80% Day High: 368 Day Low: 362

In the event of British Airways enjoying further trades beyond 368, the ……..

</p

View Previous British Airways & Big Picture ***

LSE:LLOY Lloyds Grp. Close Mid-Price: 62.56 Percentage Change: -1.23% Day High: 63.56 Day Low: 62.42

All Lloyds Grp. needs are mid-price trades ABOVE 63.56 to improve acceler ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 1928 Percentage Change: -3.84% Day High: 2010 Day Low: 1928

In the event Oxford Instruments experiences weakness below 1928 it calcul ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 1089 Percentage Change: + 0.14% Day High: 1100.5 Day Low: 1082

Further movement against Scottish Mortgage Investment Trust ABOVE 1100.5 ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***