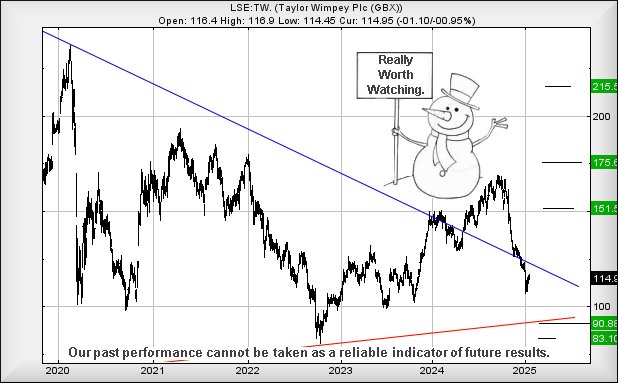

#Gold #Nasdaq Every now and then, a share price does something stupid which bodes well for the future! While this entire statement in quite contradictory, we’ve often seen this type of share price dance which can present a pretty solid hope for the future. Our silly sounding argument relates to the Blue downtrend since 2007 and how the share has behaved in relation, almost as if the downtrend actually matters? Obviously, if we paint a downtrend and pay attention to price movements, by January 2nd this year the market confirmed this 18 year old line is actually important – to the market.

From our perspective this is quite a good thing. While the share price bettered the trend in 2024, even achieving a high of 169p, the market has opted to force the share price below Blue in quite an orderly manner, which shall presumably panic private investors. From a near term perspective, they are correct but by confirming our roughly painted Blue line is important, the market has created a drop dead obvious opportunity for the future. Our fuss about this argument comes from what invariably happens, when a share price regains such a historic trend? Often, the share price shall go up, quite spectacularly, and for this reason we propose keeping an eye on Taylor Wimpey in the months ahead.

The immediate problem comes from the depth of reversals. Currently below 106p calculates with the potential of reversals to an initial 90p with our secondary, if broken, at a bottom of 83p. The problem comes, if such a scenario unfolds, is it makes our “surprise” gain scenario becomes arithmetically impossible. For now, we think LSE:TW. will prove worth keeping an eye on.

Currently, share price movement above roughly 121.519 calculates as taking the share above Blue again, ideally triggering our recovery scenario with the potential of recovery to an initial 151p with our secondary, if bettered, at a game changing 175p and considerable hope for the future.

Taylor Wimpey, currently around 114o , hopefully roars this dream with such a reality bomb, working out with the potential of ongoing gains toward a 151p with our secondary, if bettered, at 376p and the need for a entire conversation. ;about some reasonable near term potentials. .

\s

\s

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:38:22PM | BRENT | 7820.1 | |||||||||

| 10:43:01PM | GOLD | 2755.72 | 2740 | 2731 | 2720 | 2759 | 2764 | 2767 | 2793 | 2742 | ‘cess |

| 11:37:57PM | FTSE | 8513.3 | Shambles | ||||||||

| 11:41:35PM | STOX50 | 5195.3 | ‘cess | ||||||||

| 11:47:13PM | GERMANY | 21248.1 | |||||||||

| 11:55:08PM | US500 | 6079.3 | Success | ||||||||

| 10:58:50PM | DOW | 44131.1 | ‘cess | ||||||||

| 11:04:18PM | NASDAQ | 21804.6 | 21781 | 21739 | 21671 | 21837 | 21895 | 21945 | 22000 | 21820 | Success |

| 11:07:38PM | JAPAN | 39885 | 39511 | 39338 | 39135 | 39881 | 39947 | 39988 | 40074 | 39857 | Success |

22/01/2025 FTSE Closed at 8545 points. Change of -0.04%. Total value traded through LSE was: £ 5,277,040,750 a change of 4.97%

21/01/2025 FTSE Closed at 8548 points. Change of 0.33%. Total value traded through LSE was: £ 5,027,009,717 a change of 16.44%

20/01/2025 FTSE Closed at 8520 points. Change of 0.18%. Total value traded through LSE was: £ 4,317,400,042 a change of -38.76%

17/01/2025 FTSE Closed at 8505 points. Change of 1.36%. Total value traded through LSE was: £ 7,049,507,611 a change of 39.47%

16/01/2025 FTSE Closed at 8391 points. Change of 1.08%. Total value traded through LSE was: £ 5,054,366,255 a change of -17.27%

15/01/2025 FTSE Closed at 8301 points. Change of 1.22%. Total value traded through LSE was: £ 6,109,137,300 a change of -9.61%

14/01/2025 FTSE Closed at 8201 points. Change of -0.28%. Total value traded through LSE was: £ 6,758,270,581 a change of 5.88%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:BARC Barclays** **LSE:HIK Hikma** **LSE:IAG British Airways** **LSE:IGG IG Group** **LSE:IHG Intercontinental Hotels Group** **LSE:NWG Natwest** **LSE:RR. Rolls Royce** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Aviva, Barclays, Hikma, British Airways, IG Group, Intercontinental Hotels Group, Natwest, Rolls Royce, Scottish Mortgage Investment Trust, Zoo Digital,

LSE:AV. Aviva. Close Mid-Price: 511.2 Percentage Change: + 3.48% Day High: 514.2 Day Low: 496.5

Target met. All Aviva needs are mid-price trades ABOVE 514.2 to improve a ……..

</p

View Previous Aviva & Big Picture ***

LSE:BARC Barclays Close Mid-Price: 293.75 Percentage Change: -0.74% Day High: 299.3 Day Low: 292.9

Continued trades against BARC with a mid-price ABOVE 299.3 should improve ……..

</p

View Previous Barclays & Big Picture ***

LSE:HIK Hikma. Close Mid-Price: 2130 Percentage Change: + 0.95% Day High: 2128 Day Low: 2108

In the event of Hikma enjoying further trades beyond 2128, the share shou ……..

</p

View Previous Hikma & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 329.5 Percentage Change: + 0.30% Day High: 333.7 Day Low: 327.4

Target met. In the event of British Airways enjoying further trades beyo ……..

</p

View Previous British Airways & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 1073 Percentage Change: + 0.75% Day High: 1076 Day Low: 1064

Target met. Further movement against IG Group ABOVE 1076 should improve a ……..

</p

View Previous IG Group & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 10580 Percentage Change: + 1.83% Day High: 10575 Day Low: 10425

In the event of Intercontinental Hotels Group enjoying further trades bey ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 417.7 Percentage Change: + 0.12% Day High: 421.8 Day Low: 413.2

All Natwest needs are mid-price trades ABOVE 421.8 to improve acceleratio ……..

</p

View Previous Natwest & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 603.4 Percentage Change: + 1.58% Day High: 608.6 Day Low: 596.4

In the event of Rolls Royce enjoying further trades beyond 608.6, the sha ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 1075 Percentage Change: + 1.90% Day High: 1078 Day Low: 1056.5

Further movement against Scottish Mortgage Investment Trust ABOVE 1078 sh ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:ZOO Zoo Digital. Close Mid-Price: 32.5 Percentage Change: + 3.17% Day High: 32.5 Day Low: 31.5

There’s a pretty strong argument demanding this bounce from the current 32 ……..

</p

View Previous Zoo Digital & Big Picture ***